- 3 Big Scoops

- Posts

- EU vs. Big Tech

EU vs. Big Tech

Apple, Alphabet, and Meta

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,218.19 ( ⬇️ 0.32%)

Nasdaq Composite @ 16,384.47 ( ⬇️ 0.27%)

Bitcoin @ $70,553.60 ( ⬆️ 1.71%)

Hey Scoopers,

We’re off to a busy start this Tuesday. Here’s your finance edge in 5 minutes!

👉 EU takes on Big Tech

👉 Oil prices tick higher

👉 SEC vs. Ripple

So, let’s go 🚀

Market Wrap 📉

Stocks pulled back on Monday to start a shortened trading week as the market rally took a breather. However, the market is on track for its fifth consecutive month of gains after all three major indices added over 2% last week.

According to the weekly American Association of Individual Investors sentiment survey, overall sentiment remains above the historical average.

In the next three days, investors will gain further insights into the path of inflation from February’s personal consumption expenditures price index, which is the Fed’s preferred inflation gauge.

Trending Stocks 🔥

Boeing - Shares moved 1.4% higher after the aerospace company announced its CEO, David Calhoun, would step down at the end of 2024. Board chairman Larry Kellner will also step down, Boeing added.

Masimo - Shares of the medical technology company climbed close to 5%. Last week, the company disclosed plans to spin off its consumer business, following which Wells Fargo upgraded the stock to “overweight” from “equal weight.”

Super Micro Computer - The chip stock surged close to 10% after JPMorgan initiated coverage of the high-flying tech giant. The investment bank issued an “overweight” rating with a price target of $1,150, indicating an upside potential of 8% from current levels.

EU Launches Probe Into Big Tech

Yesterday, the European Union (EU) launched an investigation into big tech companies, including Apple, Alphabet, and Meta, under the new Digital Markets Act (DMA).

Source: CNBC

Here’s all you need to know about the investigation:

👉 The first two probes focus on Alphabet and Apple and relate to anti-steering rules. The DMA states tech companies are not allowed to block businesses from telling users about cheaper options for their products or about subscriptions outside app stores.

👉 In the third inquiry, the EU is investigating if Apple has complied with obligations to ensure users can easily uninstall apps on iOS and change default settings.

👉 The fourth probe targets Alphabet. The EU wants to find out if Google’s search results may lead to self-preferencing over similar rival offerings.

👉 The final investigation focuses on Meta and its pay-and-consent model. In 2023, Meta introduced an ad-free subscription model for Facebook and Instagram in Europe. The commission is investigating whether the subscription model without ads violates the DMA.

Source: Economic Times

Earlier this year, Apple was fined close to $2 billion after the EU found Apple restricted app developers, preventing them from informing iOS users about cheaper music subscription services available outside the app.

These probes are likely to be completed within 12 months. If any company has infringed the DMA, the commission can impose fines of up to 10% of total sales and may increase it to 20% in case of repeated infringement.

Crude Oil, Home Sales, and the Yen

Crude oil futures ticked higher yesterday as Ukraine drone strikes disrupted Russian refining capacity. Further, Russia is looking to lower output to meet OPEC+ targets. The West Texas Intermediate contract for May gained 1.50% and now trades at $81.84 a barrel.

Russia has ordered companies to cut oil output to meet Moscow’s commitments to OPEC+. Several OPEC+ countries have agreed to production cuts totaling 2.2 million barrels per day in Q2 of 2024.

The energy sector has gained pace in March, rising 9.2% this month, comfortably outpacing the broader markets.

On the housing front, new home sales in February clocked in at 662,000 in February, below Dow Jones estimates of 675,000. It marks a 0.3% decline from the 664,000 units sold in January.

Finally, Japan believes the current weakness in the Japanese yen does not reflect its fundamentals. The yen has weakened in the last two weeks even though the Bank of Japan raised interest rates and abolished its yield curve control policy.

The SEC vs. Ripple Labs

The Securities and Exchange Commission (SEC) has requested a New York judge to impose a $2 billion fine on Ripple Labs.

Source: Coinpedia

The SEC and Ripple Labs have been embroiled in a legal fight since 2020, when the former accused Ripple of raising $1.3 billion through the sale of XRP.

According to the SEC, the XRP is an unregistered security. In 2023, a U.S. judge ruled that some of Ripple’s sales did not violate securities laws due to a blind bid process that was in place for these transactions.

However, the judge also ruled direct sales of the token to institutional investors should be classified as securities.

Headlines You Can't Miss!

Indian bonds set to be added to global indices

Donald Trump’s net worth jumps to $6.5 billion

Adam Neumann bids $500 million for WeWork

Reddit shares rise 30% after blockbuster IPO

FTX estate is selling a majority stake in Anthropic for $884 million

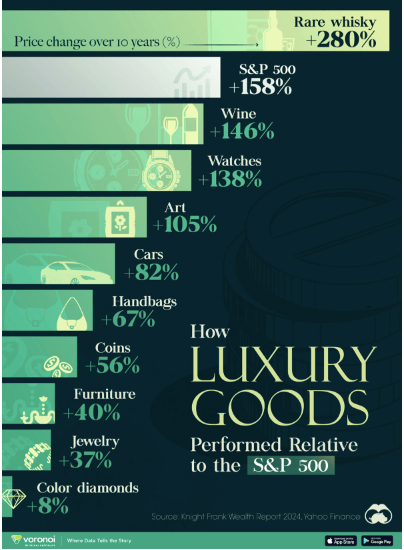

Chart of The Day

The ultra-wealthy spend money on luxury goods, including wines, art, and watches. While the money spent might seem exorbitant, a few consider them as investments that end up giving generous returns over time.

In the last decade, rare whiskey has been the best-performing luxury asset, appreciating 280%, outpacing the S&P 500 index by a wide margin.

Wine and luxury watches are the next two best-performing luxury goods, returning 146% and 138%, respectively.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.