- 3 Big Scoops

- Posts

- Tech Stocks Rebound

Tech Stocks Rebound

as inflation weighs on equities

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

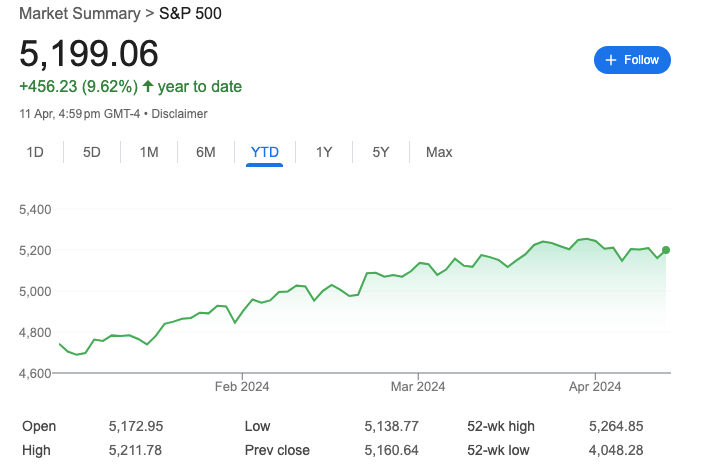

S&P 500 @ 5,199.06 ( ⬆️ 0.74%)

Nasdaq Composite @ 16,442.20 ( ⬆️ 1.68%)

Bitcoin @ $70,745.30 ( ⬆️ 1.02%)

Hey Scoopers,

Happy Friday! The weekend is on the horizon, and we’re wrapping up.

👉 Apple spikes higher

👉 Budget deficit widens

👉 A war on DeFi?

So, let’s go 🚀

Market Wrap 📉

The S&P 500 and Nasdaq Composite indices moved higher yesterday, rebounding from an earlier pullback over concerns of sticky inflation.

Tech stocks lifted the S&P 500 and Nasdaq Composite into positive territory as the producer price index reading for March came in below estimates.

Inflation data is noisy as the consumer price index for March was higher than projections. It means the Fed would be forced to keep interest rates higher with the possibility of a rate cut in June reducing to just 17%.

Yesterday, a host of “Magnificent Seven” stocks rallied with:

Nvidia rising 4.1%

Amazon touching an all-time high, and

Apple surging 4.3%

Trending Stocks 🔥

Amazon - The e-commerce giant added 1.7%, touching a record high for the first time since July 2021. In the company’s annual shareholder letter, CEO Andy Jassy pledged to lower costs while investing heavily in AI.

Nike - Shares of the sports goods maker added 3.2% following a Bank of America upgrade to “buy” from “neutral.” The bank said investors should buy the dip due to a compelling valuation.

CarMax - The used vehicle seller tumbled 13% after reporting Q4 earnings of $0.32 per share and revenue of $5.63 billion. Analysts forecast sales of $5.80 billion and earnings of $0.49 per share.

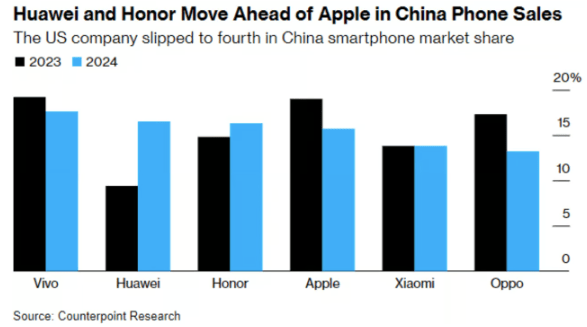

Apple Gains Pace

Apple shares climbed 4.3% on Thursday to $175.04. It was the best trading session for the hardware giant since May 2023.

Despite the recent gains, AAPL stock is down 5% year-to-date due to:

Slowing iPhone sales in China

Billion-dollar fines by the EU

JPMorgan analysts believe sentiment surrounding Apple is improving as investors are comfortable with the current valuation and the potential to benefit from AI.

JPMorgan predicts a strong iPhone sales cycle in 2026 due to upcoming AI features that should be integrated across Apple devices. Recently, Apple CEO Tim Cook told investors to expect an AI announcement later this year.

Another Bloomberg report suggested Apple is preparing new Mac laptops and desktops with next-generation '“M4 chips”, that emphasize AI.

Rise and grind, dollar bills!

Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks.

Get started today, with as little as $10.

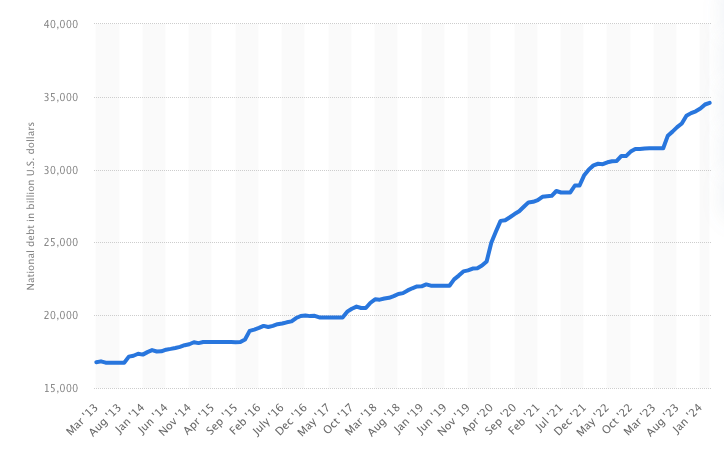

Total Government Debt Tops $34.6 Trillion

Yields on longer-dated Treasury debt ticked higher on Friday following another surge of red ink for the U.S. government budget.

The 30-year bond rose 4 basis points to 4.672%, while the benchmark 10-year note rose to 4.578%.

Public Debt of the U.S. from March 2013 to March 2024 (In billion U.S. dollars)

Source: Statista

The move came a day after the Treasury Department reported:

The fiscal deficit for March totaled $236.5 billion

The total shortfall has surged over $1.06 trillion

The total government debt stands at $34.6 trillion

Higher yields have pushed financing costs higher. The net interest on government debt totaled $79 billion in March and $429 billion for the fiscal year.

The SEC Might Sue Uniswap

The Securities and Exchange Commission (SEC) has trained its guns on crypto yet again.

Last year, it initiated 46 enforcement actions against crypto companies. Yesterday, the SEC targeted Uniswap, one of the most popular decentralized exchanges globally.

Uniswap received a Wells Notice, equivalent to a warning from the SEC. The regulatory body has accused Uniswap of violating securities laws, suggesting that legal charges against the exchange are next.

The SEC argues most cryptocurrencies are securities and should be treated similarly to other investments.

Headlines You Can't Miss!

What to expect from JPMorgan’s Q1 earnings report

Car insurance costs are skyrocketing

China to drive the global economy: World Bank

Trump faces trial on criminal hush money charges

JPMorgan explains subdued crypto VC funding poses downside risk

Chart of The Day

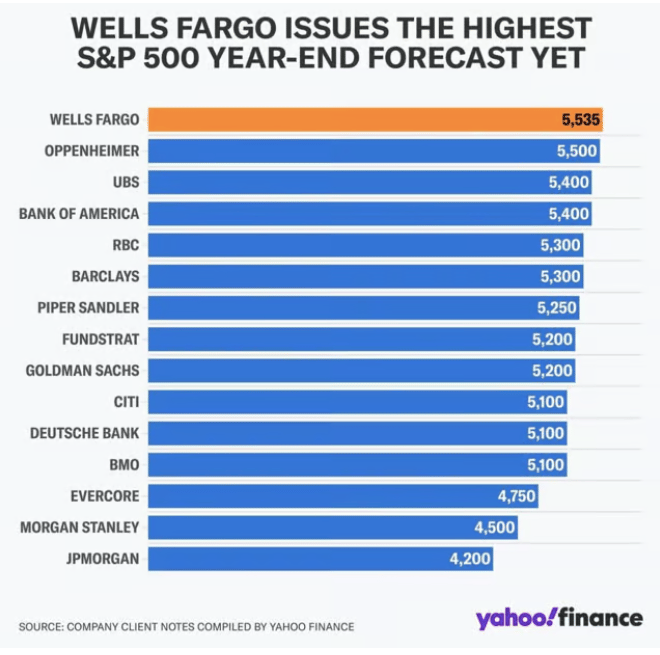

Wells Fargo analysts boosted their year-end target for the S&P 500 index to 5,535, which is the highest forecast on Wall Street.

The S&P 500 index currently trades more than 6% below this lofty estimate. Comparatively, JPMorgan has the lowest S&P 500 target and expects the index to fall by 19% from current levels.

The flagship index has already surged 9.6% in 2024 and is up a whopping 45% from October 2022.

According to Wells Fargo, the S&P 500 index would move higher due to:

👉 The AI megatrend

👉 Upbeat earnings outlook and

👉 Possible interest rate cuts

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.