- 3 Big Scoops

- Posts

- Can Microsoft Touch $5 Trillion?

Can Microsoft Touch $5 Trillion?

PLUS: Equity investing is tough

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,783.93 ( ⬆️ 0.075%)

Nasdaq Composite @ 14,072.76 ( ⬆️ 0.017%)

Bitcoin @ $42,742.02 ( ⬆️ 0.09%)

Hey Scoopers,

Happy Tuesday! We hope you enjoyed a relaxing and rejuvenating weekend.

In today’s newsletter, we look at the upside potential for Microsoft, the largest company in the world by market cap.

So, let’s go 🚀

Microsoft- A Tech Giant

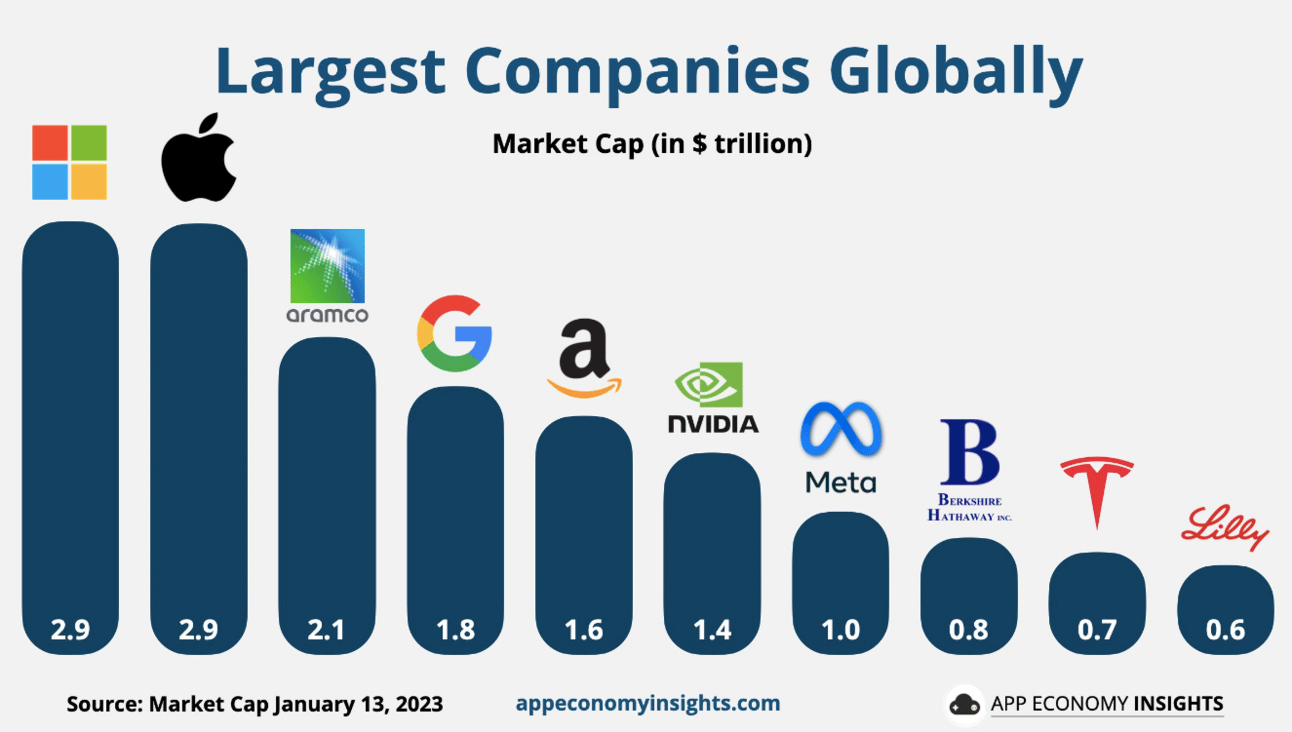

Last week, Microsoft surpassed Apple to become the most valuable company in the world by market cap.

The tech stock is valued at $2.88 trillion and has gained:

👉 64% in the past year

👉 289% in the last five years

👉 1,150% in the last 10 years and

👉 2,150% in the last 20 years

Microsoft stock went public in 1986 and has since returned a staggering 400,000% to shareholders, easily outpacing the broader markets.

But past returns don’t matter much to current and future investors. Let’s see if Microsoft can continue to outpace the broader markets in the upcoming decade.

Microsoft Has a Diversified Business

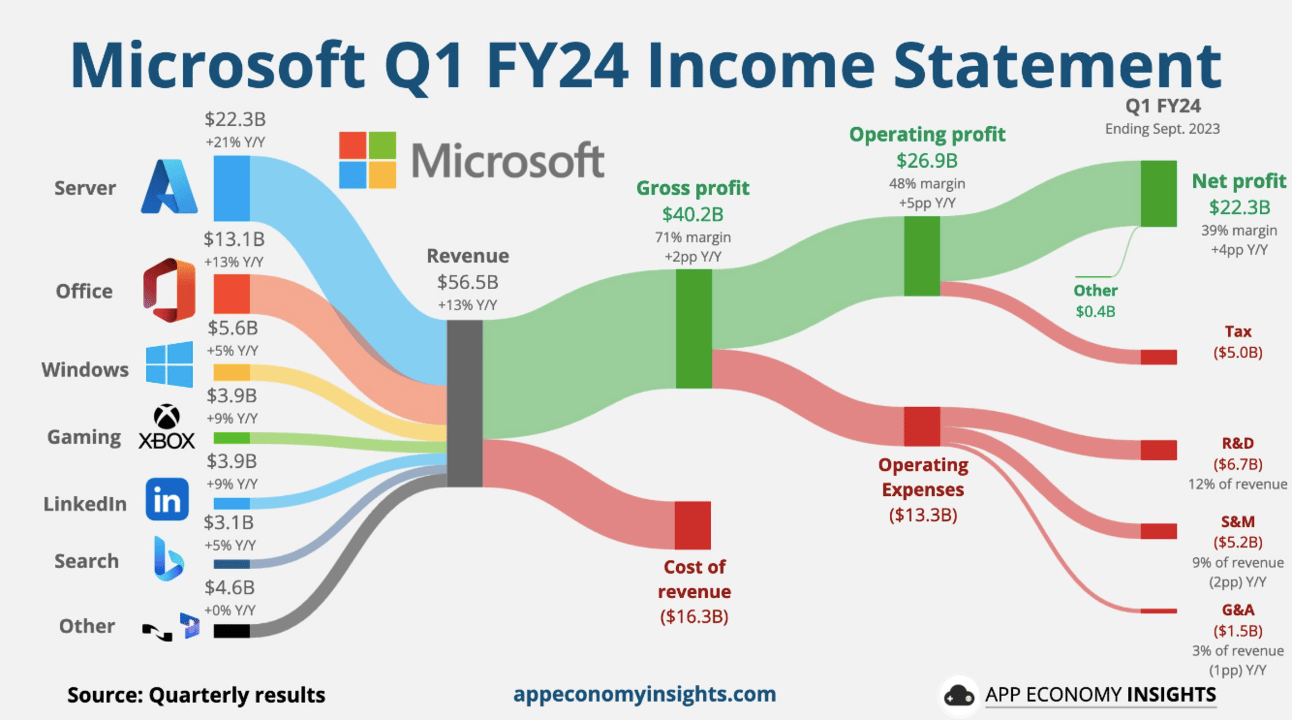

Microsoft has multiple business segments, such as enterprise software, gaming, public cloud, social media, and more.

Under Satya Nadella, Microsoft has undergone a transformation due to several factors.

First, it expanded the Azure cloud infrastructure platform and converted its desktop-based apps into cloud-based subscription services.

Then, it ditched the Windows Phone and launched iOS and Android versions of its productivity software.

Finally, Microsoft expanded its ecosystem on the back of big-ticket acquisitions such as LinkedIn, GitHub, and Mojang.

In January 2022, it announced plans to buy gaming giant Activision Blizzard, further diversifying the revenue base.

Despite its massive size, Microsoft increased its sales by 10.4% annually from $87 billion in fiscal 2014 to more than $211 billion in fiscal 2023 (ended in June).

Due to an asset-light model, its adjusted earnings per share has risen by 18% annually in this period.

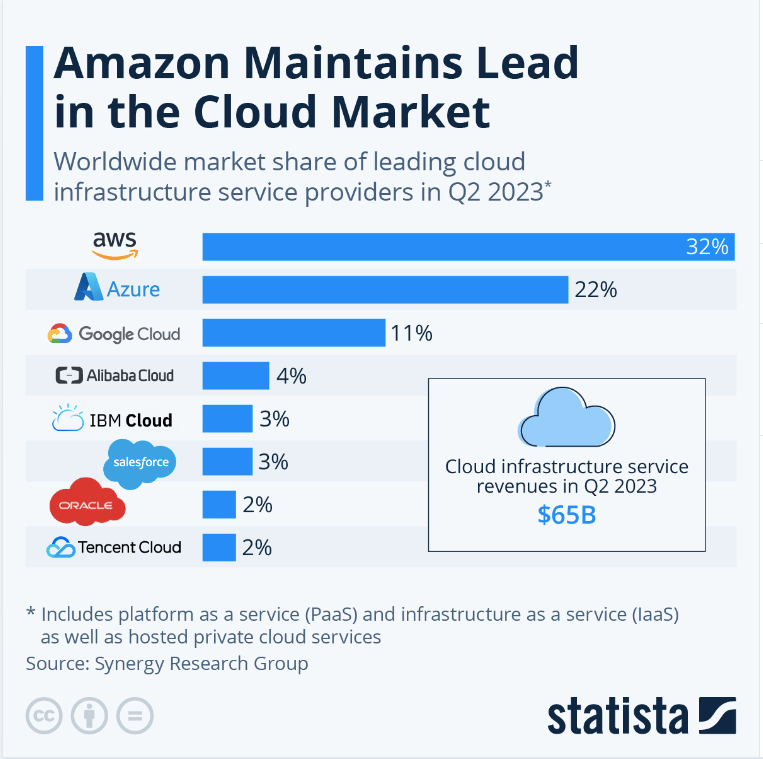

Initially, Microsoft’s cloud-based expansion compressed its margins. But as economies of scale kicked in, profit margins snowballed while Azure became the world’s second-largest cloud infrastructure platform after Amazon Web Services.

According to a report from Statista, Azure has a market share of 22% in the cloud infrastructure market, lower than AWS at 32% and higher than Google at 10%.

What Will Drive Growth for Microsoft?

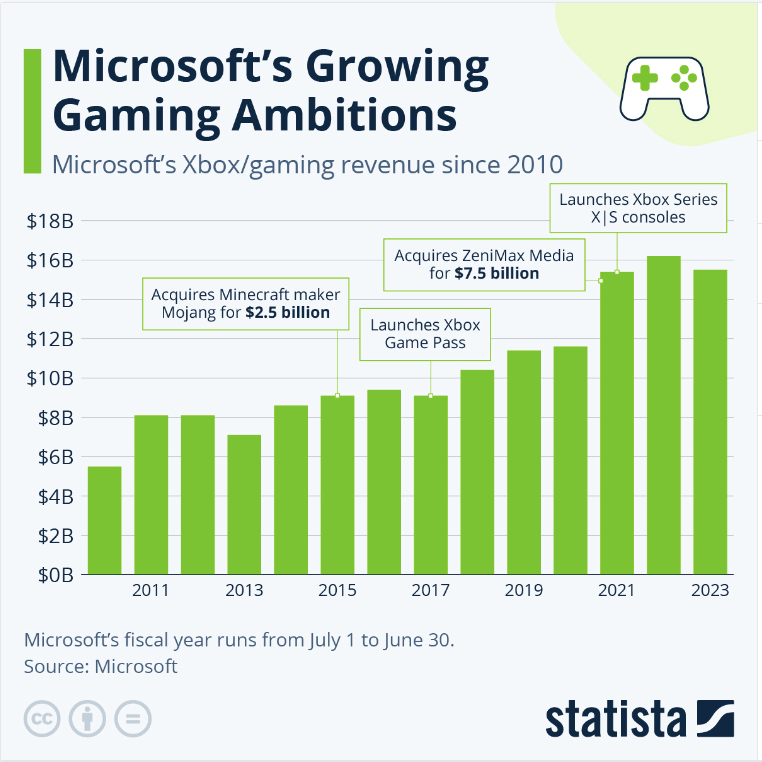

Microsoft’s growth in the upcoming decade will be driven by the expansion of its Azure ecosystem, its ability to transform the Xbox console into a cloud-based gaming service, and the expansion of AI services through investments in ChatGPT and other OpenAI products.

A report from Fortune Business Insights forecasts the cloud computing market to grow by 20% annually through 2030. Even if Microsoft maintains its current market share, cloud sales should rise 4x in the next seven years.

Further, expanding its productivity applications on iOS and Android will likely complement top-line growth in the cloud business.

Microsoft launched the Xbox Cloud Gaming service in 2020 and ended 2021 with 13.2 million players and 2022 with over 20 million players.

If Microsoft can blend its Xbox Game Pass and Cloud Gaming services, it can replace low-margin consoles with the high-margin cloud services business, enabling subscribers to play games on any device.

We can see why Microsoft was keen to acquire Activision Blizzard to its gaming portfolio and why regulators scrutinized the deal heavily.

A report from Fortune Business Insights estimates the nascent cloud gaming market will expand by a whopping 47% annually between 2023 and 2030, becoming a key driver of top-line growth for Microsoft.

Finally, Microsoft has invested billions of dollars in acquiring a sizeable stake in OpenAI, which owns ChatGPT and the image generator platform DALL-E.

Microsoft has already integrated ChatGPT into the Bing search engine and Azure while it used DALL-E to power its Bing Image Creator for AI images.

Microsoft is positioned to benefit from an early mover advantage in the AI market, which is forecast to grow by 36% annually through 2030.

Is a $5 Trillion Market Cap Inevitable?

Microsoft is firing on all cylinders, and the tech heavyweight should grow its revenue by more than 10% annually through 2030.

It suggests the company’s sales will surpass $425 billion while adjusted earnings will be close to $21 per share by fiscal 2030.

MSFT stock currently trades at 40x trailing earnings. If this multiple lowers to 35x, its stock price should be around $735, valuing it more than $5 trillion.

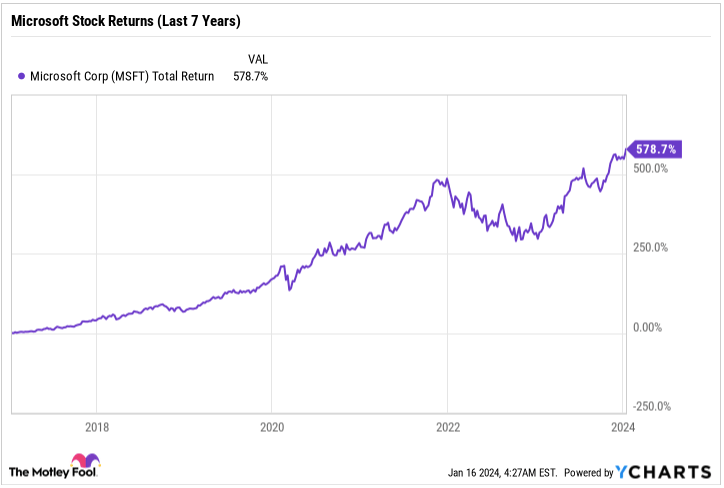

In the last seven years, MSFT stock has surged roughly 600%, and it will be almost impossible for the company to replicate these gains. But Microsoft should deliver inflation-beating returns for shareholders in the near future.

Chart of the Day

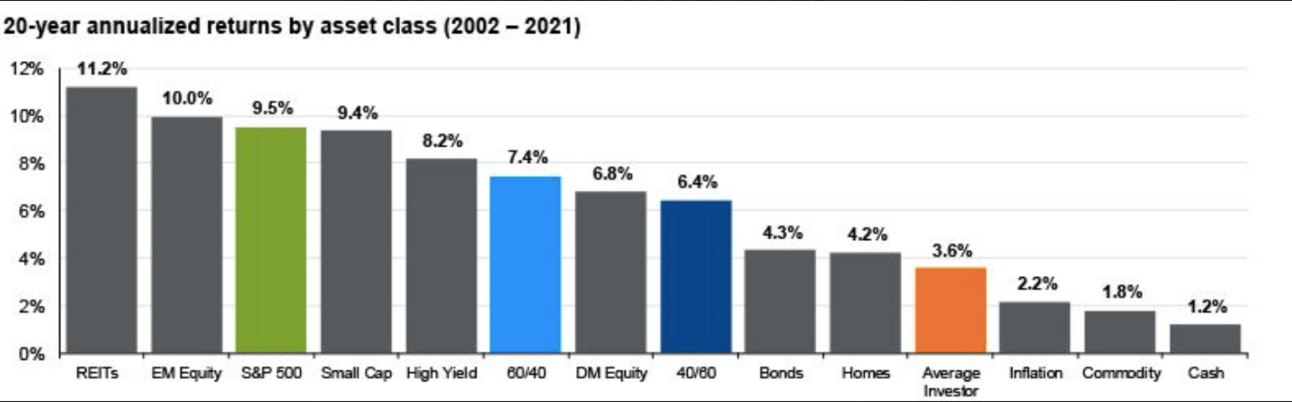

Source: JPMorgan

Myth: The stock market is a wealth-creating machine 💰

Fact: 95% of investors fail to beat the equity markets 💀

Investing in the stock markets has historically allowed participants to enjoy inflation-beating returns over time 💸.

According to a JPMorgan Chase & Co. report, the S&P 500 index delivered annual returns of 9.5% between 2002 and 2021 🚀.

But investor returns averaged a measly 3.6% in this period. The massive underperformance can be attributed to several factors, including:

👉 Higher trading volumes leading to higher brokerage costs and taxes

👉 Trying to time the market ❌

👉 Making emotional investment decisions 👨💻 and

👉 Lack of patience 🙅♂️

Investing in bonds would have been a much better option for investors as this asset class returned 4.6% between 2002 and 2021.

Takeaway: Don't invest in stocks if you are not ready to ride the bear market.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.