- 3 Big Scoops

- Posts

- 🗞 Tesla Races Past $1 Trillion

🗞 Tesla Races Past $1 Trillion

PLUS: The Dow Jones tops $44k

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

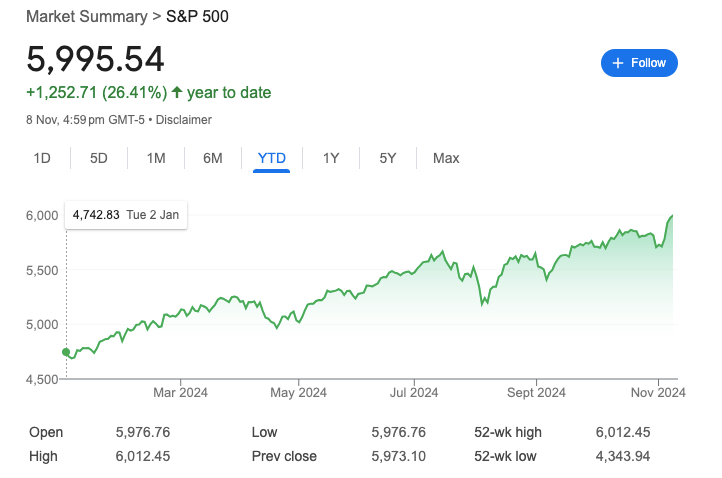

S&P 500 @ 5,995.54 ( ⬆️ 0.38%)

Nasdaq Composite @ 19,286.78 ( ⬆️ 0.090%)

Bitcoin @ $77,332.21 ( ⬆️ 1.08%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter today?

👉 Tesla rallies as Trump wins

👉 China’s trillion-dollar stimulus

👉 AppLovin spiked over 17%

So, let’s go 🚀

Market Wrap

The stock market climbed to a fresh record high on Friday, as the Dow and S&P 500 wrapped up their best week in a year after Donald Trump’s election win.

The S&P 500 index rose 4.66% last week, while the Dow spiked by 4.61%, notching their best week since November 2023. The tech-heavy Nasdaq rose 5.74%, while the small-cap benchmark Russell 2000 surged 8.57%.

Investors view a Republican government as business-friendly and favoring capitalism. While Donald Trump has proposed lowering taxes, there are concerns over the large fiscal deficit and a tariff war.

Stocks also got a boost from the Federal Reserve this week, as the central bank lowered rates by 0.25% last week. During a press conference following the rate cut, Fed Chair Jerome Powell noted he is “feeling good” about the economy.

Trending Stocks 🔥

Trump Media & Technology - The stock advanced 15% after Donald Trump disclosed he has no plans to sell his $3 billion stake in the company.

Five Below - The discount retailer slipped over 5.5% as the ramifications of Trump’s potential tariffs on Chinese imports weighed on the stock.

Sweetgreen - The stock fell almost 6% after the salad chain reported a loss of $0.18 per share on $173 million in revenue. Analysts were looking for sales of $175 million and a loss of $0.13 per share.

Tesla Rallies 29%

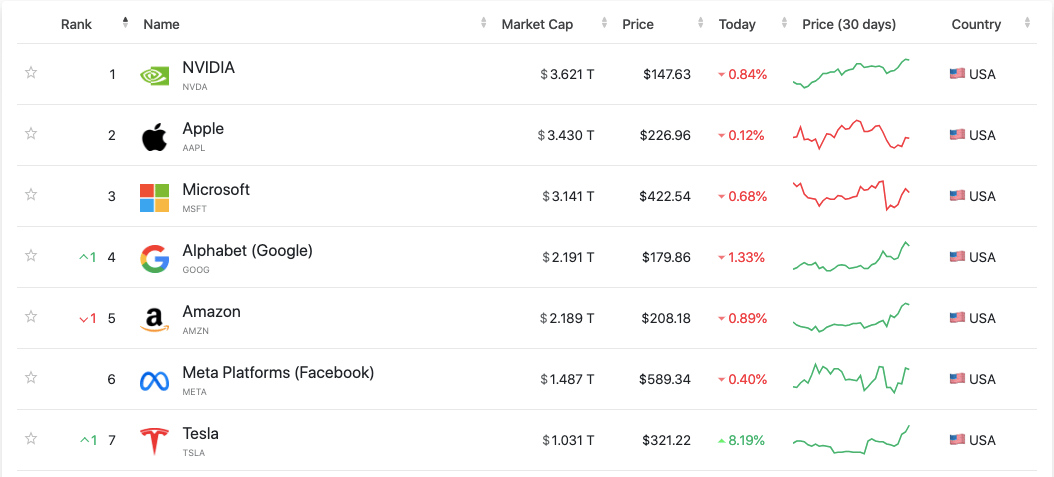

Tesla climbed 8% on Friday, pushing the electric vehicle maker’s market cap past $1 trillion.

The stock rallied close to 30% last week after Donald Trump won the U.S. presidential election, and investors expect that the former leader’s return to the White House could benefit Tesla.

Elon Musk, Tesla’s CEO, was crucial to Trump’s campaign, contributing at least $130 million to the Presidential race.

Source: Companiesmarketcap

Before the U.S. elections, Tesla stock was up 1% in 2024. After its 30% gain last week, Tesla rallied past the $1 trillion market cap, joining the likes of Nvidia, Apple, Microsoft, Alphabet, Amazon, and Meta.

Wedbush Securities analyst Dan Ives has said that a potential Trump administration could spell less regulation for Tesla and other companies.

Tesla is the largest EV manufacturer in the U.S., and Musk’s dynamic with Trump could give it a clear competitive advantage in a non-EV subsidy environment and higher China tariffs that could push cheaper Chinese EV players away from flooding the U.S. market.

In Q3 of 2024, Tesla reported revenue of $25.18 billion and a net income of $2.17 billion. During the earnings call, Musk claimed vehicle growth could range between 20% and 30% in 2025 due to lower-cost vehicles and the advent of autonomy.

Tesla has been promising and developing driverless vehicle technology for over a decade. In the Q3 earnings call, Musk said he would push the Trump administration to establish a federal approval process for autonomous vehicles.

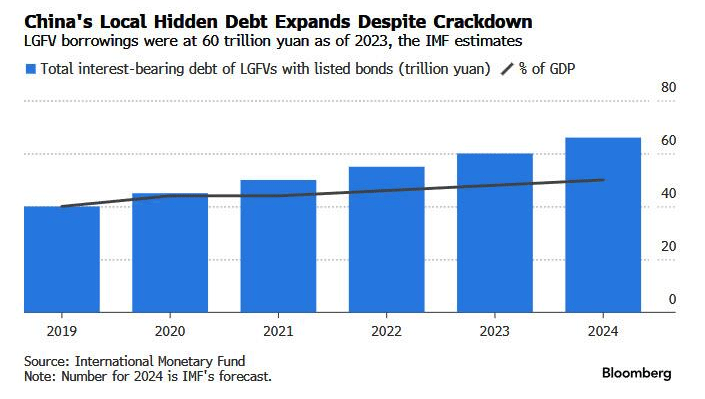

China’s Massive Stimulus Package

On Friday, China announced a five-year stimulus package totaling $1.4 trillion to tackle the government’s debt problems. China also approved a proposal to allocate an additional 6 trillion yuan ($840 billion) to increase the debt limit of local governments.

These policies would allow local governments to reduce their hidden debt of $2 trillion by more than 80% over the next four years. A lower debt balance will free up funds to support economic growth and revive China’s slowing growth rates.

China’s hidden debt refers to extensive borrowing by local governments that is not disclosed in official financial statements. The debt is accumulated through local government financing vehicles and used to fund infrastructure and development projects.

According to investment bank Nomura, China’s hidden debt may range between $7 trillion and $8.4 trillion, accounting for a sizeable portion of the country’s GDP.

Notably, China has ramped up stimulus announcements since late September, fueling a stock rally.

While the country’s central bank has slashed interest rates multiple times, the government approved a plan to increase the fiscal deficit to 3.8% from 3%, which will translate to significant hikes in government debt and spending.

AppLovin is On a Roll

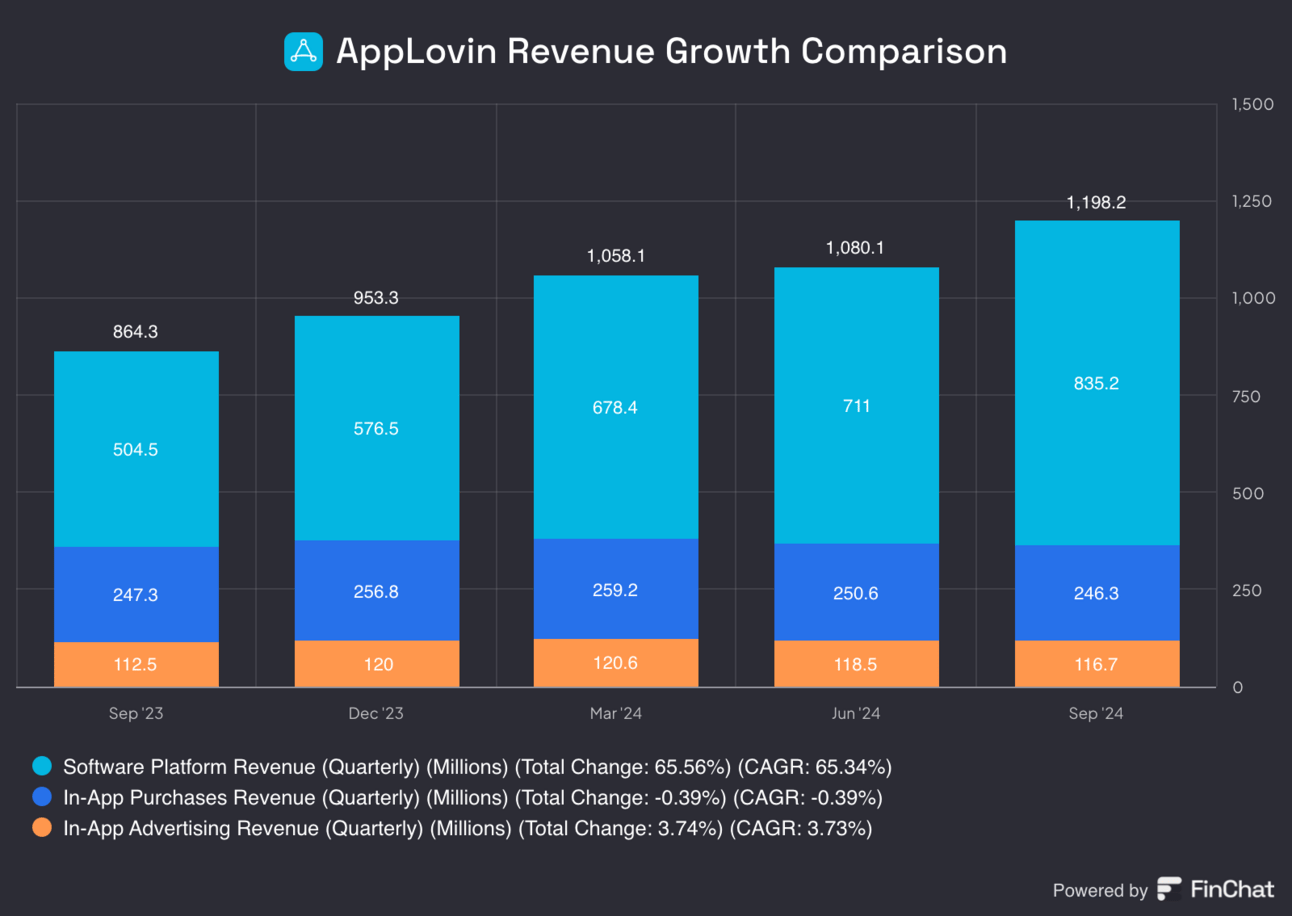

Shares of AppLovin surged close to 80% last week, bringing its year-to-date returns to almost 650%. AppLovin recently announced its Q3 results, which crushed estimates. In the September quarter, it reported:

👉 Revenue of $1.2 billion vs. estimates of $1.13 billion

👉 Earnings per share of $1.25 vs. estimates of $0.92

Its revenue rose by 39% year over year in Q3 of 2024. For the current quarter, it estimates sales between $1.24 billion and $1.26 billion, higher than the consensus forecast of $1.18 billion.

Founded in 2012, AppLovin went public in 2021, riding a Covid-era wave of excitement in online games. In addition to gaming, AppLovin has an online ad business gaining traction from AI advancements that have improved targeting.

AppLovin's AI ad engine, AXON, helps the company's mobile gaming apps display better-targeted ads. The company also licenses the software to other companies, diversifying its revenue base.

In Q3, AppLovin’s software platform sales rose 66% to $835 million due to improvements in AXON’s models.

Its strong revenue growth has allowed AppLvin to expand the bottom line aggressively. In Q3, net income rose by 300% year over year to $434.4 million, up from $108.6 million last year.

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

Headlines You Can't Miss!

Trump tariff threat looms large on Asia

TSMC to halt shipment of AI chips to China

Singapore Airlines’ profits fall 50%

Asia-Pacific markets drop on weak China data

Traders expect Bitcoin to surge to $90,000

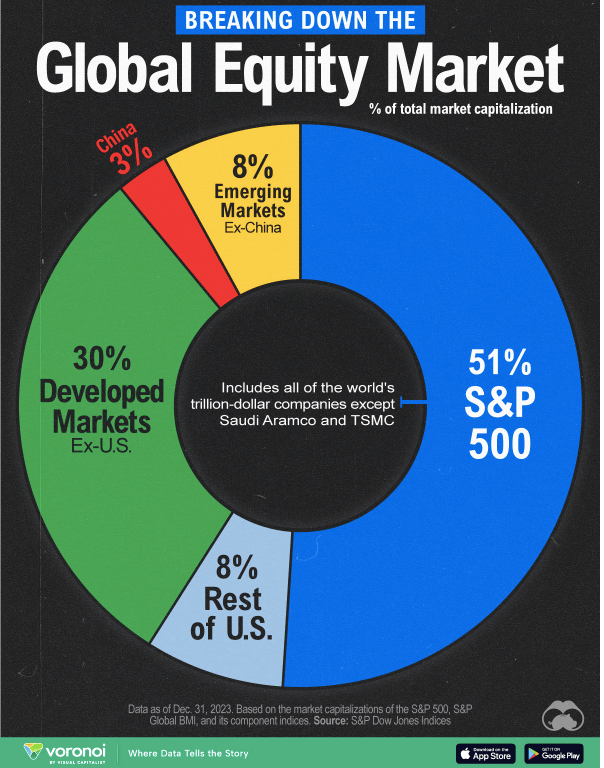

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.