- 3 Big Scoops

- Posts

- Stock of the Month: PDD

Stock of the Month: PDD

PLUS: Southwest Airlines takes off

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

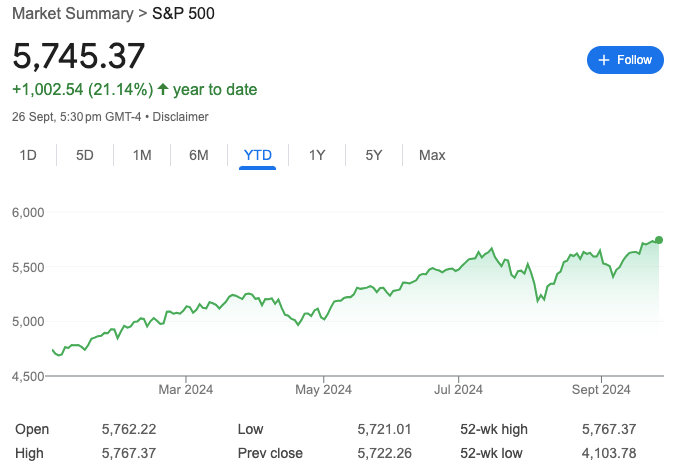

S&P 500 @ 5,745.37 ( ⬆️ 0.40%)

Nasdaq Composite @ 18,190.29 ( ⬆️ 0.60%)

Bitcoin @ $65,508.80 ( ⬆️ 4.02%)

Hey Scoopers,

Happy Friday! Are you ready for an exciting newsletter?

👉 The bull case for PDD

👉 Can Southwest Airlines stage a turnaround?

👉 Bitcoin stocks are rallying

So, let’s go 🚀

Market Wrap

Equities rose on Thursday, with the S&P 500 index hitting a new record following the release of upbeat U.S. economic data.

A slate of fresh data supported a solid economy, easing fears that perhaps the Federal Reserve is cutting rates aggressively because of a potential slowdown.

Weekly jobless claims fell more than expected, indicating a steady labor market. Durable goods orders for August were unchanged, while economists expected a decline. Finally, the final reading of Q2 GDP was unrevised at 3%.

Chip maker Micron rose close to 15% after issuing strong guidance for the current quarter. The VanEck Semiconductor ETF added 2.9%.

Trending Stocks 🔥

Super Micro Computer - Shares tumbled over 12% following a report from The Wall Street Journal that the Justice Department has opened a probe into the AI server maker.

Starbucks - Shares of the coffee chain rose 2% after Bernstein upgraded the stock to “outperform” from “market perform.” The investment firm is bullish on new CEO Brian Niccol.

New York Community Bancorp - Shares of the regional lender gained 4% after Barclays upgraded the stock to “overweight” as it repositions itself following a rocky patch.

PDD Gains Pace

Chinese markets clocked their best week in 16 years as the CSI 300 index has rallied 15.7% this week, buoyed by multiple economic stimulus measures by the central bank.

The rally comes as the People’s Bank of China cut its 7-day reverse repurchase rate from 1.7% to 1.5% and slashed its reserve requirement ratio of financial institutions by 0.5 percentage points.

The rate cut should help fuel the financial environment for China’s stable economic growth.

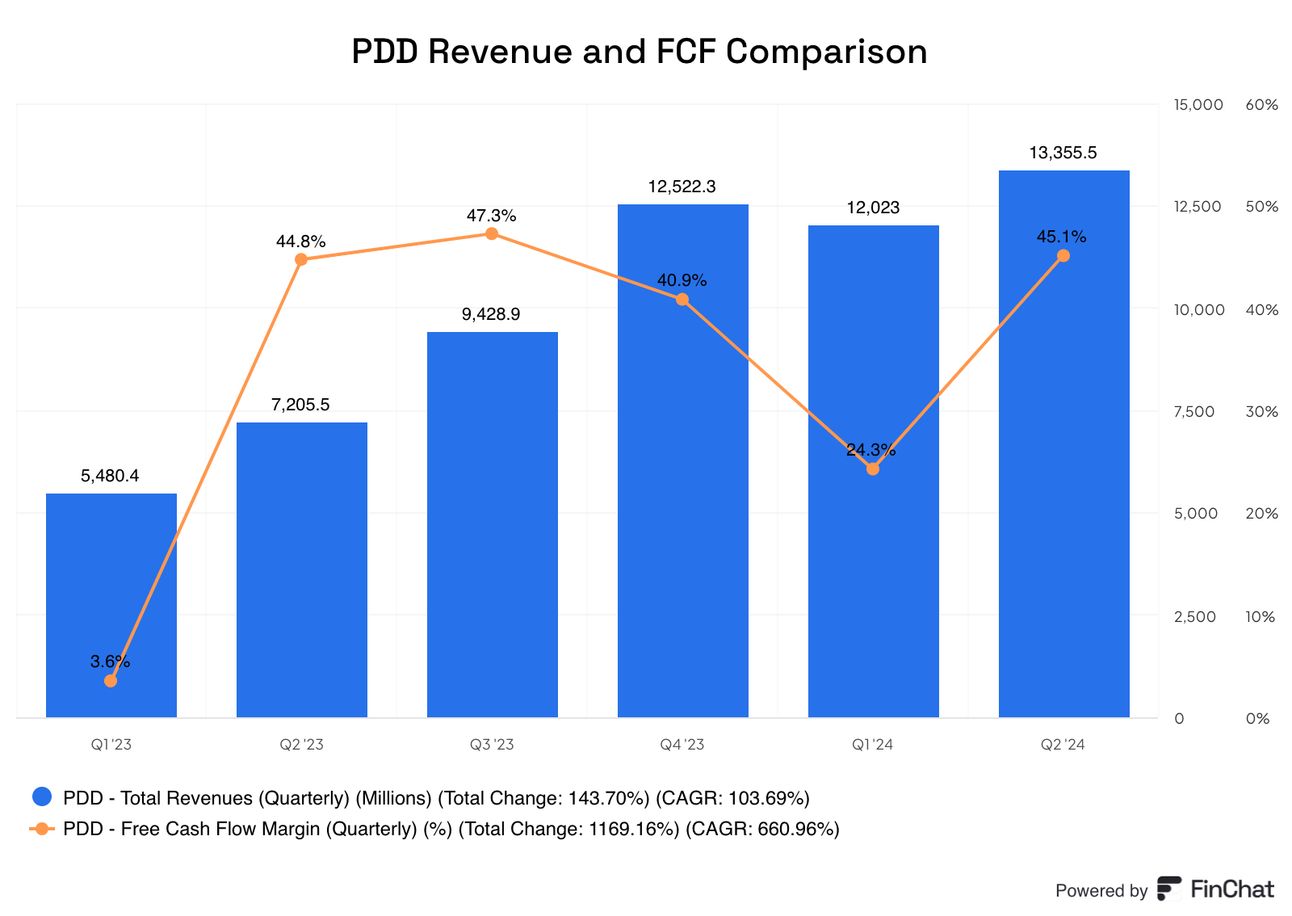

One China-based tech stock that has staged an impressive comeback this week is PDD, up close to 30%. Founded in 2015, PDD has expanded to become China’s third-largest e-commerce company after Alibaba and JD.com.

PDD initially focused on lower-income shoppers in China’s smaller cities. It sold cheaper products and encouraged shoppers to partner across social media networks and score big bulk discounts.

It then launched a farm-to-table platform, which has grown into China’s largest online agricultural platform today. Two years ago, PDD expanded overseas with Temu, a cross-border marketplace that connected Chinese merchants with overseas buyers.

Temu is among the world’s most popular e-commerce apps, with more than 167 million monthly active users.

Between 2018 and 2023, PDD sales grew at a compound annual growth rate of 80%. It became profitable in 2021, and its net income rose from $1.2 billion in 2021 to over $14 billion in the last 12 months.

Further, its free cash flow has grown to almost $20 billion in the past year. So, priced at nine times trailing cash flow, PDD stock remains cheap and is part of our equity portfolio.

Southwest Airlines Gains Over 5%

Southwest Airlines raised its Q3 forecast today and announced a series of steps designed to revitalize its business model, following which the stock gained more than 5%.

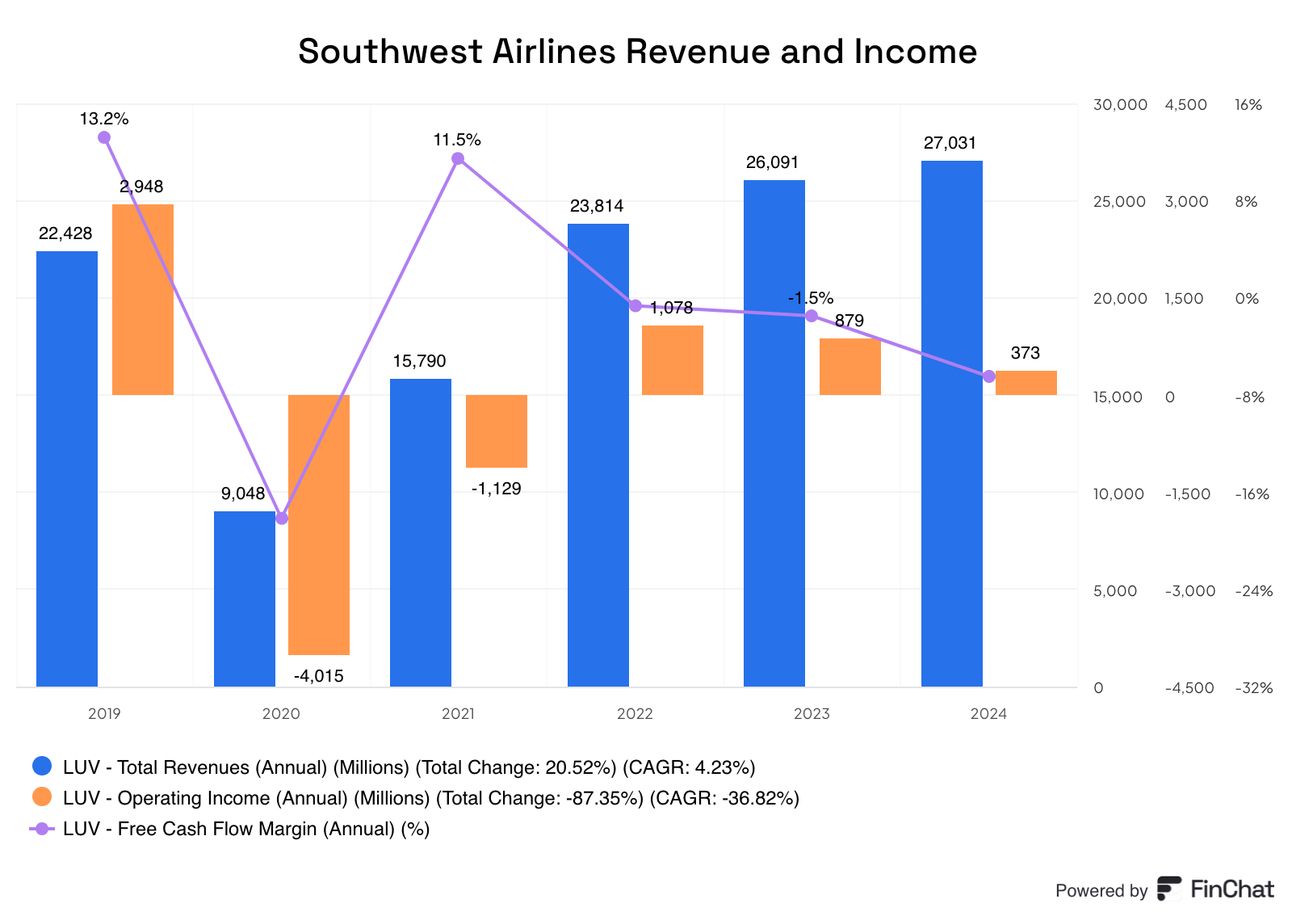

Southwest, a pioneer in the airline sector, has experienced turbulence in recent years. The stock has been down over 40% since 2019, which led activist investor Elliott Management to call for a shakeup at the company.

Southwest soon unveiled a plan to course-correct independently. It disclosed plans to begin selling assigned seating in Q2 of 2025, including add-ons such as premium seating and boarding upgrades.

It is also in the process of beefing up global partnerships while focusing on streamlining operations.

Southwest raised its Q3 revenue forecast to up to 3%, better than the previous 2% decline, and announced a share buyback plan totaling $2.5 billion. Moreover, the airline giant appointed industry veteran Bob Fornaro to its board of directors.

In the last 12 months, Southwest has reported revenue of $24.7 billion, higher than its sales of $20.9 billion in 2019. While Southwest has reported record sales in the past year, headwinds such as inflation, rising interest rates, and higher fuel prices have impacted the bottom line.

In 2019, Southwest reported:

Operating profit of $2.94 billion

Interest expense of $82 million

Free cash flow of $2.96 billion

In the last 12 months, it reported

Operating profit of $373 million

Interest expense of $230 million

Free cash flow of -$1.75 billion

Bitcoin Surpasses $65,000

Crypto stocks rallied on Thursday as the price of Bitcoin climbed back above $65,000. Coinbase increased by 7.7%, its biggest upmove since July 19. On Wednesday, the stock snapped a six-day win streak, its longest rally since March.

MicroStrategy, the largest institutional holder of Bitcoin, rose over 9%. Mining stocks, whose prices are also tied to bitcoin, saw sizeable gains. Mara Holdings, formerly Marathon Digital, and CleanSpark each gained 8%.

Bitcoin prices are up 49% year-to-date and have gained 150% in the past year.

Headlines You Can't Miss!

China’s tech stocks rally to 13-month high

French inflation cools as energy prices move lower

China’s industrial profits plunge by 17.8% year over year in August

Treasury yields dip ahead of key inflation data

U.S. Bitcoin ETFs continue to see inflows

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.