- 3 Big Scoops

- Posts

- Invest Like a Pro 💰

Invest Like a Pro 💰

Lessons from Warren Buffett, Peter Lynch, and more

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,010.60 ( ⬆️ 0.87%)

Nasdaq Composite @ 15,451.31 ( ⬆️ 1.11%)

Bitcoin @ $66,549.80 ( ⬆️ 0.46%)

Hey Scoopers,

Happy Tuesday! Today, we take a look at the investment lessons offered by some of the legends on Wall Street.

So, let’s go 🚀

Learn From the Best

One of the smartest ways to learn anything is to study the very best in the field – the people who have long, strong winning streaks. Lucky for you, I’ve put together six lessons from six investment legends that you can start using today.

Warren Buffett: Think like an owner

Warren Buffett doesn’t just play the stock market. When he buys shares, he considers himself a part-owner in the company, believing in the business and intending to stay for the long haul.

That’s why he invests only in companies with rock-solid fundamentals, top-notch management, and a competitive edge that can be maintained for decades. He’s not obsessed with short-term performance, immediate growth opportunities, or how trendy the business is.

Source: Forbes

The Oracle of Omaha wants to know a company inside out and be sure it has what it takes to thrive for generations. (Remember: his favorite holding period is “forever”).

Here’s an example of his “think like an owner” mantra. Buffett started buying Coca-Cola shares in 1988. He liked its enduring brand strength, worldwide distribution network, and ability to generate consistent profits.

He still holds those shares today – and at a nice profit. A $1,000 stake in Coca-Cola in 1988 would be worth $57,000 now.

To channel your inner Buffett, treat each stock purchase as if you’re actually buying the whole company and intending to pass it down to your grandchildren.

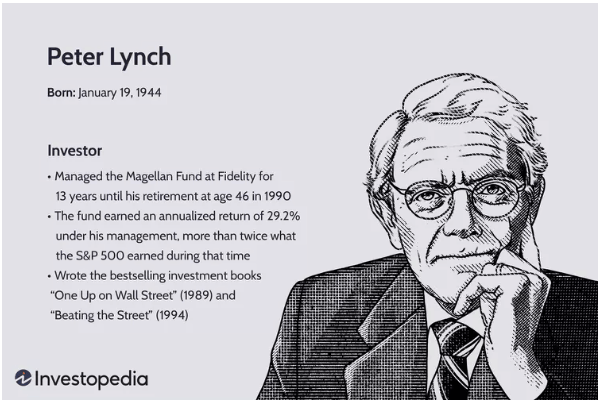

Peter Lynch: Your observations are investment opportunities

Peter Lynch would encourage you to use what you know and what you notice to find overlooked investment opportunities. It’s important that you really “get” what a company does, what it sells, and how much it could grow by seeing it for yourself or knowing a lot about its field.

It’s worked for him: Lynch turned a casual observation into a lucrative investment when he noticed his wife’s preference for L’eggs pantyhose by Hanes.

He quickly realized that this product stood out for its innovative supermarket distribution. This simple insight led him to uncover a gem hiding in plain sight well before it appeared on the radar of Wall Street analysts.

Channel your inner Lynch by using your personal observations (maybe you’ve noticed a product or service that seems way better than its competition) to spark investment ideas or by focusing on sectors or industries that you know inside out. Then, validate those insights with thorough financial analysis.

Seth Klarman: Wait patiently for the perfect hit and ignore everyone else

Hedge fund legend Seth Klarman champions a cautious approach that’s about sniffing out undervalued gems and buying them with a hefty margin of safety.

He’s not about chasing the latest trend or sweating over how his portfolio stacks up against the indexes or other investors in the short term. Nah. He focuses on the bigger prize: securing solid, absolute returns that stand tall regardless of the market’s ups and downs.

And he’s got no problem sitting on cash until the right opportunity knocks: he’s the embodiment of patience and precision in investing.

Klarman’s opportunistic approach means he sometimes ventures into territories that are less trodden. For example, he snapped up PG&E’s debt at the height of its wildfire-induced turmoil, taking advantage of some bargain basement prices.

He’s also been known to seize future drug sales rights when no one else was interested. Klarman swings wherever and whenever the opportunity lies.

Channel your inner Klarman by setting some cash aside to use only when an opportunity is too good to pass up (you’ll find those typically come along when everyone’s extremely fearful).

Don’t worry if others are making lots of money in the market in the meantime – resisting the FOMO temptation is a good exercise in itself.

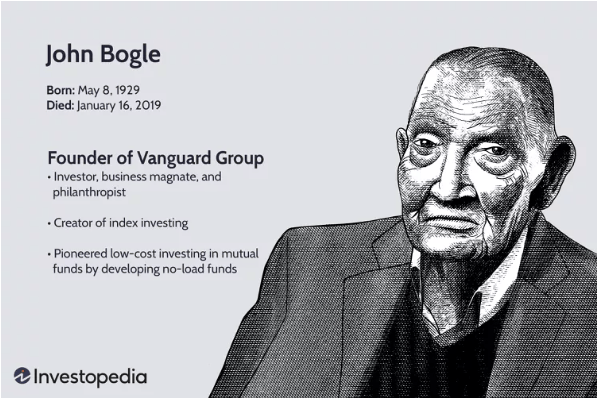

John Bogle: Keep it Simple (and cheap), Stupid

Why try to beat the market when you can be the market? John Bogle’s brainchild, Vanguard, pioneered low-cost index funds, making it possible for everyday investors to ride the market’s waves passively – and with minimal fees.

His logic was ironclad: costs matter, big time. Every penny forked over in fees is a penny not compounding on your behalf, which, over decades, adds up to a sizeable chunk of potential earnings.

Besides, as Bogle noted, many people try to outsmart the market, and it’s a fool’s errand for most - both because the market is efficient (i.e., a step ahead) and because of the higher costs associated with active management’s attempts to outperform.

His strategy is simple: keep it passive, keep costs low, and let the market do its thing. That means investing in a broad swath of the market through low-cost index funds, spreading your risks, and sidestepping the pitfalls of overpaying for the elusive promise of superior returns.

Channel your inner Bogle by investing most of your stock allocation in a cheap, diversified, global shares index ETF instead of trying to pick which stocks you think will do best in the next year.

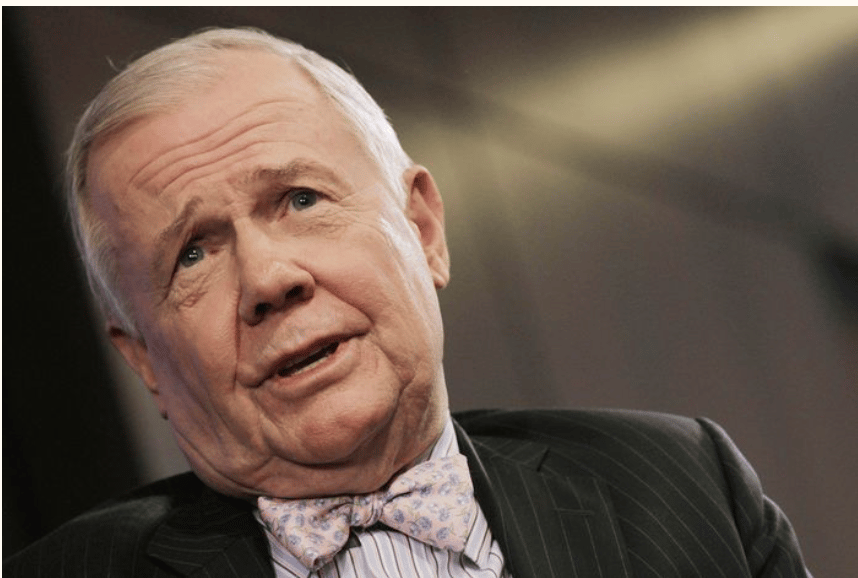

Jim Rogers: Get Outside Your Comfort Zone

Jim Rogers looks at investments with a wide global lens, zeroing in on the big picture to snatch opportunities wherever they may arise.

He believes that identifying and understanding huge, structural macroeconomic trends like commodity cycles and demographic shifts can be crucial to finding lucrative investment opportunities before others.

The way Rogers sees it, investing isn’t just about spreading your bets; it’s about spreading your horizons, too.

His contrarian streak often leads him to bet on the investment world's underdogs, from overlooked natural resources companies to emerging market shares poised for a rebound. He takes a long-term but active approach, so his portfolio may differ greatly from one year to another.

Channel your inner Rogers by learning about different asset classes, regions, or strategies. Pick a structural theme and do your homework, getting to know not just the theme but also the investment opportunities it could create.

The green energy transition or the shift from monetary policy to fiscal stimulus and its likely impact on the different asset classes would be very Roger-esque ideas to start with.

Ray Dalio: Build an all-weather portfolio

Ray Dalio’s “all-weather” portfolio originated from a simple (but important) question he pondered with his team at Bridgewater Associates: what kind of investments would do well no matter what’s happening in the economy?

This led his hedge fund to a strategy that’s all about stability and spreading investments across different things so they’re not all affected in the same way by economic changes.

If you have no idea what the future will hold and want to invest with your eyes closed for a decade, the all-weather portfolio might be just the thing.

To ensure his portfolio can truly handle anything, Dalio splits investments into four categories:

👉 Stocks for when the economy is growing and inflation is low

👉 Bonds for when the economy and inflation are weak

👉 Commodities for when growth and inflation are higher and

👉 Inflation-linked securities for when the economy is down but inflation is up

To make sure his portfolio is equally exposed to each macro environment, he sizes each asset class based on how much it moves and how different it is from the others.

Embrace your inner Dalio by ensuring your portfolio can navigate diverse economic scenarios. It doesn’t have to mimic Dalio’s all-weather portfolio, but diversification beyond stocks is generally a wise move.

What’s the Opportunity Here?

Those are six solid scripts, but you don’t have to stick rigidly to any one of them. Feel free to blend and adapt them, using their wisdom as a springboard.

For a smart move that encompasses all their insights, you could consider a core-and-satellite approach: craft a resilient, cost-effective, all-weather portfolio as your foundation, then orbit it with satellite investments inspired by the greats.

Crucially, forge and refine your own unique strategy. Who knows? Your method might be the next one I share.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.