- 3 Big Scoops

- Posts

- Netflix Gains Big 🚀

Netflix Gains Big 🚀

PLUS: Dow Jones surpasses 38k

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,864.60 ( ⬆️ 0.29%)

Nasdaq Composite @ 15,425.94 ( ⬆️ 0.43%)

Bitcoin @ $39,711.34 ( ⬇️ 0.95%)

Hey Scoopers,

Its Wednesday! Happy to tackle the midweek hustle?

Here’s the line-up for today👇

👉 Netflix crushes estimates

👉 Dow Jones tops 38k

👉 Bitcoin prices fall below $40,000

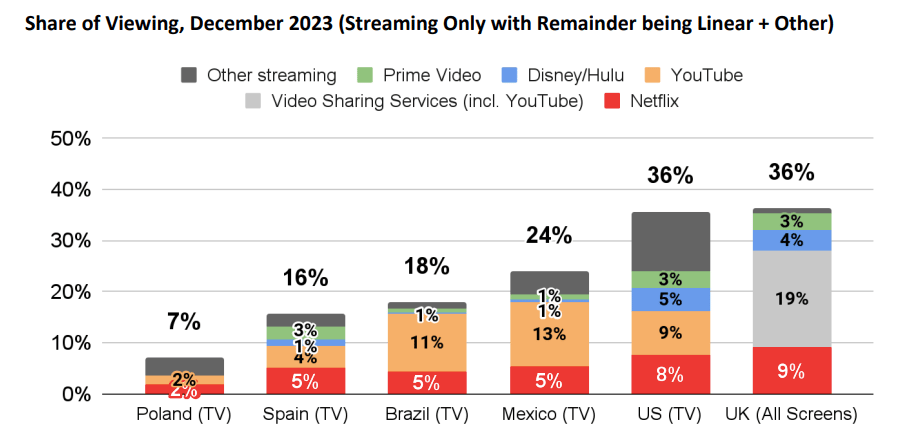

Netflix Stock Gains 9.5%

Shares of streaming giant Netflix are trading 9.5% higher in pre-market at the time of writing after the company disclosed it added 13.1 million subscribers in Q4 of 2023, much higher than the 8.76 million subscribers it added in Q3.

Meanwhile, Wall Street forecasted subscriber additions between 8 million and 9 million in Q4.

Netflix ended 2023 with 260.8 million paid subscribers due to the popularity of its ad-supported service and crackdown on password sharing.

In the December quarter, Netflix reported:

👉 Revenue of $8.83 billion vs. estimates of $8.72 billion

👉 Adjusted earnings of $2.11 per share vs. estimates of $2.22 per share

👉 Total memberships of 260.8 million vs. estimates of 256 million

Netflix reported net income of $937.8 million or $2.11 per share in Q4, much higher than $55.3 million or $0.12 per share in the year-ago quarter. Its revenue also rose by more than 12.5% year over year in the December quarter.

In addition to expanding its subscriber base, Netflix is focused on improving profit margins and estimates operating margins at 24% in 2024. It also expects earnings at $4.49 per share for Q1 of 2024, higher than Wall Street estimates of $4.10 per share.

Several streaming platforms are cutting production budgets amid a challenging macro backdrop. Alternatively, Netflix claimed it would continue to invest heavily in creating original content rather than acquiring linear assets.

But Netflix also continues to partner with content makers. For instance, the company stated it would stream the popular WWE Raw in 2025, taking its first big step into live entertainment.

Netflix is also positioned to benefit from growth in its ad-supported plan, unlocking another revenue stream for the company.

The streaming heavyweight increased its global monthly active users for ad-supported plans from 15 million in November 2023 to 23 million in January 2024.

Valued at $230 billion by market cap, Netflix stock is up 38% in the last 12 months and is priced at 30 times forward earnings, which is not too steep given its stellar growth estimates.

China is Considering a $278 Billion Rescue Package

China is considering a rescue package backed by offshore capital to stem the slump surrounding its equity markets.

Source: CNBC

A report from Bloomberg News stated authorities in China aim to allocate roughly $278 billion through offshore accounts for state-owned companies to stabilize the equity market by purchasing stocks onshore through Hong Kong.

China’s CSI index fell 11.4% in 2023, clocking its third consecutive year of decline. Meanwhile, the Hang Seng index was the worst-performing stock market in Asia and fell 14% last year.

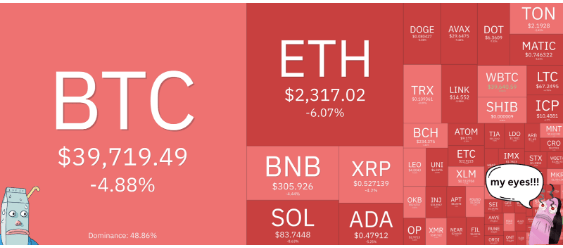

Bitcoin is in Freefall

Source: Milk Road

After touching 24-month highs of $49,000 last week, Bitcoin prices have pulled back by more than 20%. Here’s why 👇

First, FTX dumped more than $1 billion worth of GBTC. The Grayscale Bitcoin Trust of GBTC is a digital currency investment product that makes Bitcoin available to investors.

A report from Coindesk stated that FTX’s bankruptcy estate dumped 22 million shares of GBTC.

Second, the drawdown in BTC prices meant $300 million in leveraged positions were liquidated in the last 24 hours, accelerating the sell-off.

Our Take

Expect BTC prices to remain choppy in the near term before it takes off (hopefully) once the halving event is over this May.

Headlines You Can’t Miss!

U.S. oil gets a boost amid Red Sea chaos

Johnson & Johnson to pay $700 million in talc powder case

eBay to downsize workforce by 9%

Alibaba co-founders purchase stock worth $200 million

JPMorgan downgrades Coinbase to “underweight”

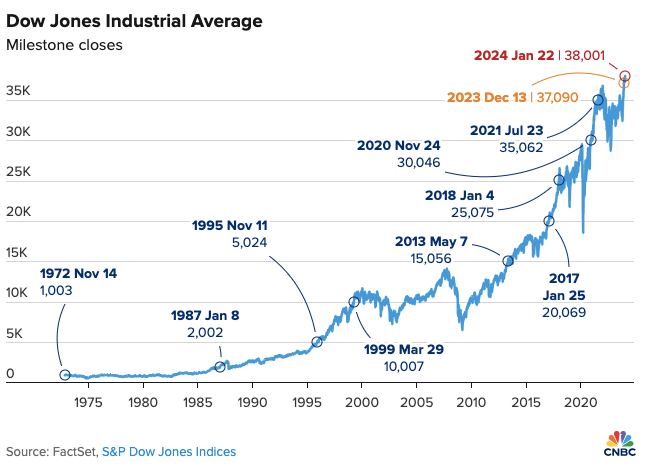

Chart of The Day

The Dow Jones Industrial Average Index crossed the 38,000 mark for the first time ever this week, 40 days after it breached the 37,000 barrier.

The threshold breach is the latest in a string of milestones on Wall Street, which saw the S&P 500 index set record highs, confirming the start of a new bull market.

The average number of days between the 1,000-point milestones has gotten shorter over time, as the percentage gain required to do so declines significantly with each new level.

Moreover, these gaps are particularly small during big market rallies. For instance, the Dow Jones index crossed seven 1,000-point barriers in less than 12 months during the COVID-19 market rally that gained momentum in the second half of 2020.

The Dow Jones index is weighted by share price and consists of just 30 stocks. It is not considered the best representation of the U.S. stock market but holds historical importance on Wall Street.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.