- 3 Big Scoops

- Posts

- 🗞 Wall Street Bets on Trump

🗞 Wall Street Bets on Trump

and Bitcoin tops $75k

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

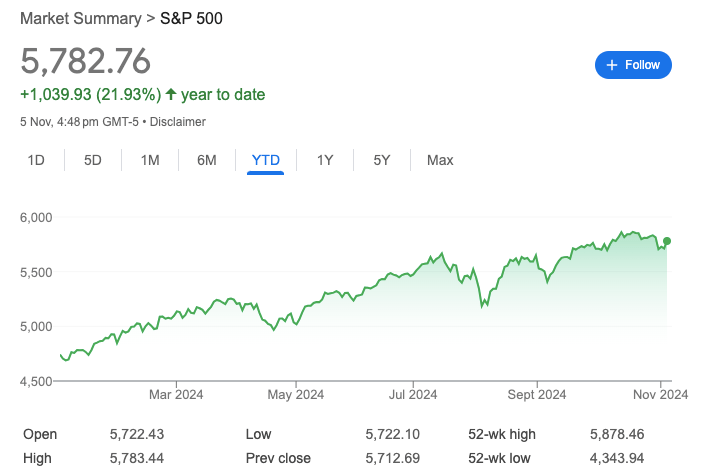

S&P 500 @ 5,782.76 ( ⬆️ 1.23%)

Nasdaq Composite @ 18,439.17 ( ⬆️ 1.43%)

Bitcoin @ $74,801.04 ( ⬆️ 9.22%)

Hey Scoopers,

Happy Wednesday! Are you ready for an exciting newsletter today?

👉 A Donald Trump win is likely

👉 Oil prices expected to remain volatile

👉 Bitcoin continues to rally

So, let’s go 🚀

Market Wrap

Stocks rose on Tuesday as traders awaited the results from a high-stakes U.S. presidential election. Notably, stock futures rose sharply as investors speculated that former President Donald Trump may have an edge in the presidential race.

Goldman Sachs predicts a Trump win and Republican sweep of Congress would spark a 3% pop in the S&P 500.

A Trump win and a dividend Congress could cause a 1.5% gain in the S&P 500, while a Kamala Harris win with a dividend Congress would cause a 1.5% drop.

Trump’s tax cut agenda could give corporate America a tangible boost. Still, steep tariffs and a potential trade war under his presidency could cause more uncertainty and a resurgence of inflation.

Alternatively, in a Harris administration, the risk of tighter regulations could bring more scrutiny to industries such as banks and healthcare and act as a tailwind for clean energy stocks and electric vehicle companies.

Trending Stocks 🔥

Wynn Resorts - The resort and casino operator’s stock dropped over 9% after Q3 results missed top and bottom line estimates.

NXP Semiconductors - The semiconductor company shed 5% on disappointing Q4 guidance, citing macro weakness in Europe and the Americas and in industrial and Internet of Things markets.

Archer-Daniels-Midland - The food processor slumped 6% after its fiscal Q3 and full-year earnings outlook missed estimates. It forecasts full-year earnings between $4.50 and $5 per share, below estimates of $5.21.

Political Ad Spend Topped $10.9 Billion

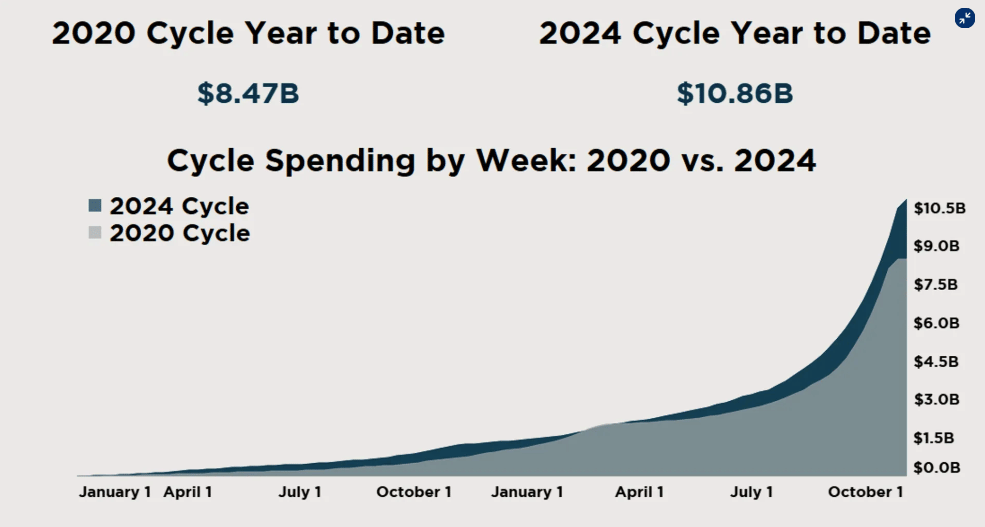

The current election cycle is the most expensive of all time, according to data from AdImpact, which tracked close to $11 billion in total political ad spending.

The cycle exceeds the previous benchmark set in 2020 when election ad spending totaled $8.5 billion.

A significant chunk of this cycle’s spending, totaling $2.2 billion, came in the last two weeks. The top ad spender in this period was the Democratic-aligned Future Forward PAC, which burnt through $170 million, while the top market was Philadelphia, which spent more than $106 million.

As in 2020 and 2016, Democrats have outspent Republicans in this year's presidential election. But unlike those races, Florida was not the top ad-spending recipient in the final 60 days of the 2024 cycle.

It will be interesting to see if the U.S. elections will have a positive impact on digital ad companies such as The Trade Desk.

Tariffs, Oil, and Student Debt

If Donald Trump comes to power, the proposed tariffs of 10% to 20% on imports and 60% to 100% on imports from China could cost American households $78 billion annually.

A second Trump administration could challenge the American economy if foreign countries and trading partners retaliate with tariffs, driving inflation higher.

Further, a Trump administration could bring volatility to the oil market. For instance, Trump could tighten sanctions on Iran, reducing supply from the Islamic Republic and putting upward pressure on near-term oil prices.

Moreover, several Trump advisors have shown strong support for Israel striking Iran’s nuclear and energy facilities. Alternatively, trade tensions could heighten through tariffs, putting downward pressure on global oil demand and prices.

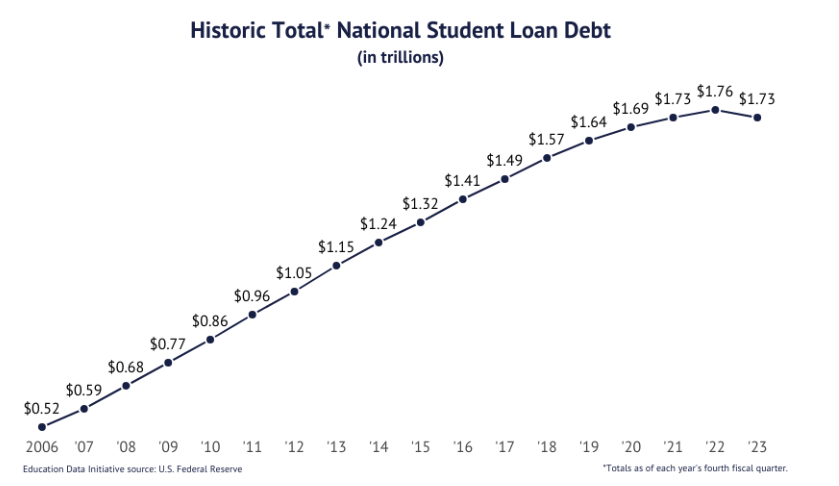

Next, President Joe Biden has tried to find ways to deliver on his promise of forgiving the student debt of millions of Americans.

However, last June, the U.S. Supreme Court stated the President did not have the power to wipe away $400 billion in consumer debt without prior authorization from Congress.

Biden then directed the U.S. Department of Education to start working on a new debt cancellation program, which the Trump administration will likely retrace.

Bitcoin Tops $75k

Bitcoin prices have surged over 9% in the last 24 hours, touching fresh record highs and briefly hitting the $75,000 threshold, as the market processed Donald Trump’s early lead in the presidential election.

After touching an all-time high of $73,000 in March, Bitcoin has remained rangebound between $50,000 and $70,000 in the last seven months.

Other top cryptocurrencies, such as Ethereum and Solana, also saw sizeable gains, rising 7% and 13%, respectively.

Bitcoin's new all-time high comes as Trump has embraced a crypto-friendly approach to the industry in his bid for a second term.

Trump began accepting crypto as a form of donation in May and has since disclosed plans to make the U.S. the world’s crypto capital.

Bitcoin is the world’s largest cryptocurrency and is up 70% in 2024, spurred by substantial inflows into spot Bitcoin ETFs in the U.S. Since their launch in January, the ETFs have generated $450 billion in daily cumulative volume.

The ETFs have attracted $3.6 billion in October, pushing year-to-date inflows to $22.5 billion.

Your Access to Select Private Investments

Join a network of 500+ accredited investors accessing private companies like OpenAI, SpaceX, Neuralink, and ByteDance.

All investments have the risk of loss. UpMarket is not associated with or endorsed by the above-listed companies. Only available to eligible accredited investors. View important disclosures at www.upmarket.co

Headlines You Can't Miss!

Novo Nordisk beats Q3 earnings estimates

Toyota’s Q2 operating profit falls 20%

Tesla jumps in pre-market as Trump win is likely

Why are solar energy stocks falling?

Dogecoin and other memecoins are rallying

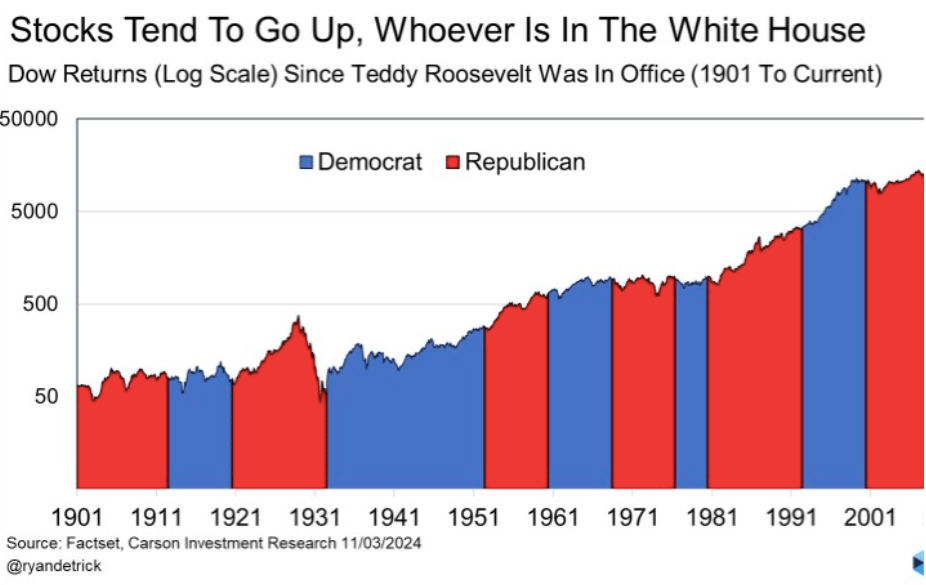

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.