- 3 Big Scoops

- Posts

- Microsoft's AI Spending Gains Pace

Microsoft's AI Spending Gains Pace

Microsoft, Apple, GM, and Ford

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

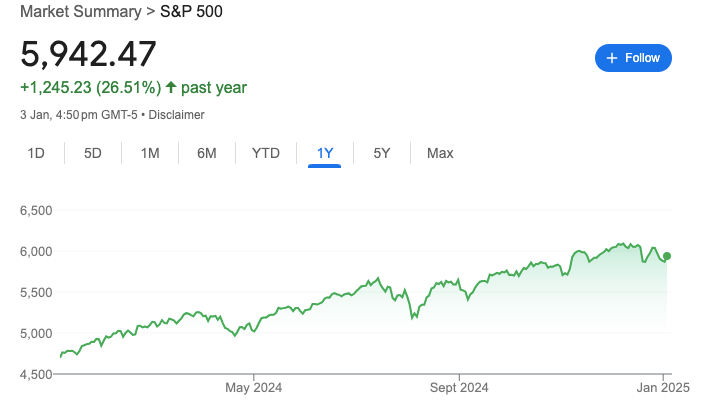

S&P 500 @ 5,942.47 ( ⬆️ 1.26%)

Nasdaq Composite @ 19,621.68 ( ⬆️ 1.77%)

Bitcoin @ $98,438.77 ( ⬆️ 2.01%)

Hey Scoopers,

Happy Monday! Let’s have a great week.

👉 Microsoft to spend $80B on AI data centers

👉 Apple might struggle in China

👉 Are auto sales recovering?

So, let’s go 🚀

Dub app raises $17M for first regulated copy trading platform

On Dub, you don't pick the stocks you want to invest in. You pick the people you want to copy, with portfolios based on hedge fund managers, investing experts, and even law makers.

When you copy a portfolio on Dub, you execute the same trades as them automatically. Dub’s team hopes this will make investing more transparent and accessible.

Dub is SEC-registered, member FINRA. All deposits are SIPC-insured.

Not investment advice. Full disclosures here.

Market Wrap

Hey, Scoopers!

Remember when everyone was panicking about the market's shaky start to 2025? Well, Friday showed us why seasoned investors keep cool during short-term turbulence. Here's what happened and why it matters for your portfolio.

The Big Picture:

Wall Street bounced back Friday, with tech stocks leading the charge. Think of it as the market's way of saying, "New year, same tech dominance."

The AI Money Trail:

Nvidia surged 4.7% (apparently, AI chips are still very much in fashion)

Super Micro Computer jumped 10.9% (because every AI chip needs a home)

Energy players Constellation Energy (+4%) and Vistra (+8.5%) joined the party (powering all those AI data centers isn't cheap)

Here's what's fascinating:

The same companies that dominated 2024 are showing strength again. It's like watching a sequel, with the main characters returning stronger than ever.

The Reality Check:

Despite Friday's impressive showing:

S&P 500: Down 0.48% for the week

Dow: Dropped 0.60%

Nasdaq: Slipped 0.51%

And about that "Santa Claus rally" everyone was hoping for? Let's say Santa might have been stuck in traffic – the traditional year-end gains didn't materialize this time.

The Smart Money Take:

As Jeremiah Buckley from Janus Henderson wisely points out, the fundamental growth drivers that powered last year's rally are still rock solid.

Translation? The AI revolution isn't a passing fad – it's reshaping how companies operate and grow.

Trending Stocks 🔥

Rivian Automotive - The stock popped 24.5% after the EV maker’s vehicle production and deliveries for 2024 met previously announced guidance.

U.S. Steel - Shares fell 6.5% following President Joe Biden’s decision to block Japan’s Nippon Steel from acquiring U.S. Steel. Biden proposed the $15 billion takeover would create risks for the nation’s supply chain.

Block - The fintech stock added 6% following an upgrade to outperform from market perform at Raymond James. The investment firm believes the stock’s valuation remains attractive at current levels.

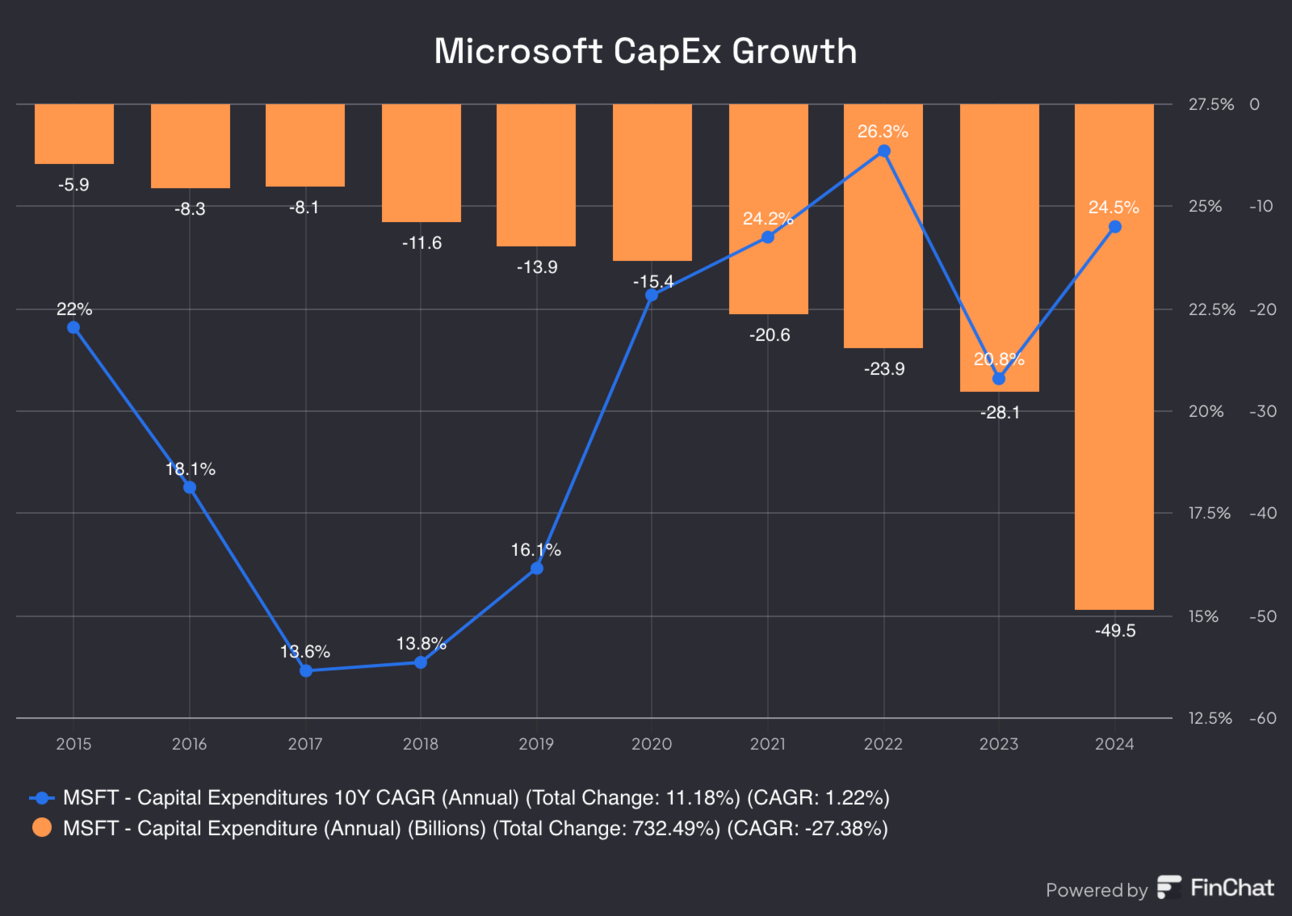

Microsoft’s $80B AI Bet

Hold onto your investment hats, folks! Microsoft dropped a bombshell that could reshape the entire AI landscape. Let's break down this massive move and what it means for your investment strategy.

The Big Numbers for MSFT:

$80 billion planned for AI data centers in FY2025

Over 50% of spending is targeted in the U.S.

The current quarter's cloud revenue is up 33% (with AI contributing 12 percentage points)

🤔 Why This Is a Big Deal:

Remember when cloud computing was the "next big thing"? This is like that moment but on steroids. Microsoft isn't dipping its toes in the AI pool—it's throwing a cannonball.

The AI Arms Race Heats Up:

Microsoft has already invested $13B+ in OpenAI

They're working with rising stars like Anthropic and xAI

They're integrating AI across their product suite (Windows, Teams, you name it)

Here's where it gets interesting:

Wall Street analysts expected about $63.2B in infrastructure spending from the tech giant. Microsoft said, "Hold my beer," and added another $17B to that estimate. That's 42% year-over-year growth, substantially above expectations.

Brad Smith (Microsoft's Vice Chair) dropped some fascinating insights about the global AI race 👇

China's offering subsidized chips to developing nations

They're promising to build local AI data centers

The U.S. needs to move "quickly and effectively" to stay ahead

💡 What This Means For Investors:

The AI revolution isn't slowing down – it's accelerating

Infrastructure players (think data centers, chip makers, and energy providers) could see sustained demand

The battle for global AI dominance could create new investment opportunities

Smart Money Watch:

Microsoft's CFO Amy Hood hinted that capital expenditures will increase next quarter. Translation? This isn't a one-time splash – it's a long-term commitment.

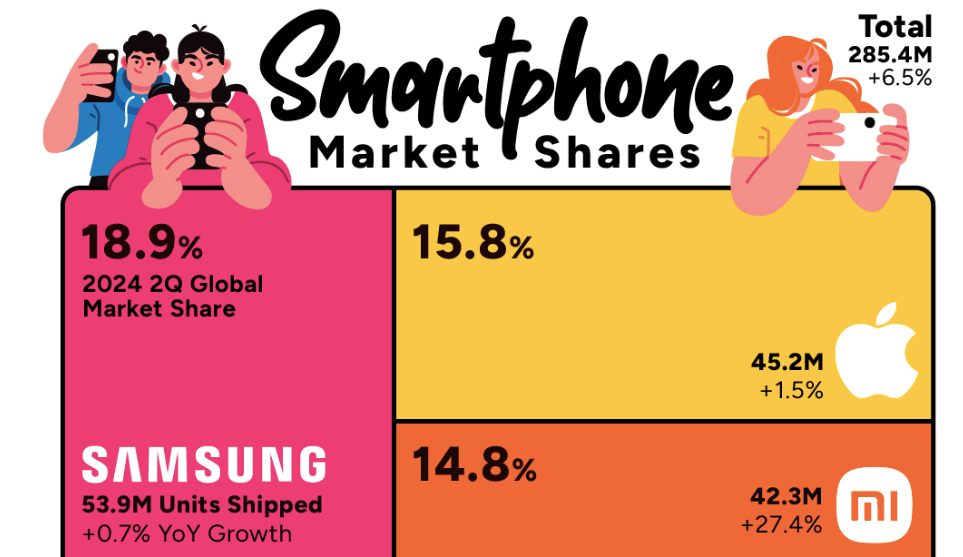

Apple's China Challenge

The numbers are from China, which tells a compelling story about the shifting tides in the world's largest smartphone market.

China’s Shocking Numbers:

Foreign phone shipments crashed to 3.04M units in November

That's a brutal 47.4% drop year-over-year

Even worse: It is 51% down from October

Apple is the heavyweight champion of foreign phone sales in China. When foreign phone sales take a hit, Apple mainly feels the punch.

The Huawei Comeback:

Remember when U.S. sanctions were supposed to knock Huawei out of the game? Well, plot twist: Huawei is making a stunning comeback, and its high-end phones are flying off shelves.

Apple's got a fascinating dilemma. Their new iPhone 16 promises cool AI features. BUT... Apple Intelligence isn't available in China yet. Meanwhile, local rivals are already showing off their AI tricks

What This Means For Investors:

The Chinese smartphone market is evolving rapidly

Local brands are no longer just "good enough" alternatives

Even tech giants need to adapt to local market demands

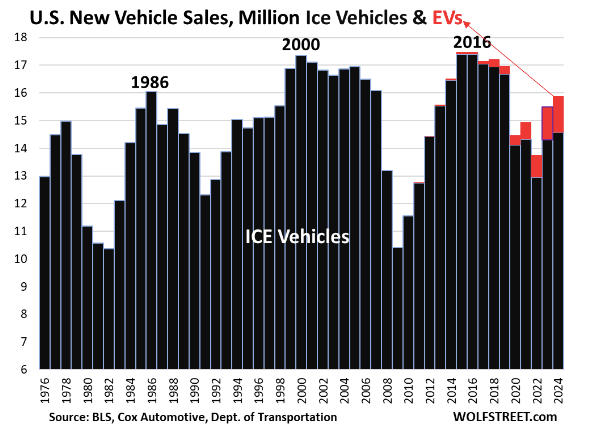

Auto Sales Rebound In 2024

U.S. auto sales roared back to nearly 16 million units in 2024—the best performance we've seen since the pre-pandemic glory days of 2019. But what's fascinating is that it's not just about the numbers; it's about who's winning and why.

General Motors is still wearing the crown, moving 2.7 million vehicles (up 4.3%) with a spectacular 50% jump in EV sales. Ford's not far behind, with its "electrified" lineup (both EVs and hybrids) surging 38.3%, accounting for 13.7% of total sales.

Meanwhile, our Asian friends are crushing it - Toyota moved 2.3 million vehicles, Honda's up 8.8%, and Hyundai and Kia hit record sales.

But not everyone's popping champagne. Stellantis (remember when we called them Chrysler?) is having a rough time, with sales plunging 15%.

Even their iconic Jeep brand skidded 9% lower. The story here? Those who've embraced electrification are thriving, while those dragging their feet are feeling the pain.

Looking ahead, S&P Global Mobility expects auto sales to reach 16.2 million in 2025. The message is clear: the auto industry isn't just recovering—it's evolving.

The winners will be those who can balance traditional offerings with electric innovation. The race is on, and this transition could be where the real opportunities lie for investors.

Headlines You Can't Miss!

UBS expects S&P 500 index to gain 12% in 2025

Cerence rallies over 50% on expanded Nvidia partnership

Alcohol stocks fall after new advisory citing cancer risk

Wolfe Research is bullish on Chewy, upgrades stock

Bitcoin network settled $19 trillion worth of transactions in 2024

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.