- 3 Big Scoops

- Posts

- 🗞 United Airlines Takes Off

🗞 United Airlines Takes Off

PLUS: Amazon goes nuclear

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

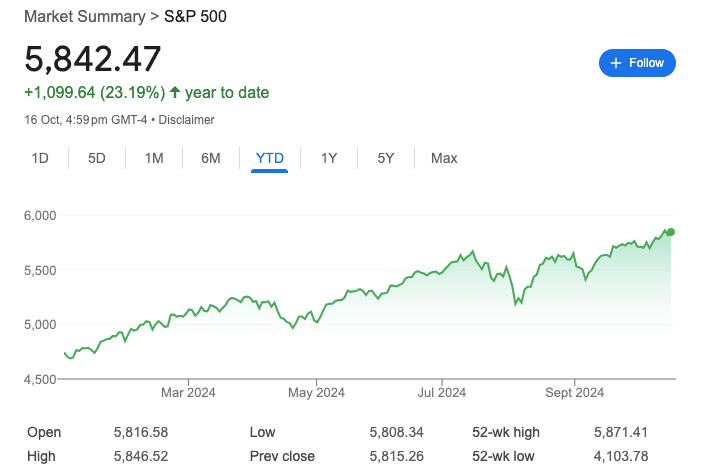

S&P 500 @ 5,842.27 ( ⬆️ 0.47%)

Nasdaq Composite @ 18,367.08 ( ⬆️ 0.28%)

Bitcoin @ $67,439.48 ( ⬆️ 0.13%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter?

👉 United Airlines beats estimates

👉 Dominion Energy to benefit from AI demand

👉 Morgan Stanley pops over 6%

So, let’s go 🚀

Market Wrap

Stocks ticked higher yesterday, with the Dow Jones Industrial Average rising to a record close, bouncing back from a sell-off in the previous session.

The earnings season is off to a strong start. Around 50 S&P 500 stocks have posted Q3 results, 79% of which have beaten estimates.

With the earnings season fully underway, analysts have finally begun to lower the bar for estimates in 2025.

For instance, the traditional earnings decay that the S&P 500 undergoes has been avoided until this point for 2025.

Current estimates reflect a 15% EPS growth rate for CY’25, which will be the highest on record if these figures are realized.

In the first nine months of 2024, tech stocks drove earnings growth, while the energy sector was the biggest detractor.

Trending Stocks 🔥

Lucid Group - The EV maker is down over 12% in pre-market after it announced a public offering of 262 million shares.

Cisco - The networking technology giant added almost 2% after Citi upgraded the stock to “buy” from “neutral” as the investment bank expects the AI business to grow over time.

Novocure - Shares soared in early market trading before moving lower as the U.S. FDA approved its Optune wearable treatment for metastatic non-small cell lung cancer.

Over the last seven elections, this asset class has outpaced the S&P 500

Instead of trying to predict which party will win, and where to invest afterwards, why not invest in an ‘election-proof’ alternative asset? The sector is currently in a softer cycle, but over the last seven elections (1995-2023) blue-chip contemporary art has outpaced the S&P 500 by 64% even despite the recent dip, regardless of the victors, and we have conviction it will rebound to these levels long-term.

Now, thanks to Masterworks’ art investing platform, you can easily diversify into this asset class without needing millions or art expertise, alongside 65,000+ other art investors. From their 23 exits so far, Masterworks investors have realized representative annualized net returns like +17.6%, +17.8%, and +21.5% (among assets held longer than one year), even despite a recent dip in the art market.*

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

United Airlines Gains 12.4%

United Airlines said it will begin a $1.5 billion share buyback program after reporting higher-than-expected earnings for the busy summer travel season and forecasting higher airfares into 2025.

The stock surged over 12%, leading the S&P 500, and closed at the highest level since February 2020. Other airline stocks also rose sharply, outpacing the broader market.

United said domestic unit revenue turned higher in August and September compared to 2023, as airlines trimmed overcapacity that was pushing down fares.

It expects adjusted earnings between $2.50 and $3 per share in Q4, above year-ago earnings of $2, while consensus estimates stood at $2.68 per share.

The airline giant expanded capacity by 4.1% in Q3. United said corporate revenue rose 13%, while premium sales, which include business class tickets, rose 5%. Notably, basic economy tickets were up 20%.

In Q3 of 2024, United Airlines reported:

👉 Revenue of $14.84 billion vs. estimates of $14.78 billion

👉 Earnings per share of $3.33 vs. estimates of $3.17

While sales rose 2.5%, earnings were higher than the company’s initial estimate of between $2.75 and $3.25 per share.

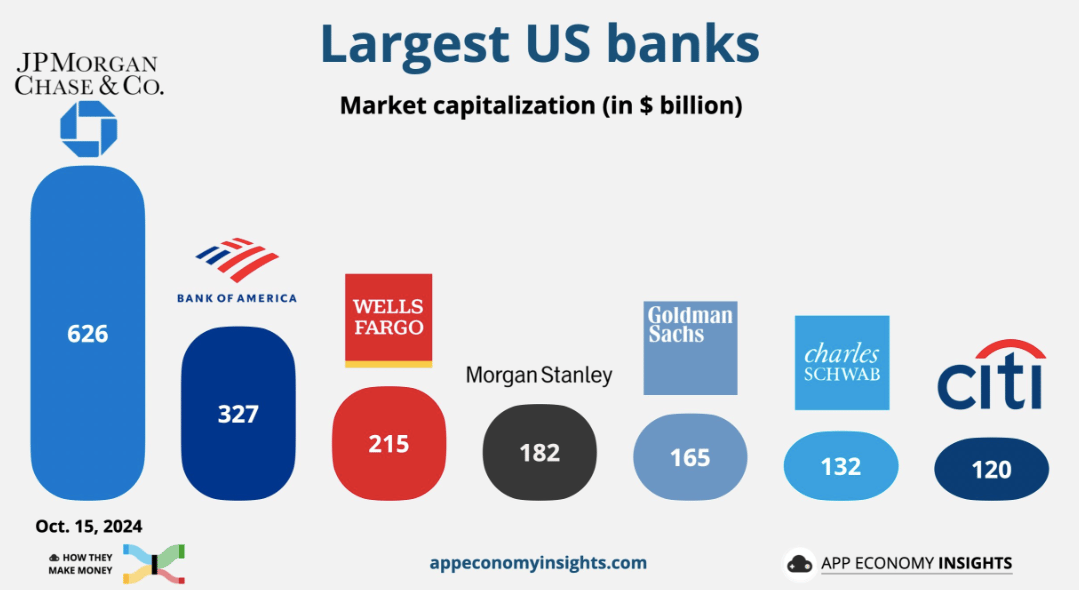

Morgan Stanley Tops Q3 Estimates

Morgan Stanley rose more than 6% yesterday after topping consensus estimates as each of its three main divisions generated more revenue than expected.

In Q3 of 2024, Morgan Stanley reported:

👉 Revenue of $15.38 billion vs. estimates of $14.4 billion

👉 Earnings per share of $1.88 vs. estimates of $1.58

While revenue rose by 16%, earnings grew by 32% year over year in the September quarter.

Morgan Stanley said several tailwinds drove revenue and earnings as buoyant markets positively impacted its wealth management business.

Further, the investment banking business staged a turnaround after a dismal 2023, while lower interest rates should encourage financing and merger activity.

Here are a few key numbers for Morgan Stanley:

Wealth management sales rose 14% to $7.27 billion, beating estimates by $400 million

Equity trading sales rose 21% to $3.05 billion, above estimates of $2.77 billion

Fixed income revenue rose 3% to $2 billion, higher than estimates of $1.85 billion

Investment banking sales rose 56% to $1.46 billion, above estimates of $1.36 billion

Investment management sales rose 9% to $1.46 billion, higher than estimates of $1.42 billion

Banking peers such as JPMorgan, Goldman Sachs, and Citigroup also topped estimates due to strong revenue from trading and investment banking.

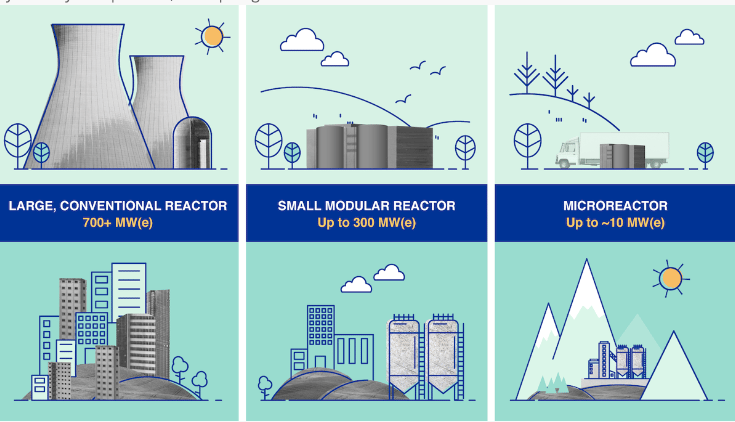

Amazon Web Services Is Investing in Nuclear Power

Amazon Web Services is investing over $500 million in nuclear power to support its energy demand as it expands services into generative AI.

Amazon’s cloud division signed an agreement with Dominion Energy to explore the development of a small modular nuclear reactor (SMR) that produces no carbon emissions.

An SMR is a nuclear reactor with a smaller footprint that allows it to be built closer to the grid. Moreover, they have faster construction times than traditional reactors.

Amazon is the latest big tech company to use nuclear power to fuel growing data center demand. Earlier this week, Google announced an agreement with Kairos Power, while Microsoft partnered with Constellation Energy to power data centers.

Dominion serves roughly 3,500 megawatts from 452 data centers across its service territory in Virginia. Dominion projects that power demand will increase by 85% over the next 15 years.

AWS expects the new SMRs to bring at least 300 megawatts of power to the Virginia region. Further, the cloud business plans to invest $35 billion by 2040 to establish multiple data center campuses across Virginia.

Headlines You Can't Miss!

China pledges additional financial support for the real estate sector

Intel faces headwinds in China

Japan visitors spend $39 billion in 2024, breaking annual records

Holiday shoppers plan to spend by taking on debt

PayPal’s stablecoin market cap is down 40% since August

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.