- 3 Big Scoops

- Posts

- 🗞 Is Uber Undervalued?

🗞 Is Uber Undervalued?

A bull case for the ride-hailing giant

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,909.03 ( ⬇️ 1.11%)

Nasdaq Composite @ 19,489.68 ( ⬇️ 1.89%)

Bitcoin @ 96,557.81 ( ⬇️ 4.6%)

Hey Scoopers,

Today’s edition unveils our first pick of 2025, Uber Technologies. So, let’s see why we are bullish on the ride-hailing giant.

Hire Ava, the Industry-Leading AI BDR

Your BDR team is wasting time on things AI can automate. Our AI BDR Ava automates your entire outbound demand generation so you can get leads delivered to your inbox on autopilot.

She operates within the Artisan platform, which consolidates every tool you need for outbound:

300M+ High-Quality B2B Prospects, including E-Commerce and Local Business Leads

Automated Lead Enrichment With 10+ Data Sources

Full Email Deliverability Management

Multi-Channel Outreach Across Email & LinkedIn

Human-Level Personalization

An Overview of Uber

Uber Technologies is a global technology platform that revolutionizes how people and goods move through cities.

It operates three main segments:

Mobility, which connects riders with drivers for services like car rides, motorbikes, and taxis)

Delivery, which links consumers with restaurants and stores for food, grocery, and other deliveries), and

Freight, which connects shipping companies with carriers for logistics services.

Uber's smartphone app has created a vast network spanning multiple continents, transforming traditional transportation and delivery models.

What started as a simple ride-hailing service in 2009 has evolved into a comprehensive mobility and logistics ecosystem serving millions of users worldwide.

After touching an all-time high of $86.34 in October, the stock has pulled back about 25% to $66. Here's why this dip might be your opportunity to grab a seat in one of tech's most compelling growth stories.

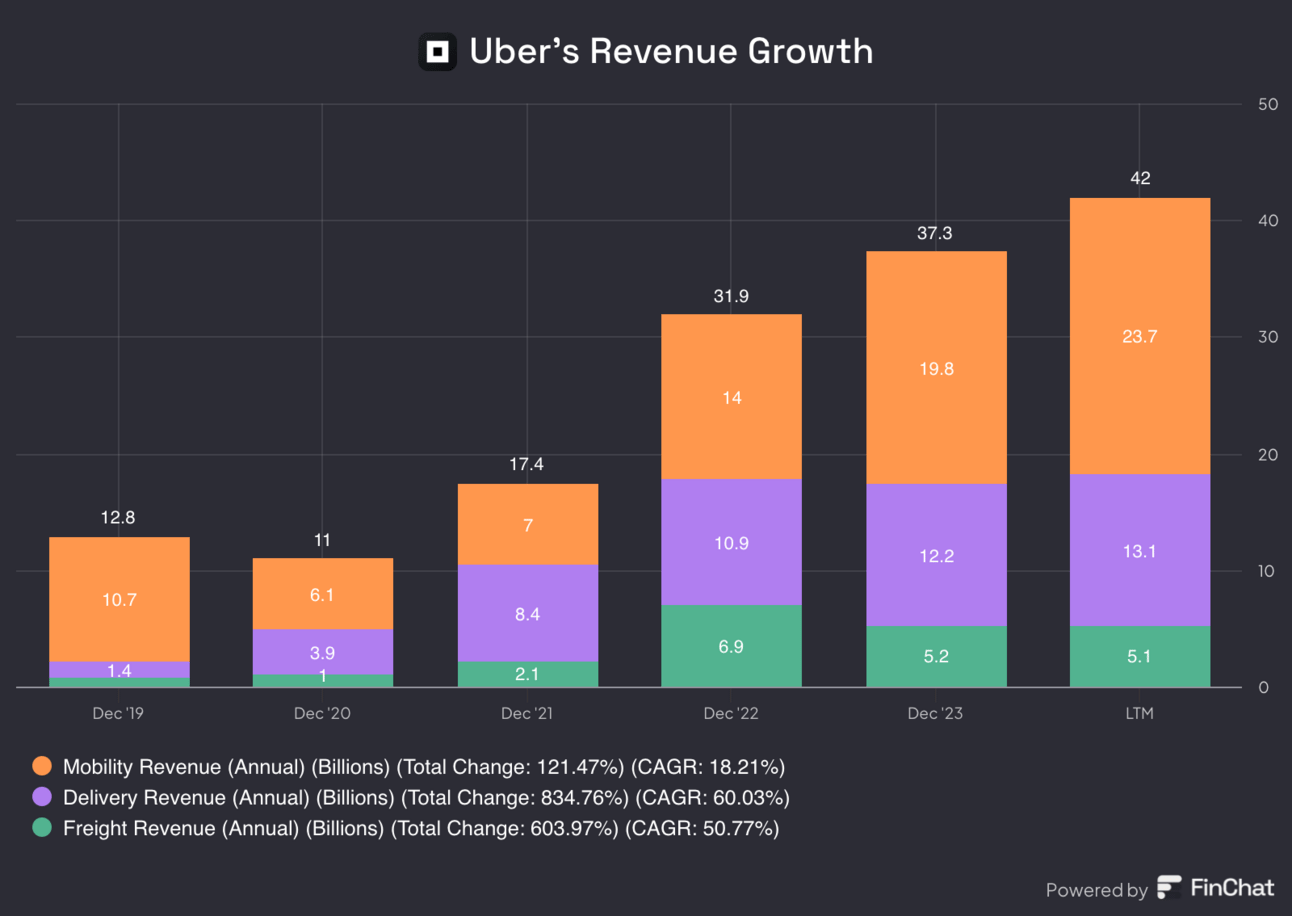

The Growth Engine That Could 📈

Let's start with the numbers that matter. Uber has grown its monthly active platform customers (MAPCs) from 91 million in 2018 to 161 million in Q3’24.

To put that in perspective, that's like adding two United Kingdom’s worth of customers in just six years.

The company's growth trajectory is even more impressive when you look at the key metrics:

2018-2023 Performance:

Gross bookings CAGR: 23%

Revenue CAGR: 27%

Total trips: 31 million per day across 10,000+ cities

Recent Performance (First 9 months of 2024):

Trips growth: 20% YoY

Gross bookings growth: 18% YoY

Revenue growth: 17% YoY

Market Dominance That Matters 🏆

Uber isn't just growing - it's dominating:

75% market share in U.S. ride-sharing

25% global market share

23% U.S. food delivery market share (second only to DoorDash's 67%)

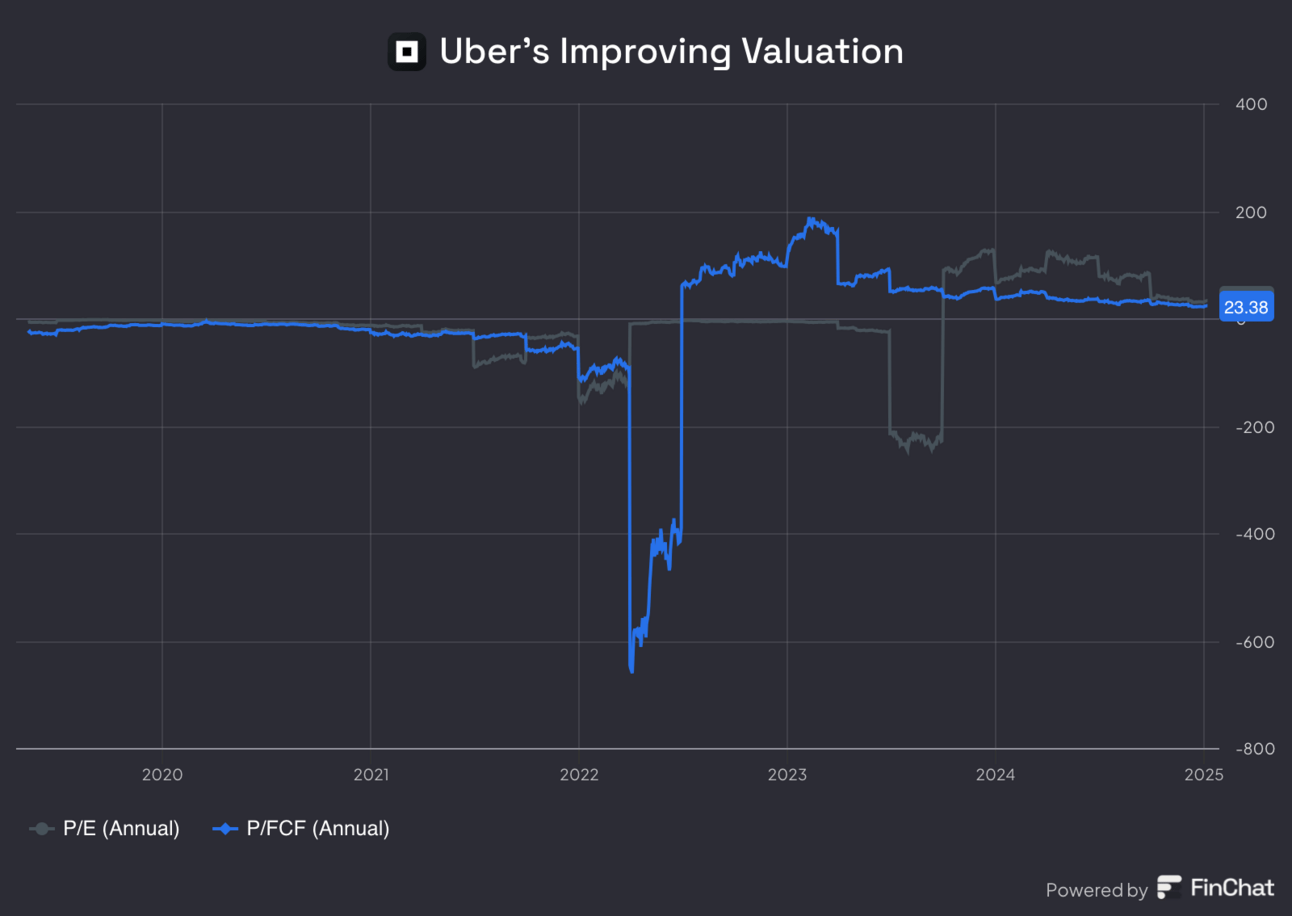

The Profit Transformation 💰

Here's where the story gets really interesting. Uber has transformed remarkably from a cash-burning startup to a profit machine.

In 2019, Uber reported an operating loss of $4 billion and negative free cash flow. In the last 12 months, its operating income was $2.7 billion, and its free cash flow was $6 billion, indicating an FCF margin of over 14%.

The Secret Weapon: Uber One 🎯

Remember how Amazon Prime transformed Amazon's business? Uber One is following the same playbook.

Uber One is a subscription service that provides members with multiple benefits (discounts, priority access, ride credits) across Uber rides and Uber Eats.

Subscription Plans for Uber One

Monthly Membership: Priced at $9.99 (or equivalent in local currency).

Annual Membership: Available for $96, offering a discount compared to the monthly plan.

Uber One has 25 million members, which is up 70% year over year. Notably, members spend 4x more than non-members and account for 40% of total bookings.

What Next for Uber? 🚗

Uber isn't sitting still and has successfully diversified revenue streams over the years. For instance, its ad sales touched a revenue run rate of $1 billion in Q3, growing 80% year over year.

Here’s what Wall Street expects from Uber 👇

Revenue to grow from $37.3 billion in 2023 to $51 billion in 2025

Earnings per share to expand from $0.87 in 2023 to $2.5 in 2025

Free cash flow to increase from $3.36 billion in 2023 to $8 billion in 2025

So, priced at 26.4x forward earnings and 17.5x free cash flow, Uber stock is cheap and should beat the broader markets in 2025 and beyond.

The Bear Case (And Why It Might Be Wrong) 🐻

Critics point to two main risks:

Fed's slower rate cut timeline affecting growth stocks

FTC probe into Uber One's subscription practices

However, the FTC investigation only targets enrollment and cancellation policies, not the core service.

Uber has already proven it can thrive in high-rate environments, as demonstrated by its 2022-2023 performance.

The Bottom Line 🎯

The ongoing pullback in Uber stock presents an attractive entry point for long-term investors. With its industry-leading market share, improved profitability, multiple growth drivers, and reasonable valuations, Uber is a quality growth investment.

Your Move 🤔

Consider using this pullback to initiate or add to a position in Uber. As always, follow our 80/20 portfolio rule: 80% in low-cost index funds and up to 20% in individual stocks like Uber.

Position sizing is crucial. Consider starting with a 2-3% position and potentially adding further weakness.

What are your thoughts on Uber's prospects? Hit reply and let me know!

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.