- 3 Big Scoops

- Posts

- Wall Street Dumps Nike

Wall Street Dumps Nike

PLUS: Container rates zoom past $10,000

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,746.75 ( ⬆️ 1.03%)

Nasdaq Composite @ 14,963.87 ( ⬆️ 1.26%)

Bitcoin @ 43,745.62 ( ⬆️ 0.14%)

Hey Scoopers,

Happy Friday. The weekend is on the horizon, and we’re wrapping up.

Here’s what’s on the menu for today:

👉 Nike disappoints investors

👉 Freight charges soar amid Red Sea crisis

👉 Solana gains pace

So, let’s go 🚀

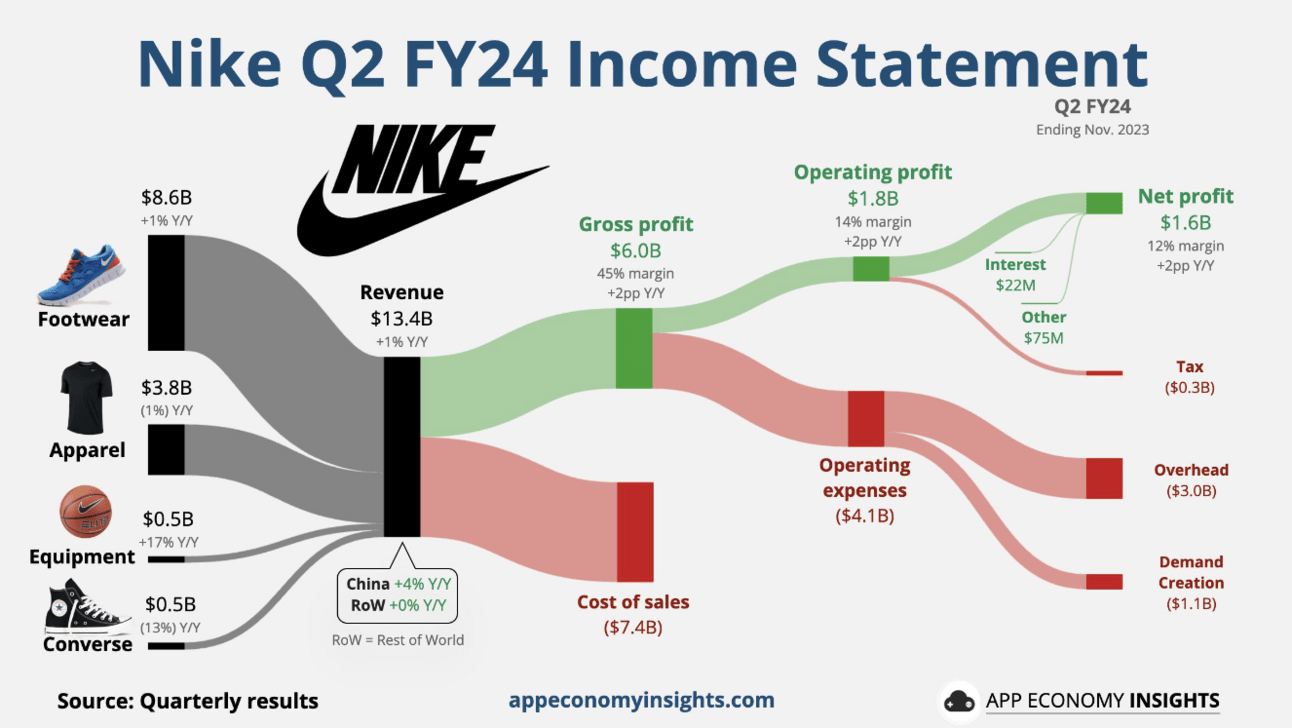

Nike Slashes Sales Outlook

Shares of retail giant Nike are down close to 12% in pre-market trading today after the company announced its quarterly results, which disappointed Wall Street.

In fiscal Q2 of 2024 (ended in November), Nike reported:

👉 Revenue of $13.39 billion vs. estimates of $13.43 billion

👉 Earnings of $1.03 per share vs. estimates of $0.85 per share

While sales rose 1%, earnings growth stood at 21% compared to the year-ago period. It expects sales to grow by just 1% in fiscal 2024, compared to its prior forecast of mid-single-digit growth.

Moreover, Nike estimates sales growth in the current quarter, which includes the all-important holiday season, to be negative year over year.

Following this outlook, shares of Foot Locker, a retailer that leans heavily on Nike products, saw shares fall by 7% in after-hours yesterday.

Despite Nike’s strong brand value, the company is wrestling with multiple headwinds as a strong U.S. dollar continues to impact consumer demand in the holiday season and wholesale order books.

As it lowered its sales outlook, Nike disclosed plans to cut costs by $2 billion in the next three years.

The retail heavyweight emphasized it is looking to simplify its product assortment, increase automation, streamline operations to cut costs and leverage its scale to boost efficiency.

These savings will then be reinvested to fuel future growth, accelerate innovation and drive profit margins higher.

Our take

Nike has underperformed the broader markets in the last two years and is down 40% from all-time highs. Despite its massive pullback, Nike stock trades at 30x forward earnings, which is expensive given its tepid growth estimates.

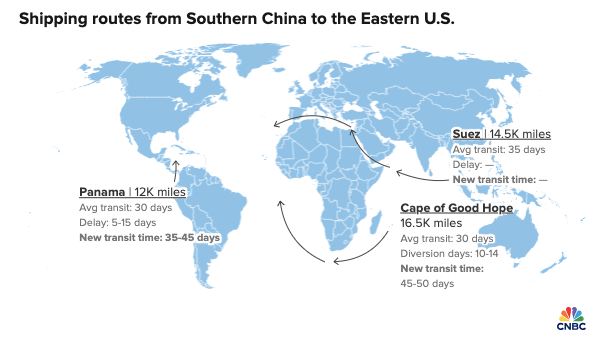

Chaos in the Red Sea

Global logistics companies are faced with a two-front storm of rising ocean and air freight prices and stranded cargo due to diversions in the Red Sea amid attacks by Houthi rebels.

Both these factors are threats to the global supply chain after three years of inflationary pressures, and delays from COVID-19 disruptions seemed to have finally eased in recent months.

The ceiling in ocean freight prices gained pace within a few hours as rates for a 40-foot container from Shanghai to the U.K. rose to $10,000, up from $2,400 last week.

As of this morning, 158 vessels are re-routing away from the Red Sea, carrying 2.1 million cargo containers worth $105 billion.

Our take

The ongoing attacks in the Red Sea might result in higher prices as the shipment of multiple products would be delayed.

For instance, retailers in the U.S. are watching these developments closely as the country imports 98% of its apparel. Companies forced to divert goods are also encountering surcharges, which will be passed on to consumers.

Inflation is likely to raise its ugly head again in 2024.

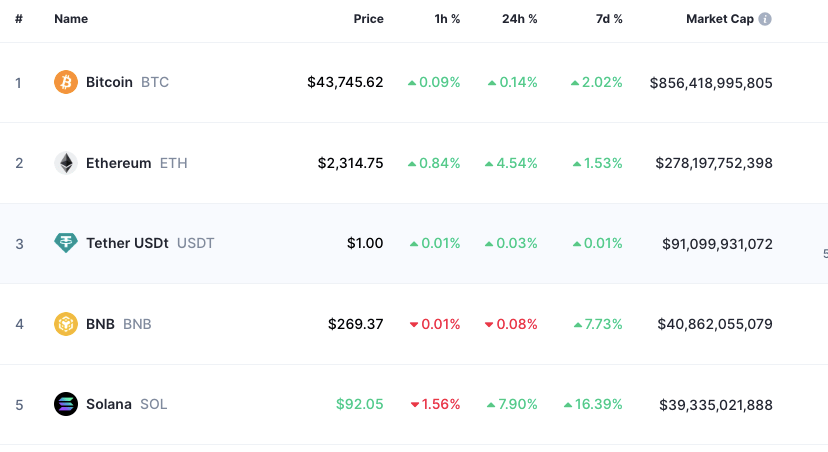

Solana Worth $40 Billion

Solana prices have surged close to 700% in 2023, valuing the cryptocurrency at almost $40 billion by market cap. It still trades 50% below all-time highs, as the digital asset was valued at $75 billion in November 2021.

Source: CoinMarketCap

Solana is currently the fifth-largest cryptocurrency in the world, closely trailing Binance.

Known as the Ethereum killer, Solana has gained traction due to its high speeds, low transaction costs, and robust efficiency.

Noted Wall Street investor Cathie Wood also emphasized Solana is a faster and more cost-effective version of Ethereum.

Headlines You Can’t Miss!

UK inches closer to technical recession

Tencent loses $43 billion as China changes gaming rules

Apple pauses Apple Watch sales due to patent dispute

Tech lay-offs surpass 100,000 in 2023

Coinbase enters France

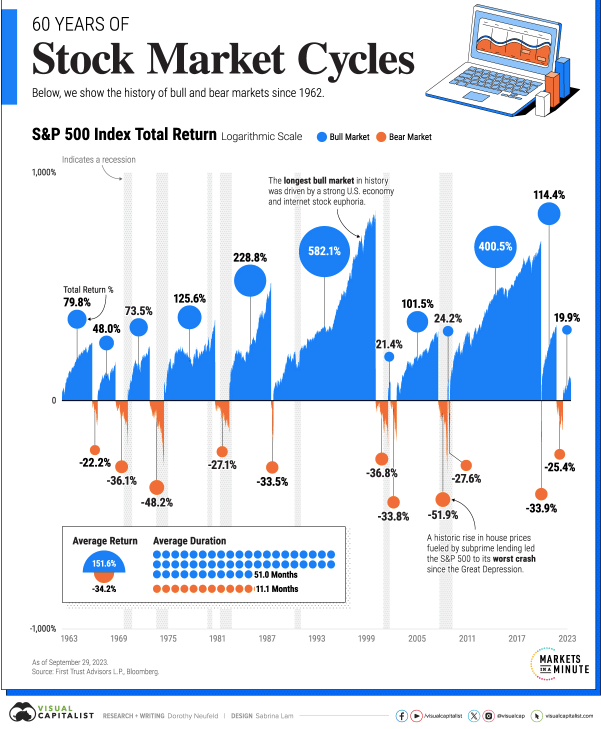

Chart of the Day

A bear market takes place when an index falls 20% from its peak. Once the market recovers to all-time highs, it enters a bull market.

The longest bear markets took place in the early 1970s and 1990s due to inflation and a tighter monetary policy. Comparatively, the longest bull market took place through the 1990s, lasting 12 years, when the S&P 500 index rose close to 600%.

So, how do you plan for a bear market, which is difficult to predict but an inevitable truth?

You should 👇

👉 Diversify equity holdings across sectors such as tech, real estate, banking, and more

👉 Diversify across asset classes such as bonds, stocks, gold, real estate and even cryptocurrency

Despite multiple bear markets, the S&P 500 index has risen 11.5% annually in the last 95 years, creating inflation-beating returns for shareholders.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.