- 3 Big Scoops

- Posts

- 🗞 Tesla and Apple Slide

🗞 Tesla and Apple Slide

while Constellation bags nuclear energy contract

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,868.55 ( ⬇️ 0.22%)

Nasdaq Composite @ 19,280.79 ( ⬇️ 0.16%)

Bitcoin @ $96,264.62 ( ⬇️ 0.64%)

Hey Scoopers,

Happy Friday! Here’s what we’re covering today 👇

👉 Tesla stock pulls back

👉 Apple offers discounts in China

👉 Constellation Energy continues to soar

So, let’s go 🚀

VaultCraft launches V2, TVL skyrockets above $100M

VaultCraft launches V2, partners with Safe, and secures $100M+ in Bitcoin

Matrixport, Asia’s leading crypto providers, commits $100M+ in Bitcoin

OKX Web3 to launch Safe Smart Vaults with $250K+ in rewards

Market Wrap

Hey, Scoopers!

Let's dive into Thursday’s market moves and what they mean for your portfolio. Remember, while daily moves can be exciting (or nerve-wracking), our focus remains on building long-term wealth through smart allocation and analysis.

📊 Market Snapshot:

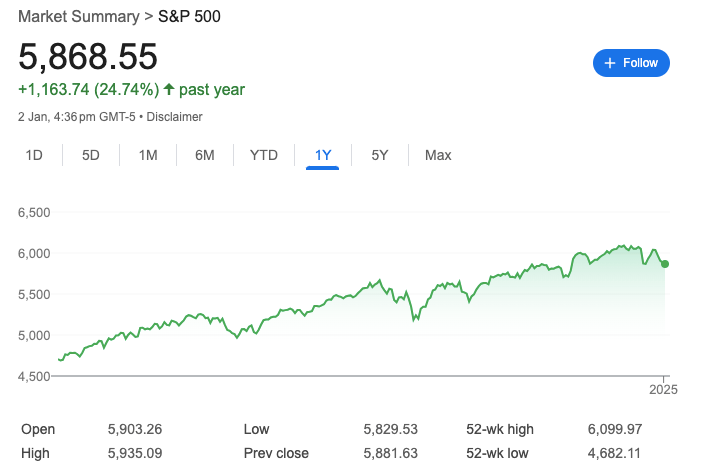

The market began 2025 with some turbulence. The S&P 500 and Nasdaq indices extended their losing streaks to five sessions, the longest since April.

While the pullback might sound concerning, let's put it in perspective:

The S&P 500 just finished 2024 up 23%. It is a perfect example of why we always emphasize looking at the bigger picture.

However, the unusual four consecutive down days to end the year (the first time since 1966) has likely derailed the traditional "Santa Claus rally" pattern.

Meanwhile, the 10-year Treasury yield touched 4.6% before pulling back, potentially making bonds more attractive to income investors.

Trending Stocks 🔥

Synaptics - The semiconductor stock jumped 8% after announcing a partnership with Google for Edge AI.

Topgolf Callaway Brands - The golf stock climbed 14.5% after Jeffries upgraded it to buy from hold.

Unity Software - The video game stock surged 9% after online personality Keith Gill, also known as Roaring Kitty, posted a gif of a “Chappelle’s Show” sketch on X. In the sketch, comedian Dave Chappelle plays the late musician Rick James. One of James’ songs is titled “Unity.”

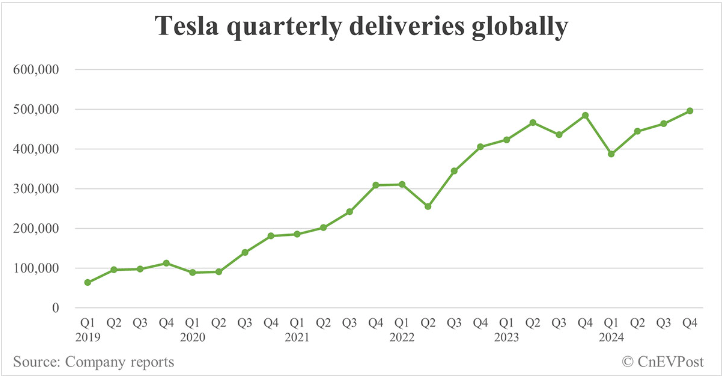

Tesla Disappoints Wall Street

Tesla just dropped its Q4 numbers, and Wall Street is not impressed.

Q4 deliveries: 495,570 (vs. expected 504,770)

2024 total deliveries: 1.79M (down from 1.81M in 2023)

Stock impact: -7% on announcement day

Despite the company's first-ever annual delivery decline, Tesla's stock finished 2024 up 63%. This perfectly illustrates why we always need to look beyond surface-level numbers.

🔍 So, What's Going On?

Market Evolution

Europe: Sales down 14% (classic market maturation)

China: Growing at 5% in an 8% growth market

North America: Still dominant but facing inventory challenges

Competitive Landscape Shift: Remember when Tesla was the only serious EV player? Those days are over:

Traditional giants (GM, Ford, BMW) are catching up

BYD is dominating in China

New players are entering at every price point

Strategic Crossroads: Tesla is facing the classic innovator's dilemma:

Premium positioning vs need for affordable options

Cybertruck inventory building up ($80k price tag isn't helping)

Balancing core business with future tech (robotaxis, AI)

💡 Investment Lessons Here:

Market Leadership Isn't Permanent

Even category creators must adapt

Innovation alone doesn't guarantee market dominance

Watch the Margins

Price cuts and incentives suggest pricing power challenges

Competition usually means margin pressure

Future Growth vs Present Reality

Tesla projects 20-30% growth in 2025

Plans for lower-cost vehicles could be game-changing

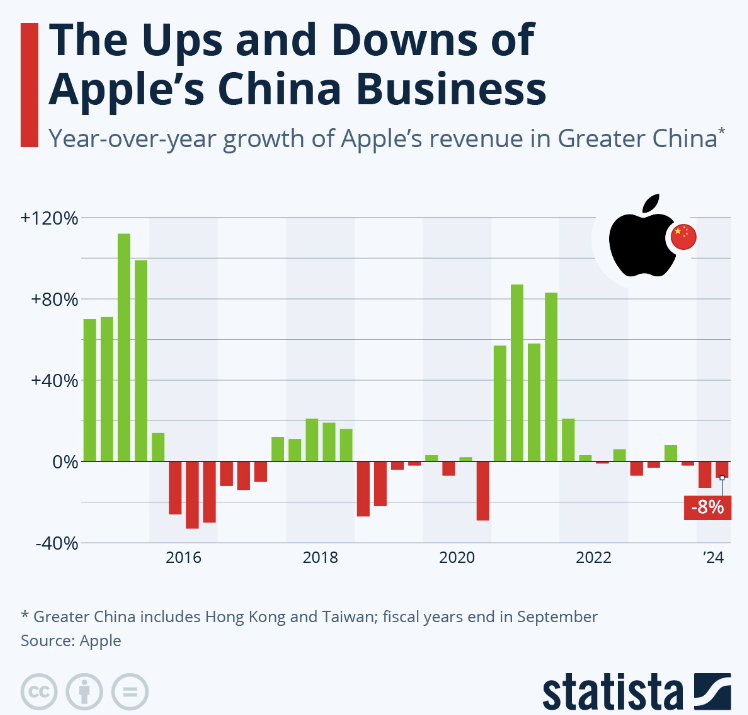

Apple Takes Aim at Huawei

YO DAWG! Drop everything - Apple's getting SPICY in China! 🌶️

TLDR: The iPhone maker is slashing prices faster than a ninja in a fruit stand. Why? Because Huawei's back with a vengeance, baby!

HERE'S THE 🍎 JUICE:

Apple's Having a FIRE SALE 🔥

iPhone 16 Pro/Pro Max: $68.50 OFF

iPhone 16/16 Plus: Cheaper by 400 yuan

Even old models getting that discount love

WILD FACT: Before 2023, Apple NEVER did direct discounts. Like, ever. It's like seeing your math teacher at a nightclub - just doesn't happen!

Plot Twist: The Huawei Comeback 📱

iPhone sales: Down 6% in China (big oof)

Market share: Dropped from 16% to 14% (double oof)

Meanwhile, Huawei: +24% YoY (absolute chad move)

GET THIS: Huawei went from being KO'd by US sanctions to dropping a TRIPLE-FOLD PHONE! That's like getting knocked out in round 1 and returning with a jetpack!

THE BIGGER PICTURE: Apple is discovering that the dragon has some fire left in China! Huawei's market share jumped from 13% to 16% faster than you can say, "Where's my charger?"

QUESTION OF THE DAY: Will Apple's flex work, or is Huawei about to eat their dim sum?

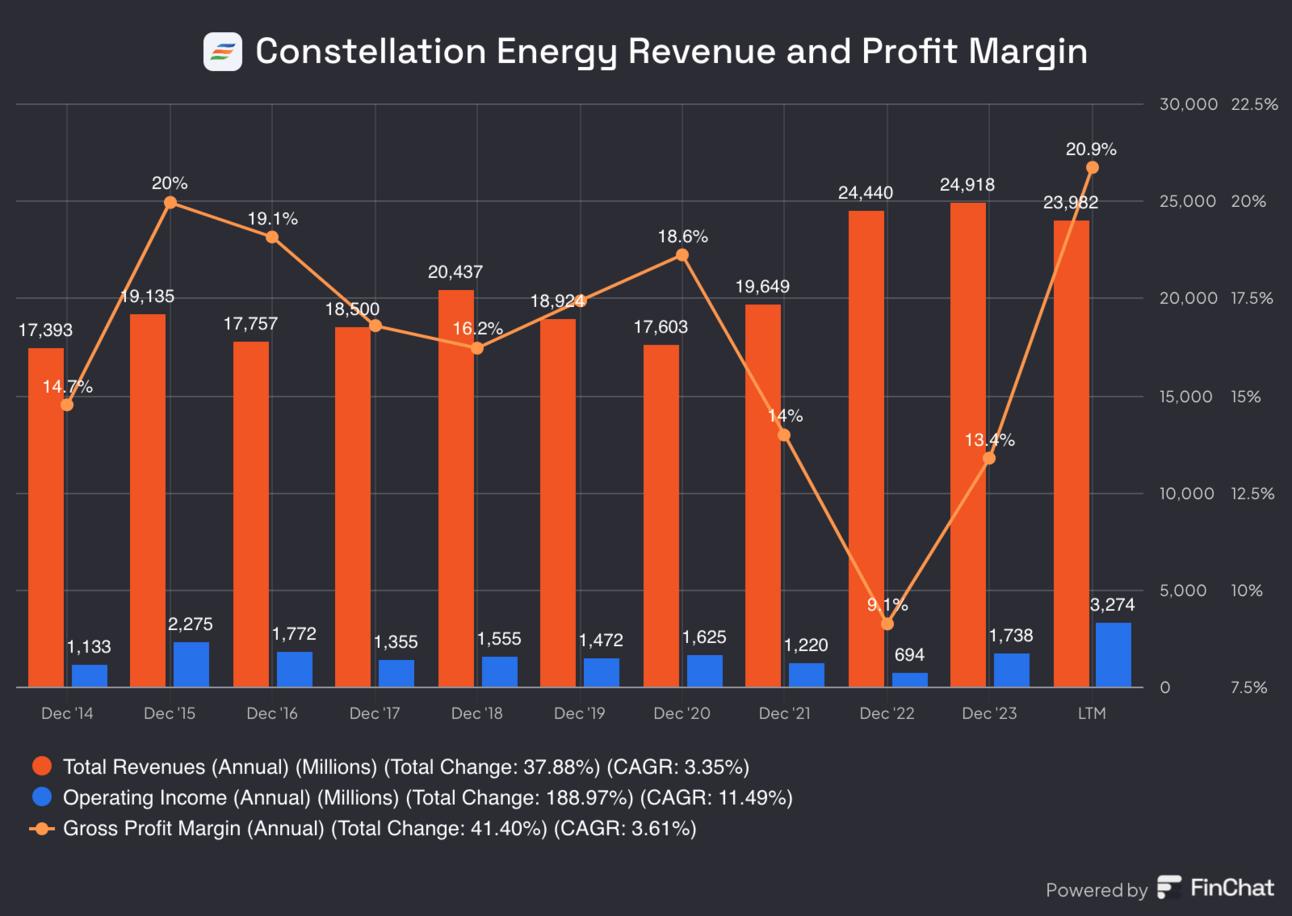

Nuclear Energy Just Got Lit

TLDR: Constellation Energy scored TWO MASSIVE government deals worth a billion dollars! And guess who else is jumping on the nuclear train? The whole tech gang!

Here’s the radioactive tea ☕:

THE BIG MONEY MOVES 💰

Deal #1: $840M to power government buildings (that's like buying 3.36 million gaming PCs!)

Deal #2: $172M for energy savings projects

Total Bag: Over $1 billion

WHO'S IN THE NUCLEAR CLUB? 🎯

Uncle Sam ✅

Microsoft ✅

Amazon ✅

Google ✅

WILD FACT: They're firing up a Three Mile Island reactor for Microsoft! That's like bringing back MySpace, but actually cool!

Constellation’s numbers are going nuclear:

Stock up 6% TODAY

DOUBLED in value over last year

That's what we call ATOMIC GAINS!

BIGGEST PLOT TWIST: Remember when nuclear was scary? Now Big Tech is treating it like the new iPhone release!

CEO Joe Dominguez dropped this🔥: "Things have changed." (Translation: Nuclear is the new Tesla, but for energy!)

BOTTOM LINE: Nuclear energy is having its "Netflix during lockdown" moment - EVERYBODY wants in!

Headlines You Can't Miss!

Biden blocks Nippon’s $15 billion acquisition bid of US Steel

Europe’s real estate recovery on track in 2025

China’s equity market continues to slump

Hindenburg Research shorts Carvana

Bitcoin investors pull out $333 million from BlackRock’s IBIT

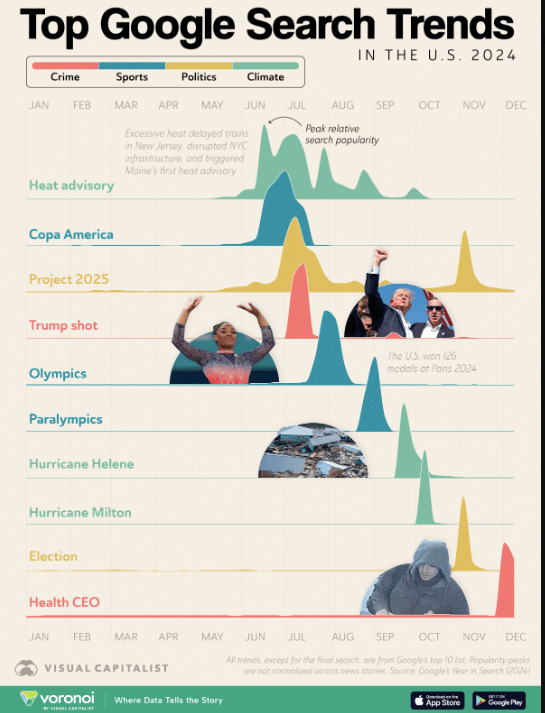

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.