- 3 Big Scoops

- Posts

- Microsoft Cloud Drives Growth

Microsoft Cloud Drives Growth

and Alphabet announces a dividend

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

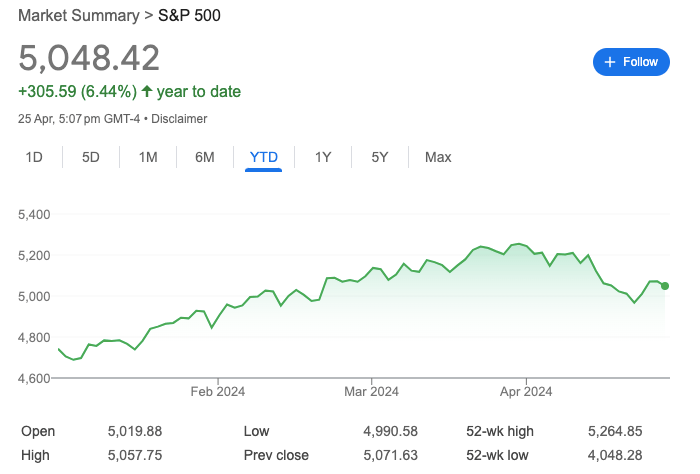

S&P 500 @ 5,048.42 (⬇️ 0.46%)

Nasdaq Composite @ 15,611.76 ( ⬇️ 0.64%)

Bitcoin @ $64,361.90 ( ⬆️ 0.12%)

Hey Scoopers,

Happy Friday! We have an exciting newsletter for you today.

👉 Azure drives sales in fiscal Q3

👉 Alphabet tops estimates

👉 Snap stock surges higher

So, let’s go 🚀

Market Wrap 📉

Equities tumbled on Thursday after the latest U.S. economic data indicated a sharp slowdown in growth while pointing to persistent inflation.

In Q1 of 2024, U.S. GDP (gross domestic product) expanded 1.6% year over year, below estimates of 2.4%.

In addition to the sluggish growth rate, the report showed that the personal consumption expenditures (PCE) price index for the March quarter rose by 3.4%, above the 1.8% advance in the previous quarter. This raised concern that incessant inflation might lower the Fed’s flexibility to cut interest rates in 2024.

Both these numbers point to a stagflationary environment, which is a combination of slowing economic growth and rising inflation that is making investors nervous.

Trending Stocks 🔥

Intel - The semiconductor giant is down almost 8% in pre-market trading after it provided a weak forecast for the current quarter.

Victoria’s Secret - Shares dropped over 3% after Goldman Sachs initiated coverage of the stock with a sell rating on the back of strong competition and a tough macro environment.

Monster Beverage - JPMorgan downgraded the stock to neutral from overweight due to cost pressures, pushing shares lower by 3%.

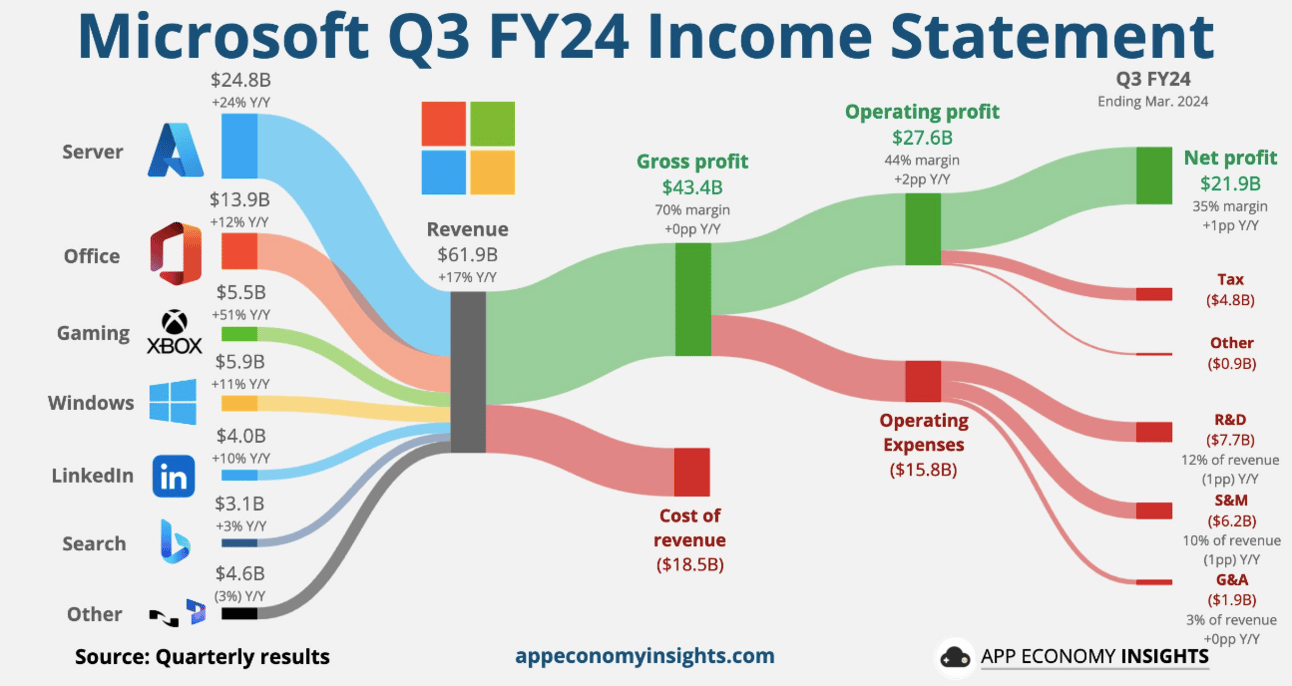

Microsoft Beats Estimates

Microsoft stock is up over 4% in pre-market after the software giant issued fiscal Q3 results (ended in March) that topped consensus estimates. In fiscal Q3, Microsoft reported:

👉 Revenue of $61.86 billion vs. estimates of $60.8 billion

👉 Earnings per share of $2.94 vs. estimates of 2.82

Total sales were up 17% in the March quarter, while the tech behemoth forecast revenue of $64 billion in fiscal Q4, just below estimates of $64.5 billion.

Here are some key numbers in fiscal Q3:

Microsoft’s Intelligent Cloud business rose 21% to $26.7 billion, above estimates of $26.26 billion

Revenue from Azure and cloud services grew by 31%, above estimates of 28.6%

AI accounted for seven percentage points of growth in Azure, up from 6% in the previous quarter

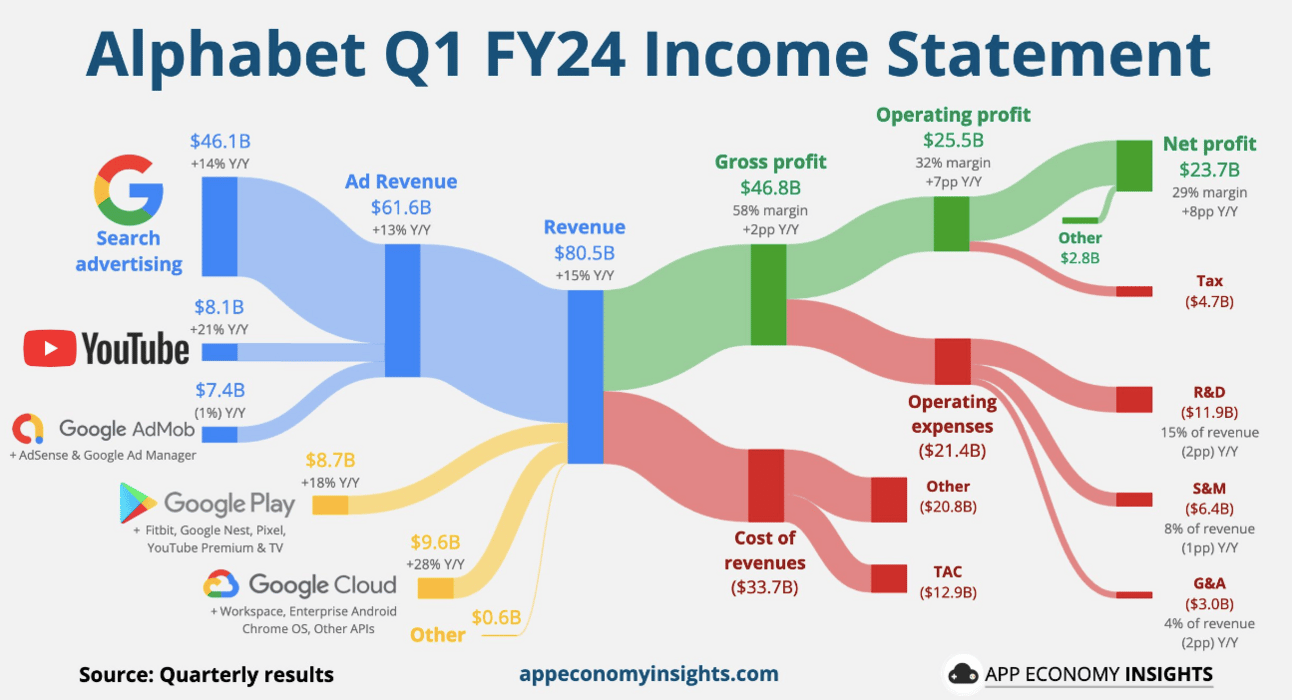

Alphabet Stock Is On Fire

Alphabet shares are up more than 11% in pre-market after the company announced results that topped estimates.

In Q1 of 2024, Alphabet reported:

👉 Revenue of $80.54 billion vs. estimates of $78.59 billion

👉 Earnings per share of $1.89 vs. $1.51

Here are some other key numbers for the world’s largest digital advertising company:

YouTube ad sales stood at $8.09 billion vs. estimates of $7.72 billion

Google cloud revenue stood at $9.57 billion vs. estimates of $9.35 billion

Traffic acquisition costs were $12.95 billion, higher than estimates of $12.74 billion

Alphabet's total sales increased by 15% from $69.79 billion in Q1 of 2023, its fastest rate of growth in two years. Moreover, the company approved a quarterly cash dividend of $0.20 per share, indicating a yield of 0.5%.

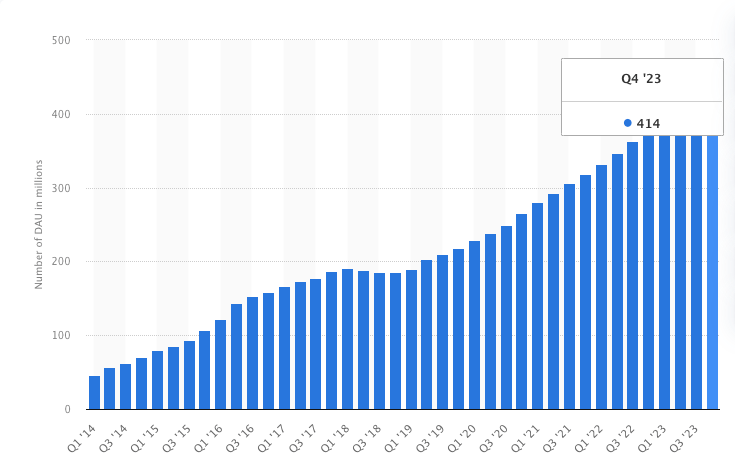

Snap Stuns Wall Street

Snap stock is up roughly 25% in premarket after the social media company beat estimates and showed a return to double-digit revenue growth.

Snap’s Daily Active User Growth Comparison

Source: Statista

Here’s how the company performed in Q1:

Revenue of $1.19 billion vs. estimates of $1.12 billion

Earnings per share of $0.03 vs. estimates of a loss of $0.05

Global daily active users of 422 million, above estimates of 420 million

Average revenue per user of $2.83 vs. estimates of $2.67

Snap’s top line rose by 21% from $989 million in the year-ago period. Its sales growth accelerated considerably in Q1 after the company reported six consecutive quarters of single-digit growth or sales declines.

Snap attributed revenue growth to improvements in its ad platform and demand for its direct-response ad solutions.

Headlines You Can't Miss!

Asia most impacted by extreme weather and climate in 2023

BoJ keeps monetary policy unchanged

Mark Zuckerberg’s net worth falls by $18 billion

Paramount and Skydance inch closer to a merger

Shiba Inu team makes a major announcement

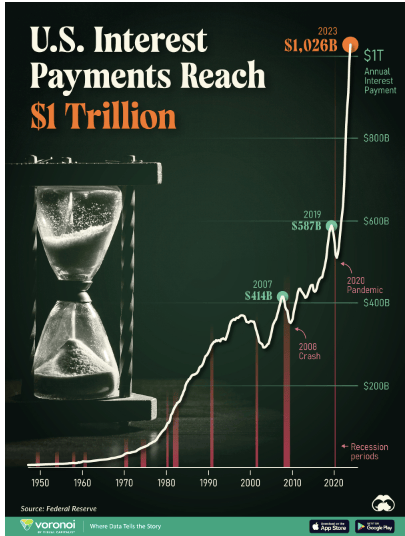

Chart of The Day

Due to high interest rates, the cost of paying the country’s national debt in the U.S. surged past $1 trillion in 2023, as the total debt stood at $34 trillion.

Interest payments in the U.S. have more than doubled in the past decade amid rising government spending during COVID-19. In fact, debt servicing costs surpassed defense spending for the first time ever in 2023.

The U.S. national debt is growing by $1 trillion roughly every 100 days or $3.6 trillion per year.

So, the government spent more than $2 billion per day on interest costs last year and might have to allocate $12.4 trillion towards these payments in the upcoming decade.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.