- 3 Big Scoops

- Posts

- E-Commerce Stocks Are Flying!

E-Commerce Stocks Are Flying!

Plus: Wells Fargo is cautious on equities

Bulls, Bitcoin & Beyond

Hello Folks,

Happy Tuesday!!

Here’s what’s on the menu for today:

👉 The Black Friday pump

👉 Wells Fargo’s outlook for stocks

👉 Crypto inflows surge past $346 million

Shopify, Etsy, and Amazon Gain Big

E-commerce stocks were flying on Monday after shoppers turned out in full force on Thanksgiving and over the Black Friday weekend. Consumers shunned brick-and-mortar retail stores and opted for online purchases instead.

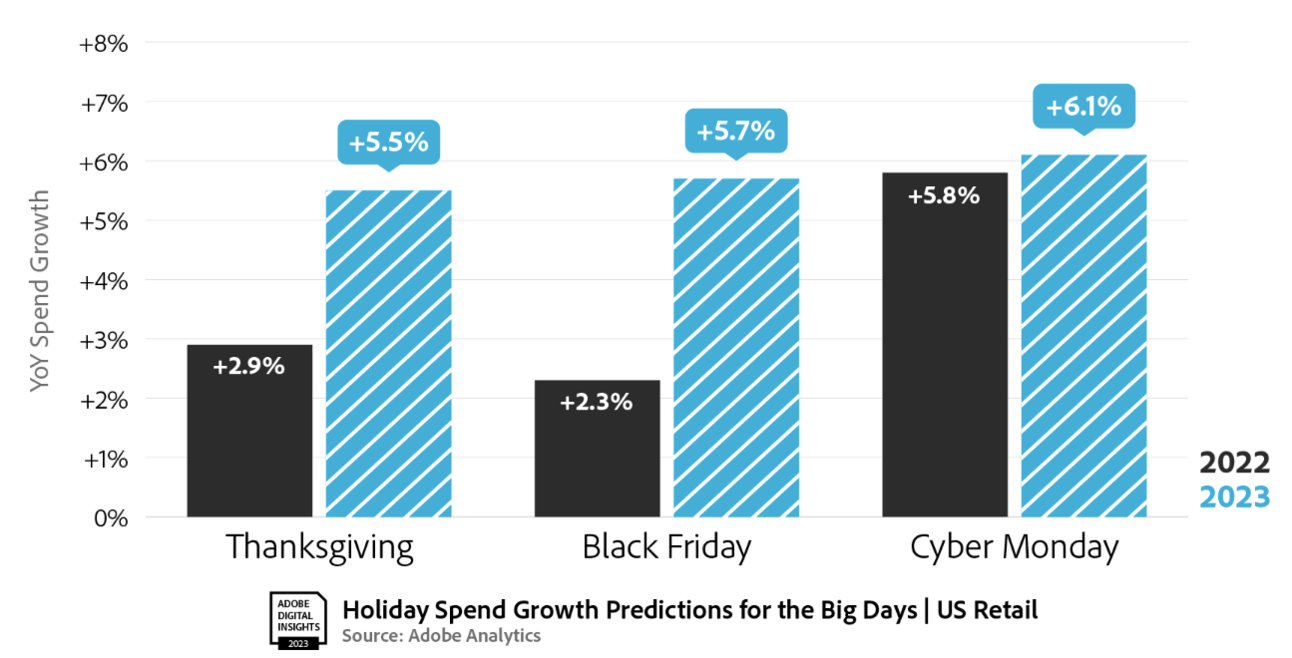

A report from Adobe Analytics estimated online spending for Black Friday in the U.S. at $9.8 billion, an increase of 7.5% compared to the year-ago period.

Moreover, online sales between Black Friday and Cyber Monday rose 7.7% to $10.3 billion.

Cyber Monday sales are forecast at a whopping $12.4 billion, making it the biggest U.S. online shopping day of the year.

These solid numbers were cheered by Wall Street and proved to be a boon for online retailers and digital platforms. For instance, yesterday, shares of:

Esty rose by 3%

Wayfair rose by 7%

Shopify rose by 5% and

Amazon rose by 0.6%

Analysts are closely watching consumer spending during the five-day shopping period, which begins on Thanksgiving Day and ends with Cyber Monday.

The National Retail Federation expects shoppers to increase spending in the holiday season of 2023 despite elevated inflation levels, resumption of student loan payments, and interest rate hikes.

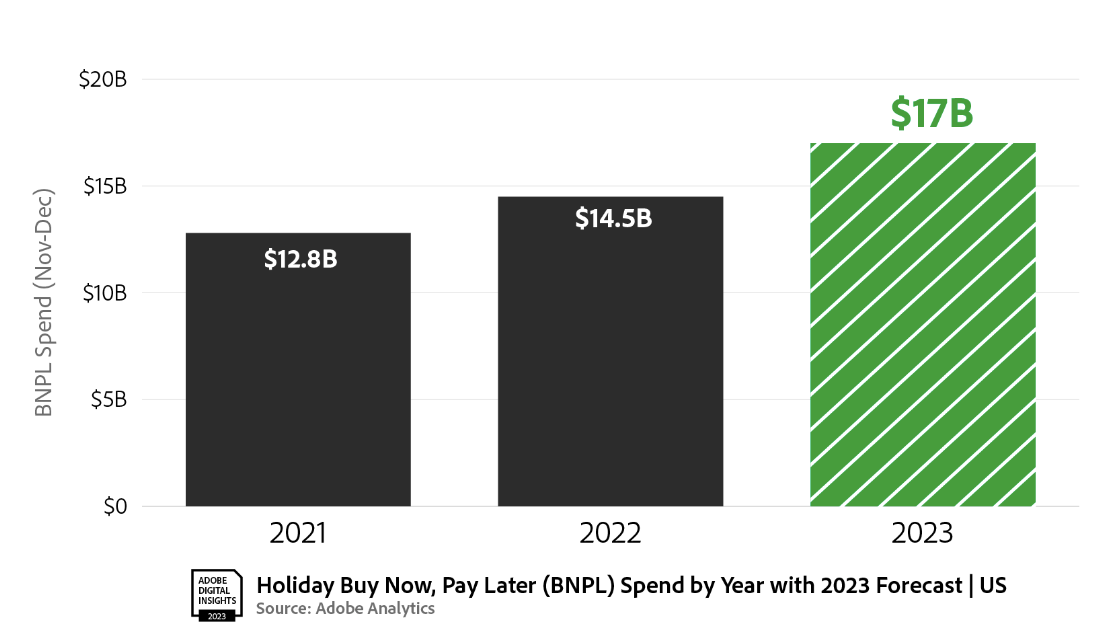

Budget-conscious customers have turned to BNPL (buy-now-pay-later) entities to boost their liquidity positions in the near term.

Adobe claimed BNPL services such as Affirm, Afterpay, and Klarna drove close to $6 billion in online spending between November 1 and November 23, an increase of 13.4% year over year.

Wells Fargo Sounds the Alarm Bells

Wells Fargo Securities is out with its stock market forecast for 2024. The investment bank’s head of equity strategy, Chris Harvey, expects the S&P 500 to be quite volatile in 2024.

Harvey explained that if the economic growth is stable, the Fed’s policy will remain unchanged. But if the economy nosedive, the Fed will be compelled to cut interest rates.

Harvey estimates the S&P 500 to gain less than 100 points in 2024, indicating a growth rate of less than 2%. In the Wells Fargo outlook report, Harvey warned investors to brace for a “trader’s market” rather than a “buy-and-hold” situation.

Crypto Investment Products Are on Fire

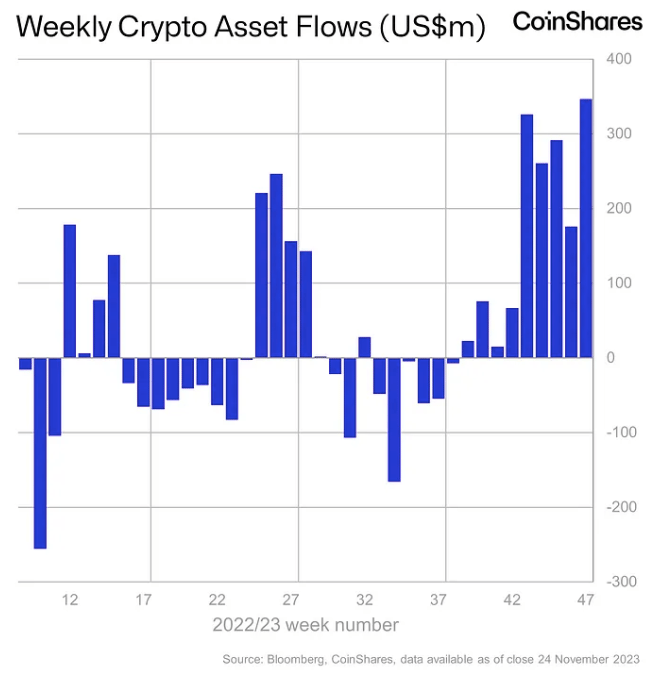

Crypto investment products experienced record inflows of $346 million last week. It was the largest weekly inflows in the last nine weeks, according to data from CoinShares.

Rising cryptocurrency prices and investor inflows have meant the assets under management or AUM in these funds have now surpassed $45 billion, the highest in more than 18 months.

Bitcoin and Ethereum, the two largest cryptocurrencies, continue to drive fund inflows. According to experts, the anticipation of a spot Bitcoin ETF in the U.S. is the key driver of inflows in the past week.

While BTC prices are up 123% in 2023, Ethereum has surged 68% year-to-date.

Headlines You Can’t Miss!

Disney’s Wish extends disappointing box-office run

Joe Biden blames corporations for high consumer costs

Treasury yields inch higher as consumers consider economic outlook

Shein files for IPO

Terra founder Do Kwon faces extradition to South Korea or the U.S.

Chart of the Day

Despite a strong labor market, corporates are feeling the heat as interest rate hikes have accelerated at a significant pace in the last two years.

In the above chart, we can see that bankruptcies in the U.S. have jumped drastically in 2023 due to an uncertain and challenging macro environment.

The U.S. economy is in the midst of the second-most aggressive cycle of interest rate hikes, and experts are still bracing for a soft landing. But each of the past hiking cycles has led to an economic recession.

The triple whammy of lower savings, resumption of student loan payments, and higher energy costs is bound to dent consumer spending, the single largest driver of the U.S. economy.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.