- 3 Big Scoops

- Posts

- 🗞 Trump Wins, Tesla Jumps

🗞 Trump Wins, Tesla Jumps

while Super Micro Computer tumbles

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,929.04 ( ⬆️ 2.53%)

Nasdaq Composite @ 18,983.46 ( ⬆️ 2.95%)

Bitcoin @ $74,861.28 ( ⬆️ 0.28%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter today?

👉 Trump stocks rally

👉 Super Micro disappoints

👉 MicroStrategy’s bitcoin pile

So, let’s go 🚀

Market Wrap

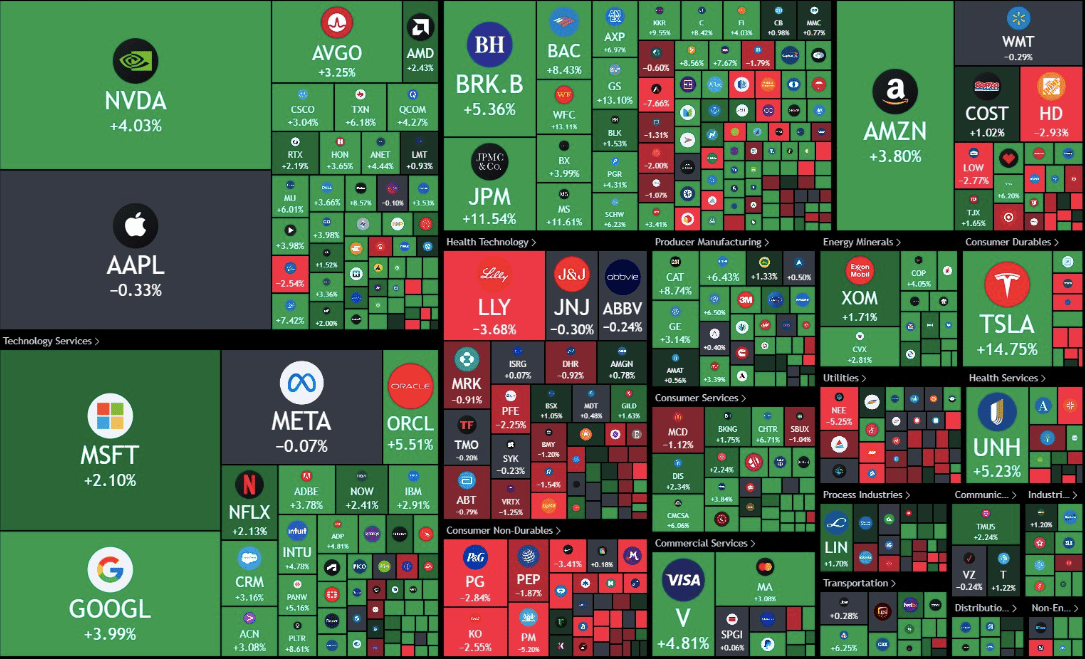

Stocks rallied on Wednesday, with all three major benchmarks hitting record highs, as Donald Trump won the 2024 presidential election.

The Dow Jones Industrial Average surged 3.57% to a record close, and other indices, such as the Nasdaq Composite and the S&P 500 index, also closed at fresh record highs.

Investments seen as beneficiaries under the Trump administration rallied, with Tesla rising over 14%. Tesla CEO Elon Musk is a prominent backer of Trump. Notably, bank stocks such as JPMorgan and Wells Fargo also posted double-digit gains.

The small-cap benchmark Russell 2000 surged 5.84%, hitting a 52-week high as they are poised to benefit from potential tax cuts and protectionist policies.

Alternatively, solar stocks sold off amid fears that the Inflation Reduction Act, which helps fund clean energy manufacturing in the U.S., will be repealed.

Clean energy companies such as First Solar, Enphase, and SolarEdge posted notable declines yesterday.

Trump is expected to lower corporate taxes and support industrial policies that favor domestic growth.

During the 2016 election, the S&P 500 index gained 5% from the day before the presidential election through the end of the year, in what was called the Trump rally.

Bitcoin prices topped $76k as cryptocurrencies could benefit from relaxed regulation. Moreover, the dollar index climbed to its highest level since July on proposed tariffs against trading partners, boosting the greenback.

The 10-year Treasury yield jumped to 4.43% on speculation that tax cuts and spending plans could widen the fiscal deficit and reignite inflation.

Trending Stocks 🔥

CVH Health - Shares rose 11.3% after the pharmacy giant posted mixed Q3 results citing higher medical costs. It reported revenue of $95.43 billion with earnings of $1.09 per share, compared to estimates of $92.75 billion and $1.51 per share, respectively.

Dollar Tree, Five Below - Shares of Dollar Tree and Five Below moved lower after Trump called for universal tariffs on all imports and a 60% tariff on imports from China.

Lyft - The ride-hailing company popped almost 20% after it reported Q3 revenue of $1.52 billion, above estimates of $1.44 billion. It forecast Q4 bookings at between $4.28 billion and $4.35 billion, ahead of estimates of $4.23 billion.

Super Micro Plunges 18%

Super Micro, the embattled server maker that has been late releasing annual financials and is at risk of being listed on the Nasdaq, reported quarterly results.

Shares fell 18% yesterday due to its revenue miss, weak guidance, and uncertainty over annual results filing.

Super Micro faces accusations of accounting irregularities and allegedly shipped sensitive chips to sanctioned nations and companies, violating export controls. Additionally, Ernst & Young, the company’s auditor, resigned last week.

Further, Super Micro faces potential delisting from the Nasdaq if it doesn’t file its annual report by the end of next week, and the hardware giant hasn’t reported audited results since May.

In the September quarter, Super Micro said it generated $5.95 billion in sales, below estimates of $6.45 billion. Its top line grew by 181% year over year as it ships servers packed with Nvidia’s processors for AI.

While SMCI stock has risen over 900% in the past five years, it is down 80% from its all-time highs.

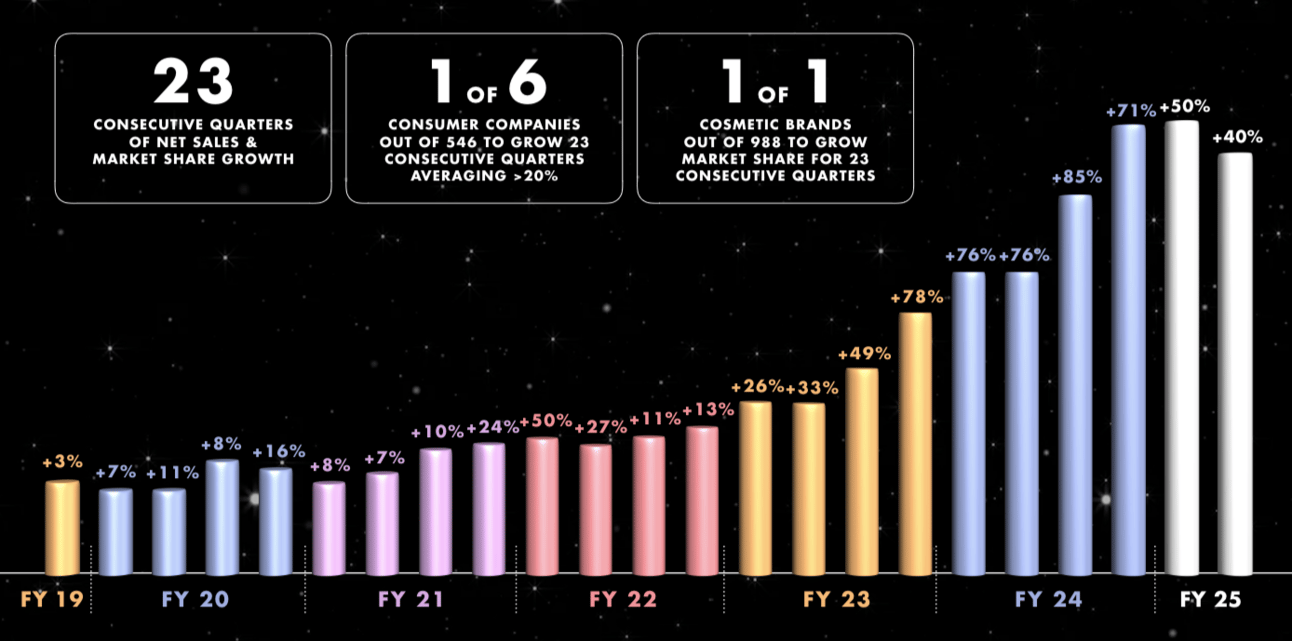

E.l.f. Beauty Raises Full-Year Guidance

E.l.F. Beauty posted a 40% growth in sales and raised its full-year guidance, driving the stock higher by 10%.

In fiscal Q2, it reported:

👉 Revenue of $301 million vs. estimates of $286 million

👉 Earnings per share of $0.77 vs. estimates of $0.42

It now expects sales between $1.32 billion and $1.34 billion in fiscal 2025, ahead of estimates of $1.30 billion. At the midpoint, its earnings in fiscal 2025 are forecast at $3.5, which aligns with consensus estimates.

Shares of the cosmetics company have been on a tear in the past two years due to its viral marketing and rising popularity among young shoppers.

Additionally, big-box retailers such as Target and Walgreens plan to expand the shelf space for E.l.f. Beauty.

In Q2, E.l.f.’s selling, general, and administrative expenses rose by $74 million to $186.1 million, accounting for 62% of sales. However, its gross margins rose marginally to 71%.

E.l.f. Beauty emphasizes its ability to provide high-quality products at a reasonable price has allowed it to gain traction among shoppers across age groups.

It has also been building out its international sales, which comprise 21% of total sales.

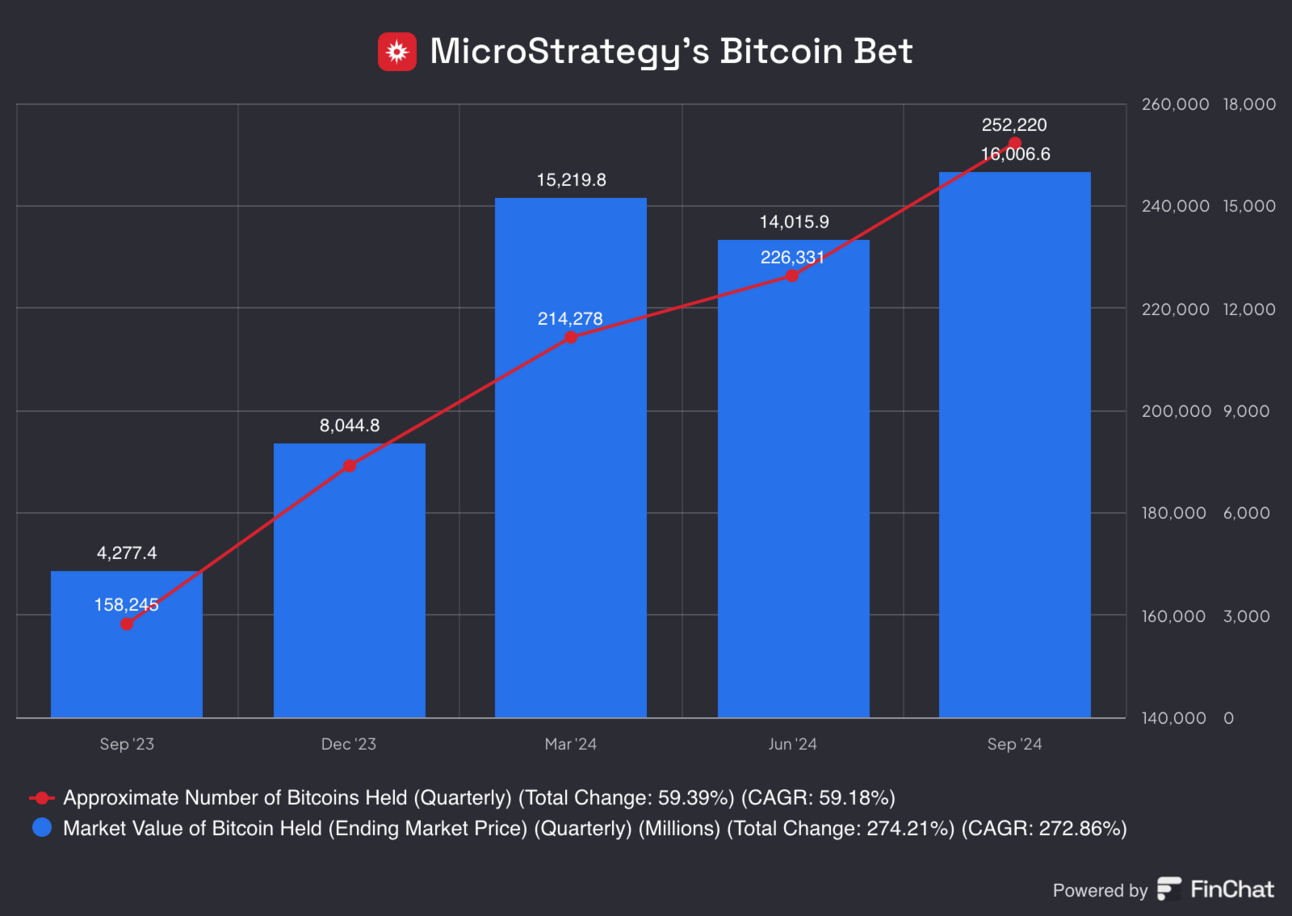

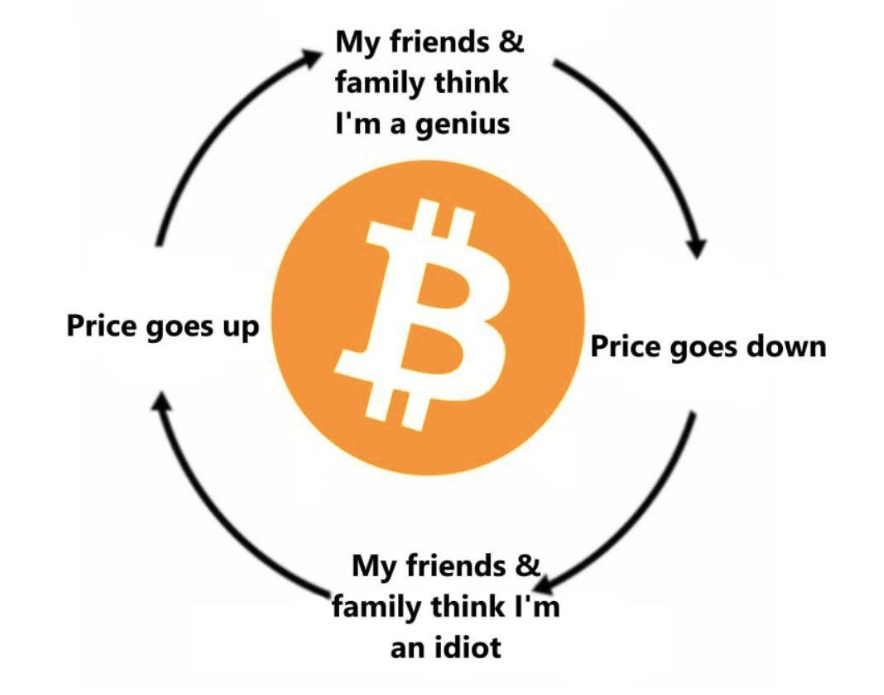

Michael Saylor Is Bullish on Bitcoin

MicroStrategy, an enterprise-facing software company, first bought Bitcoin and held it on its balance sheet in mid-2020. To date, it has accumulated 252,220 BTC. At the current price, its Bitcoin position is valued at $18 billion.

MicroStrategy’s Executive Chairman, Michael Saylor, expects BTC prices to surge to $13 million by 2045. At this price, MicroStrategy's Bitcoin position would be valued at $3.3 trillion.

MicroStrategy could possibly have the largest cash reserve of any publicly traded company, allowing it to fund innovative projects and allocate capital towards big-ticket acquisitions.

Saylor explained that MicroStrategy eventually aims to evolve into a Bitcoin bank and create capital market instruments tied to the digital asset.

New Decentraland desktop client for Mac and Windows

Enhanced avatars and social interactions

Improved performance and upgraded environments

New features: badges, daily quests, and mini-games

Headlines You Can't Miss!

Trump win could force China to expand its stimulus program

The Fed is likely to cut interest rates today

Donald Trump likely to uphold CHIPS act

China’s export volumes surge to 19-month high

BlackRock’s spot Bitcoin ETF sees $4 billion in trading volumes

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.