- 3 Big Scoops

- Posts

- Uber In Top Gear

Uber In Top Gear

PLUS: UK and Japan slip into recession!

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

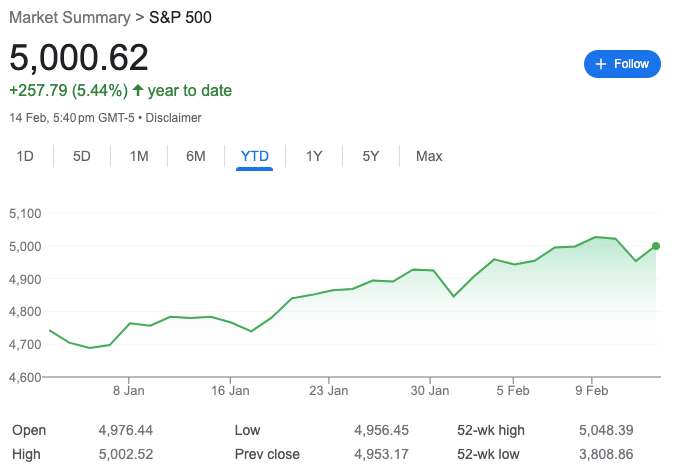

S&P 500 @ 5,000.62 (⬆️ 0.96%)

Nasdaq Composite @ 15,859.15 ( ⬆️ 1.30%)

Bitcoin @ $52,486.90 ( ⬆️ 0.86%)

Hey Scoopers,

Happy Thursday. Here’s what we’re covering today 👇

👉 Uber shocks Wall Street

👉 Japan’s economic slowdown

👉 Bitcoin marches on

So, let’s go 🚀

Market Wrap 📉

Stocks rallied on Wednesday but did not erase the losses from Tuesday’s sell-off, which came on the heels of a hotter-than-expected inflation report.

Stock futures rose today as Wall Street aims to build on a modest rebound with key economic data on deck. Moreover, investors are weighing whether the Federal Reserve can bring inflation in check without pushing the economy into a recession.

It seems robust consumer spending is buoying inflation, which may result in interest rate hikes. In fact, the market may be trading more on economic growth and earnings estimates rather than interest rates and inflation.

Trending Stocks 🔥

Cisco - Shares of the networking giant are down 4.44% in pre-market after announcing layoffs in its quarterly update.

Tripadvisor - The travel stock is up 5% after Q4 results beat consensus revenue and earnings estimates.

Twilio - The tech stock is down 13% in pre-market as its revenue guidance was softer than estimates.

Uber Announces $7 Billion Buyback

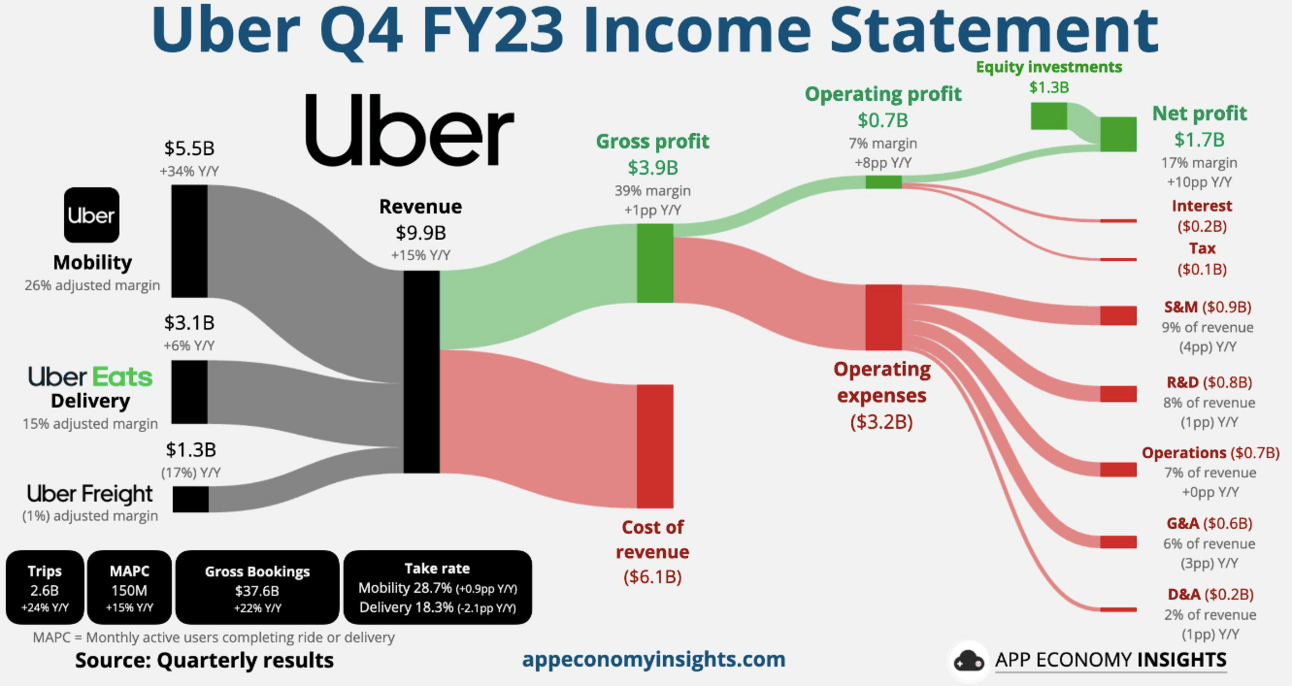

Uber’s stock closed over 14% higher yesterday after the ride-hailing company announced a share buyback program worth $7 billion.

In a press release, Uber’s CFO Prashanth Mahendra-Rajah stated, “Today’s authorization of our first-ever share repurchase program is a vote of confidence in the company’s strong financial momentum.”

The buyback news comes a week after Uber announced its 2023 results and beat top and bottom line estimates in Q4.

In the December quarter, Uber reported a net income of $1.4 billion or $0.66 per share, up from $595 million or $0.29 per share in the year-ago quarter. Its revenue also surged 15% year over year as gross bookings stood at $37.6 billion, up 22% year over year.

CEO Dara Khosrowshahi said 2023 was a year of sustainable, profitable growth for Uber as it continues to benefit from the shift in consumer spending from retail to services.

Japan Loses Spot as Third-Largest Economy

Japan has lost its sport as the third-largest economy globally to Germany as the Asian behemoth slipped into recession.

Once the world’s second-largest economy, Japan reported two consecutive quarters of contraction as its GDP fell 0.4% year over year in Q4 of 2023. Japan’s economy also fell by 3.3% in Q3.

Comparatively, economists expected Japan’s economy to rise by 1.4% in the December quarter. In 2023, Japan’s nominal GDP grew 5.7% in 2023 to $4.2 trillion, while Germany’s nominal rose by 6.3% to $4.46 trillion.

A recession is defined as two consecutive quarters of contraction, and the nominal GDP measures the value of output without adjusting for inflation.

UK’s economy also contracted by 0.3% in Q4, while it fell by 0.1% in Q3, pushing the country into a technical recession.

Bitcoin Is on Fire

Bitcoin continues to gain momentum as the world’s largest cryptocurrency reclaimed its trillion-dollar valuation.

Bitcoin prices are up 18.5% in 2024 and 115% in the past year, as the digital asset has seen close to $3 billion in funds inflow this year.

Spot Bitcoin ETFs were launched last month and have generated more than $40 billion in cumulative trading volume.

Headlines You Can't Miss!

Stellantis reports profit decline in Q4

Treasury yields fall as investors assess rate cuts

Renault stock surges on possible dividend hike

TSMC shares trade at all-time highs

Coinbase forecast to report Q4 results today

Chart of The Day

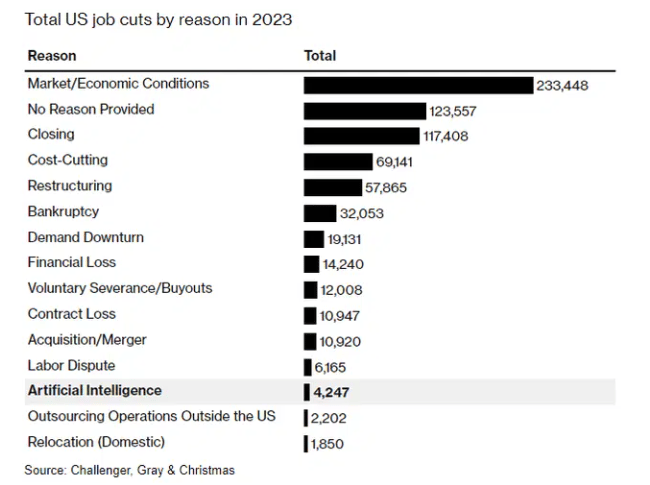

A couple of weeks ago, when UPS announced plans to slash a stomach-dropping 12,000 jobs, you could tell it was doing a delicate little dance, trying to show off how it can boost efficiency with AI while not sparking a panic over job losses.

We’ll probably see a lot more of that dance and likely an underreporting of job losses attributable to AI.

And let’s be real here: this isn’t the first time we’ve seen innovation shake up the job market – far from it. We’ve seen machinery, robotics, and computer technology transform sectors. But AI is shaking things up in a whole new way.

Here’s what’s different:

Where it’s happening. The short answer is: almost everywhere. Previous innovation upheavals, like machinery and robotics, tended to be more localized, hitting areas where certain industries dominated, like America’s manufacturing Rust Belt or its agricultural Corn Belt.

But AI’s reach is global, touching tech-advanced nations and especially sectors that are quick to adopt it, like tech, finance, and retail.

Who’s feeling it? This time around, it’s not physical labor jobs in the crosshairs; it’s the so-called white-collar crowd. And that means administrative, customer service, middle management, and even creative roles.

How fast it’s moving. The previous tech revolution meant building and installing robots and machinery – and that took a lot of time and money. AI is just software, so it’s cheaper and can be rolled out in a hurry. If you think things are moving quickly now, that’s because they are.

This shift has huge implications for the economy. The rapid and widespread nature of AI-driven changes could lead to job losses on a massive scale and much faster than before.

But it’s not all doom and gloom, as evidenced by past innovation-driven job losses. The upside is quicker gains in productivity and efficiency for businesses, which could lead to lower prices for everyone, everywhere.

History tells us that productivity boosts are generally good for global growth and the stock market in the long run, even if it means some job loss pain in the near term. Meanwhile, investing in the very tech that threatens jobs just might be the smartest way to hedge against becoming obsolete.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.