- 3 Big Scoops

- Posts

- 🗞 Uber In Reverse Gear

🗞 Uber In Reverse Gear

Uber, Disney, and Ford

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

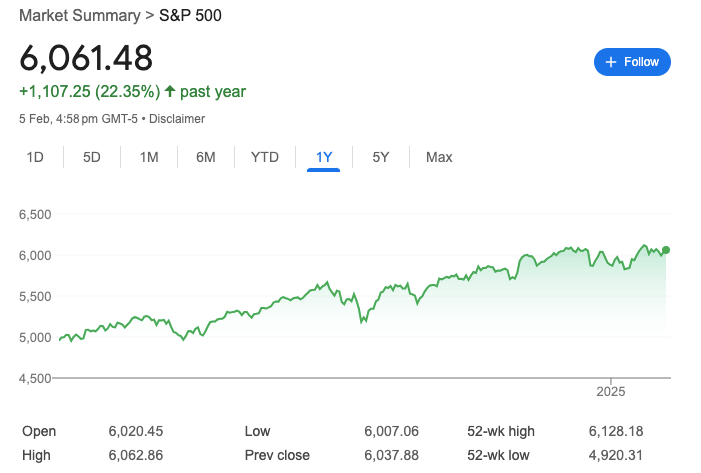

S&P 500 @ 6,061.48 ( ⬆️ 0.39%)

Nasdaq Composite @ 19,692.33 ( ⬆️ 0.19%)

Bitcoin @ $98,704.69 ( ⬆️ 1.69%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter today?

👉 Uber disappoints Wall Street

👉 Ford remains cautious

👉 Disney’s subscriber miss

So, let’s go 🚀

Market Wrap

Hey, Scoopers!

Markets rallied for the second straight day, shrugging off Monday's trade tensions.

The real excitement? Retail traders just smashed records with $3.2 billion in single-stock purchases - the highest ever recorded!

Tech Spotlight 💻

Nvidia jumped 5% on Super Micro Computer's AI data center announcement

Alphabet stumbled 7% after missing cloud revenue targets

AMD dropped 6% on disappointing data center numbers

Apple faces potential Chinese regulatory scrutiny

Money Moves 💪

Retail traders are abandoning ETFs for individual stocks, with 70% of investments flowing into the Magnificent Seven. Nvidia leads the pack with $1.3 billion in net purchases.

Active Management Revival 📈

63% of large-cap funds beat their benchmarks in January - the best performance in a year.

Small-cap managers are also outperforming, though mid-caps are struggling to keep pace.

Expert Take 🎯

Third Point's Dan Loeb remains optimistic about equities but warns of "periodic dislocations" due to unconventional policy approaches.

Translation: Stay positive, but keep your guard up!

Trending Stocks 🔥

Qualcomm - The semiconductor stock is down 5% in pre-market despite reporting stronger-than-expected earnings and revenue in fiscal Q1.

Arm Holdings - Shares of the chip maker are down 3.5% in pre-market following its fiscal Q3 revenue and earnings beat

Workday - The cloud applications provider climbed 5.5% after announcing a restructuring plan expected to eliminate 8.5% of the workforce.

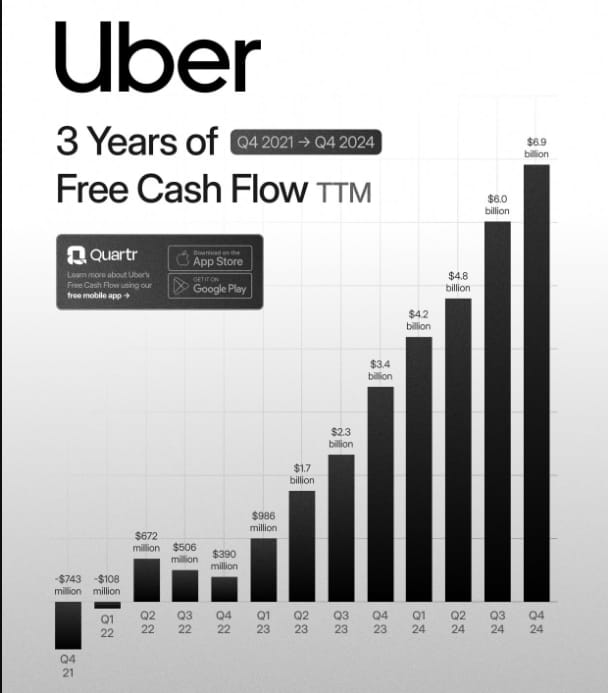

Uber’s Q4 Snapshot

The Numbers That Matter 📊

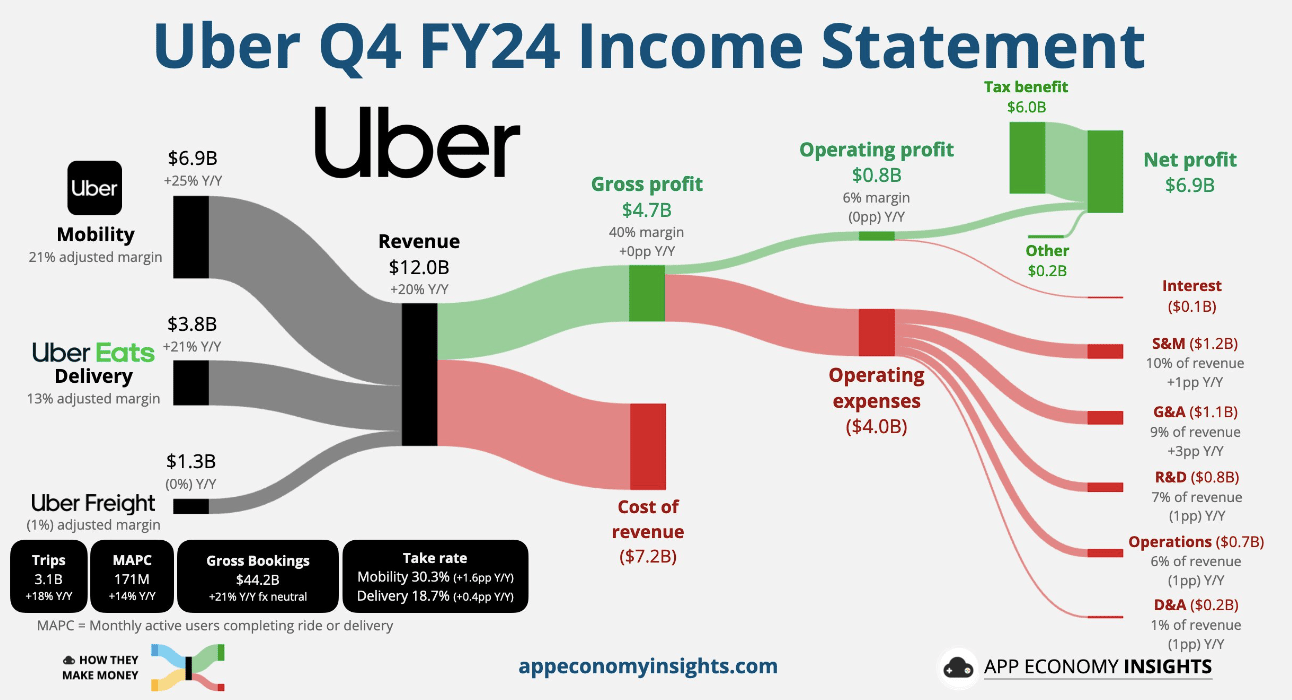

Despite beating revenue expectations with $11.96B (up 20% year over year), Uber's stock took a 7% hit after missing EPS targets in Q4 and providing cautious guidance.

The headline-grabbing $6.9B net income comes with a twist - it includes a $6.4B tax benefit.

Growth in the Driver's Seat 🚗

3.1B trips completed (+18% YoY)

171M monthly active users (+14% YoY)

Mobility bookings up 18% to $22.8B

Delivery keeping pace with 18% growth

The Robot Revolution 🤖

Austin, Texas, is about to get a taste of the future! Uber's partnership with Waymo's robotaxis is rolling out, though CEO Khosrowshahi keeps expectations in check.

While the US autonomous vehicle market could hit trillion-dollar territory, he admits it's a "many, many years" journey.

Looking Ahead 🎯

Q1 guidance suggests a slight tap on the brakes, with bookings projected at $42-43.5B.

However, with clear momentum in its core businesses and ambitious autonomous plans, Uber keeps its foot on the innovation pedal.

Are there speed bumps ahead? Maybe. But Uber's playing the long game in the future of transportation.

Ford's Q4: Record Revenue Meets Cautious Outlook

The Numbers That Matter 📊

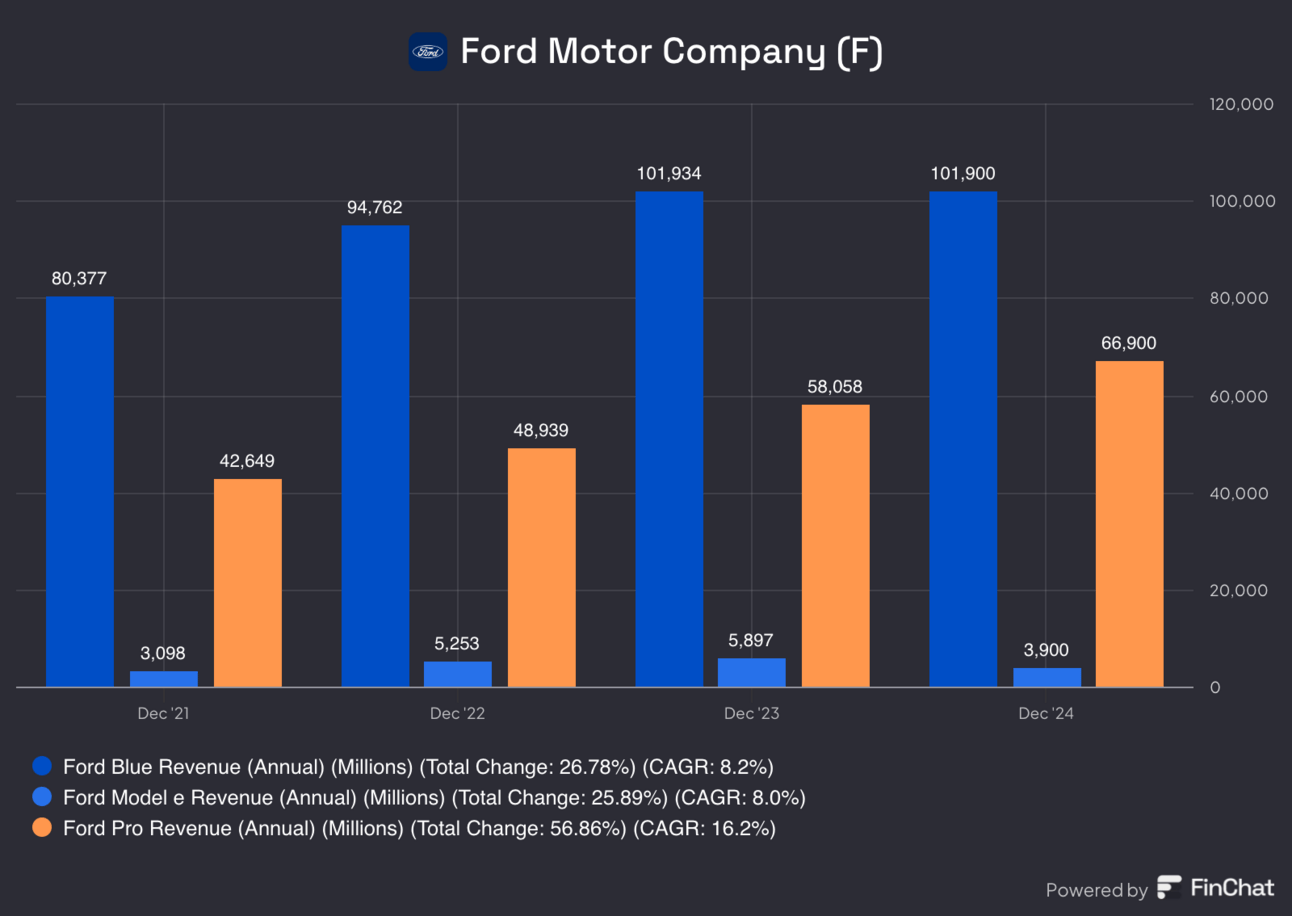

Ford topped Q4 expectations with $44.9B automotive revenue and $0.39 earnings per share, yet shares reversed 5% in after-hours trading.

While the company achieved a record total revenue of $185B in 2024, its stock struggled throughout the year, declining 20% amid quality concerns.

Division Breakdown 🚗

The company's success story is its Pro fleet business, which generated over $9B in earnings in 2024.

Meanwhile, the traditional Blue division posted $5.28B in earnings, marking a $2.2B decline from the previous year.

The electric vehicle segment, Model E, continues to face challenges, recording a substantial $5.08B loss for the year.

Road Ahead 🎯

Ford's outlook for 2025 reflects a more cautious approach. Its EBIT is forecast between $7B and $8.5B, down from $10.2B in 2024.

The company expects to break even in the first quarter and aims to reduce material and warranty costs by $1 billion.

Management's guidance anticipates a 2% industry-wide pricing decline, while Ford Credit is projected to contribute $2B in earnings.

CEO Jim Farley remains focused on the road ahead: "Our future is really in our hands," he notes, as the company works to address quality improvements amid market uncertainties.

Disney+ Loses Subscribers

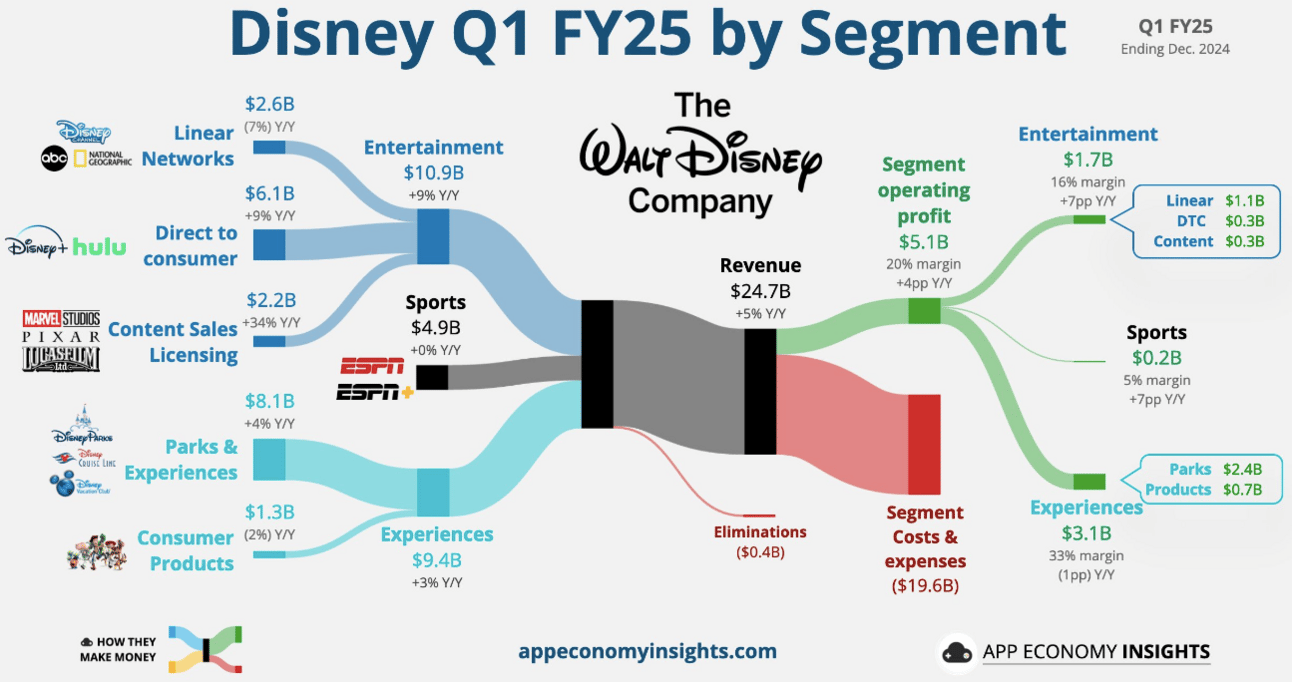

Disney exceeded expectations this quarter, delivering $24.69 billion in revenue, up 4.8% year over year, and its net income climbing 23% to $2.64 billion.

The entertainment division showed particular strength, with revenue jumping 9% to $10.87B and operating income nearly doubling to $1.7B.

Streaming Status Update 🎬

Disney’s streaming journey hit an inflection point as Disney+ experienced its first subscriber decline, dropping 1% to 124.6M subscribers.

However, the service's profitability remains intact, with average revenue per user increasing 4% to $7.99.

Meanwhile, Hulu continues to grow, adding 3% more subscribers to reach 53.6M.

Sports & Entertainment Highlights 🏈

ESPN demonstrated robust performance, with revenue rising 8% to $4.81B. College football proved remarkably successful on ABC, delivering a 56% increase in viewership.

At the box office, "Moana 2" crossed the $1B mark, contributing to strong content sales. The company's pivot from the Venu sports streaming venture sets the stage for ESPN's upcoming "Flagship" streaming app launch this fall.

Looking Ahead 🎯

Disney projects growth across its segments. Entertainment expects double-digit operating income gains, and the parks’ business forecasts 6-8% growth.

The sports segment anticipates 13% growth despite a temporary $100M impact from game timing shifts in Q2.

Magic Kingdom or Streaming Empire? Disney is betting on both while navigating the future of entertainment.

Headlines You Can't Miss!

Shipping giant Maersk jumps on profit beat

Carlsberg misses revenue estimates in Q4

BoE to resume rate cuts amid murky outlook

India likely to lower interest rates amid economic slowdown

El Salvador increases BTC reserve to 6,068

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.