- 3 Big Scoops

- Posts

- 🗞 Trump Reignites Trade War

🗞 Trump Reignites Trade War

PLUS: Tesla stock is in a downward spiral

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

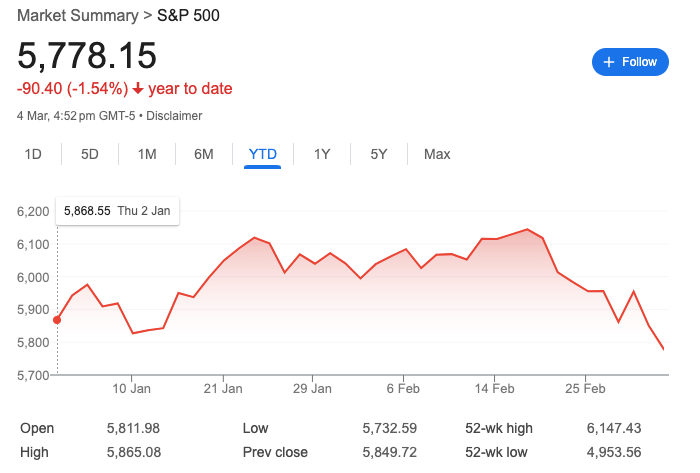

S&P 500 @ 5,778.15 ( ⬇️ 1.22%)

Nasdaq Composite @ 18,285.16 ( ⬇️ 0.35%)

Bitcoin @ $87,089.10 ( ⬆️ 1.01%)

Hey Scoopers,

Happy Wednesday! Here’s what we’re covering today:

👉 Trump’s tariff threats

👉 Tesla is tanking

👉 CrowdStrike is under pressure

So, let’s go 🚀

Market Wrap

U.S. stocks tumbled for a second consecutive day as President Donald Trump's aggressive tariff policies triggered fears of economic disruption and global trade retaliation.

The market selloff intensified after Trump imposed 25% duties on imports from Canada and Mexico and an additional 10% tariff on Chinese goods.

The market reacted swiftly and severely, pushing the S&P 500 into negative territory for 2025 and erasing all gains since Trump's election victory in November.

Companies with significant import exposure faced particularly steep declines, with GM and Ford dropping more than 4% and nearly 3%, respectively.

Chipotle, which sources approximately half its avocados from Mexico, fell 2%, while Target shed 3% as its CEO warned of imminent price increases on produce.

The international response has been just as forceful. China retaliated by implementing additional tariffs of up to 15% on selected U.S. products, while Mexican President Claudia Sheinbaum vowed to announce countermeasures this weekend.

After Canadian Prime Minister Justin Trudeau announced a 25% levy on U.S. goods, Trump threatened even higher tariffs in response, further escalating tensions.

Monica Guerra of Morgan Stanley Wealth Management advised investors to consider defensive sectors like utilities and real estate with minimal exposure to tariffs, noting that the policy is "multifaceted" and will likely create growth drag and inflation risks.

The Supply Chain Crisis Is Escalating — But This Tech Startup Keeps Winning

Global supply chain chaos is intensifying. Major retailers warn of holiday shortages, and tech giants are slashing forecasts as parts dry up.

But while others scramble, one smart home innovator is thriving.

Their strategic move to manufacturing outside China has kept production running smoothly — driving 200% year-over-year growth, even as the industry stalls.

This foresight is no accident. The same leadership team that saw the supply chain storm coming has already expanded into over 120 BestBuy locations, with talks underway to add Walmart and Home Depot.

At just $1.90 per share, this resilient tech startup offers rare stability in uncertain times. As investors flee vulnerable companies, this window is closing fast.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Trending Stocks 🔥

AeroVironment - The manufacturer of unmanned aircrafts tanked 16% after it issued weak guidance for its full-year results, calling for adjusted earnings of $2.92 to $3.13 per share on revenue of $780 million to $795 million.

Ross Stores - The off-price retailer is up 1% in pre-market after reporting Q4 earnings of $1.79 per share, compared to estimates of $1.66 per share.

Best Buy - The consumer electronics retail stock plunged 14% after CEO Corie Barry warned of higher prices for U.S. consumers due to President Donald Trump’s new China and Mexico tariffs.

Economic Fears Rise as Stagflation Concerns Return

The U.S. economy faces growing concerns about "stagflation"—a toxic combination of higher prices and slower growth not seen since the 1970s.

This economic threat has arisen as President Donald Trump enforces sweeping tariffs while various indicators indicate a slowdown in economic activity.

Consumer spending fell by the largest amount in almost four years in January despite rising incomes.

Meanwhile, the manufacturing sector saw minimal expansion in February, with new orders declining at the fastest pace in almost five years and prices rising significantly.

The Atlanta Federal Reserve's GDPNow tracker has sharply lowered its first-quarter growth forecast to an annualized decline of 2.8%—potentially the most significant drop since the early COVID shutdown in 2020.

Some relief may be forthcoming, as Commerce Secretary Howard Lutnick suggested Trump will "probably" announce tariff compromise deals with Canada and Mexico soon.

These agreements would likely involve scaling back the recently imposed 25% tariffs, easing market concerns about a broader trade war.

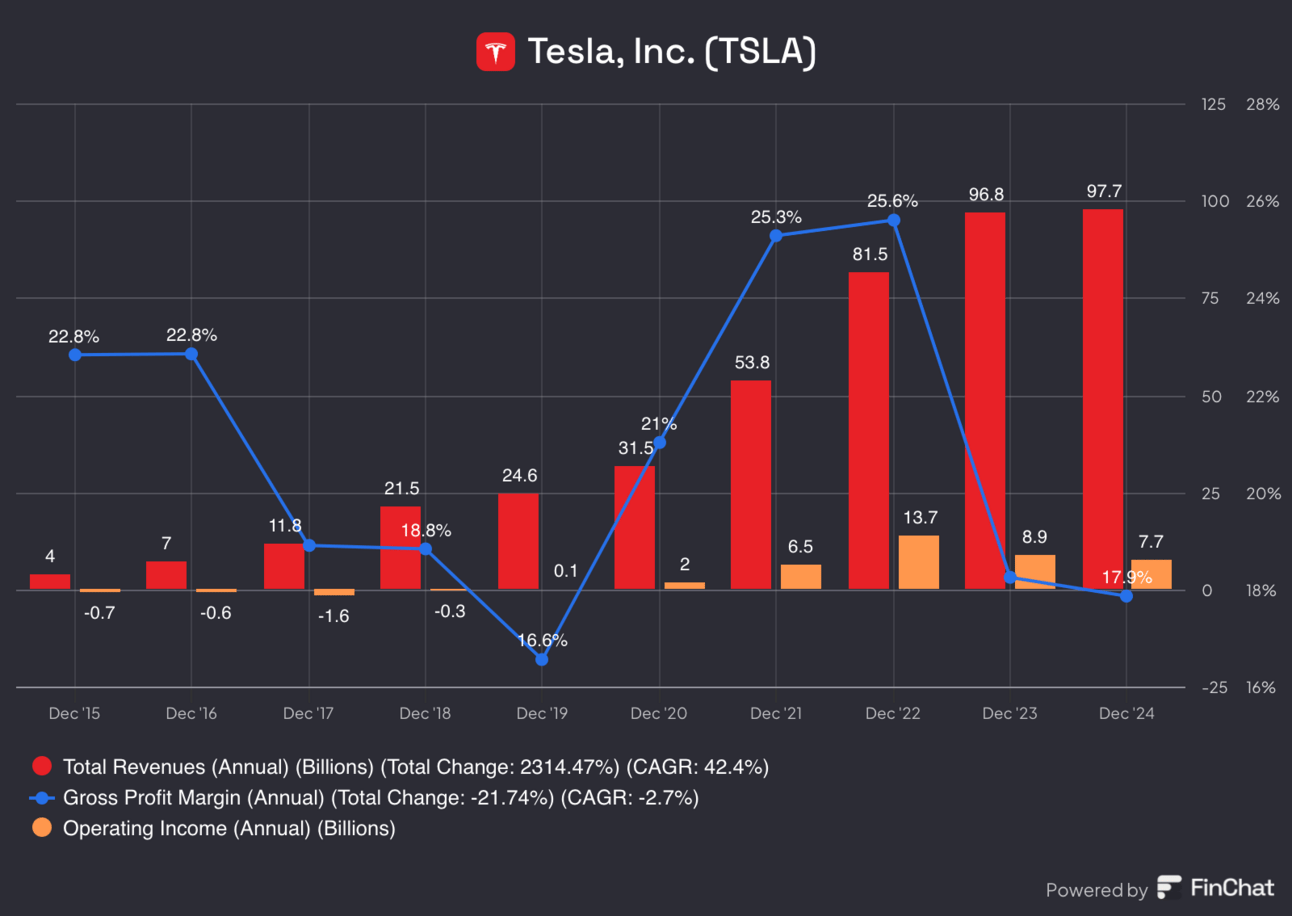

Tesla Stock Tanks Over 40%

Tesla's stock continued its downward trajectory in March, following a steep 28% drop in February—the company's worst monthly decline since December 2022.

The slide pushed Tesla's market cap below $900 billion, despite Elon Musk's optimistic weekend post suggesting a "1000% gain for Tesla in 5 years is possible" with "outstanding execution" and Morgan Stanley naming Tesla its top U.S. auto pick.

Tesla’s financial performance has raised concerns, with Q4 automotive revenue dropping 8% year-over-year and operating income falling 23%.

Beyond business fundamentals, Musk's political activities and controversial statements appear to be damaging Tesla's brand.

As head of the Department of Government Efficiency (DOGE), Musk is making sweeping federal cuts while pursuing government contracts for his companies.

His social media comments on international affairs have sparked backlash, particularly in Europe.

Key challenges facing Tesla include:

Plummeting European sales, with German registrations down approximately 60% in January

Rising anti-Tesla sentiment, including vandalism and organized boycott movements

Increasing competition in self-driving technology, with Waymo already providing 200,000 weekly trips

Significant declines in China, where Tesla's February sales dropped 49.2% while rival BYD grew 90.4%

Tesla's Chinese-made vehicle sales fell to their lowest level since August 2022, highlighting the company's vulnerability in a market where competitors launch advanced EVs at much lower price points.

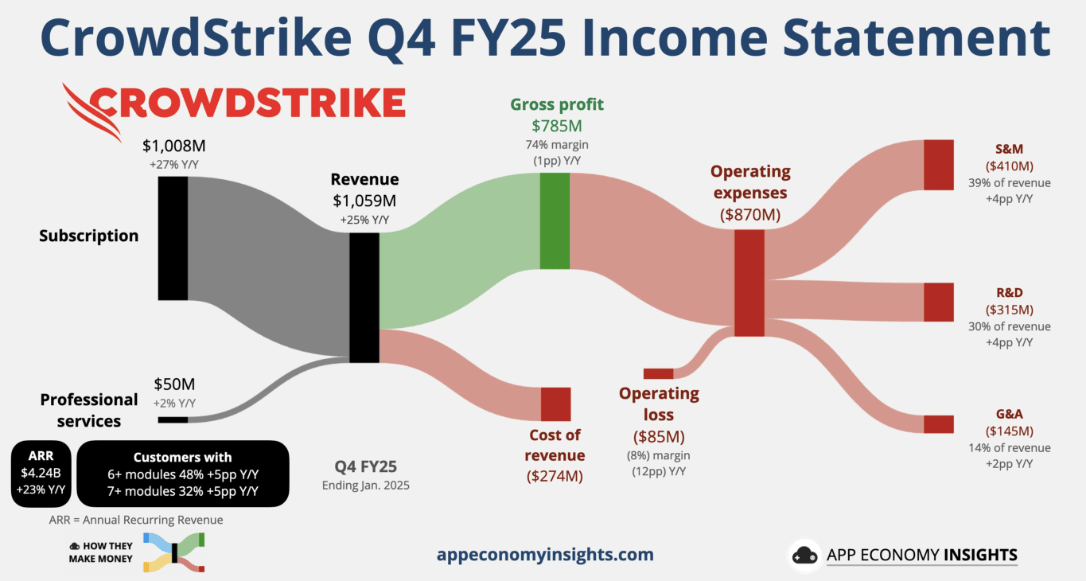

CrowdStrike’s Guidance Disappoints Wall Street

CrowdStrike shares plunged nearly 9% in after-hours trading Tuesday following the cybersecurity company's release of weaker-than-expected earnings guidance despite exceeding revenue expectations for the quarter.

It reported quarterly revenue of $1.06 billion, surpassing analysts' estimates of $1.03 billion and marking a 25% increase from the year-ago period.

However, CrowdStrike posted a net loss of $92.3 million, or 37 cents per share, compared to net income of $53.7 million, or 22 cents per share, in the same quarter last year.

Investors reacted negatively to CrowdStrike's full-year earnings forecast of $3.33 to $3.45 per share, which fell significantly short of the $4.42 per share analysts had projected.

Its Q1 earnings guidance of 64 to 66 cents per share also disappointed compared to Wall Street's expectation of 95 cents.

Some positive metrics included:

Annual recurring revenue reached $4.24 billion, growing 23% and exceeding estimates of $4.21 billion

Net annual recurring revenue totaled $224 million

Revenue guidance for the year of $4.74 billion to $4.81 billion aligned with the consensus estimate of $4.77 billion

The earnings report comes approximately eight months after CrowdStrike's technology update triggered a global IT outage that disrupted businesses worldwide and resulted in class-action lawsuits against the company.

Headlines You Can't Miss!

China targets 5% growth in 2025 amid trade war fears

Trump says U.S. will take control of Greenland

Canada, Mexico tariffs to create ripple effects on consumer prices

Trade war impacts European auto stocks

What to expect at Donald Trump’s crypto summit

Chart of The Day

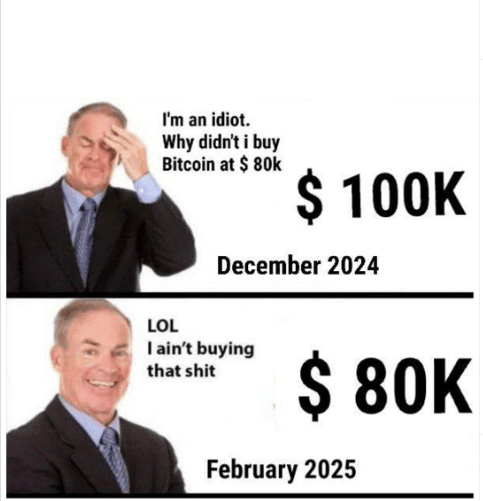

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.