- 3 Big Scoops

- Posts

- 🗞 Tesla In Top Gear

🗞 Tesla In Top Gear

Tesla, gold, and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

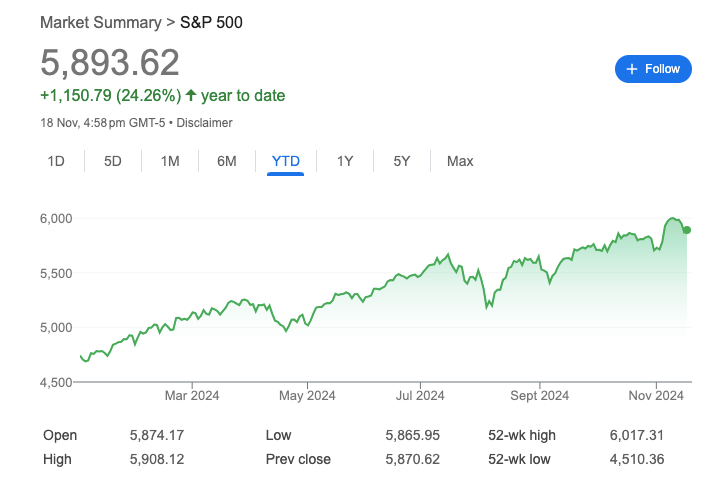

S&P 500 @ 5,893.62 ( ⬆️ 0.39%)

Nasdaq Composite @ 18,791.81 ( ⬆️ 0.60%)

Bitcoin @ $91,751.8 ( ⬆️ 1.22%)

Hey Scoopers,

Happy Tuesday! Are you ready for an exciting newsletter?

👉 Tesla continues to soar

👉 Goldman is bullish on gold

👉 MicroStrategy attracts investors

So, let’s go 🚀

Market Wrap

Stock futures are trading higher at the time of writing as investors await key earnings from retailers and chipmaker Nvidia this week.

Around 93% of S&P 500 companies have reported quarterly results this season, 75% of which have surpassed earnings estimates, while 60% have beaten revenue projections.

Equities attempted to stage a comeback on Monday, with the S&P 500 and Nasdaq indices surging 0.6% and 0.4%, respectively. However, the Dow Jones Industrial Average fell 0.1%, marking its third consecutive session in the red.

Last week, a postelection selloff was sparked by concerns about the future path of interest rates, given a strong economy and labor market.

Trending Stocks 🔥

Super Micro Computer - Shares of the server company rallied over 37% after it appointed BDO as its new independent auditor. It also submitted a plan to regain compliance with Nasdaq’s listing requirements.

Trump Media & Technology - The stock shed 4% on news that it is in talks to buy cryptocurrency trading firm Bakkt.

Marathon Digital Holdings - The stock tanked over 14% after it disclosed plans to raise $700 million through a private offering of convertible senior notes to acquire additional Bitcoin and refinance debt.

Tesla Stock Surges Over 5%

Tesla shares jumped over 5% yesterday following a report that President-Elect Donald Trump’s transition team plans to make a federal framework to regulate self-driving vehicles a top priority for the U.S. Transport Department.

Tesla CEO Elon Musk was a central figure in the business world pushing for Trump’s return to the White House in the lead-up to this month’s elections.

The tech billionaire now stands to benefit from the close relationship he has formed with the Republican politician, who previously served a first presidential term between 2017 and 2021.

A federal framework for regulating self-driving vehicles would be a major boon to Musk’s Tesla. The company has been promising fully self-driving vehicles for several years but has failed to deliver a car capable of being driven autonomously without a human behind the wheel.

Tesla's long-term vision is to produce a fleet of so-called robotaxis, autonomous vehicles that can drive people around without human supervision.

Last month, Musk showed off Tesla’s long-awaited robotaxi—a concept car called the “Cybercab,” a $30,000 two-seater vehicle without steering wheels or pedals.

Tesla has already been beaten to the punch in the robotaxi race by Google’s Waymo venture, among the few companies that have successfully launched self-driving cars on public roads.

‘Go for gold,’ says Goldman Sachs

Investment bank Goldman Sachs has projected a significant increase in gold prices driven by heightened central bank acquisitions and expected interest rate cuts in the U.S.

Goldman Sachs emphasized that gold will be a leading commodity trade in 2025, with prices anticipated to reach $3,000 per ounce by December 2025.

Further, it expects a cyclical boost from rising investments in exchange-traded funds (ETFs) as the Fed enacts rate cuts.

The forecast by Goldman Sachs comes amid significant movements in the gold market. Last month, the SPDR Gold Trust saw its highest monthly inflows in 2.5 years, with net inflows of $1.8 billion.

However, sentiment shifted dramatically after Donald Trump won the election, leading to an outflow of $1 billion from the ETF in early November, its largest weekly outflow in two years.

Investors moved away from a safe-haven asset, anticipating a strong dollar under Trump’s second term.

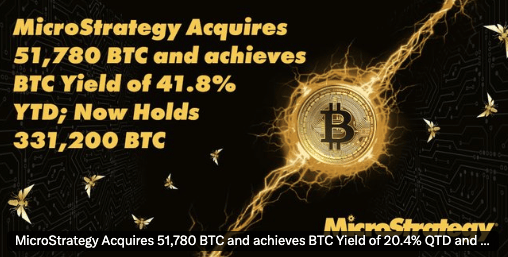

Investors Pile Into MicroStrategy

MicroStrategy is considered a Bitcoin proxy of sorts since it became the leading corporate holder of Bitcoin in August 2020.

The company now holds 331,200 BTC, worth roughly $29.7 billion, after a monster purchase of approximately $4.6 billion on Monday — its largest single-day set of transactions yet.

Over the past week, institutional investment managers with at least $100 million in equity assets under management filed 13F reports with the U.S. Securities and Exchange Commission.

According to 13f.info, the number of institutional holders of MicroStrategy jumped from 667 to 738, with a total reported value of $15.3 billion.

Vanguard Group, the world's second-largest asset manager, and Capital International Investors bought nearly 16 million MicroStrategy shares apiece in the third quarter — around a 1,000% increase in both companies' MSTR holdings.

The price of bitcoin is up nearly 110% year-to-date, which significantly lags MicroStrategy shares that have amassed a 450% gain in the same period. MSTR recently crossed its previous all-time high.

Do You Own Bitcoin? |

Free Daily Trade Alerts: Expert Insights at Your Fingertips

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Headlines You Can't Miss!

Nestle unveils $2.8 billion cost-cutting plan

Google to merge Chrome OS with Android

China is doubling down on Latin America ties

What to expect from Walmart in Q3?

Goldman Sachs to spin out its crypto business

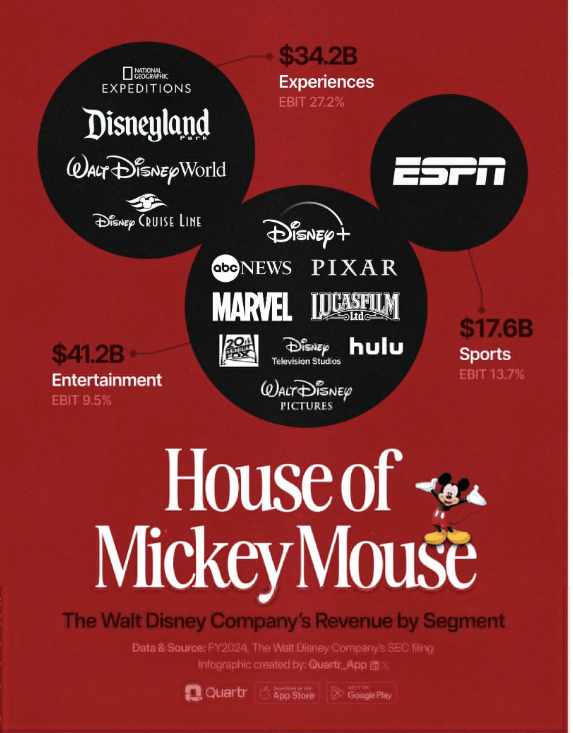

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.