- 3 Big Scoops

- Posts

- 🗞 Markets Tumble on Tariff Concerns

🗞 Markets Tumble on Tariff Concerns

PLUS: Gold surges to record highs

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,580.94 ( ⬇️ 1.97%)

Nasdaq Composite @ 17,322.99 ( ⬇️ 2.70%)

Bitcoin @ $83,825.10 ( ⬇️ 2.11%)

Hey Scoopers,

Happy Monday! Here’s what we’re covering today:

👉 Wall Street remains bullish

👉 Gold’s spectacular bull run

👉 CoreWeave disappoints on market debut

So, let’s go 🚀

Market Wrap

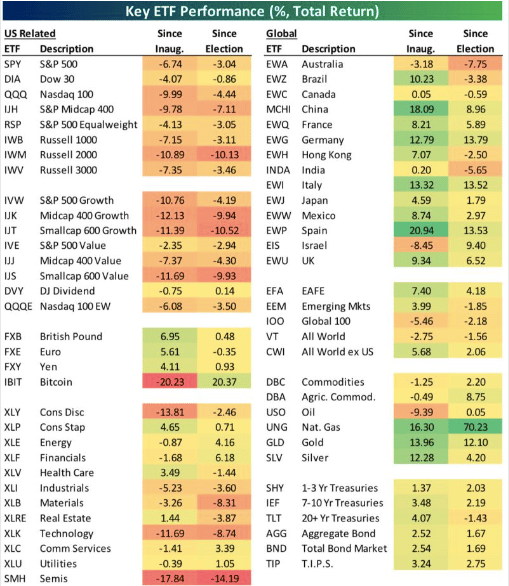

Stocks plunged sharply on Friday as investors grappled with uncertainty over U.S. trade policy and disappointing inflation data.

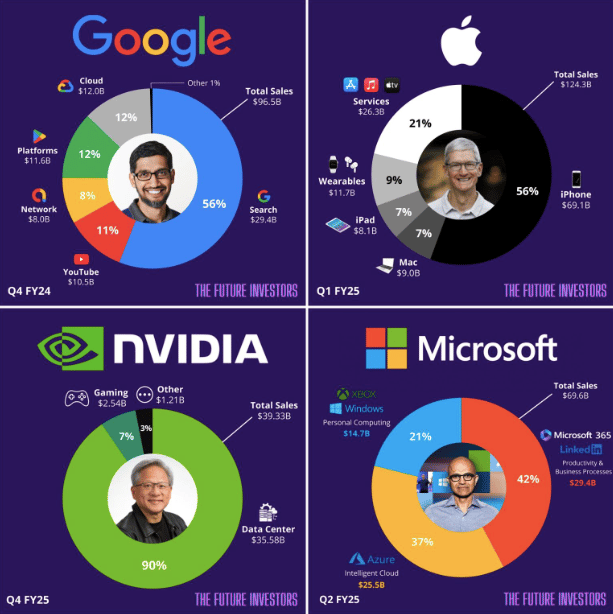

The Dow Jones Industrial Average dropped 1.69%, while the S&P 500 fell 1.97%, marking its fifth weekly decline in six weeks. The tech-heavy Nasdaq Composite suffered the steepest drawdown, tumbling 2.7% to 17,322.99.

Technology giants led the market downward, with Alphabet shedding 4.9%, while Meta and Amazon each lost 4.3%. The sell-off intensified after economic reports showed:

February's core PCE price index rose 2.8% year-over-year, exceeding economist expectations of 2.7%

University of Michigan's consumer sentiment survey revealed the highest long-term inflation expectations since 1993

The market turbulence comes amid escalating trade tensions, with investors anxiously awaiting President Trump's additional tariff announcements, which are expected this week.

Canada has already promised retaliatory measures following Trump's recent 25% tariff on imported vehicles, while the EU is reportedly considering concessions to reduce reciprocal tariffs.

The Supply Chain Crisis Is Escalating — But This Tech Startup Keeps Winning

Global supply chain chaos is intensifying. Major retailers warn of holiday shortages, and tech giants are slashing forecasts as parts dry up.

But while others scramble, one smart home innovator is thriving.

Their strategic move to manufacturing outside China has kept production running smoothly — driving 200% year-over-year growth, even as the industry stalls.

This foresight is no accident. The same leadership team that saw the supply chain storm coming has already expanded into over 120 BestBuy locations, with talks underway to add Walmart and Home Depot.

At just $1.90 per share, this resilient tech startup offers rare stability in uncertain times. As investors flee vulnerable companies, this window is closing fast.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Trending Stocks 🔥

RocketLab - The aerospace manufacturer fell 1.1% even as the U.S. Space Force listed the company as one of the firms entered in its pool of launch providers.

Braze - The cloud software stock added over 2% after it reported adjusted earnings per share of $0.12, above estimates of $0.05. It posted a revenue of $160.4 million vs. estimates of $155.7 million.

Lululemon - Shares of the athleticwear company plunged more than 14% after the firm issued 2025 guidance that disappointed analysts.

Analysts Maintain a Bullish Outlook on Stocks

Despite the S&P 500's recent 4.4% decline since late February, industry analysts maintain an optimistic outlook for the index.

Their aggregated forecasts suggest the S&P 500 could see a 21.3% price increase over the next twelve months, based on the difference between the bottom-up target price of 6,904.84 and the March 27 closing price of 5,693.31.

The technology sector leads projected gains with analysts expecting:

Information Technology: +30.4%

Consumer Discretionary: +27.0%

Communication Services: +25.1%

Meanwhile, defensive and cyclical sectors trail with more modest projections:

Consumer Staples: +11.1%

Energy: +12.0%

Financials: +12.2%

What's particularly striking is that while the index has fallen by 4.4% since February's end, analysts have trimmed their bottom-up target price by a mere 0.5%.

This hesitancy to adjust forecasts downward might suggest that analysts view the recent market pullback as temporary, with strong fundamentals still supporting significant upside potential.

Trade Tensions Push Gold Prices Higher

Gold prices have catapulted to unprecedented heights, with spot gold reaching a historic $3,059.30 per ounce on March 27, 2025 – marking the metal's 17th record high this year alone.

The precious metal has surged 13.6% since January, breaking through the psychological $3,000 barrier as investors seek safe havens amid growing economic uncertainty.

President Trump's recent announcement of a 25% tariff on imported vehicles has accelerated gold's upward trajectory.

These tariff measures, perceived as inflationary, have intensified global trade tensions and driven investors toward traditional safe-haven assets.

Key factors supporting gold's remarkable performance include:

Sizeable central bank purchases, particularly from Asian nations

Robust ETF inflows reaching $9.4 billion in February (highest since March 2022)

Total gold ETF holdings climbing to 3,353 tonnes, with assets under management hitting $306 billion

Major financial institutions have responded with increasingly bullish outlooks, with Goldman Sachs raising its end-2025 forecast to $3,300 per ounce and Bank of America projecting $3,350 by 2026.

However, analysts caution that potential U.S. fiscal tightening or reduced geopolitical tensions could temper gold's meteoric rise.

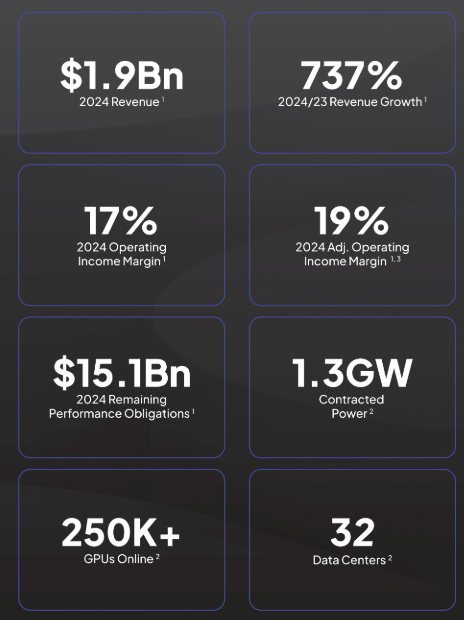

CoreWeave’s IPO Fails to Impress

CoreWeave, the first pure-play AI infrastructure company to go public, closed at $40 in its Nasdaq debut on Friday, just $1 above its opening price and matching its IPO price—which had already been reduced from the initial target range of $47-$55.

Despite the muted performance, the company successfully raised $1.5 billion, marking the largest tech IPO in the U.S. since UiPath in 2021.

CoreWeave’s Financials and Growth

The offering faced headwinds, launching on a day when the Nasdaq plunged nearly 3%.

CoreWeave's business model centers on renting access to hundreds of thousands of Nvidia GPUs to AI companies, including:

Microsoft (its largest customer, accounting for 62% of $1.92 billion revenue)

Meta

IBM

Cohere

Despite explosive revenue growth of 737% last year, CoreWeave reported an $863 million net loss, reflecting the capital-intensive nature of operating data centers. The company has accumulated nearly $13 billion in debt, primarily for GPU purchases.

Notably, Nvidia anchored the IPO with a $250 million order, highlighting its relationship with CoreWeave as both supplier and customer.

Market observers are watching closely to see if CoreWeave's debut will encourage other AI companies, such as Databricks and Hinge Health, to pursue public offerings.

Headlines You Can't Miss!

Japan’s Nikkei slumps over 3%

Hang Seng Tech Index slides into correction territory

Goldman Sachs wary of Trump tariffs

Novo Nordisk’s diabetes pill slashes cardiovascular risk

Mara Holdings plans $2 billion stock offering to buy Bitcoin

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.