- 3 Big Scoops

- Posts

- Apple Bets Big On India 🇮🇳

Apple Bets Big On India 🇮🇳

PLUS: Macy's receives $5.8 billion offer

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,604.37 ( ⬆️ 0.41%)

Nasdaq Composite @ 14,403.97 ( ⬆️ 0.45%)

Bitcoin @ $42,213.67 ( ⬇️ 3.67%)

Hey Scoopers,

Happy Monday!!

Here’s what’s on the menu for today:

👉 Apple’s big bet on India

👉 An acquisition offer for Macy’s

👉 Robinhood launches crypto trading in Europe

So, let’s go 🚀

Apple Is Bullish On India

Apple has set ambitious targets to significantly raise its iPhone production in India. The tech giant plans to manufacture at least 50 million units in India annually by the end of 2026.

It indicates that India would account for approximately 25% of Apple’s iPhone production even though China will remain the leading iPhone producer in the world.

Source: Getty Images

Several manufacturers, including Apple, want to reduce their reliance on China and are looking to shift capital investments towards India.

Foxconn, among Apple’s top suppliers, is set to open a new plant in the Indian state of Karnataka next April, where it will manufacture 20 million smartphones each year.

Further, an Indian conglomerate, the Tata Group, already owns an iPhone manufacturing plant in Karnataka, which was acquired from Wistron in early 2023.

Tata has partnered with Apple to launch 100 retail stores in India. Moreover, it wants to build India’s biggest iPhone assembly plant in the southern state of Tamil Nadu.

India is crucial for Apple

Apple CEO Tim Cook believes India could echo the role China has played for the tech titan in the last 15 years.

India is the fastest-growing major economy in the world, with a rapidly expanding middle class and rising purchasing power.

Apple currently accounts for less than 6% of the smartphone market in India. While Apple’s annual sales in Greater China are roughly $74 billion, they are less than $7 billion in India.

Will Macy’s Get Acquired?

Arkhouse Management and Brigade Capital Capital Management have teamed up to acquire Macy’s for $5.8 billion. The offer indicates a premium of 19% from its closing price on Friday.

Arkhouse is a real estate investment company, while Brigade Capital is an asset management firm.

Source: Bloomberg

Macy’s continues to struggle to draw customers to its brick-and-mortar chains. In October, it announced 30 new store locations at strip malls as it pivots away from traditional shopping malls.

Despite these turnaround efforts, Macy’s sales have slumped, falling 7% year over year. It is now an acquisition target as it wrestles with falling sales and rising competition from e-commerce companies.

Legacy retailers are facing the heat as interest rate hikes and inflation are weighing on consumer spending. Alternatively, demand in the online shopping business has remained resilient.

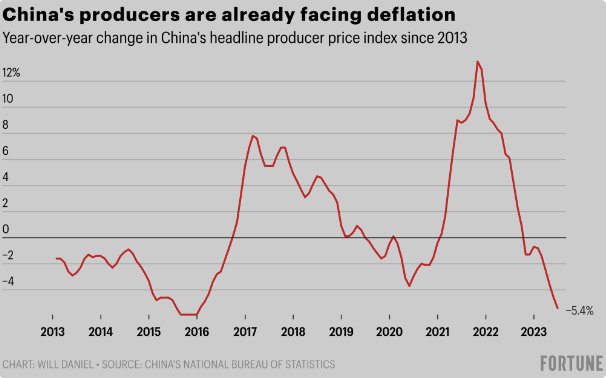

China’s Stocks Are Rising

Today, China’s equity market is trading higher after data showed persistent deflationary pressures from weak domestic demand.

China’s inflation numbers showed a faster-than-expected decline in consumer prices as the second-largest economy has been grappling with sluggish spending patterns in recent months.

Robinhood Enters Crypto Market in Europe

Robinhood is all set to launch commission-free crypto trading in the European Union. Last week, it disclosed plans to begin stock-broking services in the United Kingdom.

The new-age trading app will allow European crypto investors to buy and sell more than 25 cryptocurrencies, including Bitcoin, Ethereum, and Solana.

Here are a few key points you need to be aware of:

👉 Robinhood’s free crypto-trading operations in Europe will begin this Thursday

👉 It will provide you access to over 25 cryptocurrencies

👉 Robinhood will introduce a unique cashback-like loyalty program which will be based on monthly trading volumes

Headlines You Can’t Miss!

Japan’s tech giant Rakuten to launch AI model next year

TikTok to invest $1.5 billion in Indonesian e-commerce start-up

China’s November prices fall at the fastest pace since late 2020

Elon Musk’s Tesla loses Swedish court case

Senator Elizabeth Warren calls crypto a threat

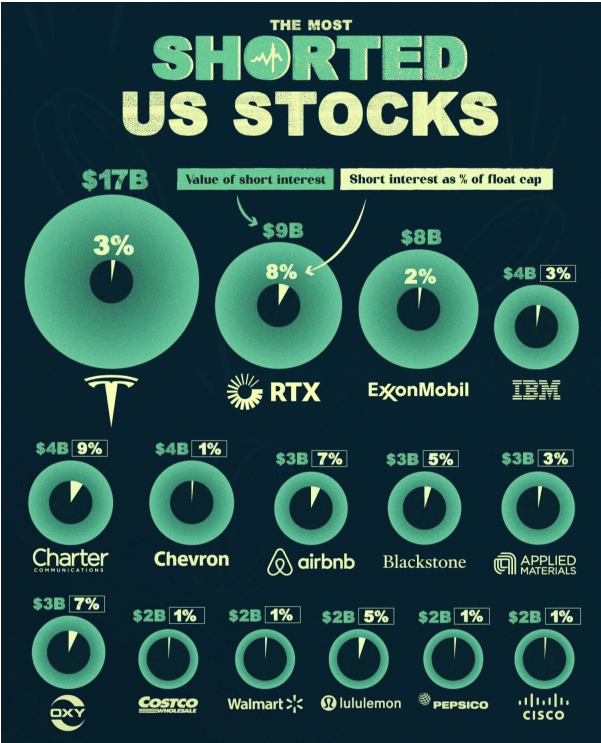

Chart of the Day

Source: Visual Capitalist

When you “short” a stock, you borrow its shares, sell them at current prices, and repurchase them at a lower price (hopefully) in the future. Basically, short sellers are betting the stock will decline in the near-term.

In the first ten months of 2023, Tesla is the most shorted stock in terms of short interest value.

Seven of the top 15 companies listed in the chart rank among the top 50 largest companies globally. These include giants such as Exxon Mobil and Airbnb.

Meanwhile, Charter Communications holds the highest percentage of float cap at 9%. While Tesla stock has gained 126%, Charter is up 7.6% in 2023.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.