- 3 Big Scoops

- Posts

- 🗞 Trump Unveils a $500B AI Plan

🗞 Trump Unveils a $500B AI Plan

OpenAI, Softbank, and Oracle

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

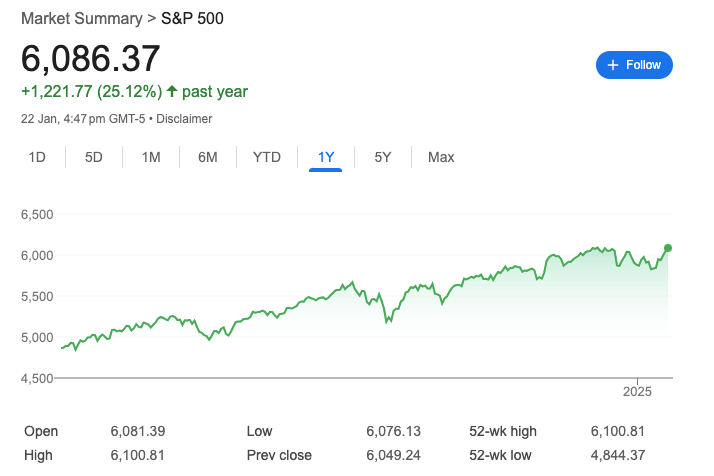

S&P 500 @ 6,086.37 ( ⬆️ 0.61%)

Nasdaq Composite @ 20,009.34 ( ⬆️ 1.28%)

Bitcoin @ $101,936.44 ( ⬇️ 3.41%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter today?

👉 Donald Trump bets big on AI

👉 Active fund managers fail to perform

👉 Retirement planning 101

So, let’s go 🚀

Market Wrap

Hey, Scoopers!

The stars aligned on Wall Street on Wednesday as the S&P 500 rocketed to unprecedented territory, powered by a perfect storm of technological innovation, streaming success, and political certainty.

AI Continues Its Victory Lap

Remember when AI was just a buzzword? Those days are long gone. Tech giants Oracle and Nvidia led the charge as investors digested the implications of the massive Stargate project.

Netflix's Knockout Performance

Speaking of transformations, Netflix just delivered a masterclass in exceeding expectations:

Milestone Alert: 300 million paid memberships (and counting!)

A content strategy that's firing on all cylinders, from "Squid Game" to live sports

The Trump Effect

Wall Street's optimism is palpable as President Trump settles into his new term. Investors are betting on his agenda, particularly the prospects of regulatory relief and corporate tax cuts that could fatten corporate America's bottom lines.

The Bottom Line

Recent market moves remind us that while history doesn't repeat, it often rhymes. As AI continues to dominate the narrative, investors might want to buckle up – this bull market seems to have found its second wind.

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Some credit cards can help you get out of debt faster with a 0% intro APR on balance transfers. Transfer your balance, pay it down interest-free, and save money. FinanceBuzz reviewed top cards and found the best options—one even offers 0% APR into 2027 + 5% cash back!

Trending Stocks 🔥

Knight-Swift Transportation - Shares of the transport company gained more than 5% after Q4 results showed improved operating margins. It reported an adjusted earnings per share of $0.36, above estimates of $0.33.

Alaska Air - The airline stock rose 3% after Q4 results topped estimates on the top and bottom lines. Alaska reported a positive net income of $71 million for the quarter after booking a loss a year ago.

Electronic Arts - The video game publisher cut its net bookings guidance for the most recent quarter and its full fiscal year, which ends March 31. EA cited weakness in its Global Football franchise for the guidance change.

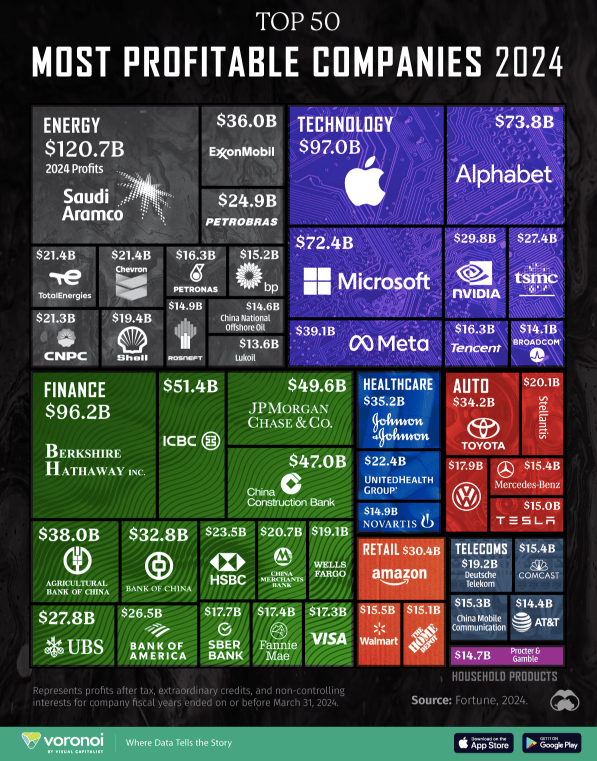

Trump's $500B AI Moonshot

Well, folks, it looks like the AI arms race just got a new heavyweight contender, and this one's wearing stars and stripes!

U.S. President Trump just announced "Project Stargate" - a whopping $500 billion AI initiative that makes most venture capital rounds look like pocket change.

Think of it as America's "We choose to go to the moon" moment, except it aims for artificial intelligence supremacy this time.

Source: CNBC

The Dream Team Assembles

Picture this: Trump, OpenAI's Sam Altman, Oracle's Larry Ellison, and SoftBank's Masayoshi Son all walking into the White House. (No, this isn't the setup for a tech industry joke.)

They're bringing together a veritable Justice League of tech giants.

Show Me The Money! 💰

Initial investment: $100B (because why start small?)

The ultimate goal: $500B over four years

The Plot Thickens...

Remember when Masa Son pledged $100B at Mar-a-Lago? Trump apparently said, "Make it $200B." Well, Son came back with $500B instead. Talk about overdelivering!

The Bottom Line

While China races ahead in AI, America just went all-in with a Texas-sized bet on artificial intelligence.

Whether this massive investment will help the U.S. maintain its technological edge remains to be seen, but one thing's for sure - the AI race just got much more interesting.

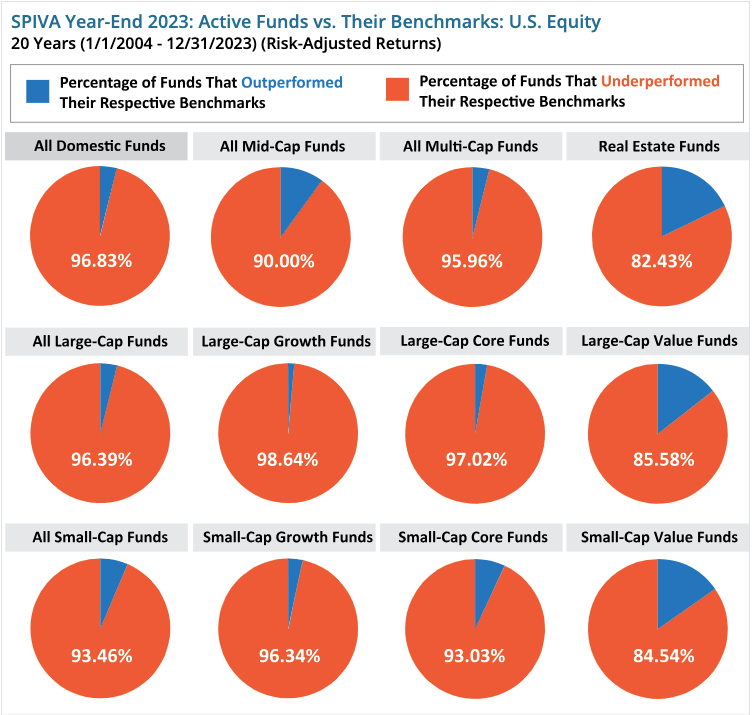

Active Fund Managers Continue to Underperform

Remember when your friend bragged about their hot-shot fund manager who could "beat the market"?

Well, S&P Global's latest SPIVA U.S. Scorecard might rain on that parade. Let's dive into why the data suggests your index fund isn't looking so dull after all.

The Numbers Don't

Picture this: You're in a room with 100 active fund managers. 73 failed to beat their benchmarks over a one-year period in the past two decades.

Fast-forward five years, and a staggering 95 of them are trailing behind.

No Place to Hide

Do you think international markets might offer a refuge? Here's the sobering scorecard:

U.S. large-cap equity funds: Outperformed in 3 out of 23 years

International developed markets: Beat indexes just 17.4% of the time

Emerging markets: An even more dismal 8.7% success rate

The Game You Never Knew You Were Playing

Remember that underperforming fund you owned a few years ago? It might have quietly disappeared, merged into another fund, or vanished from the statistics.

This sleight of hand, known as "survivorship bias," has affected nearly 70% of domestic stock funds over the past 20 years.

The Bottom Line

The real question isn't "Which active manager should I choose?" but "Why am I still trying to beat the market when the odds are stacked against me?"

Remember: In investing, sometimes the tortoise beats the hare—especially when the tortoise is a low-cost index fund with a long-term perspective.

Why Does Your Savings Rate Matter?

Forget chasing a mythical retirement number – financial experts say your personal savings rate is the key to retirement success.

Fidelity's recommendation is straightforward: aim to save 15% of your pre-tax income annually, including employer contributions.

Speaking of employers, don't leave their matching contributions on the table – it's essentially free money waiting for you.

Here's your 2025 action plan:

Review your 401(k) contribution rate and ensure you maximize your employer match.

Take advantage of this year's IRA contribution limits – $7,000 (plus $1,000 if you're 50+) for the 2024 and 2025 tax years.

After 2024's impressive 11% growth in average 401(k) balances, now is the perfect time to revisit your investment allocations.

Consider your risk tolerance and capacity, and remember that target date funds can simplify retirement investing.

Remember: Building retirement savings isn't about reaching a magic number – it's about creating sustainable habits that grow with time.

Headlines You Can't Miss!

SAP CEO sounds rallying cry for Europe on AI

China urges state-backed funds to buy more shares amid slump

Puma shares fall 12% on revenue miss

SK Hynix reports a 2,000% jump in operating profits

Crypto execs expect U.S. regulations to gain pace in 2025

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.