- 3 Big Scoops

- Posts

- 🗞 Nvidia Blows Past Estimates

🗞 Nvidia Blows Past Estimates

but Wall Street wants more!

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

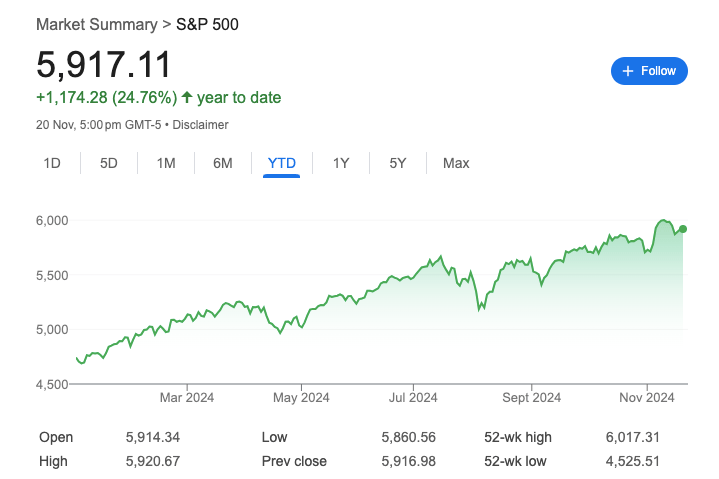

S&P 500 @ 5,917.11 ( ⬆️ 0.0022%)

Nasdaq Composite @ 18,966.14 ( ⬇️ 0.11%)

Bitcoin @ $97,147.32 ( ⬆️ 4.21%)

Hey Scoopers,

Happy Thursday! Are you ready for an exciting newsletter

👉 Nvidia stuns Wall Street

👉 Target tanks over 20%

👉 Bitcoin blows past $97k

So, let’s go 🚀

Market Wrap

Futures tied to the Nasdaq 100 are down at the time of writing as investors parsed the all-important earnings release from AI darling Nvidia.

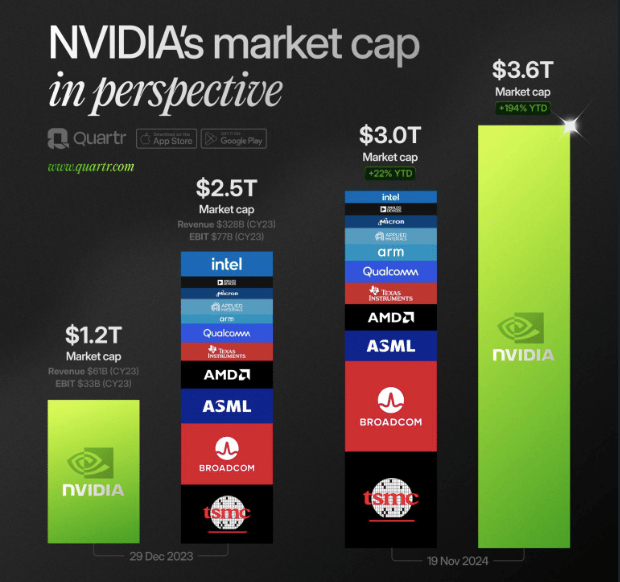

Investors kept a close eye on Nvidia earnings, the chipmaker that has dazzled Wall Street for over a year as a key AI beneficiary.

While the company beat estimates and issued strong guidance, Nvidia stock is down more than 2% in pre-market trading.

Traders will watch Thursday for economic data on jobless claims and existing home sales.

On the corporate earnings front, investors will parse reports from Gap and Intuit expected after the market closes.

Trending Stocks 🔥

Snowflake - The cloud stock soared 18% after beating earnings estimates for Q3 and issued strong guidance.

Jack in the Box - The restaurant chain tumbled 5.6% after revenue for fiscal Q4 came in below estimates.

AppLovin - The stock popped over 1% after Piper Sandler initiated coverage of the mobile app developer with an “overweight” rating. The firm set a price target that was 25% above current levels.

Nvidia Smashs Q3 Estimates

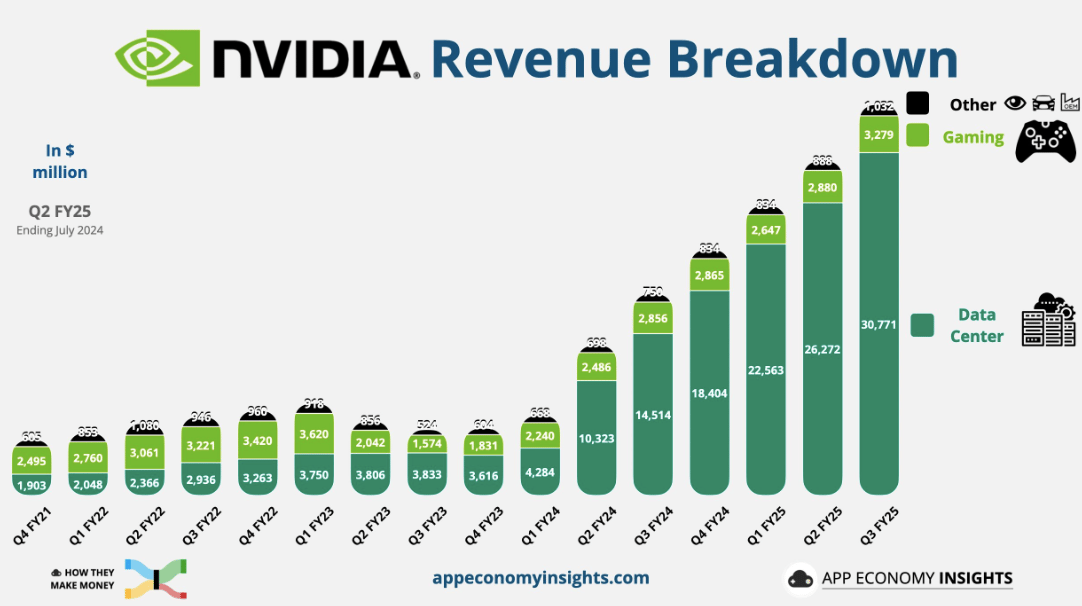

Nvidia just announced its fiscal Q3 of 2024 (ended in October) results, reporting:

👉 Revenue of $35.08 billion vs. estimates of $33.16 billion

👉 Earnings per share of $0.81 vs. estimates of $0.75

Nvidia projects revenue at $37.5 billion in the current quarter, above estimates of $37.08 billion.

The market bellwether’s Q2 forecast indicates a 70% year-over-year growth rate, which is impressive but much slower than its 265% growth in the year-ago period.

In Q3, Nvidia grew sales by 94% year over year as it remains at the epicenter of the artificial intelligence boom. Its data center business, which generates revenue from AI processors, has more than doubled sales to $30.8 billion, higher than estimates of $28.8 billion.

Several Nvidia end-customers, including Microsoft, Oracle, and OpenAI, have begun receiving the next-generation AI chip called Blackwell. Nvidia will start ramping up the production of these chips in 2025, which will be a key revenue driver for the company over the next 12 months.

Further, Nvidia also develops and sells chips for gaming devices such as personal computers, laptops, and consoles. In Q3, its gaming business reported sales of $3.28 billion vs. estimates of $3.03 billion.

Its automotive sales rose by 72% to $449 million due to rising chip demand for self-driving cars and robots. Finally, the professional visualization business grew sales by 17% to $486 million.

Target Misses the Mark

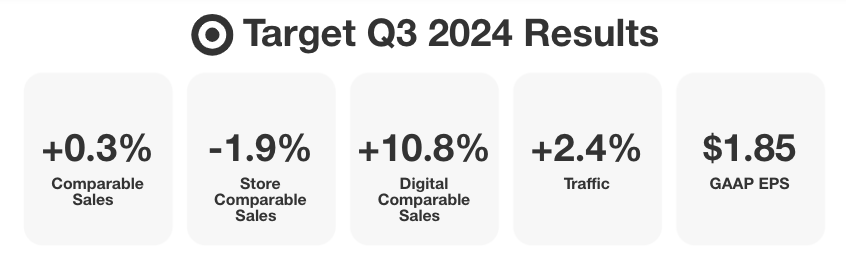

Big-box retail giant Target announced its fiscal Q3 of 2025 (ended in October) results yesterday and reported:

👉 Revenue of $25.67 billion vs. estimates of $25.90 billion

👉 Earnings per share of $1.85 vs. estimates of $2.30

During its earnings call, Target reversed course and cut its profit guidance for fiscal 2025, three months after hiking the forecast. It expects EPS between $8.30 and $8.9, below the prior midpoint estimate of $9.35.

In fiscal Q3, Target missed EPS estimates by 20%, its biggest miss in two years. It also missed revenue estimates for the first time in five quarters, plunging to a 52-week low.

Target attributed its performance to softness in discretionary categories combined with cost pressures.

Target is well-known for its broad portfolio of cheap clothing, home goods, and discretionary merchandise. However, inflation and higher interest rates have impacted the company’s ability to attract steady foot traffic amid slower consumer spending.

Customer traffic across its stores and website increased by 2.4%, while digital sales grew by 10.8%, powered by double-digit gains in curbside pickup and same-day home deliveries. However, comparable store sales were down 1.9% year over year in Q3.

Target cut prices on frequently purchased items this year, such as diapers, toys, and ice cream, to attract price-sensitive customers. By the end of the holiday season, Target said it will lower prices on more than 10,000 items this year.

Target stock has trailed the broader markets significantly in 2024, falling over 15% this year.

Bitcoin ETFs Continue to Attract Funds

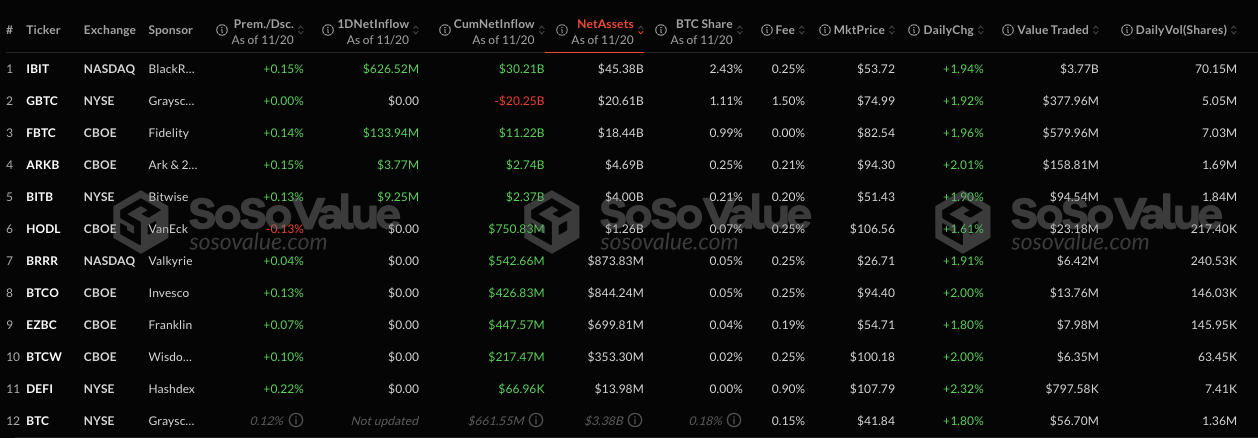

Spot Bitcoin exchange-traded funds were launched in the U.S. in January 2024 and have since attracted $84 billion in assets under management, according to a Bloomberg report.

At the time of writing, Bitcoin prices have more than doubled in 2024 to over $97,000, as investors expect the Trump administration to be crypto-friendly, driving the adoption of these digital assets.

The rising popularity of Bitcoin ETFs has meant they already hold 66% of the AUM compared to gold ETFs. Spot Bitcoin ETFs will likely overtake the AUM of gold ETFs by the end of January 2025.

Bitcoin ETFs have registered multiple records this month, which include:

IBIT surpassed $1 billion in inflows on a single day on November 7.

IBIT reported a trading volume of $4.1 billion on November 7, the most since the ETF was launched.

That day, the cumulative trading volume of spot Bitcoin ETFs touched $6 billion, higher than stocks such as Visa, Netflix, and Berkshire Hathaway.

This Smart Home Company Hit $10 Million in Revenue—and It’s Just the Beginning

No, it’s not Ring or Nest—it’s RYSE, the company redefining smart home innovation, and you can invest for just $1.75 per share.

RYSE’s patented SmartShades are transforming how people control their window shades—offering seamless automation without costly replacements. With 10 fully granted patents and a pivotal Amazon court judgment safeguarding their technology, RYSE has established itself as a market leader in an industry projected to grow 23% annually.

This year, RYSE surpassed $10 million in total revenue, expanded to 127 Best Buy locations, and experienced explosive 200% month-over-month growth. With partnerships in progress with major retailers like Lowe’s and Home Depot, they’re set for even bigger milestones, including international expansion and new product launches.

This is your last chance to invest at the current share price before their next stage of growth drives even greater demand.

Headlines You Can't Miss!

Gautam Adani charged with fraud, shares nosedive

GQG Partners stock slumps 25% due to exposure to Adani Group

Nvidia’s slowing revenue drags Asian chip stocks lower

Alphabet backs SAP rival Odoo, valued at $5.6 billion

FTX co-founder Gary Wang avoids prison time

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.