- 3 Big Scoops

- Posts

- 🗞 What Next for Nvidia?

🗞 What Next for Nvidia?

PLUS: OpenAI eyes profits

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

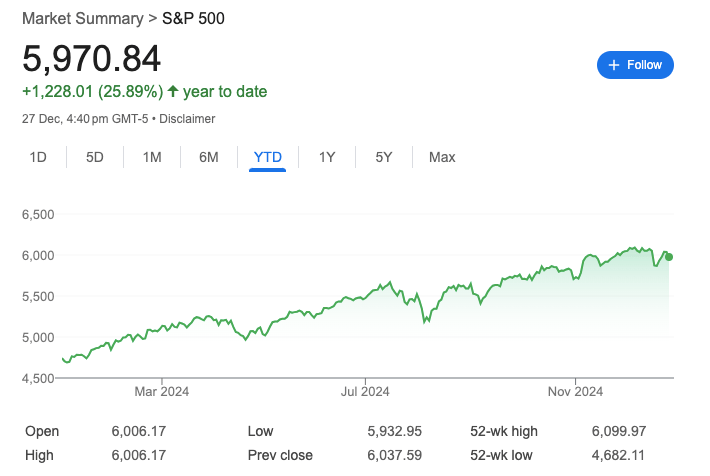

S&P 500 @ 5,970.84 ( ⬇️ 1.11%)

Nasdaq Composite @ 19,772.03 ( ⬇️ 1.49%)

Bitcoin @ $95,106.34 ( ⬇️ 1.98%)

Hey Scoopers,

Happy new year (in advance)!

It’s the last newsletter for the year, and here’s what we’re covering today 👇

👉 Nvidia’s AI dominance

👉 A broader AI rally in 2025?

👉 OpenAI is now a “for-profit”

So, let’s go 🚀

Market Wrap

The stock market showed resilience in thin holiday trading on Friday. The Dow Jones recovered from an early 182-point decline to finish marginally higher (+0.07% to 43,325.80).

This recovery, alongside minimal changes in the S&P 500 (-0.04%) and Nasdaq (-0.1%), demonstrates underlying market strength despite low trading volumes.

The week's performance has been notably positive, particularly building on a historic Christmas Eve rally where the S&P 500's 1.1% gain marked its strongest Christmas Eve showing since 1974. The weekly gains are telling:

S&P 500: +1.8%

Dow: +1.1%

Nasdaq: +2.3% (driven by megacap tech strength)

The timing is particularly significant as it coincides with the start of the traditional Santa Claus rally.

Historical data since 1950 shows that this period (the last five trading days of the year and the first two of January) typically delivers a 1.3% return, significantly outperforming the average seven-day return of 0.3%.

However, there's a notable divergence in monthly performance for December 2025:

Nasdaq: +4.2% (buoyed by Tesla, Apple, and Alphabet gains)

S&P 500: +0.1% (essentially flat)

Dow: -3.5% (heading toward its worst monthly performance since April)

The mixed economic signals add complexity to the market narrative. Initial jobless claims (219,000) came in better than expected, but continuing claims reached their highest level (1.91 million) since November 2021, suggesting some potential softening in the labor market.

Long Angle: A Vetted Community for High-Net-Worth Entrepreneurs and Executives

Private, vetted community offering confidential discussions and education

Entrepreneurs and executives, 30–55 years old, with $5M to $100M net worth

Preferential access to top-tier alternative investments

NVIDIA's Unstoppable Rise

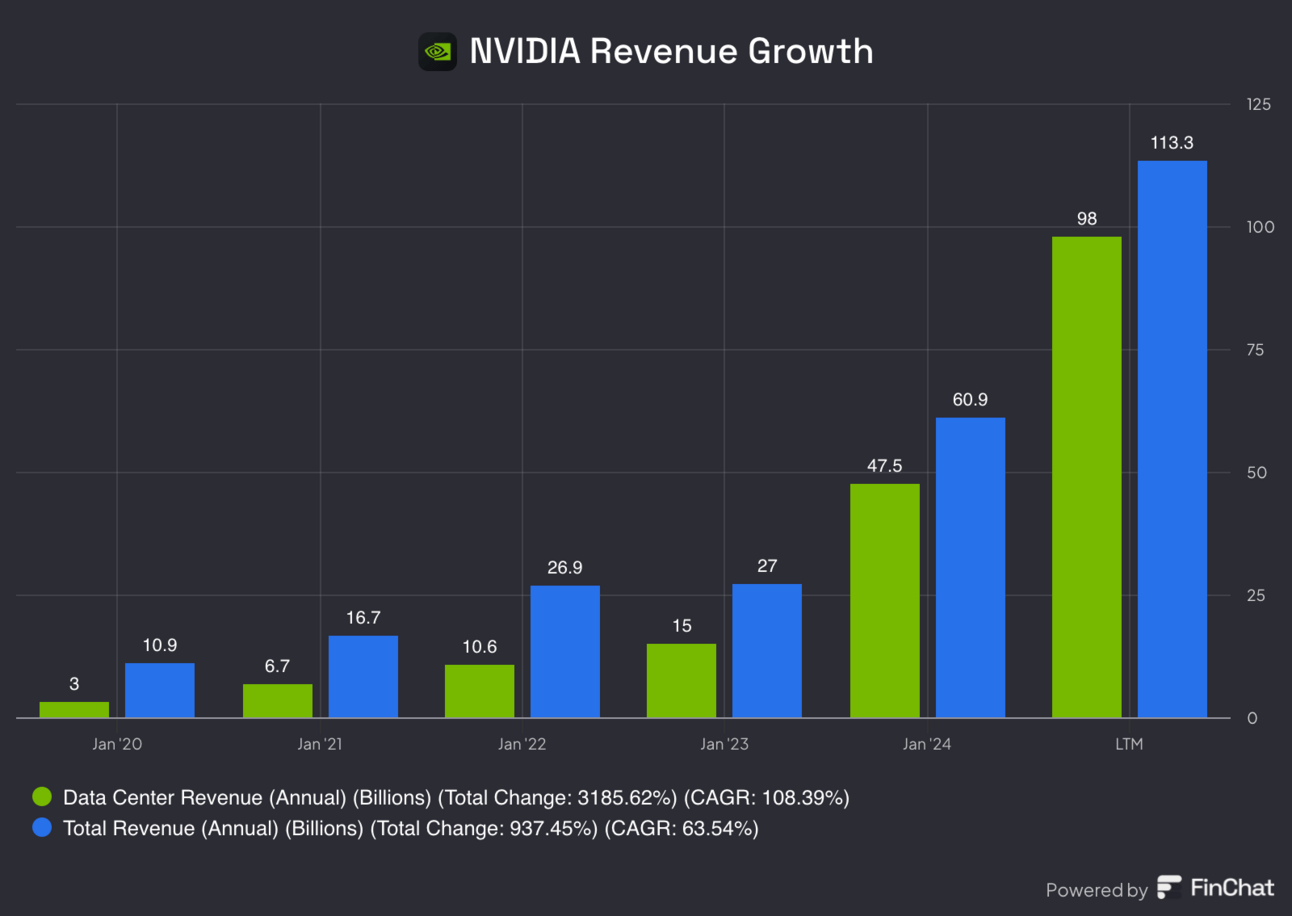

In 2024, Nvidia achieved something extraordinary: It briefly surpassed Apple to become the world's most valuable company.

But here's what most people miss about Nvidia's dominance:

It's not just about being first - it's about building an ecosystem that's nearly impossible to replicate.

Here's the fascinating breakdown:

87% of Nvidia's $35.1B revenue comes from data centers

They control 80-90% of the AI chip market

Their new Blackwell chips are already sold out through most of 2025

The secret? While everyone focuses on their hardware, Nvidia's true moat is CUDA - their software platform that developers can't live without.

AMD and Intel are trying to compete. But there's a catch:

Building chips is only 50% of the battle. Building a developer ecosystem? That's the other 90%. (Yes, that's 140% - that's how hard this game is)

The wildest part? Even if competitors gain ground, Nvidia still wins.

Why? The AI market is growing so fast that even a smaller piece of the pie means massive growth.

Would you bet on Nvidia maintaining its dominance through 2025?

The AI Trade is Shifting: Why 2025 Will Look Different?

The AI gold rush is entering a new phase. While everyone's watching the Magnificent 7, smart money is already preparing for what's next.

Here's what Wall Street's top strategists are betting on for 2025: 🧵

First, the big picture:

Goldman Sachs sees the S&P 500 hitting 6,500 in 2025.

BofA is even more bullish, with a target of 6,666.

But here's what everyone's missing...the real story isn't about Big Tech anymore. It's about who's USING their technology.

Think about it: The people who got rich in the gold rush were not just the miners but also the ones selling pickaxes.

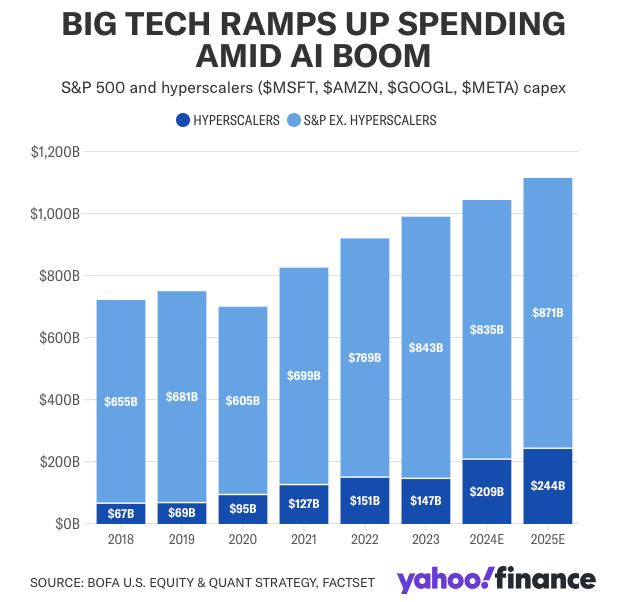

Here’s a mind-blowing stat to support the argument: One AI data center uses as much power as New York City daily. This is why utility stocks are already up 20% in 2024.

The AI trade is evolving in 3 phases:

Phase 1: Hardware (Nvidia)

Phase 2: Infrastructure

Phase 3: AI Users

Wall Street is betting Phase 3 will be the biggest yet. But who's in Phase 3? Well, it’s the companies using AI to boost sales, such as:

Salesforce

Adobe

Mastercard

Their stocks are already moving.

Alternatively, you also need to follow the big money. For example, Big Tech will spend $244B on AI infrastructure in 2025. However, the real winners will be the companies that turn that infrastructure into revenue.

Key insight:

2024 was about who BUILDS AI, and 2025 will be about who USES it best.

The playbook is changing:

Stop asking, "Who's the next Nvidia?" Start asking, "Who's using AI to transform their business?"

Bottom line:

The AI revolution is no longer just about tech. It's about every company that can turn AI from a cost center into a profit center.

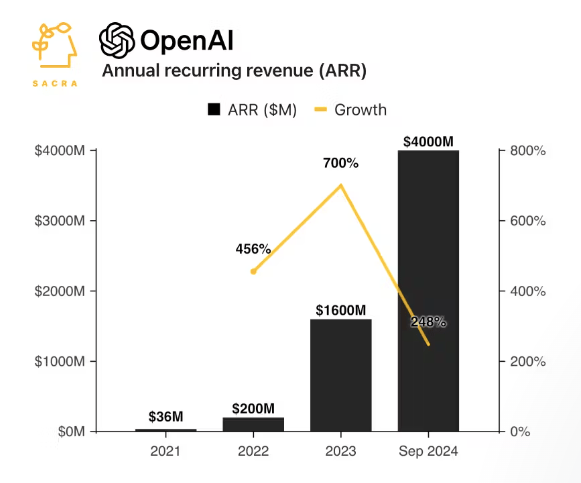

OpenAI's Bold Pivot: From Nonprofit to $157B Tech Giant

In a stunning announcement, OpenAI is making its biggest transformation yet.

The creator of ChatGPT is evolving into a public benefit corporation in 2025, and the numbers behind this move are staggering:

Current valuation: $157 billion

2024 Revenue: $3.7 billion

Latest funding round: $6.6 billion

Expected losses: $5 billion

But here's what makes this story fascinating 👇

OpenAI started as a nonprofit research lab in 2015. Now, it says its structure no longer supports its mission. Why?

The AI race has become exponentially expensive due to:

Massive computing infrastructure needs

Fierce competition from tech giants

Billions needed for R&D

Yet OpenAI’s transition isn't without drama:

Multiple high-profile executive departures

Legal battle with Elon Musk

Growing concerns about AI safety vs. commercialization

💭 Key Question: Can OpenAI maintain its original mission while competing in a trillion-dollar market?

Headlines You Can't Miss!

Big Tech is betting big on nuclear power

Credit card debt set to hit a high in 2024

Starboard aims to drive AI growth at Riot Platforms

Memecoins lose $40B in December 2024

Ethereum NFT volume hits weekly high of $186M

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.