- 3 Big Scoops

- Posts

- TSMC Rides the AI Wave

TSMC Rides the AI Wave

PLUS: Bitcoin ETFs turn one!

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

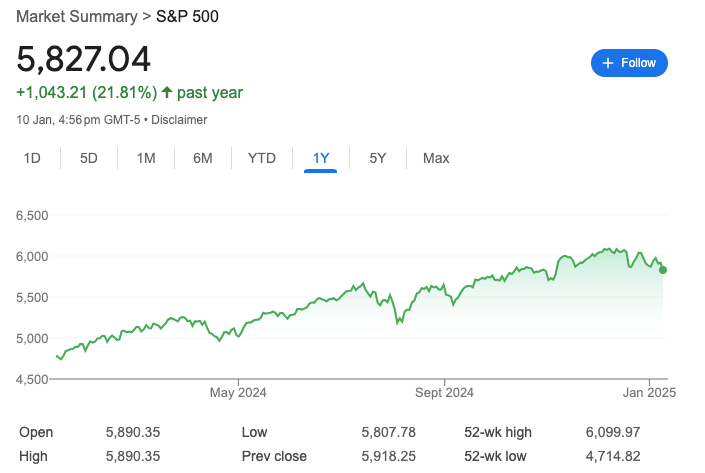

S&P 500 @ 5,827.04 ( ⬇️ 1.54%)

Nasdaq Composite @ 19,161.63 ( ⬇️ 1.63%)

Bitcoin @ $94,605.23 ( ⬆️ 0.19%)

Hey Scoopers,

Happy Monday! Let’s have a great week.

👉 TSMC is growing rapidly

👉 Apple continues to struggle in China

👉 Bitcoin ETFs remain popular

So, let’s go 🚀

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

Market Wrap

Hey, Scoopers!

The markets just got a reality check that's spicier than your grandmom's secret chili recipe.

Here's what went down:

The Scoop:

December jobs report dropped a bomb - 256k new jobs vs the expected 155k.

Why It Matters:

Remember when everyone was dreaming of Fed rate cuts in March? The odds for a rate cut dropped from 41% to 25%, faster than your New Year's resolutions fell apart.

The Spicy Details:

Unemployment: Down to 4.1% (surprise!)

10-year Treasury: Jumped like it saw a ghost

Tech stocks: Got hammered (Nvidia -3%, AMD -4.8%)

Markets this week: S&P 500 (-1.9%), Nasdaq (-2.3%)

TLDR: Strong economy = No rate cuts soon = Markets throwing tantrums.

Sometimes, good news is bad news in this crazy market!

Trending Stocks 🔥

Delta Air Lines - The stock popped 9% after posting adjusted earnings of $1.85 per share on $14.44 billion of revenue, surpassing estimates of $1.75 per share and $14.18 billion, respectively.

Constellation Energy - The stock popped over 25% after it announced the acquisition of Calpine, a geothermal and natural gas company. It also guided full-year adjusted EPS, which was above consensus estimates.

Allstate, Chubb - Insurers exposed to the California homeowners market sold off as the devastation caused by the LA wildfires spread.

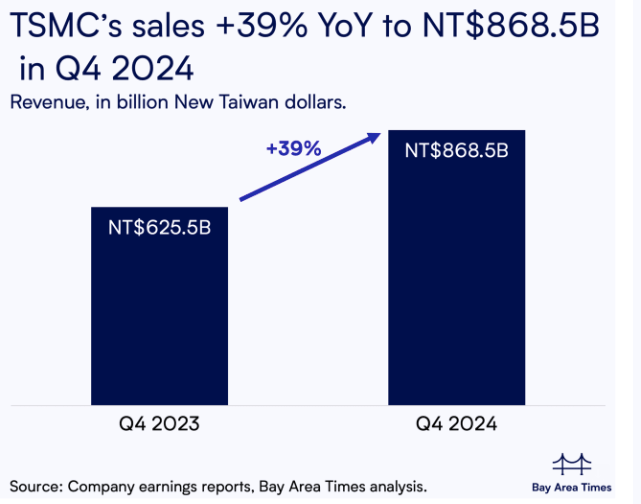

TSMC - The Chip King is Crushing It

Taiwan Semiconductor Manufacturing dropped its Q4 numbers, which stunned Wall Street! Let's dive into this money printer.

The Scoop:

TSMC posted $26.3B in revenue in Q4 of 2024 (up 39% y/y).

Translation: They're swimming in cash like Scrooge McDuck. 🏊♂️

Why It Matters:

TSMC ain't your regular chip company - it makes the fancy silicon for Apple, Nvidia, and anyone who's anyone in tech.

Think of TSMC as the kitchen where all the AI magic gets cooked. 🧑🍳

The Spicy Details:

2024 Revenue: Highest since going public (1994!)

Stock: Up 88% in 12 months (cha-ching!)

Fun fact: Advanced chip factories are running at 100%+ capacity

Microsoft's helping the cause by dropping $80B on AI data centers

TLDR: The AI gold rush is real, and TSMC is selling all the pickaxes. When both smartphone and AI chip makers buy everything you can make... you know business is GOOD.

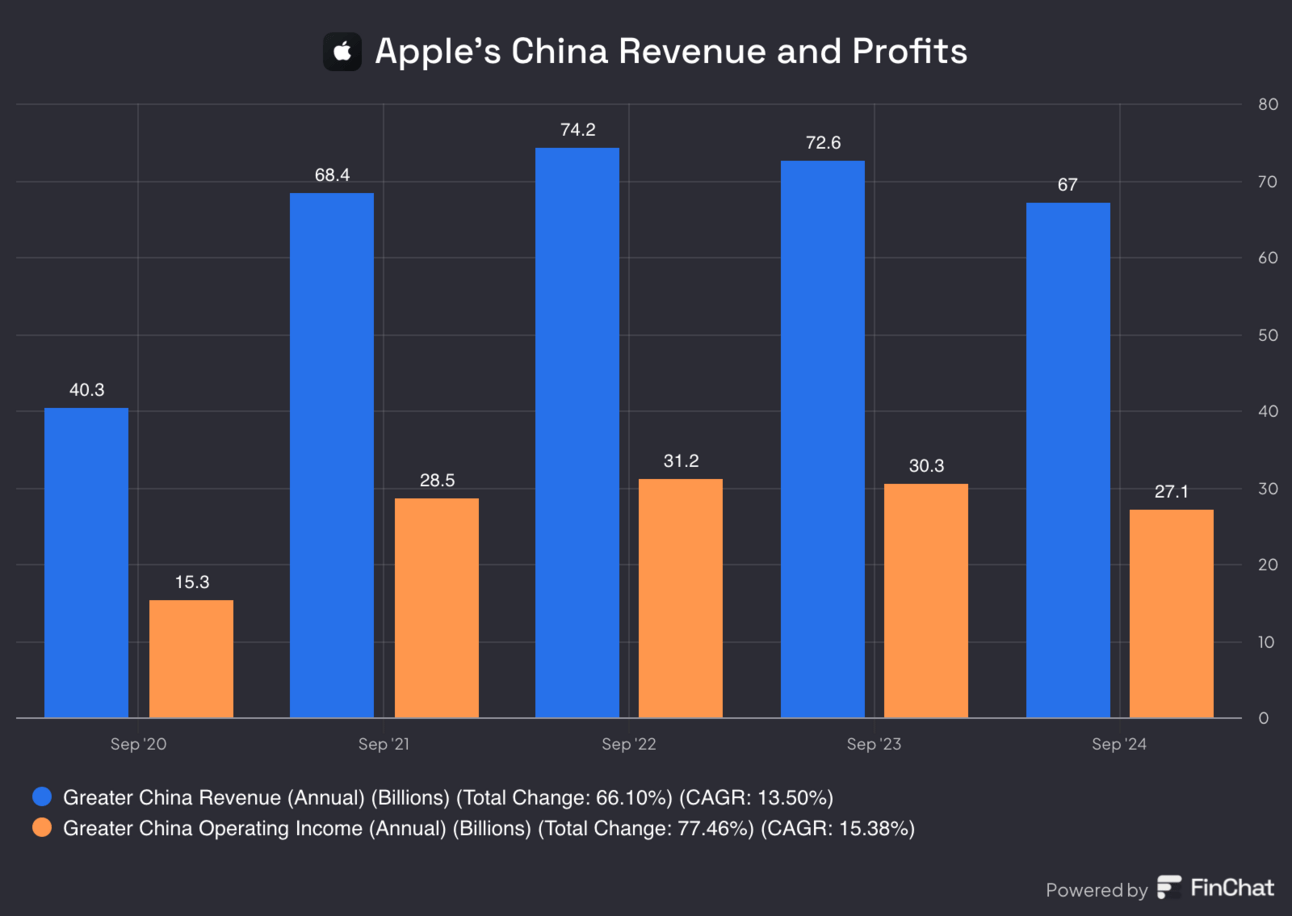

Apple's Getting Ghosted by China

Apple's slice of the Chinese market is shrinking faster than your motivation at the gym. Top analyst Ming-Chi Kuo just dropped some numbers that had Apple's stock in limbo (-2.4%). 📱

Why It Matters:

China has been Apple's BFF for years, but now they have relationship issues.

December was rough. While China's overall phone market was chillin', iPhone sales took a 10-12% nosedive.

The Spicy Details:

2025 outlook: iPhone shipments expected to drop 6% in first half

New iPhones might be too thin for China's SIM cards (awkward!)

Apple's AI game? Kuo says it's not moving the needle

Expected shipments: 220-225M vs Street's 240M+ dream

PLOT TWIST: That fancy on-device AI they're cooking up? Supply chain folks say it's as exciting as a software update notification. Meanwhile, cloud AI is eating everyone's lunch.

TLDR: Apple's got 99 problems and China's among the major ones. Time to watch if Tim Cook's got any tricks left in that minimalist sleeve.

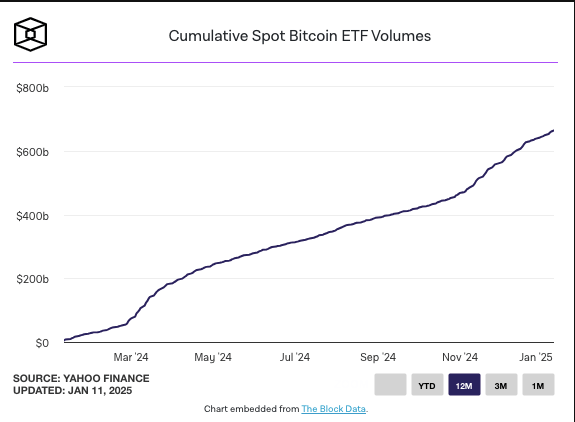

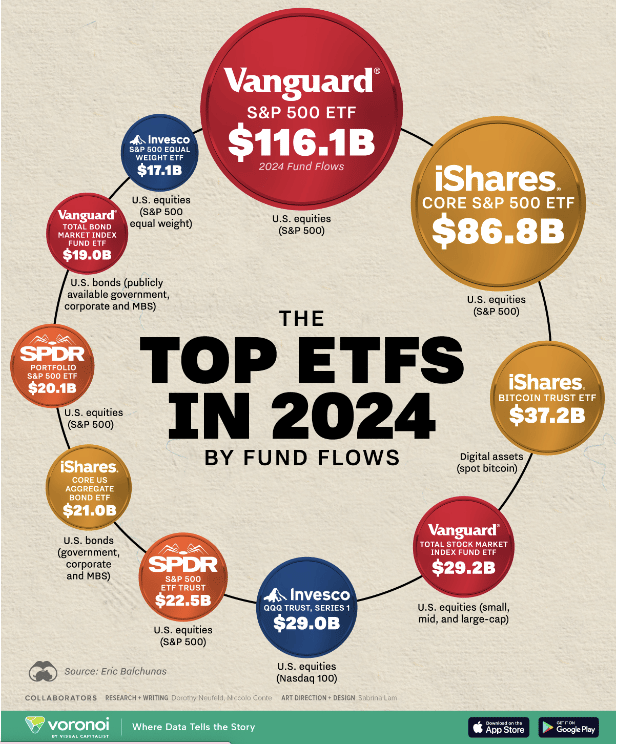

The Bitcoin ETF Glow-Up is Real!

BlackRock's Bitcoin ETF just became the fastest ETF to hit $50B... EVER. Like, faster than the gold ETF that's been stacking since 2005! Even Bloomberg's ETF nerds called it "unprecedented." 🚀

Why It Matters:

The OG crypto finally got its Wall Street membership card, and everyone wants in on the action.

Morgan Stanley's letting their fancy advisors offer it, BlackRock's crushing records, and even Trump's talking about making a strategic Bitcoin reserve (wild times!).

The Spicy Details:

Trading volume: $660B (that's like buying Netflix... twice!)

Bitcoin price: Touched $108k in December (up 123% in 2024)

ETF holdings: Now own more Bitcoin than mysterious creator Satoshi

Financial advisors offering crypto: Doubled to 22% in 2024

BlackRock's IBIT options: Trading more than Google & Meta 🤯

Bonus Scoop:

56% of advisors say they're more likely to jump in this year after the election. Talk about FOMO!

TLDR: Wall Street said, "Bitcoin can sit with us." Now it's the most popular kid in school.

Headlines You Can't Miss!

Meta bends the knee as the Trump administration takes guard

Nordstrom raises sales outlook as holiday season powers demand

Mark Zuckerberg slams Apple for lack of innovation

Tesla recalls 239k vehicles over rearview camera fails

Is MicroStrategy’s Bitcoin debt loop risky?

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.