- 3 Big Scoops

- Posts

- Amazon vs. TikTok

Amazon vs. TikTok

PLUS: Will airfares remain high in 2024?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,697.24 ( ⬆️ 0.18%)

Nasdaq Composite @ 14,524.07 ( ⬆️ 0.095%)

Bitcoin @ $44,030.80 ( ⬆️ 0.80%)

Hey Scoopers,

It’s Monday! Brace yourself for a thrilling newsletter. Here’s the scoop 👇

👉 TikTok is eyeing e-commerce

👉 Airfares and fuel costs in 2024

👉 Bitcoin might surpass $500k by 2025

So, let’s go 🚀

TikTok Takes on Amazon

Late last year, TikTok launched its e-commerce business in the United States, where it already has over 150 million users. Called TikTok Shop, the social media giant is bringing a slew of features to its latest offering as it takes on e-commerce incumbent Amazon.

The TikTok Shop tab is equipped with features such as live video shopping, affiliate programs for creators, and shoppable ads.

TikTok has reportedly been testing its foray into e-commerce since November 2022 as it aims to combine the power of community with online shopping.

For instance, creators can easily tag products, making buying things from in-feed and live videos simpler. Moreover, brands can make their product portfolios accessible from their profile pages.

TikTok has partnered with Shopify to offer businesses with digital solutions, allowing it to already onboard more than 200,000 sellers on the Shop platform.

TikTok’s e-commerce business has been successful in Asia, which is among the fastest-growing regions globally. The company aims to end 2023 with $20 billion in gross merchandise value in its e-commerce business, an increase of almost 400% year over year.

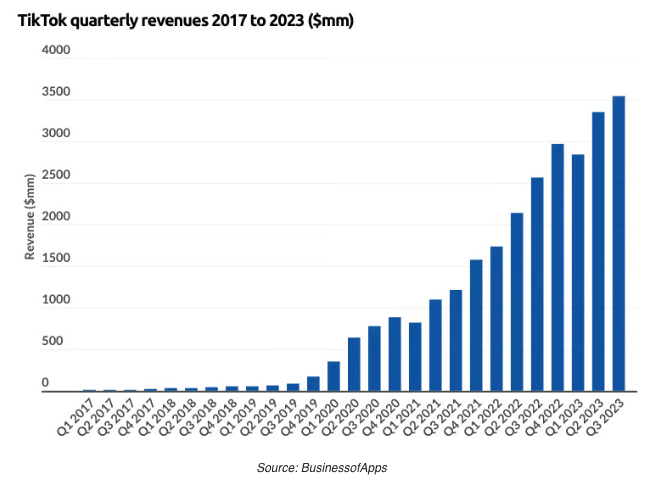

TikTok initially gained massive traction as a short video platform and has surpassed $10 billion in annual sales. Its meteoric rise in the U.S. has enabled it to become the platform of choice among creators and marketers.

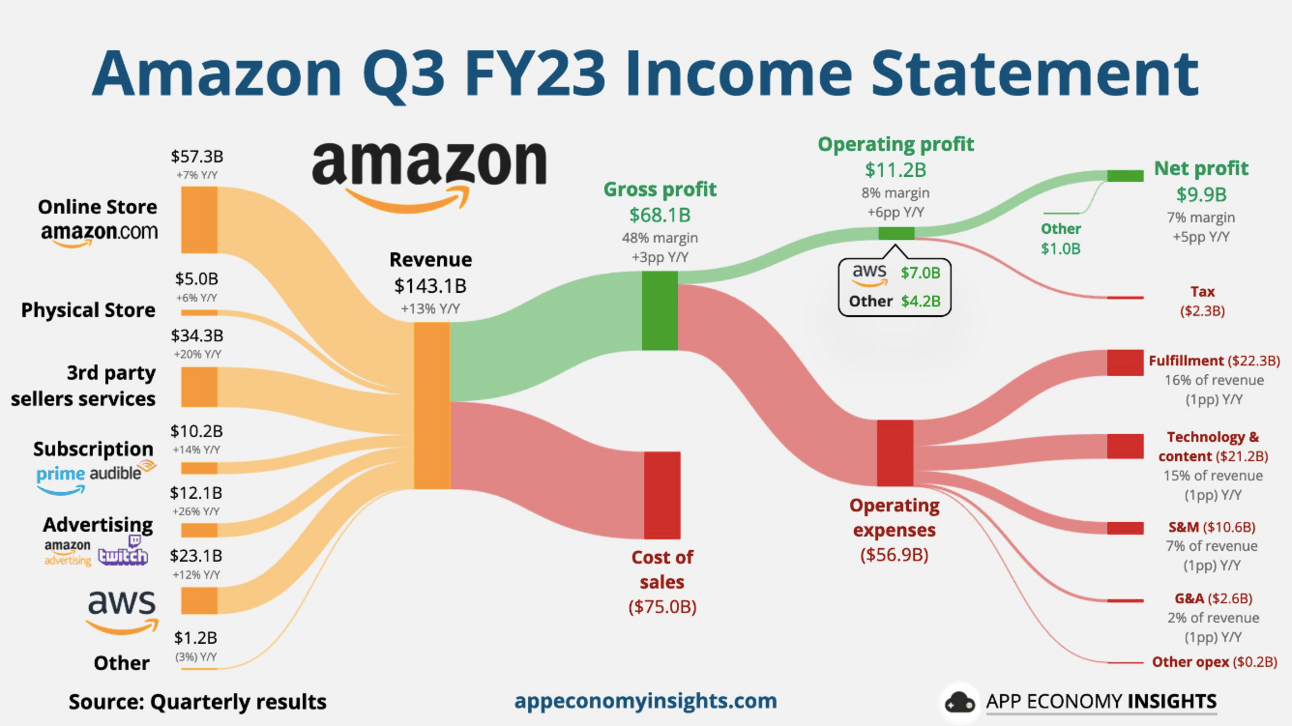

Will TikTok’s foray into e-commerce impact the top-line growth of Amazon, the undisputed online shopping leader in the U.S.?

Airfares to Remain Elevated In 2024

The airline sector has experienced robust demand in 2023 after the COVID-19 pandemic brought travel to a standstill for more than two years.

But the industry’s rapid climb from the depths of COVID-19 might end soon as normalcy is eventually restored.

Source: CNBC

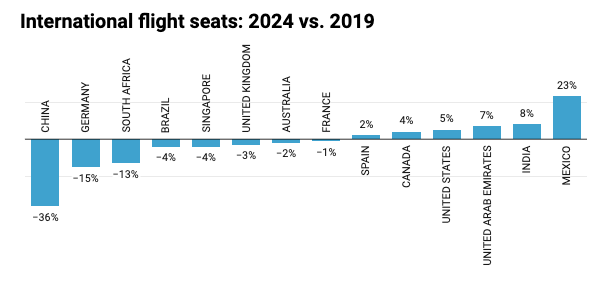

A report from IATA estimates 40 million flights in 2024 to carry 4.7 billion people in 2024, up from 38.9 million flights and 4.5 billion people in 2019.

Moreover, analysts expect travel demand to soften as “revenge travel” ends, after which supply and demand should hit an equilibrium.

In the next 12 months, global airfares are forecast to rise between 3% and 7% due to high fuel costs, fleet upgrades, and sustainability changes.

Several airline stocks reported record earnings in 2023. But macro headwinds might lower the bottom line this year.

IATA expects global airline sales to touch $964 billion in 2024, with a net income of $25.7 billion, indicating a margin of 2.7%, higher than the 2.6% margin in 2023.

Bitcoin’s Price Prediction

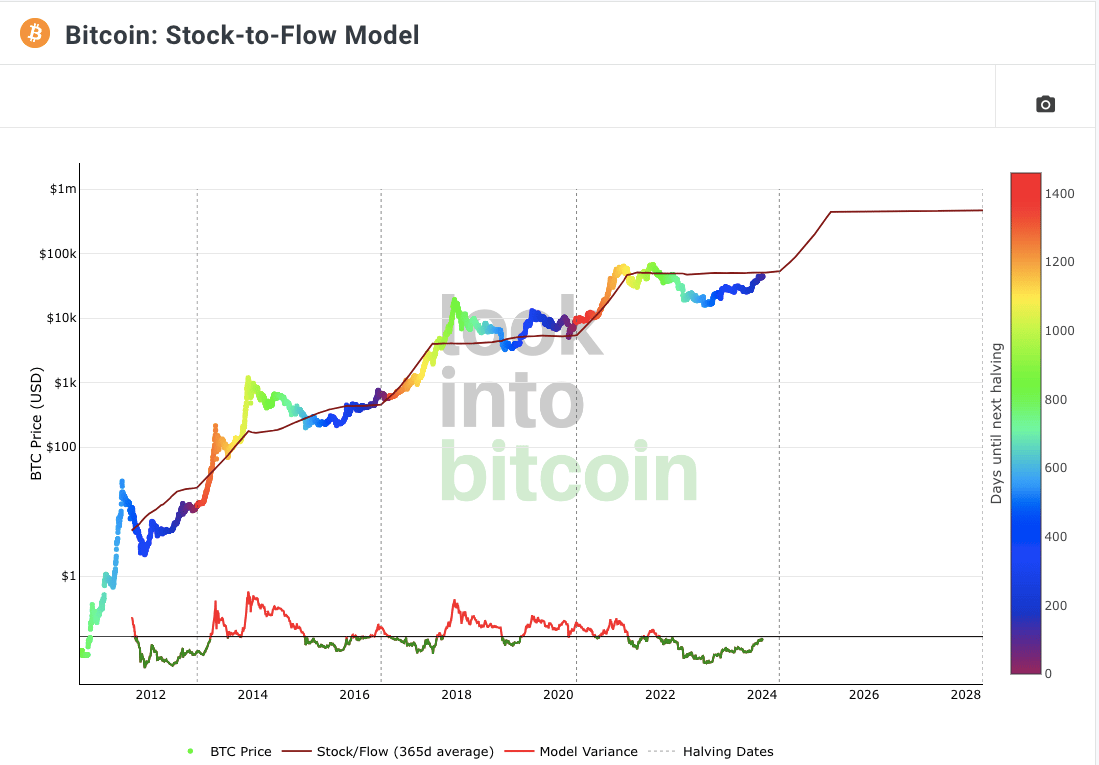

According to the Stock-2-Flow Model:

👉 Bitcoin prices will range around $55,000 by the end of April 2024

👉 Bitcoin prices will soar to record highs of $532,000 by the end of 2025

The Stock-2-Flow model has been eerily accurate in the last few years, successfully predicting BTC’s astonishing rise during the bull market in 2021.

If BTC prices increase to $532,000, the digital asset will be valued at $10.5 billion by the end of 2025. Is this possible?

Headlines You Can’t Miss!

Analysts are bullish on Asian markets

China’s shadow bank files for bankruptcy as property crisis looms large

How did the U.S. economy perform in 2023??

Peloton shares gain as it partners with TikTok

Cryptocurrency investors await ruling on Bitcoin ETF

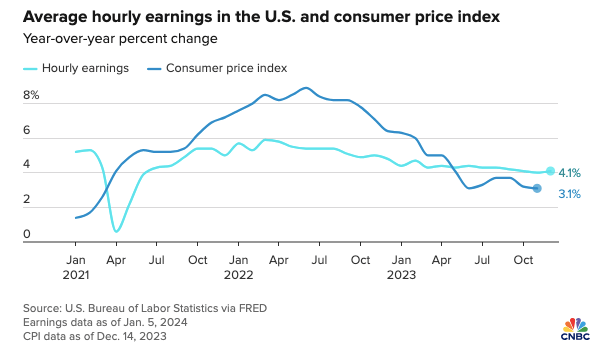

Chart of the Day

Despite an uncertain macro environment, the U.S. economy would up a pretty good year in 2023.

Consumer spending remained high as equity markets rebounded while the Fed somewhat tamed inflation last year.

The U.S. labor market was strong, creating over 200,000 jobs in December, rising for 36 consecutive months as the unemployment rate stood at 3.7%.

Moreover, consumer spending was resilient as advanced monthly retail sales were over $600 billion for most of 2023.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.