- 3 Big Scoops

- Posts

- Meta Disappoints Wall Street

Meta Disappoints Wall Street

Meta, Chipotle, and Ford

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

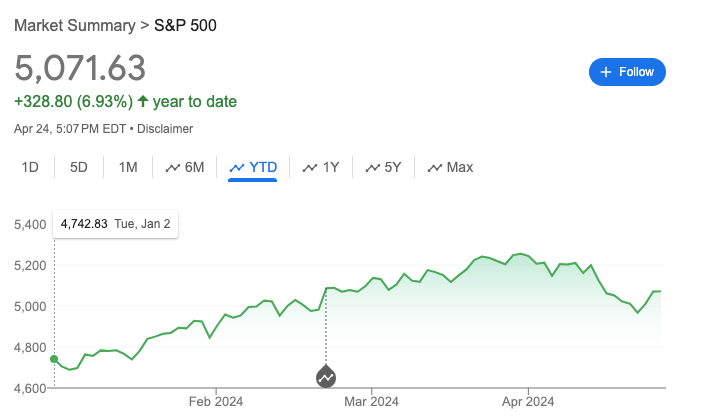

S&P 500 @ 5,071.63 (⬆️ 0.021%)

Nasdaq Composite @ 15,712.75 ( ⬆️ 0.10%)

Bitcoin @ $64,208.80 ( ⬇️ 2.03%)

Hey Scoopers,

Happy Thursday! Here’s what we are covering today:

👉 Meta stock loses $200 billion

👉 Chipotle beats estimates

👉 Ford ticks higher

So, let’s go 🚀

Market Wrap 📉

The S&P 500 index was rangebound on Wednesday as interest rate fears continue to stem investor enthusiasm amid a strong slate of Q1 earnings.

Over 25% of S&P 500 companies have reported Q1 earnings, of which 79% have beaten earnings forecasts.

However, the benchmark 10-year Treasury note topped 4.67%, while the rate on the 2-year note surpassed 4.95%, pressuring stocks.

Traders will closely watch the Q1 reading of the U.S. GDP (gross domestic product), which is due today before the market opens. Economists expect the real GDP at 2.4%.

Data for the personal consumption expenditures (PCE) price index will be issued on Friday. The PCE is the Fed’s preferred inflation gauge and is forecast to rise 2.6% year over year.

Trending Stocks 🔥

International Business Machines - The global tech giant is down over 8.5% in pre-market trading after it reported revenue of $14.46 billion in Q1, lower than estimates of $14.55 billion.

Boeing - Shares of the airline manufacturer slid close to 3% as it reported an adjusted loss of $1.13 per share on revenue of $16.57 billion. Analysts forecast sales at $16.23 billion with adjusted earnings of $1.76 per share.

Airbnb - The vacation property rental platform added over 1% after Mizuho upgraded the stock from neutral to buy. Mizuho expects the launch of sponsored listings and incremental demand from the Summer Olympics to drive financials for Airbnb.

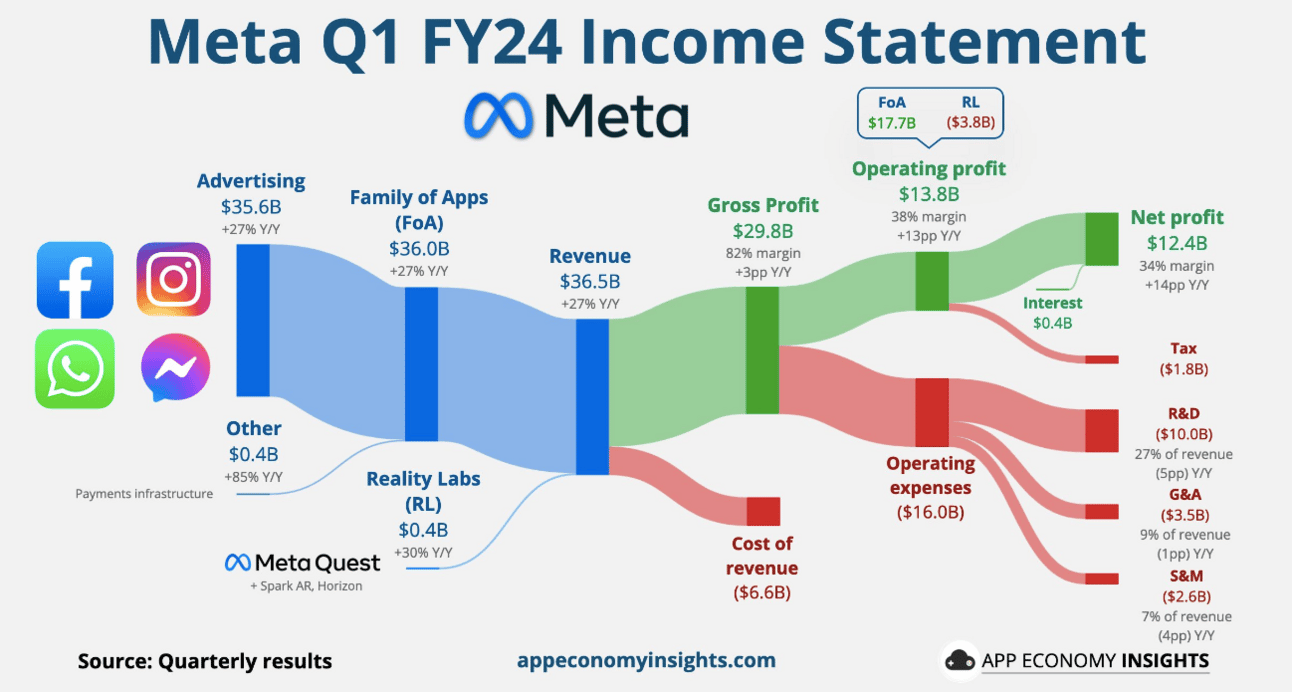

Meta Stock Tanks Over 15%

Meta stock is down more than 15% in pre-market trading today after the social media giant issued a light forecast even as it beat Q1 estimates. In the March quarter, Meta reported:

👉 Revenue of $36.46 billion vs. estimates of $36.16 billion

👉 Earnings per share of $4.71 vs. estimates of $4.32

Revenue surged 27% year over year, the fastest rate of expansion since 2021, while net income more than doubled from $2.20 per share in the year-ago period, as marketing costs slid over 16%.

Ad sales, which account for the majority of Meta’s business, jumped 27% to $35.64 billion in Q1.

The tech heavyweight is benefiting from a stabilizing economy and higher spending from China-based discount retailers such as Temu and Shein that have been pumping money into Facebook and Instgram to reach a wide base of users.

Meta forecasts Q2 sales between $36.5 billion and $39 billion, compared to estimates of $38.3 billion. Moreover, it expects capital expenditures to range between $35 billion and $40 billion, higher than its previous forecast of between $30 billion and $37 billion.

The sell-off in Meta stock can be attributed to higher investments in segments such as artificial intelligence, mixed reality, and glasses.

Meta’s Reality Labs unit, which houses the hardware and software required to develop the metaverse, reported sales of $440 million and operating losses of $3.85 billion. Since the end of 2020, the segment has lost over $45 billion.

Chipotle Reports Sales of $2.7 Billion

Shares of Chipotle Mexican Grill are up more than 3% in pre-market after it beat Q1 estimates on the back of higher traffic. In the March quarter, the restaurant giant reported:

👉 Revenue of $2.7 billion vs. estimates of $2.68 billion

👉 Earnings per share of $13.37 vs. estimates of $11.68

The company’s net sales grew by 14.1% year over year as it added 47 new locations to its footprint in the March quarter. The restaurant chain’s growth story is far from over, as it aims to double the total number of locations to 7,000.

For 2024, Chipotle expects same-store sales to grow by a mid-to-high single-digit percentage and reiterated its forecast to open between 285 and 315 new locations this year.

Further, Chipotle enjoys pricing power as it continues to report rising transactions despite higher menu prices. The company raised prices last October to combat inflation, while peers have turned to limited-time offers and deals to attract lower-income consumers.

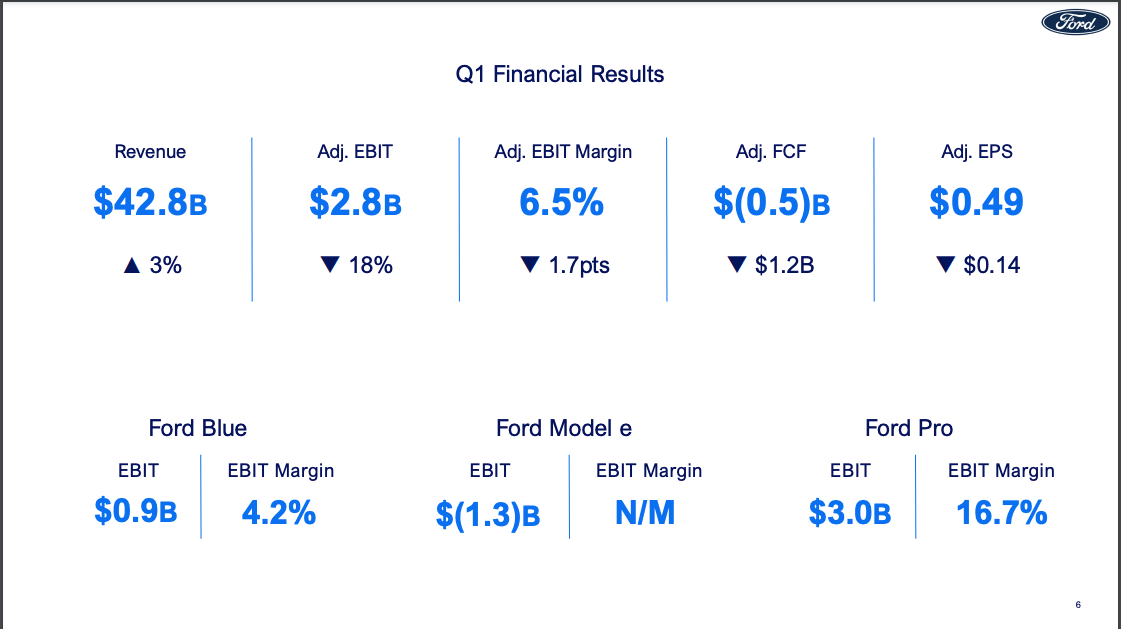

Ford Beats Earnings Estimates in Q1

Shares of Ford Motor are up 2.4% in pre-market today as the automobile manufacturer beat earnings estimates in Q1, where it reported:

👉 Automotive revenue of $39.89 billion vs. estimates of $40.1 billion

👉 Earnings per share of $0.49 vs. estimates of $0.42

The company’s total sales, which includes its credit business, rose 3% to $42.78 billion in Q1 of 2024.

Source: Company Presentation

Ford now expects its EV business to lose between $5 billion and $5.5 billion in 2024. However, it expects to lower total costs by $2 billion through reductions in expenses such as materials, freight, and manufacturing.

Headlines You Can't Miss!

Barclays swings back to profit

Japanese yen hits fresh 34-year low

SK Hynix reverses losses due to explosive AI demand

China may have to brace for new bond defaults

Will Binance’s cofounder Changpeng Zhao go to prison?

Chart of The Day

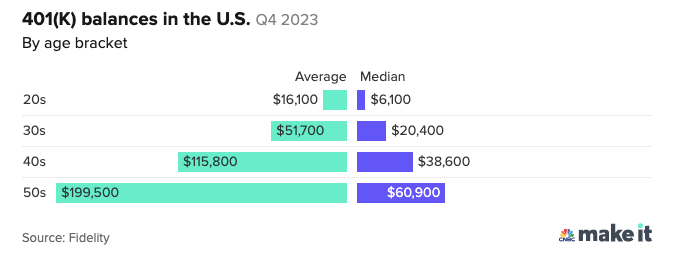

If you’re in your 40s and have saved over $40,000 for retirement, you’re ahead of most people in this age bracket.

According to data from Fidelity Investments, the median 401(k) balance for people between the ages of 40 and 49 is $38,600.

Fidelity emphasizes you should aim to grow your retirement nest egg to at least three times your annual salary in your 40s. So, if you earn $75,000 each year, your retirement account should have at least $225,000.

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.