- 3 Big Scoops

- Posts

- United Airlines Takes Off

United Airlines Takes Off

United Air, TSMC, and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

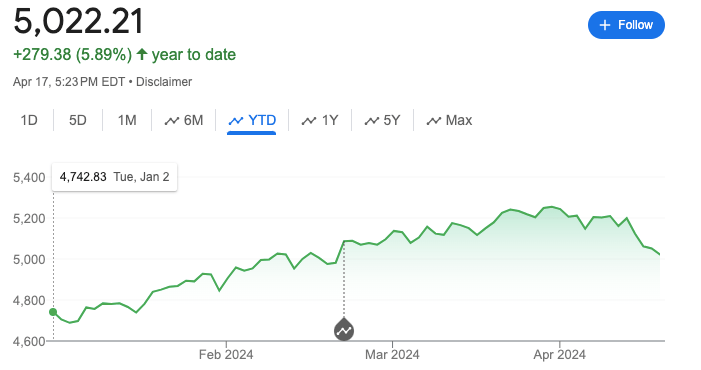

S&P 500 @ 5,022.21 (⬇️ 0.58%)

Nasdaq Composite @ 15,683.37 ( ⬇️ 1.15%)

Bitcoin @ $60,911.20 ( ⬇️ 4.79%)

Hey Scoopers,

Hello there. Let’s jump into today’s exciting news.

👉 United Airlines spikes post Q1 results

👉 TSMC thumps estimates

👉 Bitcoin is under pressure

So, let’s go 🚀

Market Wrap 📉

The S&P 500 index declined for the fourth consecutive session on Wednesday as big tech stocks experienced a sell-off.

Shares of semiconductor giant Nvidia pulled back almost 4%, while the tech sector fell 1.7% yesterday.

The ongoing weakness surrounding the equity markets has overshadowed a strong start to the earnings season.

While less than 10% of the S&P 500-listed companies have reported Q1 results, 75% of them have surpassed consensus estimates.

After a strong performance in Q1 of 2024, the Dow Jones index is down 5% in April, while the S&P 500 and Nasdaq Composite have tumbled by more than 4%.

Trending Stocks 🔥

Eli Lilly - Shares of the healthcare giant added 2.6% after announcing its weight loss drug Zepbound showed potential to treat patients with obstructive sleep apnea.

Travelers Companies - The insurance stock fell 8% after a disappointing report in Q1 of 2023. It reported an earnings miss due to higher-than-expected catastrophe losses.

ASML - The semiconductor equipment company dropped 8% after sales and new bookings fell short of estimates. Its net sales fell 22% year over year.

United Airlines Spikes Over 17%

Shares of United Airlines surged more than 17% in a single trading session after the carrier forecast stronger-than-expected earnings in Q2 despite delivery slowdowns from Boeing.

Source: CNBC

United Airlines forecast earnings between $3.75 per share and $4.25 per share in Q2, compared to estimates of $3.76 per share. Investors should note that airlines derive a majority of their profits during the peak travel season during Q2 and Q3.

The airline giant reiterated its full-year earnings forecast of between $9 and $11 a share while lowering its capital expenditure forecast to $6.5 billion from $9 billion for 2024.

United Airlines also posted a narrower-than-expected loss in Q1 due to strong travel demand, even though it took a $200 million hit associated with the grounding of the Boeing 737 Max 9.

Other airline stocks, such as Delta Air Lines and American Airlines, also saw a spike in share prices yesterday, rising 3% and 5%, respectively.

TSMC Beats Q1 Estimates

Taiwan Semiconductor Manufacturing Company (TSMC) beat revenue and earnings estimates in Q1 due to strong demand for its chips used in AI applications.

Source: CNBC

In Q1 of 2024, TSMC reported:

👉 Revenue of $18.87 billion vs. estimates of $18.56 billion

👉 Net income of $7.17 billion vs. estimates of $6.8 billion

TSMC’s sales rose by 16.5% year over year, while net income increased by 8.9%. The company has experienced a strong demand for AI chips led by the proliferation of generative AI tools, including ChatGPT, resulting in a 56% spike in share prices in the past year.

TSMC is the world’s largest manufacturer of advanced processors, and its client base includes companies such as Nvidia and Apple.

It accounts for 61% of global foundry revenue, providing TSMC with a wide competitive moat and pricing power, which is reflected in its profit margins.

For instance, TSMC reported a net margin of 40% in Q1, much higher than the industry average of 14%.

Bitcoin Briefly Dips Below $60k

Yesterday, Bitcoin dipped below the $60,000 threshold for the first time since March 5th as investors are awaiting the halving event, which is set to take place on Friday.

Bitcoin halving occurs every four years, after which block rewards for miners are reduced by 50%. This also impacts the issuance of new BTC tokens.

The halving mechanism was designed to control inflation and maintain the scarcity of the digital asset.

Due to the supply-demand mismatch post the halving event, BTC prices tend to move higher in the next 18 months 🚀.

👉 BTC prices surged from less than $5 in April 2012 to more than $1,000 in December 2013

👉 BTC prices surged from $420 in April 2016 to $19,600 in December 2017

👉 BTC prices surged from $6,875 in April 2020 to $68,000 in November 2021

Headlines You Can't Miss!

Nokia expects profits to accelerate in Q2

Google terminates 28 employees after multi-city protest

Wall Street pushes out rate cut expectations

Biden wants to triple China tariffs on steel and aluminum imports

Binance is all set to re-enter India

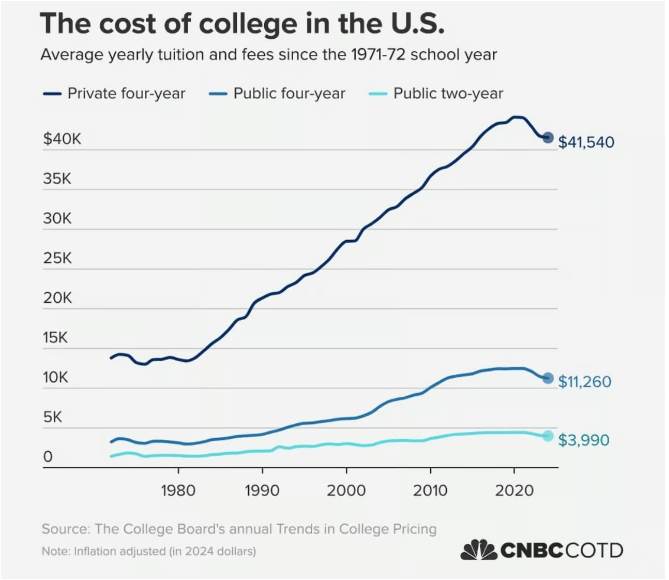

Chart of The Day

The average annual cost of private college tuition is $41,540 in 2024, up from less than $15,000 in 1980, according to College Data.

Several parents are going to work for schools to avail of tuition benefits amid the rising costs of a college degree.

While tuition costs have escalated significantly, the average income for college students has risen at a far lower pace, resulting in mounting student debts in the U.S.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.