- 3 Big Scoops

- Posts

- Visa Faces DoJ Lawsuit

Visa Faces DoJ Lawsuit

PLUS: China stimulates the stock market

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

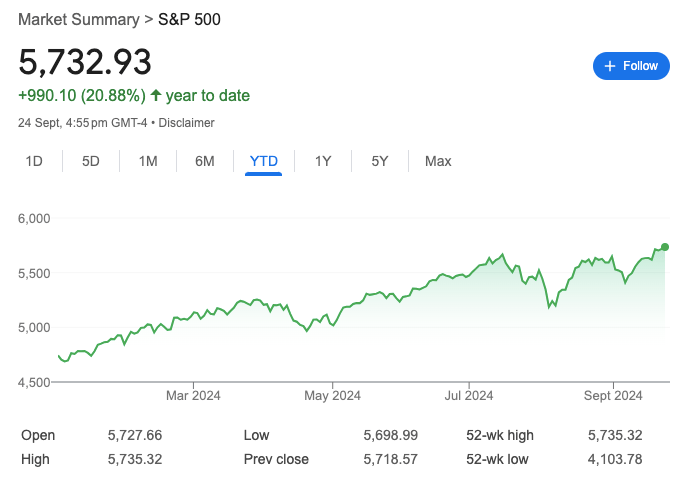

S&P 500 @ 5,732.93 ( ⬆️ 0.25%)

Nasdaq Composite @ 18,074.52 ( ⬆️ 0.56%)

Bitcoin @ $64,086.32 ( ⬆️ 1.06%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 Visa stock tanks over 5%

👉 Chinese stocks rally

👉 Caroline Ellison sentenced in FTX fraud

So, let’s go 🚀

Market Wrap

The S&P 500 index rose to a fresh record on Tuesday and largely shook off a weak consumer confidence reading due to a sharp rise in Nvidia.

Shares of artificial intelligence darling Nvidia rose close to 4% after a regulatory filing showed that CEO Jensen Huang wrapped up his sales of the chipmaker’s stock for the time being.

Elsewhere, consumer confidence suffered its most significant one-month decline in over three years, hitting 98.7 for September, lower than estimates of 104.

The data follows a warning from JPMorgan Chase CEO Jamie Dimon about worsening geopolitical instability. Dimon added that a volatile backdrop could influence “the state of the economy” moving forward.

Trending Stocks 🔥

Smartsheet - Shares surged 6.5% after Blackstone and Vista Equity Partners agreed to buy the software maker for $56.5 a share in cash, valuing the deal at $8.4 billion.

Flowserve - The industrial giant rose over 7% after Bank of America stated its nuclear exposure was underappreciated.

Liberty Broadband - The stock surged 26% after offering a counterproposal to Charter’s business combination plan.

Pre-IPO | The Biggest Disruption to $martphones Since iPhone

Turning Smartphones into Revenue for Users.

32,481% Growth in 3 Years.

Over $60M+ in Revenue. $1T+ Market Opportunity.

This is a paid advertisement for Mode Mobile Reg A offering. Please read the offering statement at https://invest.modemobile.com/.

The DoJ vs. Visa

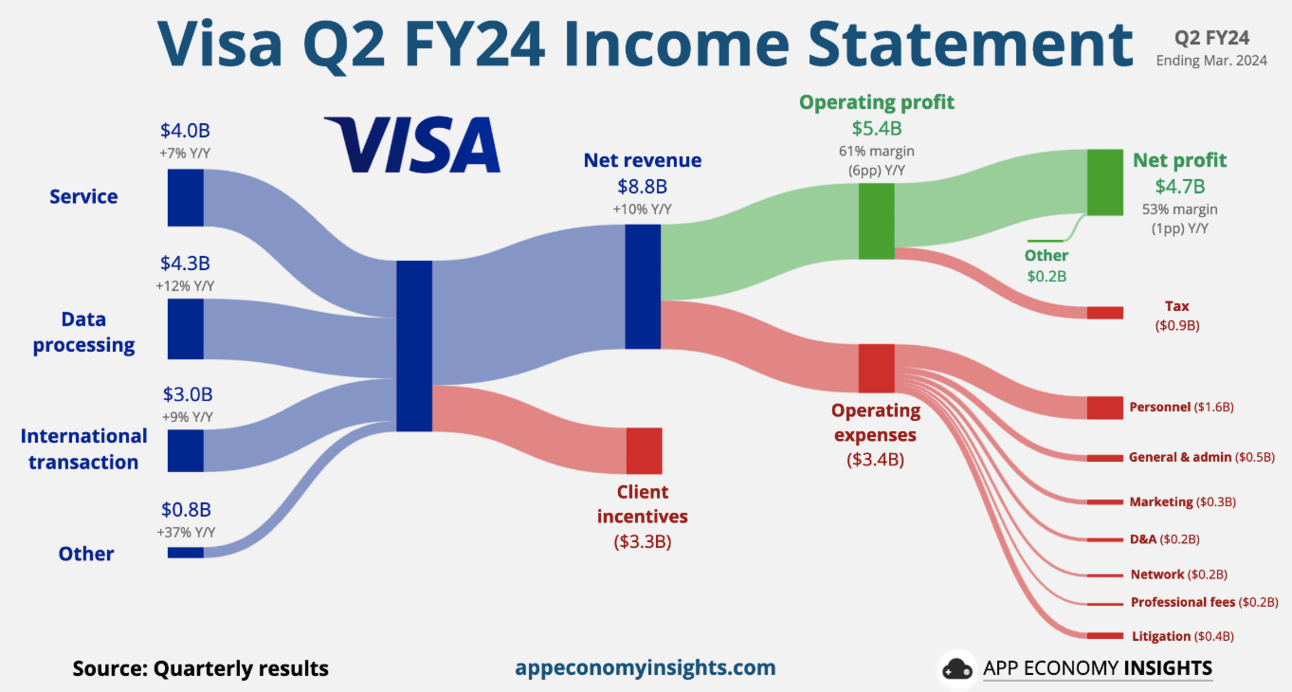

Visa shares moved lower by more than 5% after it was revealed that the Department of Justice (DoJ) plans to sue the financial services giant over antitrust concerns.

The federal government has recently sued several big tech companies, so the latest development shouldn’t surprise investors. With a market cap of $530 billion, Visa is among the largest companies in the world and enjoys a wide economic moat in the payments processing space.

Notably, the DoJ is preparing to sue Visa for preventing competitors from entering the market by punishing customers who try to use alternative payment services.

The lawsuit, which could be filed this week, follows a years-long investigation. The DOJ also successfully sued the company to block its acquisition of Plaid in 2020.

Since the suit has yet to be filed, it's difficult to say what the impact on Visa's business will be. At a minimum, it's likely to be a legal headache for the payment processing giant, and at worst, it could result in billions of dollars in fines and prevent Visa from entering new markets.

Dislodging the company's grip on the credit card industry won't be easy, though. It essentially has a duopoly with Mastercard, and rebuilding its network of merchants would be challenging.

Visa had an estimated 52% of credit card purchase volume in the U.S. in 2022 ($2.84 trillion), and its operating margins indicate a monopoly at greater than 60%.

All Eyes on China

Chinese stocks leapt out of the gate, with shares of Yum China Holdings, JD.com, Pinduoduo, and Li Auto rising by 7.2%, 13.9%, 11.5%, and 11.4%, respectively, as China’s central bank unveiled its biggest stimulus since the pandemic.

China’s economy remains under pressure and, due to weak consumer demand, is at serious risk of missing the government’s target of growing GDP by 5% in 2024.

The government is pumping money into the economy and cutting interest rates to boost spending, which should lower mortgage payments and credit card debt while increasing disposable income.

The People’s Bank of China is also cutting the minimum down payment on Chinese mortgages to 15% to encourage more home buying.

However, economists remain cautious about the move and explained that these measures might not pull China’s economy out of a low-growth rut marked by a festering real-estate crisis and spiraling trade tensions.

For instance, borrowing costs are already low, but credit data suggests that households and businesses are not that interested in borrowing.

Alternatively, most Chinese stocks trade at a cheap valuation and might outperform the broader markets, especially if the economy revives in the near term.

Caroline Ellison Goes to Prison

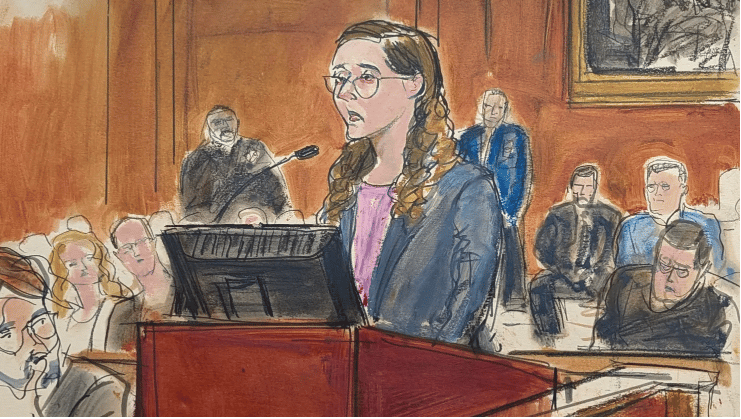

Source: CNBC

Caroline Ellison, the star witness in the prosecution of her former boyfriend, FTX founder Sam Bankman-Fried, was sentenced Tuesday in New York federal court to two years in prison and ordered to forfeit $11 billion for her role in the massive fraud and conspiracy that doomed the cryptocurrency exchange once valued at $32 billion.

Ellison helmed Alameda Research, which received $8 billion in customer funds looted by Bankam-Fried from FTX. The stolen money was used for Alameda’s trading operation and other purposes.

The judge explained that the FTX case is probably the greatest financial fraud perpetrated in U.S. history, resulting in Ellison's two-year prison sentence.

Headlines You Can't Miss!

Why rate cuts might not be enough for China?

Senate grills Novo Nordisk on weight loss drug pricing

Mortgage rates dip, increasing the spending power of households

Elliott Management calls for a special meeting for Southwest Airlines

OpenAI rolls out much-awaited advanced voice feature

Chart of The Day

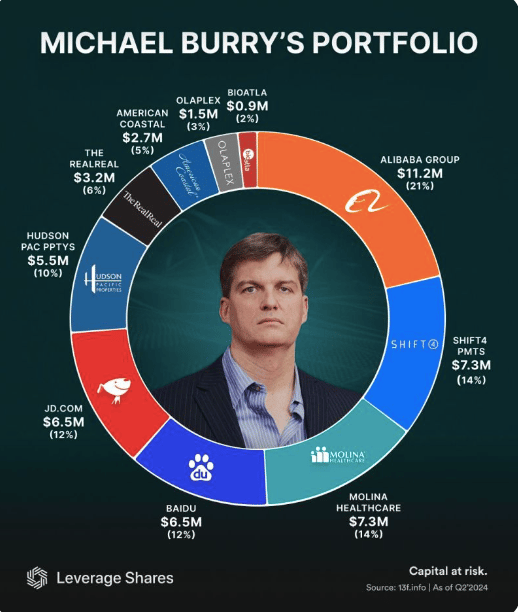

Michael Burry’s biggest stock bets are paying off.

Chinese stocks such as Alibaba, Baidu, and JD.com account for over 50% of Burry’s portfolio.

After predicting 10 of the last two recessions, “The Big Short” star is cashing in on long positions.

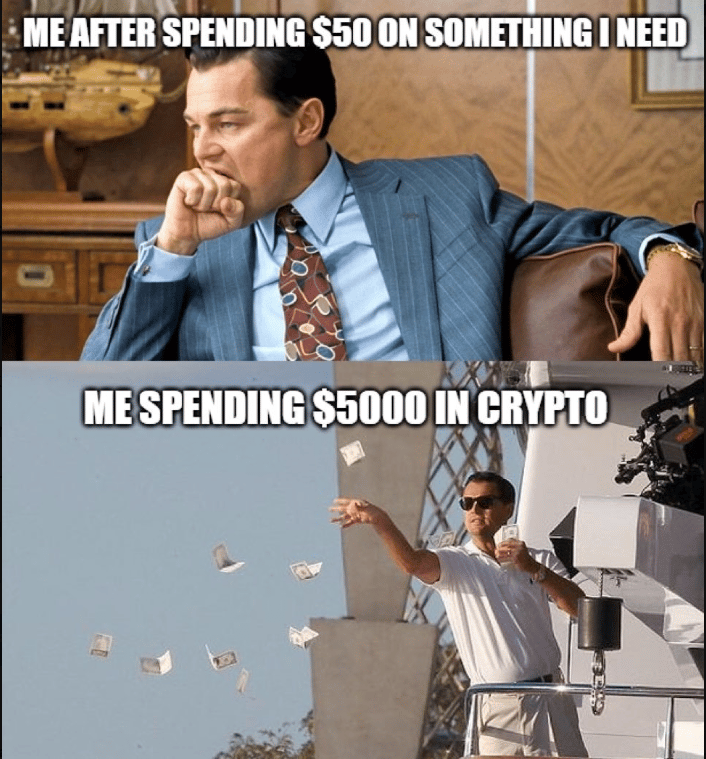

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.