- 3 Big Scoops

- Posts

- 🗞 Mag 7 Continues to Disappoint

🗞 Mag 7 Continues to Disappoint

PLUS: Nike fails to impress

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,667.56 ( ⬆️ 0.08%)

Nasdaq Composite @ 17,784.05 ( ⬆️ 0.52%)

Bitcoin @ $84,303.43 ( ⬆️ 0.41%)

Hey Scoopers,

Happy Monday! Here’s what we’re covering today:

👉 Big Tech trails the S&P 500

👉 Nike tanks post earnings

👉 Analysts remain bullish on stocks

So, let’s go 🚀

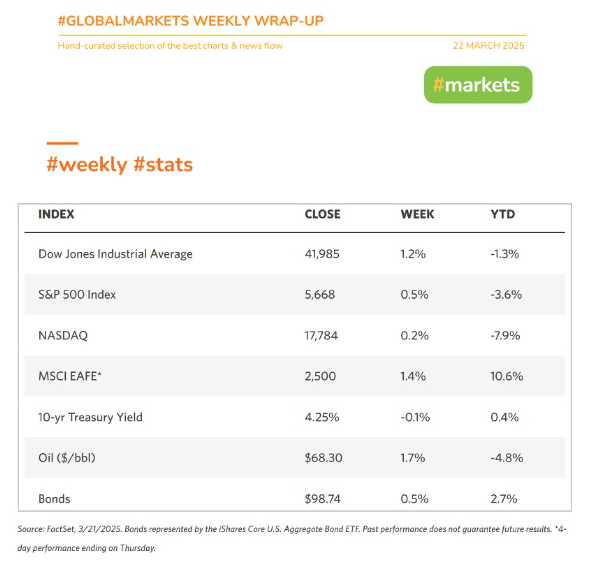

Market Wrap

The S&P 500 edged higher on Friday, ending a four-week losing streak with a modest 0.5% weekly gain.

During the "quadruple witching" session, markets showed volatility when approximately $4.7 trillion in options contracts expired.

Stocks recovered from early losses after President Donald Trump hinted at "flexibility" with tariffs, though he maintained that reciprocal tariffs would still take effect at the April 2 deadline.

Economic concerns persisted as key bellwethers faltered. FedEx dropped 6.5% after cutting its earnings outlook, citing "weakness and uncertainty in the U.S. industrial economy."

Nike fell more than 5% after warning that tariffs and declining consumer confidence would hurt quarterly sales.

The S&P 500 remains nearly 8% below its record high as companies increasingly report uncertainty around planning and investment decisions due to trade policy turmoil.

Meanwhile, Donald Trump has again called for Federal Reserve interest rate cuts, citing concerns about his administration's upcoming tariffs that will begin to "transition their way into the economy."

In a Truth Social post on March 20, Trump argued that the Fed would be "MUCH better off CUTTING RATES" as his tariffs impact the economy.

The Federal Reserve has revised its economic outlook, lowering 2025 GDP growth projections to 1.7% from 2.1% while raising inflation expectations.

Trending Stocks 🔥

Boeing, Lockheed Martin - Defense contractor Lockheed Martin sold off nearly 7% after President Donald Trump chose Boeing instead for a contract to create the next-generation fighter jet. Boeing shares surged almost 5%.

Cleveland-Cliffs - The steel producer declined 2% after a report stated it would temporarily idle two factories, resulting in hundreds of job cuts. That decision comes as automakers have reduced orders amid uncertainty tied to President Donald Trump’s tariff policies.

FedEx - Shares tumbled more than 8% after the parcel delivery company slashed its full-year guidance, citing “continued weakness and uncertainty” in the U.S. industrial economy.

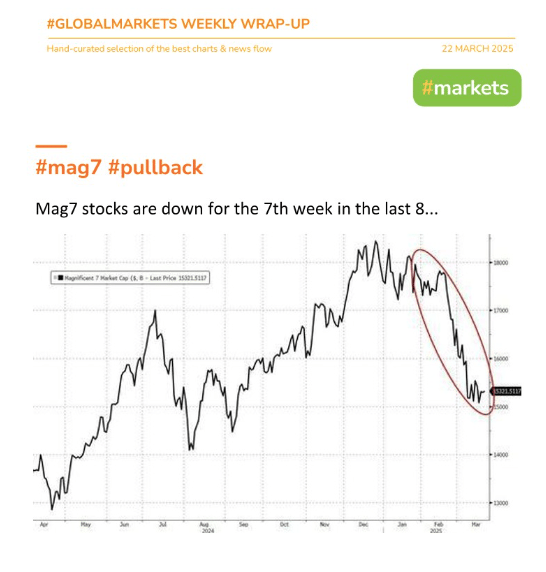

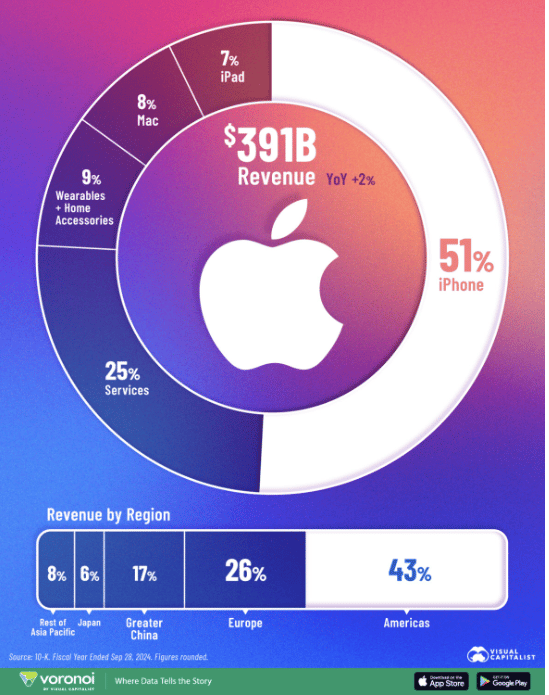

Mag 7 Is Struggling In 2025

The "Magnificent Seven" tech giants have faced significant losses just months into 2025, with six companies tracking substantial year-to-date declines.

Tesla leads the downturn with a dramatic 40% drop, while Meta Platforms remains the sole member, maintaining a slim gain.

This tech sell-off comes despite the initial post-election rally following Donald Trump's victory and the industry's strong presence at his January inauguration.

Macroeconomic uncertainty, recession fears, and concerns over tariff impacts have driven a broader market decline, pushing all major averages into negative territory for 2025.

Earlier this month, the megacaps collectively lost over $750 billion in market value during the Nasdaq's worst day since 2022.

Even AI leader Nvidia hasn't been immune. It has dropped nearly 14% this year and shed almost a fifth of its value since January's record high. The former $3 trillion company has lost $767 billion in market capitalization.

Other notable declines include:

Alphabet down more than 14% this year

Microsoft on its worst losing streak since 2008

Tesla losing approximately $780 billion in market value

Apple shedding nearly $700 billion

Amazon headed for its longest weekly losing streak since 2022

Meta experiencing five consecutive negative weeks

These losses underscore the volatility facing tech giants as economic concerns overshadow their previous momentum.

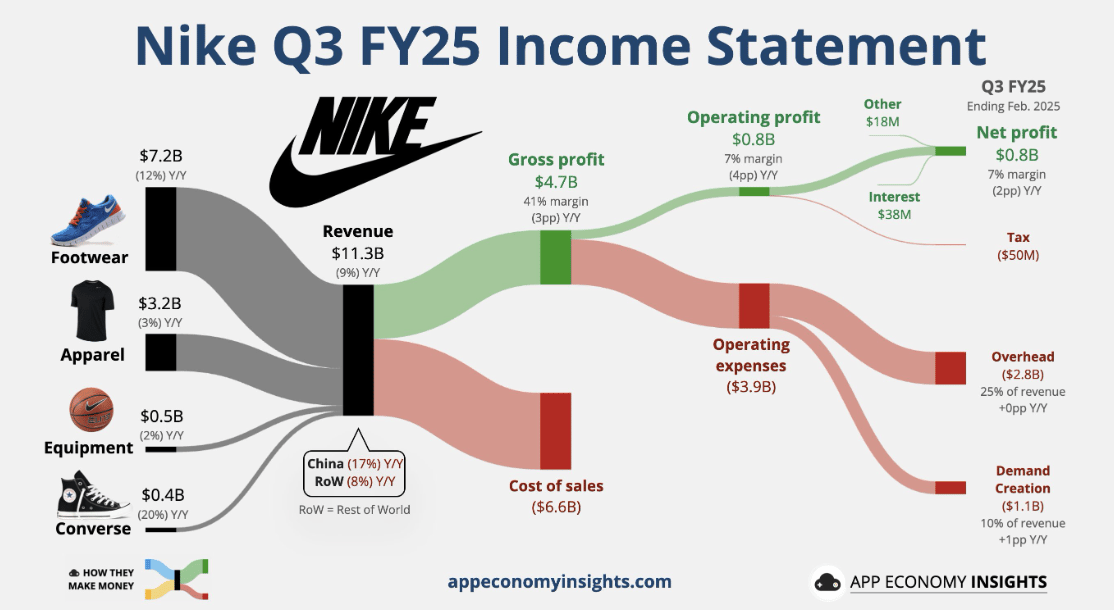

Nike Warns of Double-Digit Sales Drop

Nike shares fell more than 5% on Friday after the sportswear giant warned of a significant sales decline in its current fiscal quarter, which ends in May.

The company expects revenue to drop at the "low end" of the "mid-teens range" as it navigates multiple challenges, including new tariffs, declining consumer confidence, and continued inventory struggles.

Despite beating Wall Street's expectations for its fiscal third quarter with earnings of $0.54 per share on revenue of $11.27 billion, Nike's profit fell 32% from the year-ago period.

Nike’s gross margin decreased by 3.3 percentage points to 41.5% as it ramped up efforts to liquidate excess inventory and stale styles.

CEO Elliott Hill, who returned to Nike last year, acknowledged the progress made in his turnaround efforts but admitted, "While we met the expectations we set, we're not satisfied with our overall results."

Nike’s comeback faces additional headwinds from President Trump's 20% tariff on Chinese imports, with approximately 24% of Nike's suppliers located in China.

During the quarter, sales dropped 9%, with China seeing a steep 17% decline. North American sales fell 4% to $4.86 billion, though this exceeded analyst expectations.

Nike is focusing its recovery on innovation, with promising early results from new product launches like the Pegasus Premium and Romero 18.

The company is also pursuing female consumers through its recently announced NikeSKIMS partnership with Kim Kardashian's brand.

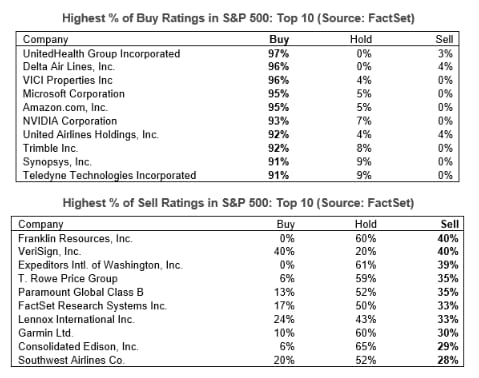

Wall Street Is Bullish on the S&P 500

Wall Street analysts are showing increased optimism toward S&P 500 stocks as the second quarter approaches, with Buy ratings reaching their highest level in nearly three years.

Of the 12,320 total ratings on S&P 500 components, 55.7% are Buy ratings, exceeding the five-year average of 55.0%. If this holds through month-end, it will mark the highest percentage of Buy ratings since August 2022.

Meanwhile, Hold ratings (38.7%) and Sell ratings (5.6%) sit below their five-year averages.

The Energy sector has the highest percentage of Buy ratings at 65%, followed closely by Information Technology and Communication Services at 63%.

Three "Magnificent 7" companies—Microsoft, Amazon, and NVIDIA—rank among the top ten stocks with the highest percentage of Buy ratings.

On the bearish side, analysts remain most skeptical about Consumer Staples, which has both the lowest percentage of Buy ratings (41%) and the highest rate of Hold ratings (52%). The utilities sector has the highest percentage of sell ratings at 9%.

This growing optimism represents a significant shift from late October 2024, when Buy ratings had fallen to 53.6%.

Headlines You Can't Miss!

Elon Musk hits out at vandals

StubHub files for IPO

BoE expected to keep interest rates steady

CoreWeave to raise over $2.5 billion in market debut

Crypto’s long battle with SEC comes to a close

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.