- 3 Big Scoops

- Posts

- 🗞 Delta Sues CrowdStrike

🗞 Delta Sues CrowdStrike

PLUS: KeyBanc Downgrades Apple

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

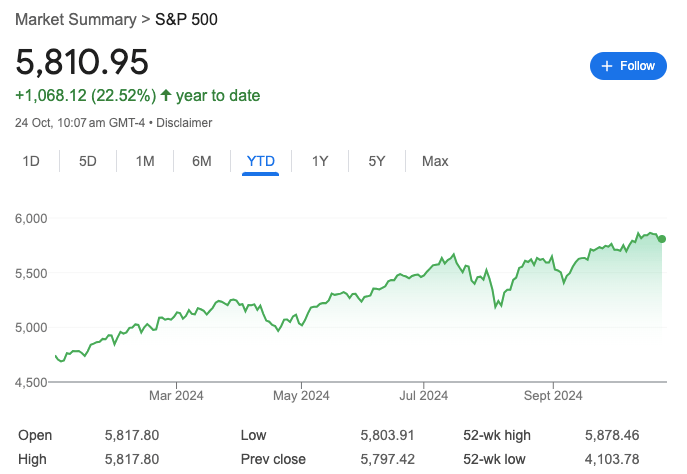

S&P 500 @ 5,797.42 ( ⬇️ 0.92%)

Nasdaq Composite @ 18,276.55 ( ⬇️ 1.60%)

Bitcoin @ $67,381.39 ( ⬆️ 1.67%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter?

👉 Tesla beats earnings estimates in Q3

👉 IBM disappoints Wall Street

👉 Boeing wrestles with machinists’ strike

So, let’s go 🚀

Market Wrap

Stock indices are moving higher in early-market trading on Thursday as the S&P 500 index looks to rebound following three consecutive losing sessions.

Yesterday, the Dow Jones Industrial Average index suffered its biggest one-day loss since last December, losing more than 400 points as the S&P 500 shed almost 1% and the Nasdaq lost 1.6%.

Megacap stocks were under pressure on Wednesday, with Apple and Nvidia losing over 2%. Meta Platforms slid 3%, while Netflix and Amazon were lower by roughly 2%.

Treasury yields moved lower, lifting market sentiment after rising yields kept stocks under pressure this week.

Meanwhile, the earnings season continues to gain pace. Over 27% of the S&P 500 companies have reported Q3 numbers, of which 76% have beaten consensus estimates.

Trending Stocks 🔥

Honeywell - The stock is down 2% in early market after the industrial giant reported revenue of $9.73 billion with adjusted earnings of $2.58 per share, compared to estimates of $9.9 billion and $2.50 per share, respectively.

T-Mobile - The telecom giant rose 3% after its Q3 earnings surpassed consensus estimates.

Hims & Hers Health - The stock tumbled 9% after Novo Nordisk appealed to the U.S. FDA to bar compounded versions of semaglutide, the active ingredient in its weight loss drugs.

Tesla In Top Gear

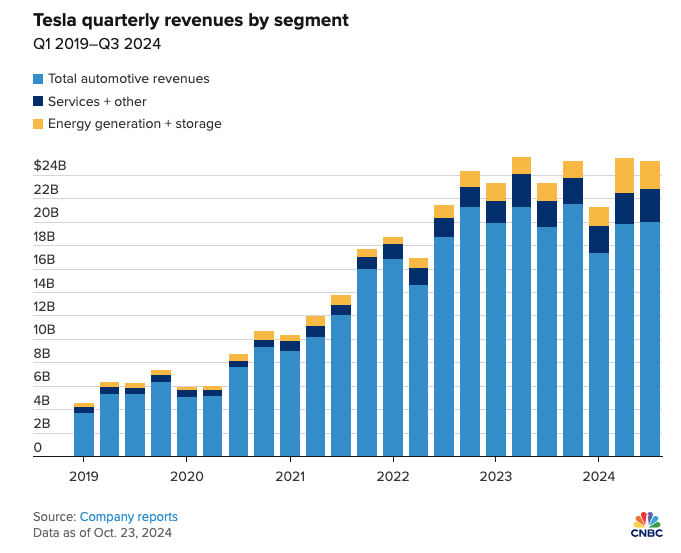

Tesla just announced its Q3 earnings, reporting:

👉 Revenue of $25.18 billion vs. estimates of $25.37 billion

👉 Earnings per share of $0.72 vs. estimates of $0.58

The company’s sales rose 8% year over year, while net income was bolstered by $739 million in automotive regulatory credit revenue.

Moreover, automotive sales rose by 2% to $20 billion, while energy generation and storage sales rose by 52% to $2.38 billion. Services and other revenue jumped 29% to $2.79 billion.

Tesla CEO Elon Musk expects vehicle growth to range between 20% and 30% in 2025 due to lower-cost vehicles, which drove investor optimism higher.

Comparatively, analysts were projecting vehicle deliveries to increase by 15% to 2.04 million in 2025.

Tesla emphasized that the Cybertuck is now the third-best-selling fully electric vehicle in the U.S., behind the Model 3 and Model Y.

According to estimates from Kelley Blue Book, Tesla sold over 16,000 cybertucks in Q3 despite grappling with quality issues. Tesla also confirmed that the angular steel pick-up achieved a positive gross margin for the first time.

IBM Stock Falls Over 4%

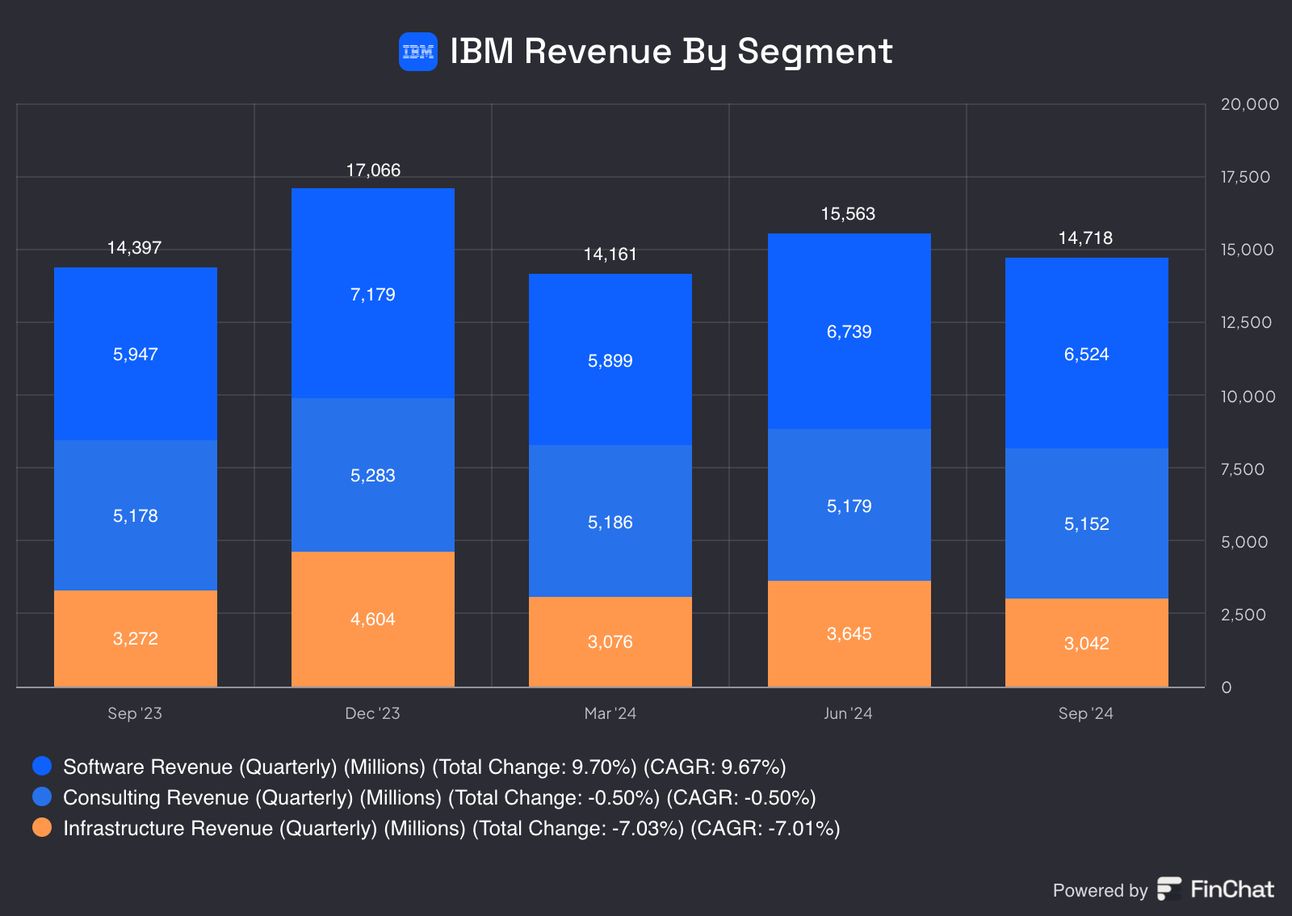

IBM shares are down 4% in early-market trading after the hardware, software, and consulting provider fell short of consensus revenue estimates in Q3.

In the September quarter, IBM reported:

👉 Revenue of $14.97 billion vs. estimates of $15.07 billion

👉 Earnings per share of $2.30 vs. estimates of $2.23

Here are some of the key numbers for the diversified tech company:

IBM forecasts a free cash flow of $12 billion in 2024, having brought in $6.6 billion year-to-date.

Its software sales in Q3 stood at $6.52 million, up 10% year over year and above estimates of $6.37 billion.

Revenue from Red Hat, a 2019 acquisition, grew 14%, compared with 7% in the second quarter. It was the highest single quarter of signings since the acquisition.

IBM’s AI business exceeded $3 billion in Q3, an increase of over $1 billion compared to Q2. Around 80% of its AI sales originated from its consulting business, while the rest came from the software segment.

Boeing Stock Continues to Underperform

Boeing shares are down 2% in early-market trading after its machinists voted against a new labor deal that included 35% wage increases over four years. The vote extended a five-week strike that has halted most of the company’s aircraft production.

The contract was rejected by 64% of the voters, a significant setback for the aircraft manufacturer. Boeing warned it would continue to burn through cash in 2025 after reporting a $6 billion loss in Q3.

The ongoing strike costs Boeing $1 billion a month, and it quickly needs to reach a deal with machinists to get the company back on track after years of safety and quality problems.

Boeing’s more than 32,000 machinists in the Puget Sound area, in Oregon, and in other locations, walked off the job on Sept. 13 after overwhelmingly voting down a previous tentative agreement that proposed raises of 25%.

The International Association of Machinists and Aerospace Workers union had originally sought wage increases of 40%. It is the machinists’ first strike since 2008.

The latest proposal, announced last Saturday, included 35% raises over four years, increased 401(k) contributions, a $7,000 bonus and other improvements.

Maximize Your Portfolio with These Free Daily Trade Alerts

Master the market in just 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Headlines You Can't Miss!

Barclays shares hit nine-year high as Q3 profits jump 23%

Nvidia supplier SK Hynix posts record Q3 profits as AI demand soars

Chinese smartphone maker Oppo in talks with Google and Microsoft for AI

Meta and Snap are spending billions on AI glasses

EURC stablecoin supply reaches all-time high; market cap nears $100 billion

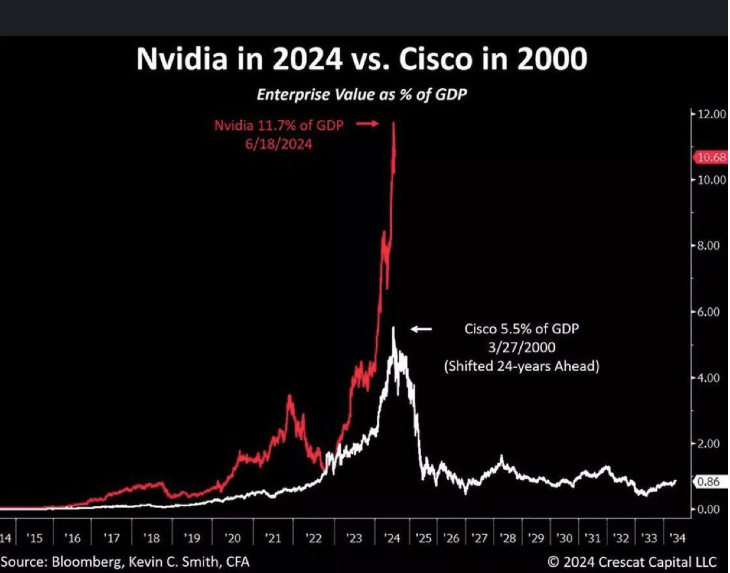

Chart of The Day

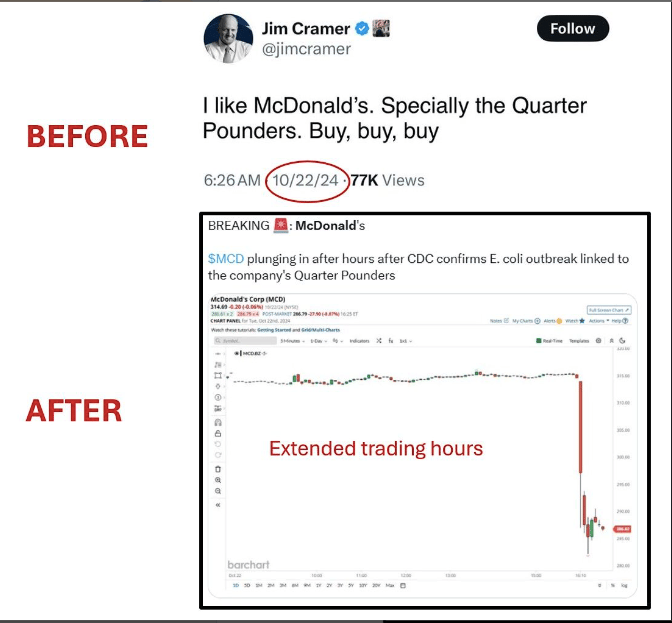

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.