- 3 Big Scoops

- Posts

- U.S. Stocks are Flying

U.S. Stocks are Flying

PLUS: earnings outlook for the S&P 500 in 2024

Bulls, Bitcoin & Beyond

Hello Folks,

Happy Friday!!

Here’s what’s on the menu for today:

👉 The ongoing stock market rally

👉 Deflation this holiday season?

👉 Solana crushes the crypto market

Nasdaq Index Surges 36% In 2023

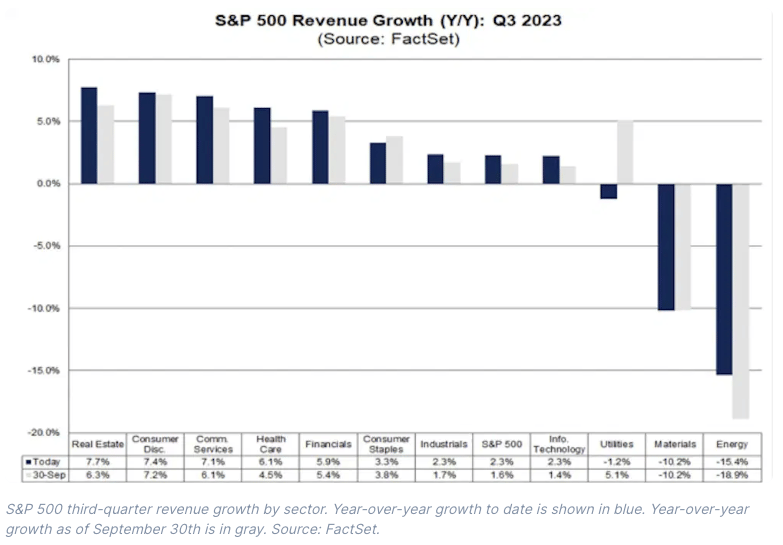

The earnings season is winding up on Wall Street, and things aren’t too shabby. Around 82% of the S&P 500 companies have surpassed estimates, higher than the five-year average of 77%.

Analysts now expect S&P 500 companies to eke out a profit of 1%, much better than the earnings slump predicted previously.

Eight out of the 11 sectors part of the S&P 500 index have seen an expansion in profits this year. A stellar round of Q3 earnings and lower-than-expected inflation has driven share prices higher in recent times.

For instance, the tech-heavy Nasdaq index has spiked almost 36% YTD as investors expect interest rates to have peaked.

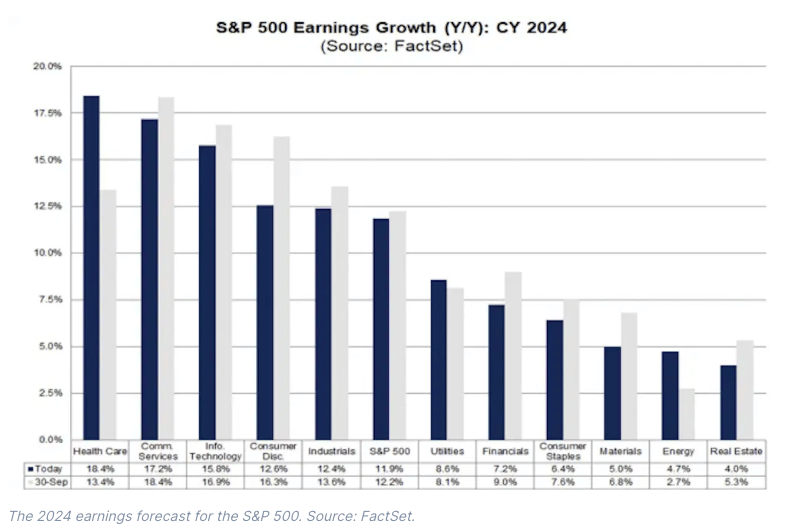

Wall Street expects earnings to grow by 12% in 2024 for the S&P 500, the fastest pace since 2018. This forecast is incredible, given companies have to tide over:

👉 Higher bond rates

👉 A tepid lending environment

👉 A sluggish global economy and

👉 Geopolitical tensions

It’s important to take a step back from the market noise. Historically, U.S. companies have always found ways to cut costs and grow corporate earnings, allowing the S&P 500 index to deliver inflation-beating returns over time.

Walmart Sounds the Alarm Bells

Shoppers are likely to get an early present this holiday season as prices across gift categories might fall lower.

Source: CNBC

Yesterday, Walmart CEO Doug McMillon emphasized deflation could weigh on general merchandise and key grocery items such as eggs and chicken, making them cheaper.

McMillon explained, “In the U.S., we may be managing through a period of deflation in the months to come. And while that would put more unit pressure on us, we welcome it because it’s better for our customers.”

Will deflation negatively impact sales and profit margins for big-box discount retailers in Q4 of 2023?

Solana Gains Big In 2023

Valued at a market cap of $24.7 billion, Solana is among the 10 largest cryptocurrencies globally. The SOL token has surged close to 500% year-to-date, dwarfing the gains of Bitcoin, which has more than doubled this year.

Noted Wall Street investor Cathie Wood remains bullish on Solana, contributing to its recent gains. According to Wood, Solana is well-positioned to gain traction due to:

A low-cost platform

High transaction speeds

Improved network performance

Headlines You Can’t Miss!

Alibaba shelves spin-off plans, stock falls

China’s EV adoption rate is rapid

Gap blows past earnings in Q3

A Taylor Swift cruise in 2024?

Ethereum price soars post ETF announcement

Chart of the Day

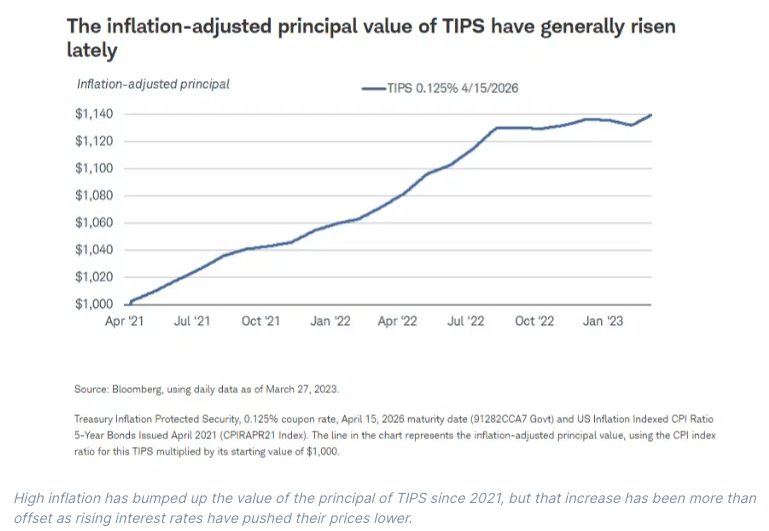

TIPS or Treasury Inflation-Linked Securities are government bonds armed with a superpower as the bond’s principal and semi-annual interest payments adjust in line with inflation rates.

If held until maturity, you will be protected against inflation as your principal amount is tied to the inflation rate.

But TIPS are bonds, exposing their prices to interest rates. Typically, bond prices and rates are inversely related.

So, how do TIPS work?

Picture this: You snag $10,000 worth of TIPS with a neat 2.5% annual interest. Now, let’s say inflation decides to jump up by 3% within a year. Here’s the play-by-play for your investment:

First, your TIPS will bulk up with inflation, boosting your principal by 3% to $10,300.

Next, your interest will get more interesting – it’ll be calculated at the beefier amount. So, instead of pocketing $250 in yearly interest, you’ll be scooping up $257.50.

Finally, fast-forwarding to the year’s end (assuming that’s when the TIPS matures), you’ll walk away with your $10,300 principal and $257.50 interest, leaving you with a cool $10,557.50.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.