- 3 Big Scoops

- Posts

- 🗞 Tesla Unveils the Robotaxi

🗞 Tesla Unveils the Robotaxi

PLUS: AMD takes on Nvidia with AI chip

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

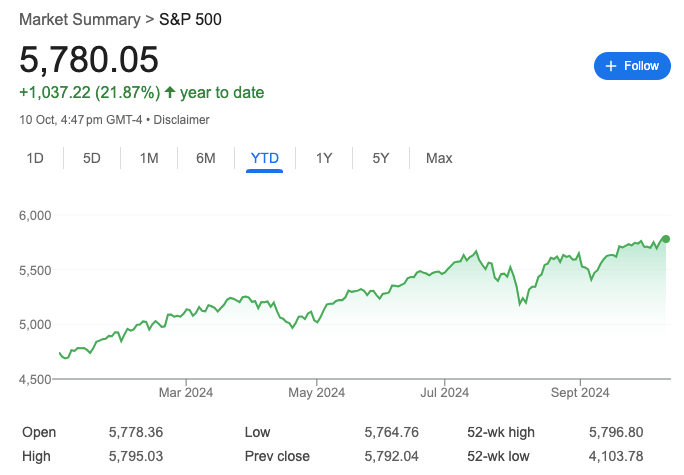

S&P 500 @ 5,780.05 ( ⬇️ 0.21%)

Nasdaq Composite @ 18,282.05 ( ⬇️ 0.052%)

Bitcoin @ $60,586.30 ( ⬇️ 4.11%)

Hey Scoopers,

Happy Friday! Are you ready for an exciting newsletter?

👉 Tesla prices the Cybercab at $30k

👉 AMD launches AI chip

👉 UBS cautious ahead of Q3 earnings

So, let’s go 🚀

Market Wrap

Stocks declined on Thursday, with the S&P 500 and Dow Jones Industrial Average falling from records as economic data pointed to stubborn inflation.

September’s consumer price index rose 0.2% monthly, ahead of estimates of 0.1%. The annual inflation rate of 2.4% was also higher than estimates of 2.3%. Notably, the year over year number is the lowest since February 2021.

The data comes as concerns mount that the Fed may slow the pace of future cuts. Today, the FedWatch tool suggests an 85% likelihood of a quarter-percentage-point cut.

Moreover, initial filings for unemployment benefits rose to 258,000, up 33,000 from the previous week and above estimates of 230,000.

What next for investors?

The S&P 500 index trades just below its all-time high and could see further upside with the upcoming earnings season.

Historically, the S&P 500 gains 2% in the first four weeks of reporting, according to Oppenheimer. The earnings season for Q3 kicks off Friday, with banking giants JPMorgan and Wells Fargo due to report before the market opens.

Trending Stocks 🔥

First Solar - The solar stock shed over 9% after Jeffries cut its price target due to ongoing supply chain and labor shortages, which could impact near-term financials.

TD Bank - Shares of the Canadian bank fell over 5% after it is expected to pay $3 billion in penalties and have limits on its U.S. business as part of a settlement over money laundering charges.

Delta Air Lines - Shares fell 1% after the airline issued disappointing revenue guidance for Q4. It expects revenue to rise between 2% and 4% year over year, below its earlier estimate of a 4% growth.

Up to 4X Profits? Yes, Chef!

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

Carmy’s tattooed arms may no longer be the most distinctive ones in kitchens. As fast food brands face 150% turnover rates, they’re turning to Miso to increase profits up to 4X via AI. After logging 150k+ hours in kitchens for brands like Jack in the Box, Miso just launched its smallest, smartest, fastest robot yet. And its first production run sold out in just 7 days. White Castle even announced interest in rolling out Flippy to 100 of their locations. There are 170+ US fast food brands in need.

Elon Musk Launches FSD Vehicles

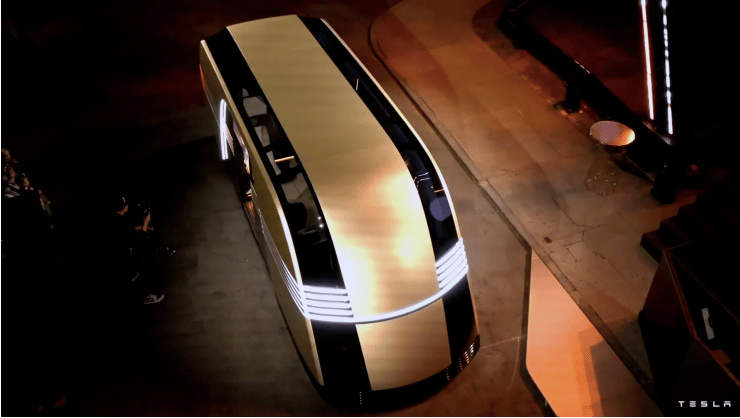

After a decade of unfulfilled promises about driverless vehicles, Tesla CEO Elon Musk hyped the company’s Cybercab concept yesterday, showing off a two-seater vehicle with no steering wheel or pedals.

Musk offered no details about where Tesla plans to manufacture the cars but claimed consumers could buy a Tesla Cybercab for less than $30,000 while vehicle production could start before 2027.

Moreover, Musk said he expects Tesla to introduce unsupervised FSD in the Model 3 and Model Y EVs in Texas and California in 2025. FSD, or full self-driving, is Tesla’s driver assistance system, which is already available today but not fully autonomous.

Musk also revealed plans to introduce an autonomous electric Robovan that can carry up to 20 people or be used to transport goods.

Musk first promised to deliver a fully autonomous EV in 2017. In 2019, Musk announced that Tesla would have more than 1 million robotaxi vehicles on the road in 2020, each capable of completing 100 hours of driving work per week.

Yesterday was Tesla’s first product unveiling since its launch of the Cybertruck design five years back.

AMD Eyes AI Moat

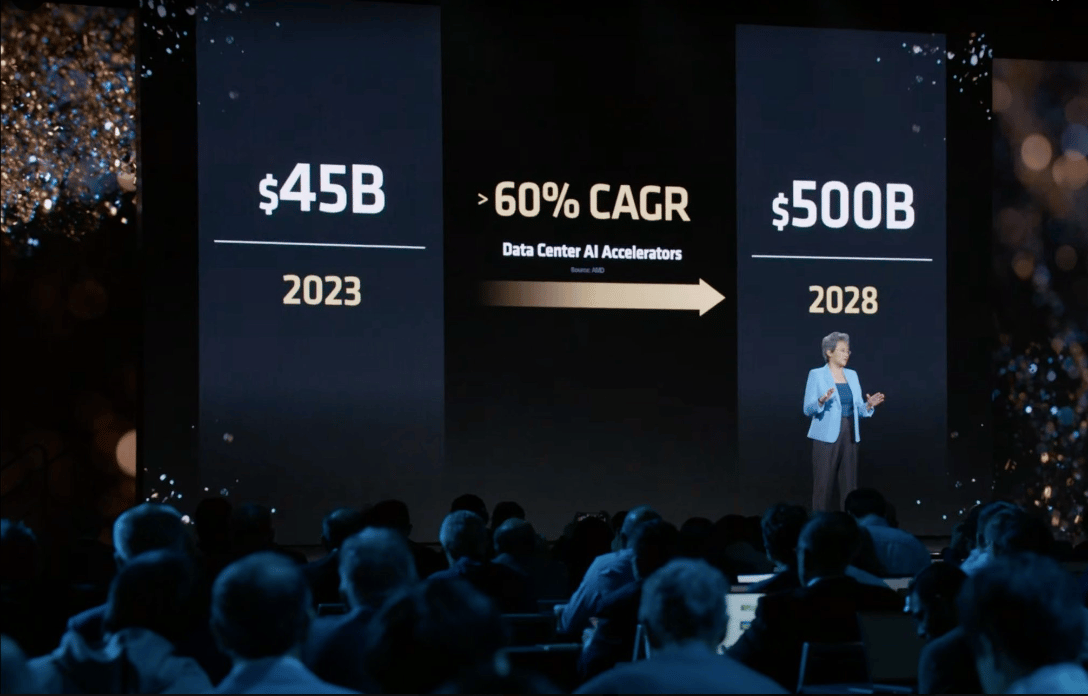

AMD launched a new AI chip on Thursday, directly taking aim at Nvidia’s data center graphics processors or GPUs.

AMD’s latest chip, Instinct MI325X, will start production by the end of 2024. If these chips are viewed as a substitute for Nvidia’s products, it could put pricing pressure on the latter, which has enjoyed gross margins of 75% due to robust demand over the past year.

In recent years, Nvidia has dominated the data center GPU market. Now, AMD aims to take share from its rival and capture a sizeable chunk of the market, which is forecast to expand to $500 billion by 2028.

The MI325X’s rollout will pit it against Nvidia’s upcoming Blackwell chips, which Nvidia has said will start shipping in significant quantities early next year.

AMD’s data center sales in the June quarter more than doubled year over year to $2.8 billion, with AI chips accounting for $1 billion. Meanwhile, Nvidia has sold more than $40 billion worth of AI chips in the past year.

UBS Expects Earnings to Remain Soft

Investment bank UBS expects quarterly earnings to experience softness in Q3 of 2024.

UBS explained that S&P 500 earnings growth has come in above the long-term average in the past three quarters and is expected to remain robust through year-end 2025 and beyond.

However, UBS noted that the softness is broad-based, with slower growth in eight of the 11 sectors and 66% of companies.

Earnings in the September quarter are forecast to grow by 4%, compared to the 11.6% growth in Q2. Alternatively, as most companies have provided cautious guidance, earnings growth will be much higher at 7.5% in Q3.

Earnings growth for the six mega-cap tech names stood at 68.2% in Q4 of 2023. In Q3, earnings growth forecasts for big tech stocks are much lower at 19.3%.

Headlines You Can't Miss!

UK economy grows 0.2% in August, in line with estimates

Zealand Pharma is optimistic about its obesity drug

What to expect from JPMorgan in Q3 of 2024?

Berkshire slashes BoA stake to less than 10%

Bitcoin slips on higher-than-expected CPI print

Chart of The Day

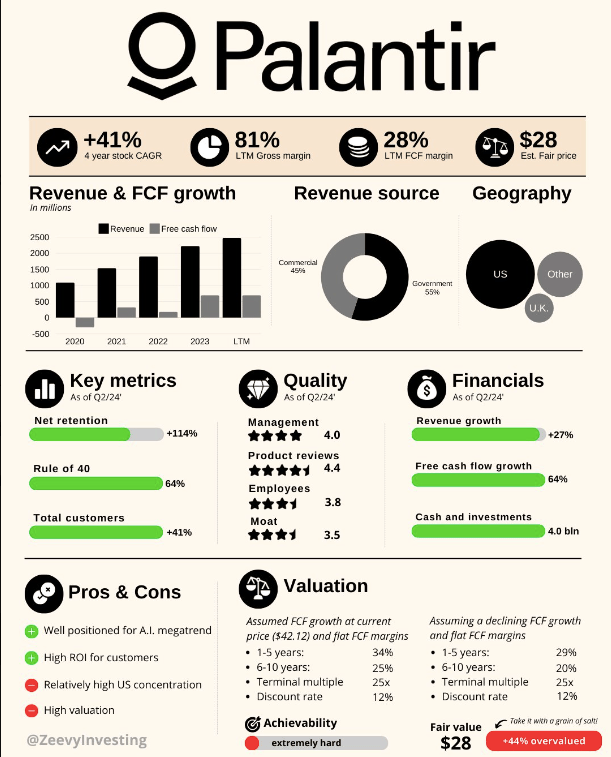

Valued at more than $95 billion, Palantir stock is up 143% in the last year. However, it trades at a steep multiple and is highly overvalued.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.