- 3 Big Scoops

- Posts

- 🗞 Portfolio Update: 2024

🗞 Portfolio Update: 2024

AppLovin leads the race

Bulls, Bitcoin, & Beyond

Hey Scoopers,

Here’s what we’re covering in today’s special edition 👇

👉 Our portfolio update

👉 Our value proposition

👉 What next for subscribers?

Our Stock Portfolio

Hello Scoopers,

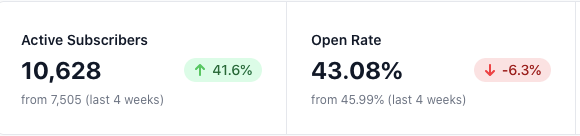

We are excited to announce that the 3 Big Scoops newsletter has surpassed 10,000 subscribers.

So, thanks a ton for your support, and we hope you continue to be an integral part of our wealth-building journey.

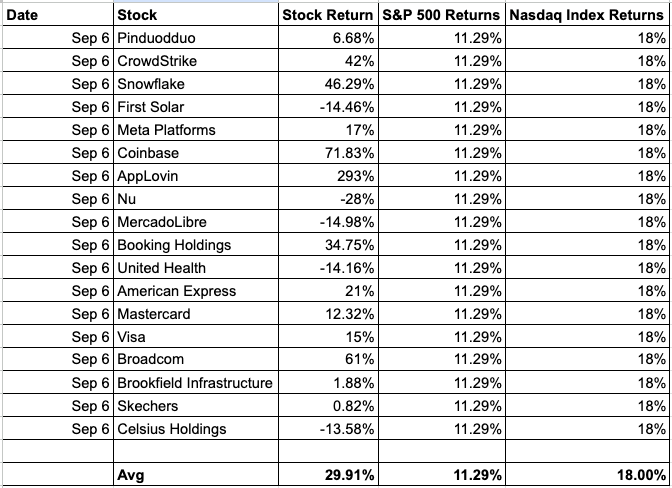

In early September, we provided subscribers with 18 publicly listed companies positioned to deliver outsized gains.

Since the report was sent, the S&P 500 index has gained close to 11.3%. Our portfolio returned 29.91% during this period, outpacing the broader index by over 150%. Our portfolio has also beaten the tech-heavy Nasdaq index, up 18%.

While our stock-picking ability might seem impressive, we still advise you to hold around 80% of your equity investments in diversified ETFs that track indices such as the S&P 500.

Why? Stock picking is incredibly difficult, and more than 85% of fund managers globally fail to outperform the underlying index.

Further, the S&P 500 index has returned 10% annually on average over the last six decades, creating massive shareholder wealth.

You can then play around with the other 20% and consider gaining exposure to fundamentally strong growth stocks trading at a reasonable valuation.

Scoopers can also look at our equity portfolio using the below link. The Google sheet will be updated again by the end of Q1 of 2025 and then every quarter going forward.

Portfolio Update

Investors should note that we have not recommended many Big Tech stocks, as they already form the core of the S&P 500 and Nasdaq indices.

Our 3 top performing picks were:

Applovin ⬆️ 293%

Coinbase ⬆️ 72%

Broadcom ⬆️ 61%

Alternatively, the worst-performing portfolio stocks are:

Nu ⬇️ 28%

MercadoLibre ⬇️ 15%

First Solar ⬇️ 14%

Even if we remove the top three performing stocks from the list, the average return stands at a healthy 12%.

In the future, we will aim to publish weekly write-ups discussing our thesis behind these stock picks.

What Next for Subscribers?

The primary aim of the newsletter is to educate readers about the wealth-building process.

Over time, the equity markets have demonstrated a remarkable ability to deliver steady gains to long-term investors. However, stock-picking can be extremely tricky for those without the time or expertise to analyze individual companies.

At 3 Big Scoops, we want to simplify this journey. So, watch out for content to help you better analyze companies and accelerate your decision-making capabilities.

Feel Your Best on the Field With Nike Kylian Mbappé Collection.

Discover the Nike Kylian Mbappé collection, crafted for players ready to take their skills to the next level. Featuring standout styles like the Vapor and Superfly, these boots combine cutting-edge technology with eye-catching designs inspired by the pros. Experience the game-changing Air Zoom unit for explosive acceleration and a responsive touch, whether you’re making that perfect through ball or striking from distance. Treat yourself to a fresh pair from the collection and dominate the pitch. You deserve to feel your best on the field.

In addition to our daily newsletter, here’s what we are offering for FREE:

Access to our stock picks

Educational content on stocks, investing, and personal finance

Access to my personal portfolio when I begin investing from scratch in the U.S. markets next year

Now, unlike other newsletters, where you have to pay for premium content, we want to ensure that our content is free to all community members (at least the first 10k of which you are all a part).

So, here’s how you can support 3 Big Scoops and help us provide you with quality, actionable stock market insights.

Refer other users: Referrals are an organic and effective way to scale a newsletter. So, help us lower customer acquisition costs by referring the newsletter to friends, family, and colleagues.

Follow and share us on social media: Share our content and follow us on X (Twitter). Our Twitter handle is @threebigscoops.

Engage with our advertisers: Subscribers can take a closer look at our advertisement partners and increase engagement, which should result in higher monetization rates for the newsletter.

We aim to grow this newsletter to more than 30k subscribers by the end of 2025. This goal will be easier to reach if we have the support of a growing and highly engaged community.

You can also follow or message me directly on my personal X account.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.