- 3 Big Scoops

- Posts

- Thanksgiving: Boom or Bust for Retail?

Thanksgiving: Boom or Bust for Retail?

PLUS: U.S. consumer spending slows

Bulls, Bitcoin & Beyond

Hello Folks,

Happy Holidays!!

Here’s what’s on the menu for today:

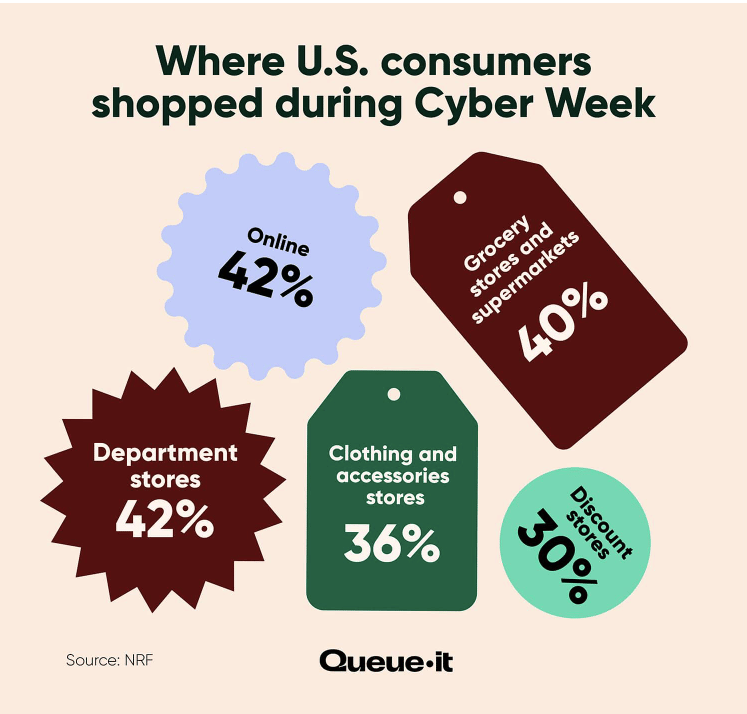

👉 Will Thanksgiving help U.S. retail?

👉 A look at consumer spending patterns

👉 The next potential crypto scam

Retailers Cautious on Holiday Spending

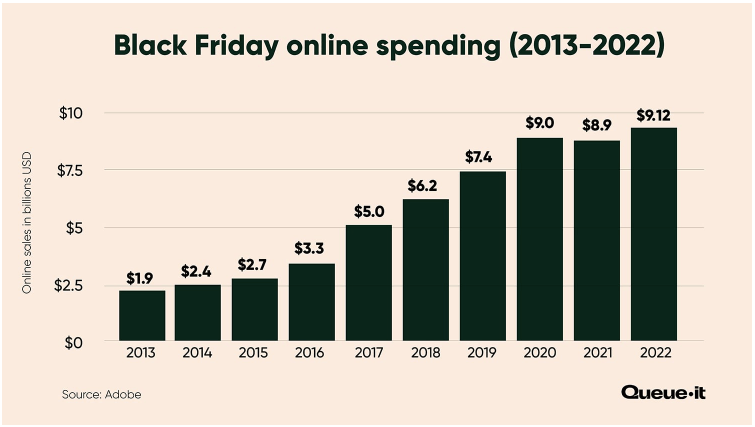

A dark cloud hangs over Black Friday as a slew of retailers have issued a disappointing outlook for Q4 in the past month. It seems a spell is cast on the all-important holiday season as companies gear up for the year's biggest shopping day.

Companies across the spectrum, ranging from luxury goods heavyweight- Tapestry to big-box discount retailers such as B.J.’s Wholesale Club, have cited multiple reasons that have forced them to reduce their outlooks or issue forecasts that were well below estimates.

According to data from NRF, holiday spending is expected to slow to 3% to 4% in 2023, significantly below prior years. For instance, holiday spend grew:

👉 9.1% in 2020

👉 12.7% in 2021 and

👉 5.4% in 2022

Of the 43 retailers that issued earnings forecasts, 86% came in below Wall Street estimates.

Walmart emphasized consumer spending weakened in the last week of October. Earlier this month, it forecast adjusted earnings between $6.40 and $6.48 per share for the year, below consensus estimates of $6.50 per share.

The holiday season is a crucial driver of revenue growth for retailers and big tech giants such as Apple, Microsoft, Amazon, Meta, and Alphabet.

While Apple and Microsoft benefit from robust demand for their products (iPhone, Xbox etc.) in Q4, Amazon generally experiences record e-commerce sales through the Thanksgiving week. Comparatively, Alphabet and Meta gain from higher enterprise ad spending.

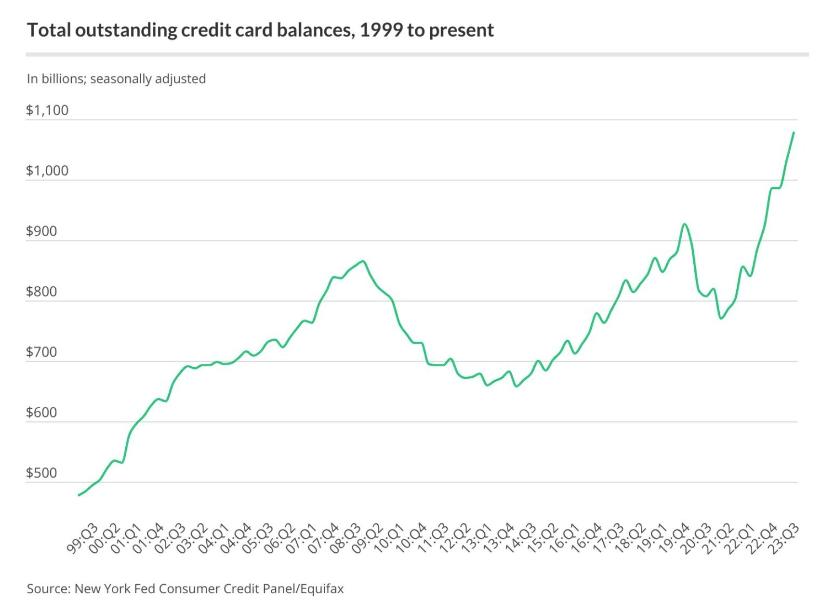

Holiday Debt Looms Large Over U.S. Shoppers

The holiday season might cause a financial strain on U.S. shoppers. Why? Coz, 25% of Americans, are still paying off their holiday debt from 2022, according to WalletHub.

So, for those already carrying significant credit card debt, it might make sense to pull back on expenses this year, as higher interest rates have made it quite expensive to repay the debts.

Average credit card interest rates have spiked to 21% in November, up from 16% two years back.

So, a $1,000 balance would keep someone in debt for 40 months if they make only minimum payments each month.

Is Justin Sun the Next Crypto Fraud?

Around $115 million has been stolen so far after hackers exploited the HTX exchange and the Hco chain. Both crypto platforms are linked to high-profile entrepreneur Justin Sun.

HTX, previously known as Huobi, was targeted by hackers who stole $30 million worth of digital assets. Moreover, $85.4 million worth of cryptocurrency was stolen from the Heco Chain.

Is Justin Sun involved in the hack? Sun founded Tron, a cryptocurrency valued at $9 billion. About four platforms linked to Sun were hacked in the last two months.

Something smells fishy here!!!

Headlines You Can’t Miss!

How are airlines cutting costs??

Black Friday deals from Hulu and other streaming platforms

Turkey hikes interest rates to 40%

U.K. tax cuts are not working

Singapore to tighten crypto regulations

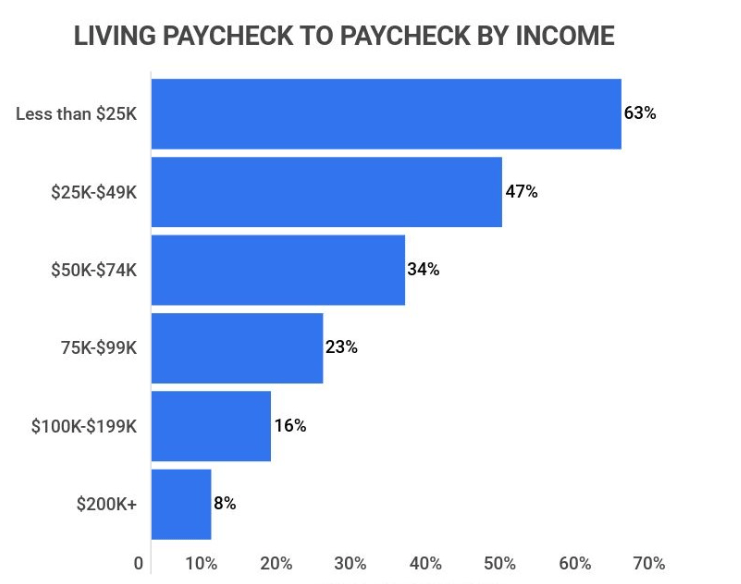

Chart of the Day

Source: Zippia

Households are feeling the heat even as inflation has cooled off in recent months. As of October, 60% of adults in the U.S. have stated they are living paycheck to paycheck.

Further, around 40% of consumers consider themselves worse off compared to 2022.

Credit card debt has surged to over $1 trillion, and 96% of shoppers expect to overspend this holiday season.

Around 50% of consumers plan to take on additional debt to pay for holiday expenses, and less than 25% plan to pay it off within the next two months.

Around 74% of Americans say they are stressed about finances due to inflation, rising interest rates, and a lack of savings.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.