- 3 Big Scoops

- Posts

- Investing in Real Assets

Investing in Real Assets

Real estate, infrastructure, and commodities

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,178.51 ( ⬆️ 0.56%)

Nasdaq Composite @ 16,166.79 ( ⬆️ 0.39%)

Bitcoin @ $62,065.70 ( ⬇️ 2.76%)

Hey Scoopers,

Happy Wednesday. Let’s conquer the midweek hustle. Today, we look at the pros and cons of investing in real assets.

So, let’s go 🚀

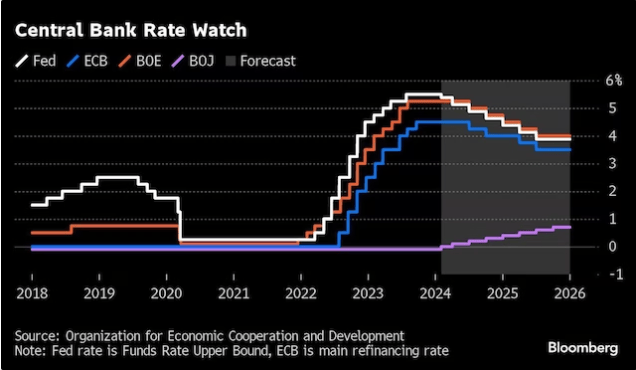

We’re living in a time when inflation has reached levels not seen in decades, and so investors have sought assets that offer attractive returns that can help mitigate its corrosive effects.

Real assets – physical assets that have a tangible value, such as infrastructure, real estate, commodities, or precious metals – have been touted as ideal investments for these times.

They either offer inflation-linked income streams (e.g., real estate and infrastructure) or are assets that themselves are a key driver of higher prices (e.g., commodities).

While inflation remains well above central bank targets, the past 18 months have provided an ideal environment to review how effective these assets have really been in helping to offset their impact.

Real assets performance

Navigating the past two years has been treacherous for investors. If inflation can be characterized as a sickness afflicting the global economy, both financial markets and central banks were initially slow to diagnose and treat this ailment.

We can view the performance of real assets across three distinct stages during this period through the same lens.

Investigation and diagnosis – inflation is high, but will it go away on its own?

Real assets initially performed well. With markets still believing that inflation was transitory, demand for inflation-linked cash flows was high, while there was limited focus on the impact of rising yields on asset valuations.

However, as central banks and markets started to realize that inflation wasn’t transitory, the first cracks in markets and real assets started to emerge.

Real estate was the most obvious example of this. Rising bond yields led investors to question what impact this might have on valuations despite leases that are usually inflation-linked. Listed real estate investment trusts (REITs) saw their discounts to asset valuations increase.

For assets such as infrastructure, "cushions" in asset valuations for rising bond yields provided comfort that, even if rates did rise, investors were being compensated, while inflation-linked income supported performance.

Areas of the market, such as renewable infrastructure, performed well – reflecting both inflation-linked cash flows and their exposure to rising power prices.

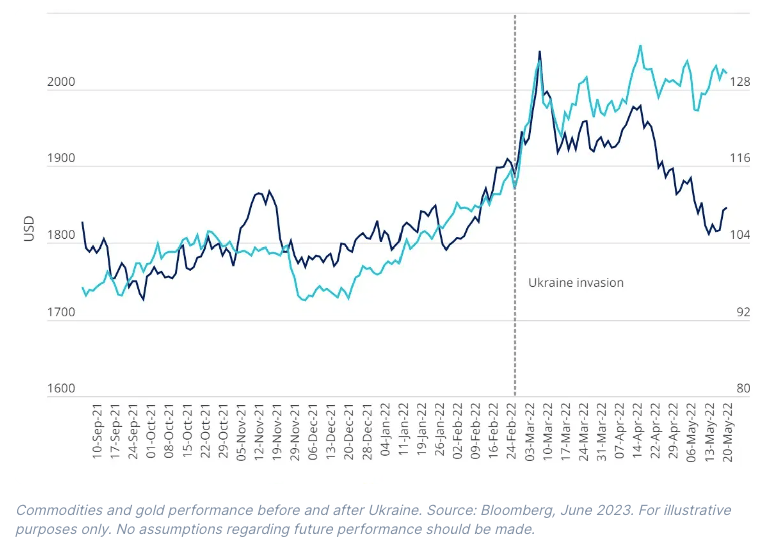

Commodities, a leading driver of high prices, also performed well, especially in the months following Russia’s invasion of Ukraine in early 2022. Gold was more mixed, performing well on the same geopolitical events but weakening as the US dollar strengthened in anticipation of interest rate rises.

The medicine of rate rises – watch out for nasty side effects

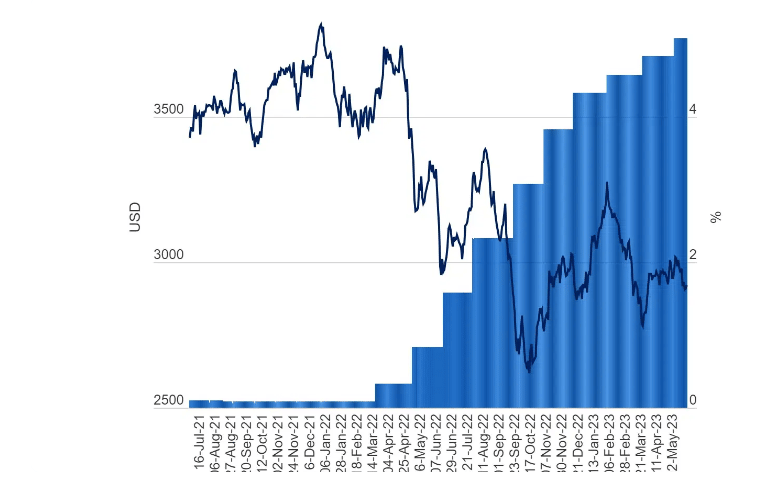

Central banks provided multiple doses of rate rises to fight inflation. However, nobody was quite sure if or when these would work. Market volatility increased for almost all asset classes. But the most obvious casualty was the bond market, which suffered due to rates rising globally. Real assets, meanwhile, continued to see divergent performance.

Real estate suffered further as investors didn’t just have to think about valuations but also balance sheet risks as debt costs spiked. In addition, investors also started to question how sustainable those coveted inflation-linked cash flows would be if economic growth weakens.

Source: Bloomberg

Underlying infrastructure valuations continued to be robust, although investors did become more discerning between assets – those with inflation-linked, defensive cash flows were in most demand.

However, after even more doses of rate hikes, investors did start to question if these inflation-linked cash flows could still offset the impact of higher bond yields on asset valuations.

Commodities and gold continued to be mixed as the initial shock that drove commodity prices higher began to ease, while gold felt the impact of further rate hikes and a strong US dollar.

More doses needed – could the side effects get worse?

Investors initially felt that the worst was over with the medicine of rate hikes starting to work. However, it soon became apparent that this was overly optimistic, with inflation stubbornly resistant. Further rate hikes followed with many investors focused on how severe the side effects could get.

Gold performed well, reflecting optimism that the end of rate hikes was close, while the risk of recession increased. Commodities continued to be mixed as concerns over lower future demand weighed on prices.

A new dynamic also started to play out. Real assets with an inflation linkage had looked very attractive, while bond yields were low for most of the past decade.

However, with higher bond yields, the relative attraction of real assets appeared more muted for many investors who started to feel that the worst of this bout of inflation was behind them. Portfolio repositioning created some indigestion for infrastructure and real estate.

Do real assets mitigate inflation risks?

Inflation has proven more persistent than most expected, and we’ve yet to find out if central banks have delivered enough rate hikes to cure it.

However, this period allows us to analyze how effective real assets have been in providing inflation-linked returns. To us, the clear conclusion is that real assets are not all linked to inflation in the same way:

Real estate

This asset class has faced multiple challenges. Inflation-linked revenues alone have been ineffective when offset by falling valuations and rising debt costs. Listed REITs now trade at relatively large discounts to asset values that reflect at least some of this pain.

However, this asset class still needs a lot of healing. Therefore, while opportunities may start to emerge in assets with structural drivers, such as logistics and residential, a healthy dose of caution is required.

Infrastructure

This asset class did what many investors had hoped for during large parts of this period of high inflation. Inflation-linked revenues protected income, while asset valuations and the demand for these assets have remained robust.

Although there is more competition from fixed income within portfolios (which has weighed on recent performance), the risk of persistent inflation remains high. Therefore, we think there continue to be clear reasons as to why investors should retain an allocation.

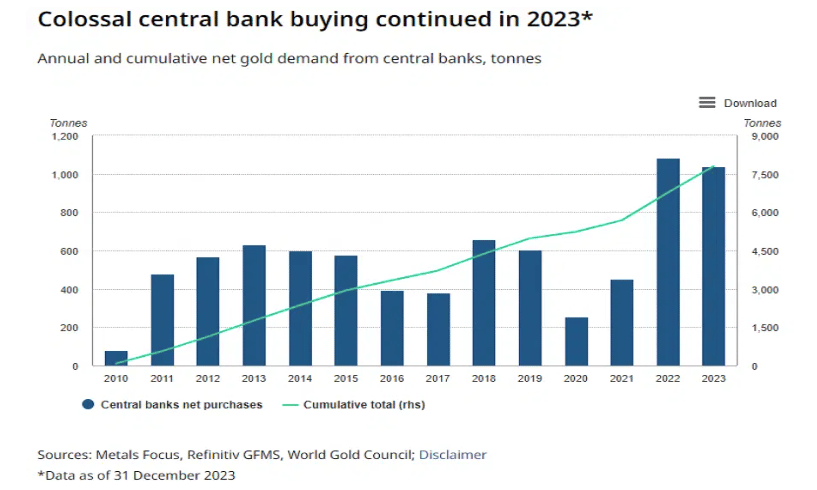

Precious metals and commodities

Neither asset class has provided consistent protection from inflationary pressures or from the second-order effects of inflation. However, we do see reasons why having an allocation to gold or precious metals in portfolios might still make sense, with inflation running high and the increased risk of a recession in the medium-term outlook.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research