- 3 Big Scoops

- Posts

- 🗞 Nvidia Leads Big Tech Sell-Off

🗞 Nvidia Leads Big Tech Sell-Off

as market rally broadens!

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,969.34 ( ⬆️ 0.35%)

Nasdaq Composite @ 19,003.65 ( ⬆️ 0.16%)

Bitcoin @ $98,273.58 ( ⬆️ 0.09%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter?

👉 Nvidia tanks over 3%

👉 UBS bullish on AI compute

👉 Texas Pacific Land joins the S&P 500

So, let’s go 🚀

Market Wrap

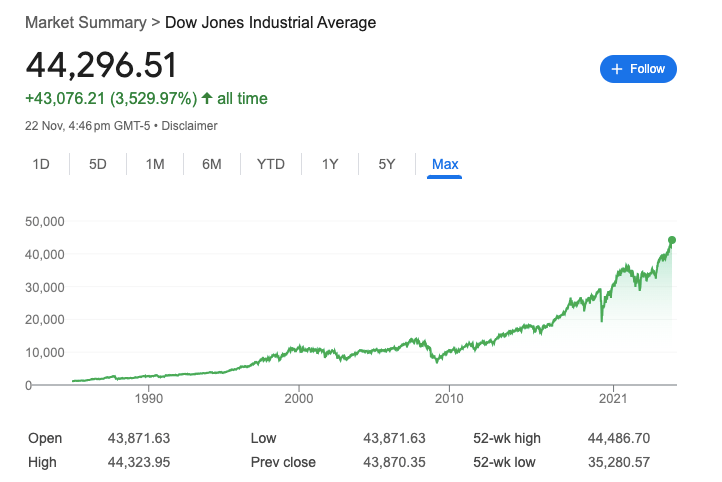

The Dow Jones Industrial Average closed at a new record high on Friday, capping off a winning week for stocks. The Dow ended the week 2% higher, while the S&P 500 and Nasdaq each added about 1.7%.

The uptick on Friday continued a trend of investors shifting exposure from tech to names in more economically sensitive market sectors.

Investors are rotating out of previous high-flyers in large-cap communication services and technology and into other cyclical sectors, such as consumer discretionary, industrials, and financials.

Despite a shorter trading week, the interest rate outlook is back in focus with the release of October’s personal consumption expenditure (PCE) price index, the Fed’s preferred inflation measure.

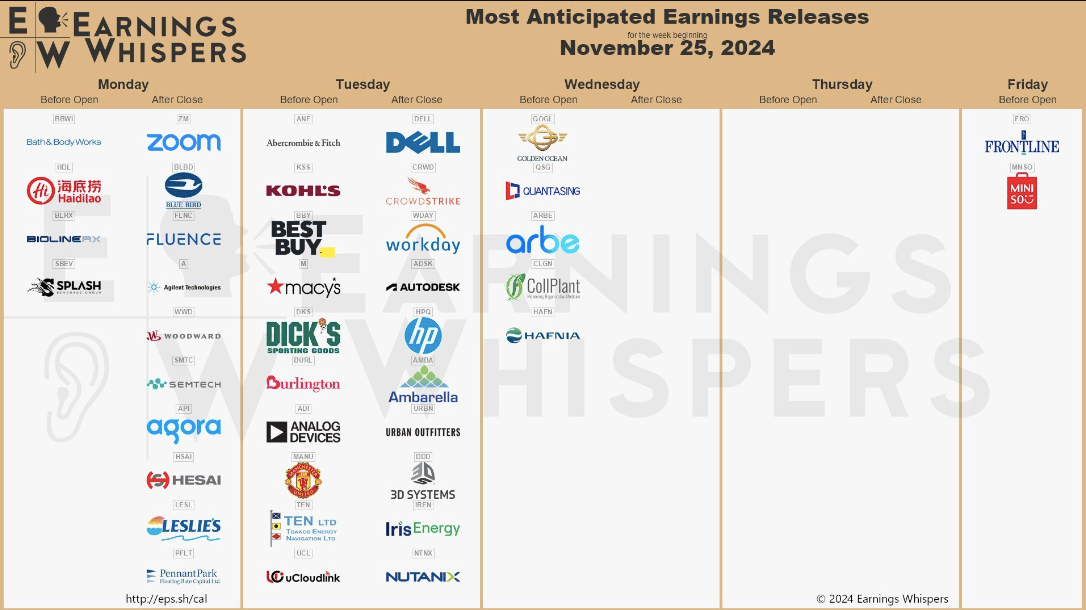

On the earnings front, companies such as Bath and Body Works, Macy’s, Nordstrom, CrowdStrike, and Dell Technologies will report quarterly results.

Trending Stocks 🔥

Elastic - Shares surged 15% after topping Wall Street’s expectations for fiscal Q2, reporting revenue of $365 million and earnings of $0.59 per share, ahead of estimates of $357 million and $0.38 per share, respectively.

Reddit - The stock tumbled over 7% after reports stated that Advance Magazine Publishers is looking to establish a credit facility using $1.2 billion of its stake in Reddit.

Super Micro Computer - The stock rallied over 11%, extending its 15% gain in the previous session. The server maker gained 73% last week after appointing BDO as its new auditor and providing plans about how it will maintain compliance rules with the Nasdaq exchange.

Nvidia Leads Big Tech Sell off

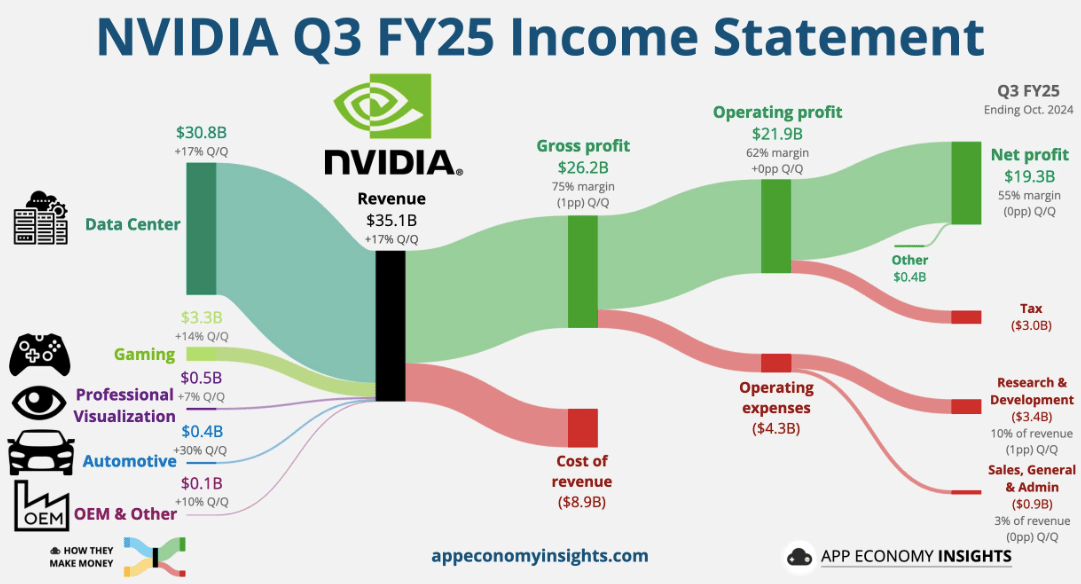

Despite almost doubling revenue in fiscal Q3, Nvidia shed over 3% on Friday, capping off a bumpy week during which the stock fluctuated between the red and the green.

Meanwhile, Google-parent Alphabet ended the week 5% lower after the U.S. Department of Justice recommended the company divest its Chrome browser as a remedy due to its antitrust case. E-commerce giant Amazon also fell 3.4% last week.

Even though other Magnificent Seven stocks did contribute to that, buoyant markets mostly have companies less in the spotlight, like Super Micro Company, to thank.

Likewise, small-cap stocks, which have languished behind their bigger cousins for years, seem to be staging a comeback as interest rates fall and Trump is poised to reenter the White House.

The Russell 2000 ended the week 4.5% higher, outperforming the above three indexes.

Elsewhere, Bitcoin, once dismissed by most mainstream investors and institutions as an esoteric plaything with no inherent value, is close to shattering the $100,000 ceiling.

UBS Remains Bullish on AI and Nvidia

UBS expects Nvidia shares to gain following its quarterly beat and expected Blackwell ramp. Moreover, it stays positive on the AI computing industry, looking ahead to the end of 2025.

“On the back of strong expected revenue growth in 2025, we maintain our positive view on the AI compute industry and NVIDIA in particular,” analyst Sundeep Gantori wrote in a Thursday note. “Still, investors should not lose sight of potential risks in 2025, including around the product transition and tariff-related uncertainties.”

Given his positive view on AI semiconductors and leading cloud platform providers, Gantori recommended investors take advantage of higher near-term volatility by buying the dip in quality AI stocks or through structured strategies.

″[We do see some product transition risks around end-2025 and tariff-related uncertainty. At this stage, however, we think these risks are relatively manageable for the AI supply chain,” he said.

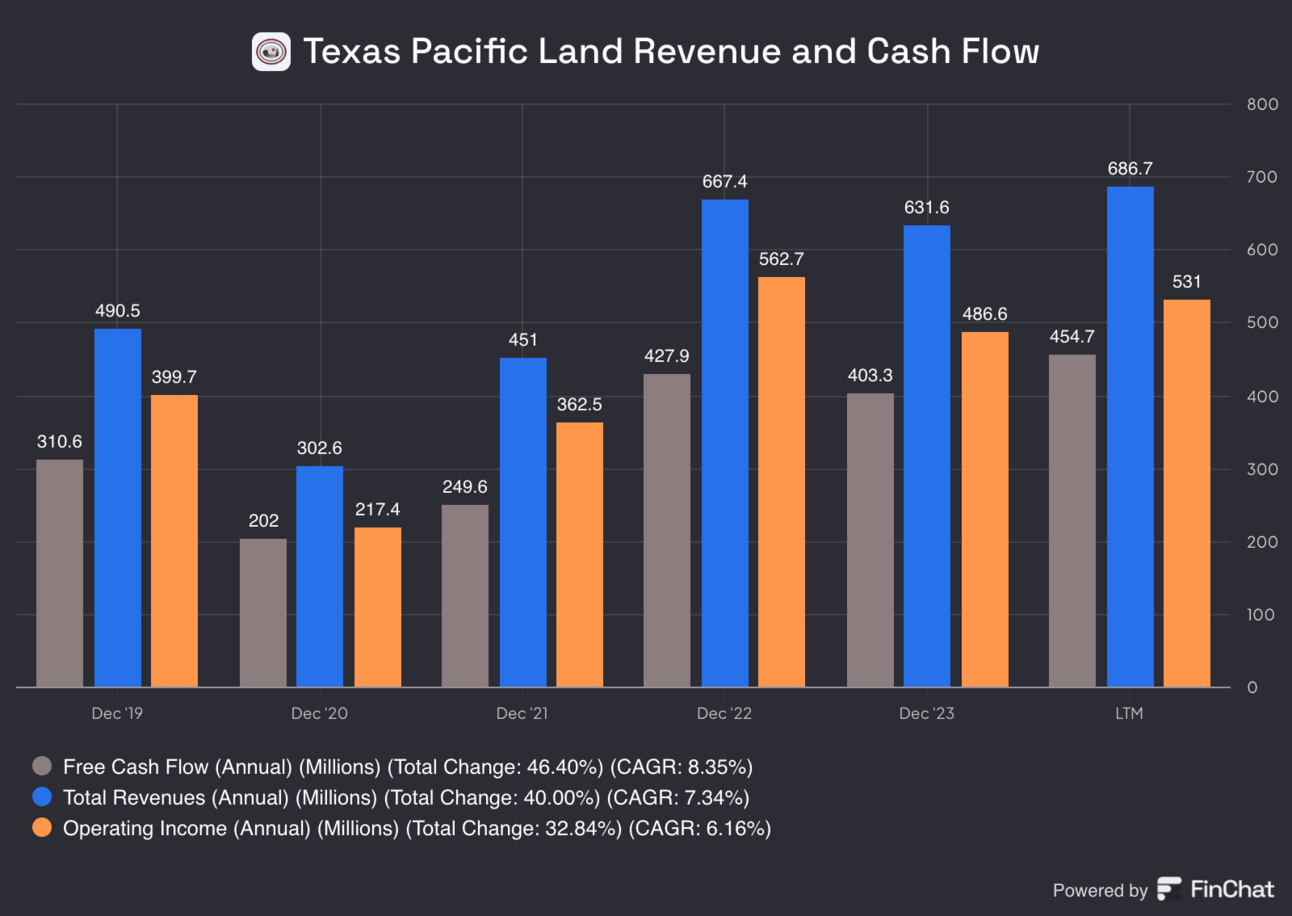

Texas Pacific Land Next S&P 500 Addition

Texas Pacific Land shares rose over 13% on Friday, a day after the S&P 500 Dow Jones Indices said the real estate operating company would replace Marathon Oil in the S&P 500 index.

Known as the S&P Phenomenon, an announcement of membership tends to lead to a temporary spike in a company’s stock, as institutional investors widely track the index.

The S&P 500 is an index weighted by market cap. It is the most popular benchmark for index funds and is considered the single most important barometer of the state of large-cap equities in the U.S.

Because of its overwhelming popularity, additions to the index have a measurable impact on prices. Investors have allocated nearly $11.2 trillion in assets indexed or benchmarked to the S&P 500 index.

The change will take effect tomorrow as ConocoPhillips will complete the acquisition of Marathon Oil by the end of the week.

TPL is one of the largest landowners in Texas, with most of its ownership concentrated in the Permian Basin, the state's booming oil and gas field. Shares have soared nearly 200% year-to-date through Thursday's close.

S&P Dow Jones Indices announced the move as part of a series of index changes on Thursday evening. In corresponding moves, Mueller Industries will slide up to the S&P MidCap 400, and Atlas Energy Solutions will join the S&P SmallCap 600.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Headlines You Can't Miss!

UniCredit may acquire Banco BPM for $10.5 billion

Singapore’s inflation rate falls in October

China’s central bank keeps medium-term loan rates unchanged

Auto giants need to partner with domestic firms to survive in China

Lutnick, Cantor Fitzgerald negotiate a 5% stake in Tether

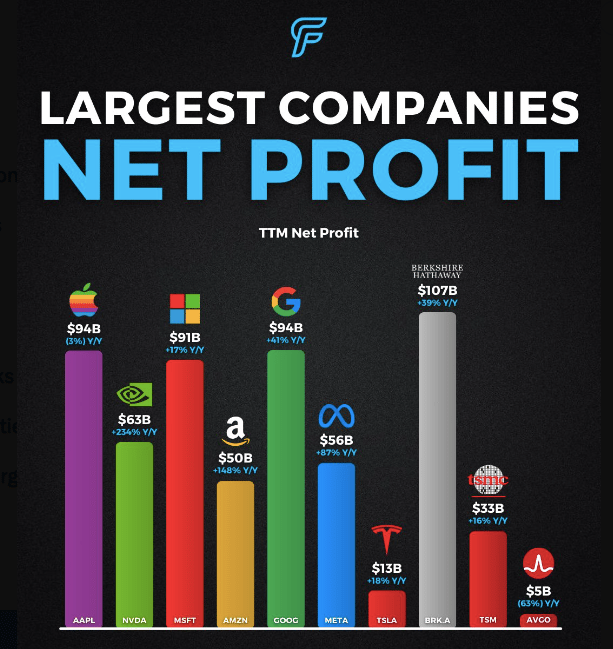

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.