- 3 Big Scoops

- Posts

- 🗞 Microsoft's Quantum Leap

🗞 Microsoft's Quantum Leap

PLUS: Amazon surpasses Walmart

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

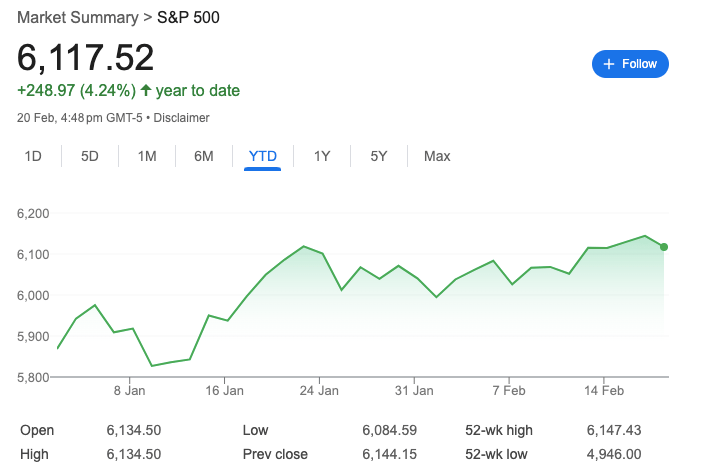

S&P 500 @ 6,117.52 ( ⬇️ 0.43%)

Nasdaq Composite @ 19,962.36 ( ⬇️ 0.47%)

Bitcoin @ $98,199.65 ( ⬆️ 0.16%)

Hey Scoopers,

Happy Friday! Here’s what we’re covering today 👇

👉 Microsoft unveils first quantum chip

👉 Walmart disappoints Wall Street

👉 Alibaba continues to rally

So, let’s go 🚀

Market Wrap

Stocks pulled back Thursday as Walmart's disappointing forecast sparked broader concerns about consumer spending and economic health.

The retail giant's shares tumbled 6.5% as it delivered weaker-than-expected 2026 earnings guidance despite beating fourth-quarter estimates.

The warning triggered a retail sector selloff, with Target and Costco losing about 2%.

Tech darling Palantir dropped 5.2%, extending its weekly decline beyond 15%, amid concerns about the Defense Department budget and CEO stock sales.

Adding to market jitters, The Conference Board's Leading Economic Index unexpectedly contracted in January. St. Louis Fed President Alberto Musalem advocated a cautious approach to rate cuts despite inflation moving toward the 2% target.

Meanwhile, individual investor sentiment showed an interesting shift – bearishness dropped to 40.5% from a 15-month high of 47.3%, while bullishness remained muted at 29.2%.

Contrarian investors view this combination of above-average pessimism and below-average optimism as potentially positive, suggesting selling pressure may be exhausting while significant sideline cash awaits deployment.

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

Trending Stocks 🔥

Celsius Holdings - The energy drink company is up 35% in pre-market after reporting adjusted earnings of $0.14 per share and revenue of $332 million in Q4, compared to estimates of $0.11 per share and $326 million, respectively.

Dropbox - The cloud storage stock is down 9% in pre-market after it reported an adjusted gross margin of 83.1% in Q4, in line with estimates.

Block - The fintech stock dipped 7% after missing consensus revenue and earnings estimates in Q4 of 2024.

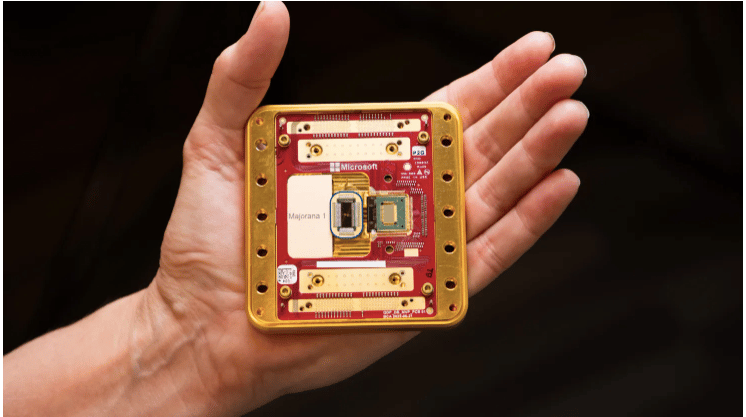

Microsoft Unveils Breakthrough Quantum Chip

Microsoft debuted its quantum computing chip, Majorana 1, on Wednesday. The tech giant says building it required creating an entirely new state of matter.

The chip, which features eight topological qubits made from indium arsenide and aluminum, emerged after nearly 20 years of research.

Unlike quantum rivals Google and IBM, Microsoft took a unique approach: It manufactured the chip in-house at U.S. facilities.

Microsoft says its atom-by-atom construction method was necessary to achieve the precise material alignment needed for topological quantum states.

While Microsoft won't immediately offer Majorana 1 through its Azure cloud platform, executive VP Jason Zander told CNBC the company aims to scale to "a few hundred qubits" before discussing commercial applications.

The development could accelerate Microsoft's $13 billion AI business, potentially enabling drug discovery and molecular science breakthroughs.

The announcement follows surging investor interest in quantum computing. In 2024, competitors IonQ and Rigetti saw their shares soar 237% and 1,500%, respectively24.

Zander believes widespread quantum computing could arrive "in years, not decades," challenging more conservative industry timelines.

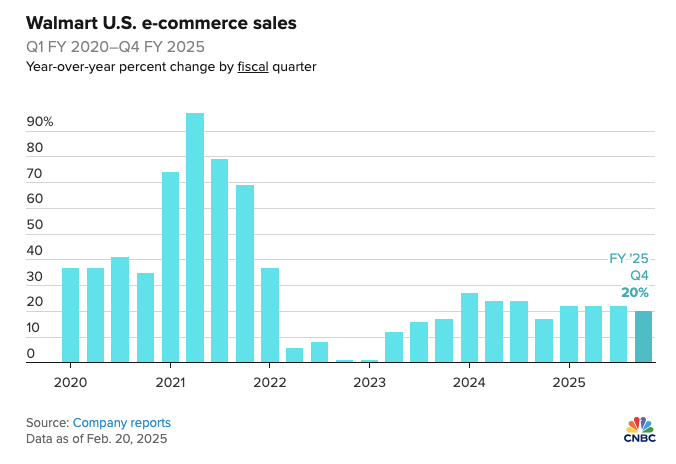

Walmart Stock Tanks 6%

In a historic shift in retail dominance, Amazon has surpassed Walmart in quarterly revenue for the first time, marking the end of Walmart's 12-year reign as America's top revenue generator.

Amazon reported $187.8 billion in fourth-quarter revenue, outpacing Walmart's $180.5 billion.

While Walmart maintains its annual revenue crown with projected sales of $708.7 billion for the upcoming fiscal year, Amazon is closing the gap rapidly, with analysts expecting $700.8 billion in 2025 revenue.

Amazon's rise reflects its successful diversification beyond retail. Third-party seller services now account for 24.5% of total sales, while Amazon Web Services contributes nearly 17%.

Meanwhile, Walmart has been adopting elements of Amazon's playbook, launching its own marketplace, fulfillment services, advertising business, and Walmart+ membership program.

The revenue milestone underscores a fundamental shift in American retail. Digital innovation and service diversification are becoming as crucial as traditional retail operations in driving growth.

Walmart's stock dropped over 6% Thursday after the retail giant's cautious profit forecast overshadowed robust holiday quarter results, signaling potential headwinds for the broader retail sector.

While Q4 revenue climbed 4% to $180.55 billion and U.S. e-commerce sales surged 20%, investors focused on the company's muted outlook.

Walmart projects 3-4% net sales growth and 3.5-5.5% operating income growth for fiscal 2026, below the previous year's 9.7% increase.

CFO John David Rainey described consumer spending as "steady" but cited geopolitical uncertainties, including potential tariffs on Mexican and Canadian imports.

The retailer's new revenue streams showed promise, with its advertising business growing 29% and membership income rising 16%.

Notably, U.S. store traffic increased by 2.8% while average ticket size grew by 1.8%, suggesting resilient consumer spending.

However, the company's conservative earnings guidance of $2.50-$2.60 per share fell short of Wall Street's $2.76 expectation, reflecting broader market concerns about retail sector growth and economic uncertainties.

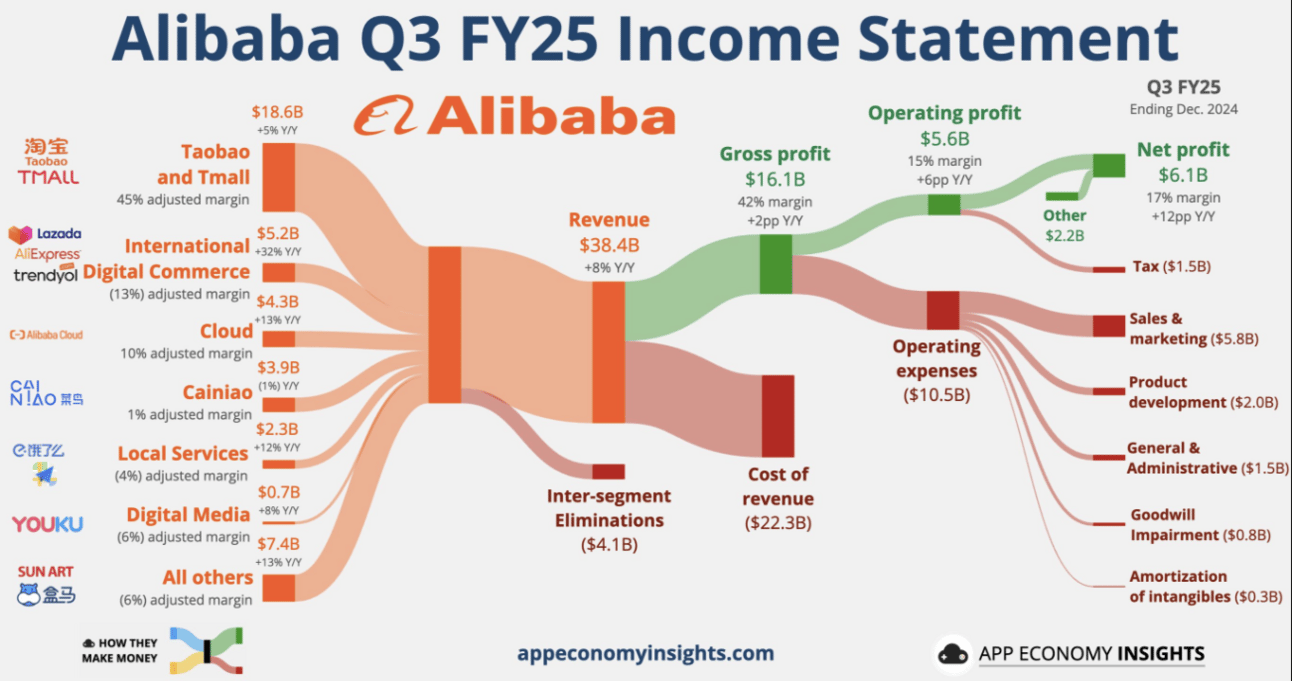

Alibaba Surges on Profit Beat

Alibaba shares jumped more than 8% Thursday after the Chinese tech giant reported quarterly profit nearly tripled to 48.9 billion yuan ($6.72 billion), significantly beating analyst expectations of 40.6 billion yuan.

The strong performance was driven by renewed growth in its cloud business and robust e-commerce sales.

Cloud Intelligence Group revenue grew 13%, marking a return to double-digit growth. Sales in the core Taobao and Tmall retail units climbed 5% to 136.1 billion yuan.

Alibaba’s international commerce division surged 32%, powered by strong cross-border performance.

CEO Eddie Wu announced aggressive AI infrastructure investment plans over the next three years, exceeding the company's total cloud spending over the past decade.

The push comes as Alibaba partners with Apple on AI features for Chinese iPhones and competes with local rival DeepSeek in the AI race.

The results follow founder Jack Ma's attendance at a rare meeting with President Xi Jinping. Chinese leadership urged private businesses to "show their talents" in a "new era," potentially indicating a significant shift in Beijing's stance toward tech giants.

Headlines You Can't Miss!

Japan’s inflation climbs to two-year high of 4%

Meta approves plan for bigger executive bonuses amid layoffs

Rivian lowers delivery forecasts for 2025

Airbus to prioritize non-U.S. deliveries amid tariff threats

Sam Bankman-Fried flatters Donald Trump, requests pardon

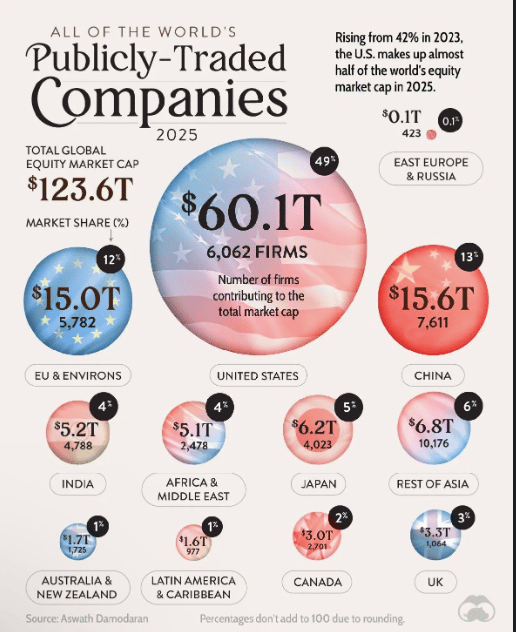

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.