- 3 Big Scoops

- Posts

- 🗞 Nvidia's rapid growth continues

🗞 Nvidia's rapid growth continues

Nvidia, Salesforce, and Snowflake

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

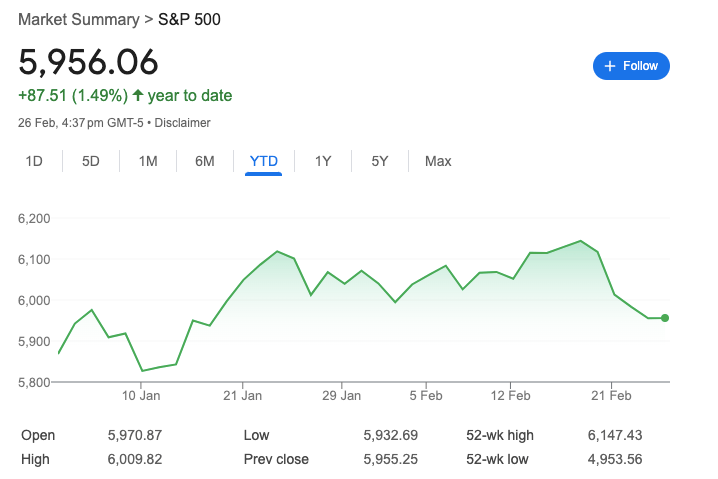

S&P 500 @ 5,956.06 ( ⬆️ 0.014%)

Nasdaq Composite @ 19,075.26 ( ⬆️ 0.26%)

Bitcoin @ $85,966.20 ( ⬇️ 2.61%)

Hey Scoopers,

Happy Thursday! Here’s what we’re covering today:

👉 Nvidia smashes estimates (again!)

👉 Salesforce disappoints Wall Street

👉 Snowflake is on the move

So, let’s go 🚀

Market Wrap

The S&P 500 posted a modest gain on Wednesday, ending a four-day losing streak. However, stocks retreated from session highs as investors processed President Donald Trump's aggressive trade rhetoric.

During his first cabinet meeting, Trump announced that tariffs against Canada and Mexico would soon take effect and declared plans to impose 25% tariffs on European Union goods.

According to FactSet data, consumer staples, which had been a safe haven during recent volatility, became Wednesday's worst-performing S&P 500 sector.

Next, investors are focused on:

Thursday's weekly jobless claims report

Friday's PCE price index release - the Fed's preferred inflation gauge

Upcoming earnings from Warner Bros. Discovery and Dell Technologies

Fidelity's Jurrien Timmer observed that only 53% of S&P 500 stocks are trading above their 50-day moving averages. "We are in a 'buy the rumor, wait for the news' mode," Timmer wrote on X.

The S&P 500 has struggled in February, gaining just 1.3% year-to-date as enthusiasm about AI and election-related issues has cooled.

Top Investors Are Buying This “Unlisted” Stock

When the team that grew Zillow to a $16B valuation starts a new company, investors notice. No wonder top firms like SoftBank invested in Pacaso.

Taking the industry by storm all over again, Pacaso’s platform offers co-ownership of premier properties – completely revamping a $1.3T market.

And by handing keys to 1,500+ happy homeowners, Pacaso has made $100M+ in gross profits.

Now, with aggressive global expansion underway, their current share price won’t last long.

Trending Stocks 🔥

AppLovin - The mobile software stock tumbled 12% after short sellers Culper and Fuzzy Panda released short reports on Wednesday.

Flywire - The global payments stock plunged over 40% after it reported a Q4 miss on revenue and earnings.

Bloomin’ Brands - The stock nosedived 17% after the Outback Steakhouse owner posted first-quarter and full-year earnings guidance below consensus estimates.

Nvidia’s Revenue Rises 78%

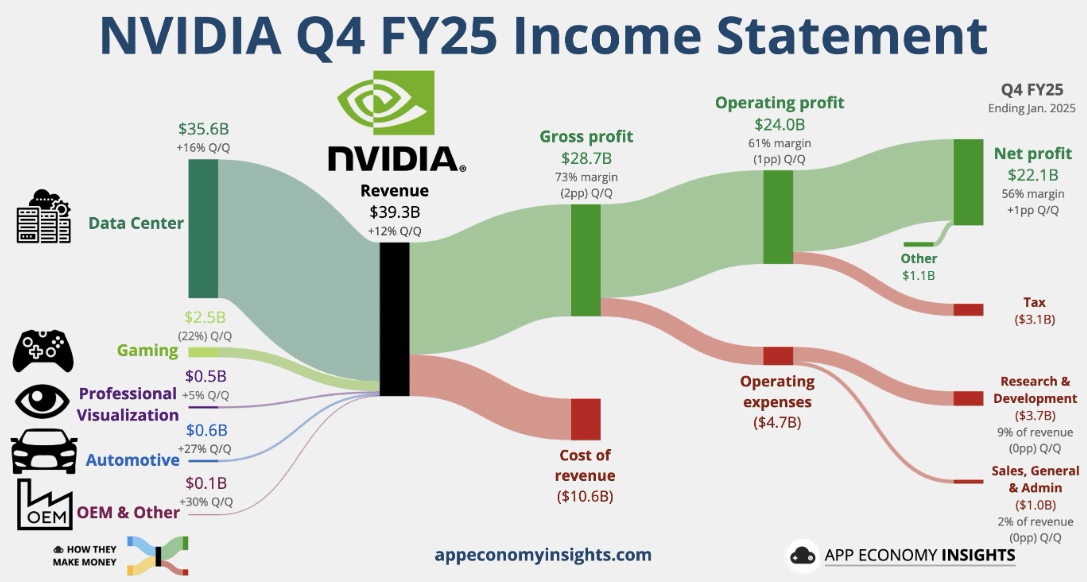

Nvidia reported impressive fiscal Q4 2025 (ended in January) results on Wednesday.

The chipmaker beat Wall Street expectations with $39.33 billion in revenue and adjusted earnings of $0.89 per share, underscoring its continued dominance in the AI chip market.

Nvidia provided an optimistic outlook, forecasting approximately $43 billion in first-quarter revenue, exceeding analyst expectations of $41.78 billion.

While this represents 65% year-over-year growth, it marks a deceleration from the extraordinary 262% growth rate seen a year earlier.

CFO Colette Kress highlighted the "significant ramp" expected for Blackwell, Nvidia's next-generation AI chip, calling it "the fastest product ramp in our company's history." CEO Jensen Huang noted that demand for these chips is "amazing."

Key highlights from the report:

Data center revenue surged 93% to $35.6 billion, now accounting for 91% of total sales

Net income rose to $22.09 billion, nearly doubling from $12.29 billion in the year-ago period

Gross margin remained robust at 73%, though down slightly due to more complex product costs

Gaming revenue declined 11% to $2.5 billion

Automotive sales grew 103% to $570 million

During the earnings call, Huang addressed concerns about competition from custom chips developed by major tech companies, stating, "Just because the chip is designed doesn't mean it gets deployed."

He also noted increasing competition from Chinese companies, specifically mentioning Huawei as a "very competitive" rival.

Nvidia spent $33.7 billion on share repurchases in fiscal 2025, signaling confidence in its long-term prospects despite the gradual slowing of its explosive growth rate.

Salesforce Does Not Impress Investors

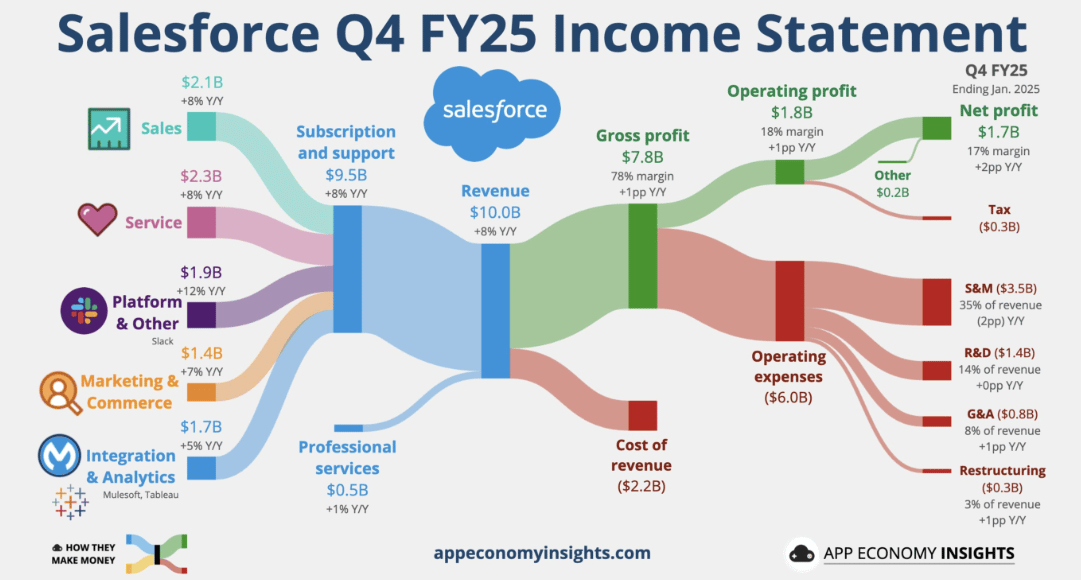

Salesforce shares are down 4% in pre-market after the cloud software giant reported quarterly revenue that missed Wall Street expectations and provided a forecast that disappointed investors.

It posted revenue of $9.99 billion for the quarter ending January 31, falling short of the $10.04 billion analysts expected despite growing 7.6% year over year. Earnings were a bright spot, with adjusted EPS of $2.78, beating estimates of $2.61.

Salesforce's core subscription categories underperformed, with service revenue reaching $2.33 billion (up 8% but below the $2.37 billion consensus) and sales revenue hitting $2.13 billion (up 8% but short of the $2.17 billion expected).

CEO Marc Benioff highlighted the company's AI progress, noting that since October, Salesforce has completed over 3,000 paid deals involving its Agentforce AI technology.

Looking ahead, Salesforce provided guidance that fell below expectations:

Fiscal Q1: $2.53-$2.55 adjusted EPS on $9.71-$9.76 billion revenue (vs. $2.61 EPS and $9.9 billion revenue expected)

Full fiscal 2026: $11.09-$11.17 adjusted EPS on $40.5-$40.9 billion revenue, implying 7.4% growth (vs. $11.18 EPS and $41.35 billion expected)

Outgoing CFO Amy Weaver noted that Agentforce will make only a modest revenue contribution in fiscal 2026, with a more significant impact expected the following year.

Salesforce shares have underperformed the broader market, declining approximately 8% year-to-date, while the S&P 500 has gained about 1%.

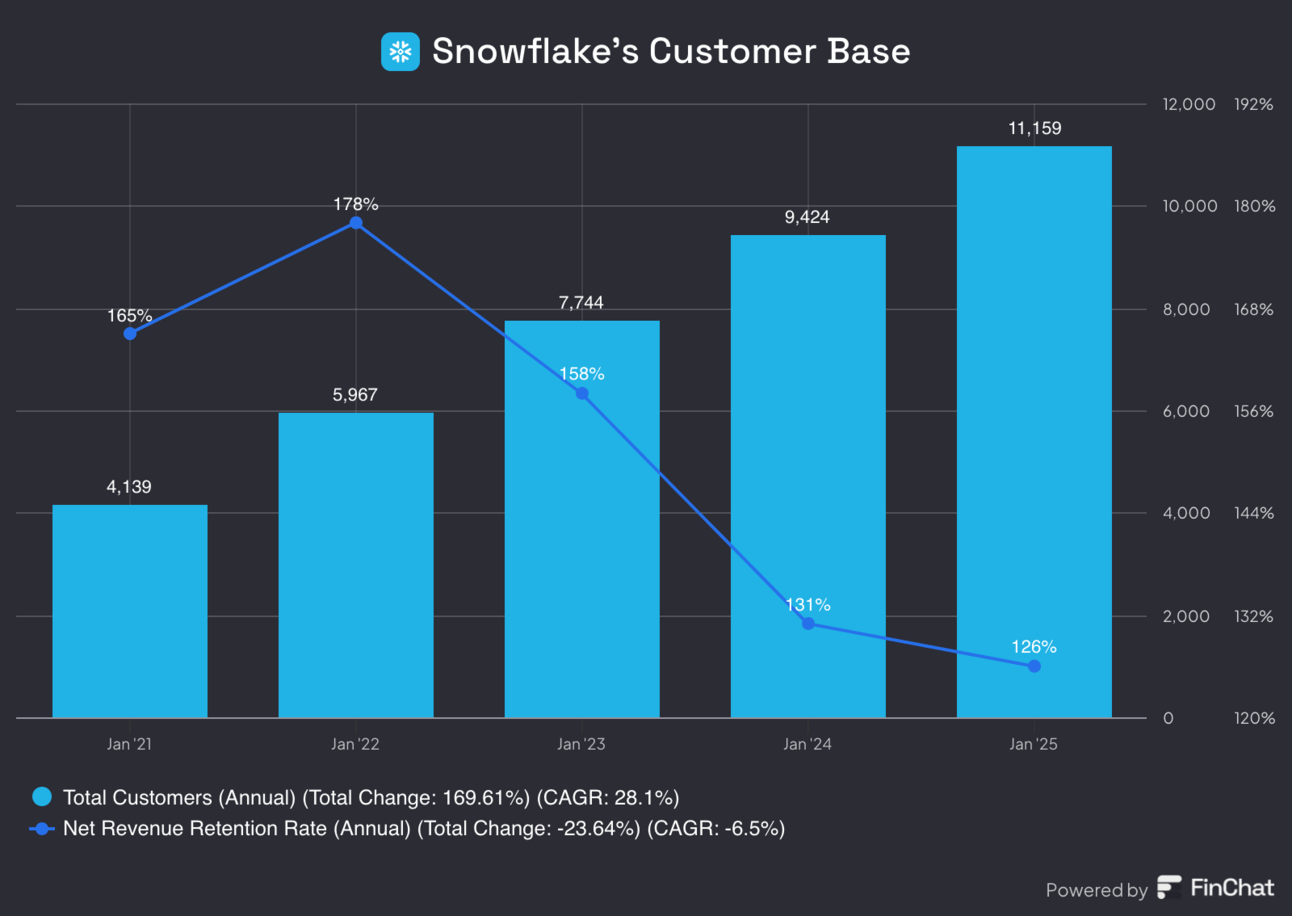

Snowflake stock is up 9% in pre-market trading following the cloud data platform's impressive fourth-quarter results, which significantly exceeded Wall Street expectations.

It reported earnings per share of $0.30, far outpacing analysts' estimates of $0.18. Revenue climbed to $986.7 million, beating the expected $956.9 million and representing a robust 27% year-over-year increase.

CEO Sridhar Ramaswamy highlighted the company's growing customer base, noting that "more than 11,000 customers are already betting their business on our easy-to-use, efficient, and trusted platform."

Snowflake now serves 580 clients with trailing 12-month product revenue exceeding $1 million, up 27% from the previous year.

Key financial highlights:

Product revenue reached $943.3 million, surpassing guidance of $906-911 million

Operating income margin of 9%, outperforming the company's 4% guidance

Net revenue retention rate of 126%, though slightly down from 131% the previous year

Snowflake revealed an expanded partnership with Microsoft and OpenAI after the earnings announcement.

This partnership will make the latest OpenAI models available to Snowflake clients on Microsoft's Azure platform.

The collaboration aims to enable enterprises to build AI-powered applications using Snowflake's data platform.

Headlines You Can't Miss!

European auto stocks slide on tariff threat

China to cut inflation outlook to two-decade low

Next-gen AI will require 100x more computing power

Teladoc slumps as loss widens

Key metric shows Bitcoin hasn’t peaked

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.