- 3 Big Scoops

- Posts

- Portfolio Building: 101

Portfolio Building: 101

From $1k to $100k 💸

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,078.18 ( ⬆️ 0.17%)

Nasdaq Composite @ 16,035.30 ( ⬆️ 0.37%)

Bitcoin @ $57,270.50 ( ⬆️ 0.34%)

Hey Scoopers,

Happy Wednesday! We are in the midst of a busy week, so let’s take a breather.

In today’s newsletter, we look at the ways you can build your portfolio from scratch.

So, let’s go 🚀

Let’s say you’ve finally got some cash to invest, and you’re ready to make the jump. Now, the big question is how to build a portfolio for the long term.

And the answer depends not just on your goals and constraints but also on the amount of money you have to invest.

So, let’s take a look at how you might build a solid long-term portfolio, whether you’ve got $1,000, $10,000, or $100,000.

So, where do you start?

There’s no “one-size-fits-all” here. The important thing in designing a long-term portfolio is that it fits where you are today. So let’s assume the following:

👉 You’ve got a relatively long investment horizon (say, a decade or more) and won’t need to draw money along the way. You’re realistic and hoping to make between 5% and 10% per year.

👉 You think you can stomach some bumps along the way, but – let’s be real – anything more than a 50% nosedive would probably freak you out.

👉 You’re ready to research and choose your own stocks, but what you really want to understand is what a long-term asset allocation might look like. That’s sensible: your mix of assets will determine as much as 90% of your long-term performance.

👉 You’re looking for a mostly set-it-and-forget-it approach, one that doesn’t require constant moves in and out of assets or complicated market-timing strategies.

👉 You don’t want your portfolio to rely too much on any single economic scenario and want to keep it as “neutral” as possible.

The $1,000 Portfolio

Let’s say you’ve got a grand to invest: that’s an awesome start. And, no, it’s probably not going to turn into a cool million overnight, but hey, all epic sagas begin with a single step.

Trust me, you’re going to pick up some priceless knowledge as you get your money moving.

With just $1,000 in the kitty, you’re going to want to keep a close eye on those pesky trading fees (we’re talking $5 to $15 a pop for ETF trades if you’re not on a freebie account). And that means keeping your plan focused.

Now, no one wants to take any massive investment hits, but if you’ve got some hustle and think you can stay on track even if you suffer some losses, it may be worth taking a reasonably ambitious approach with your modest pot. And that means skewing more toward stocks.

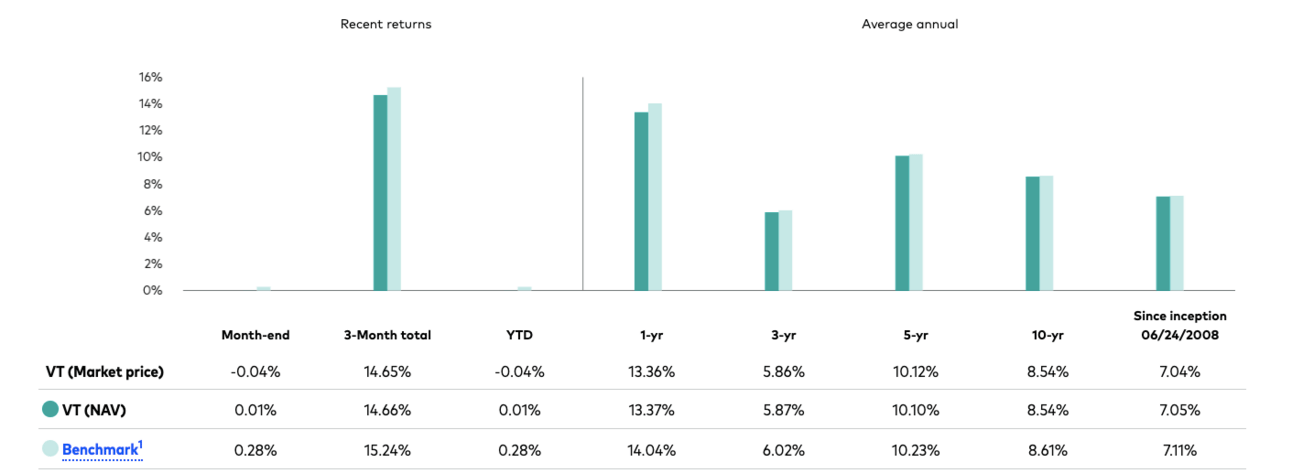

The simplest, most efficient play for that amount of money is to put it all in a fund like the Vanguard Total World Stock ETF (ticker: VT; expense ratio: 0.07%).

It’s heavy on US large-cap stocks (hovering around 60%), but you’d still be getting a taste of global action, with 30% in big Asian and European companies. And with that lean expense ratio, you’d be paying almost nothing in yearly costs.

Vanguard Total World Stock ETF Returns

Although it might not be the most exciting portfolio in the world, it’s probably going to give you the biggest bang for your buck, given your budget and risk tolerance.

If you’re itching to get your hands dirty with some stock-picking, though, you could consider splitting your bet – putting half in the ETF and half into two or three companies you like – ideally from different corners of the globe and different sectors.

Just a heads up: this route might increase your risk: outsmarting the simple ETF strategy is a tough gig. That said, the lessons learned could be priceless.

The $10,000 Portfolio

More money gives you more options (or mo’ problems, if Notorius B.I.G. is to be believed).

If you’ve got $10,000 to invest, you’ll still want to be careful about keeping your costs down. Holding more than ten ETFs and rebalancing them once a year (at $10 each) would set your portfolio back by more than 1% annually, enough to make a dent in your long-term compounded return.

For the lion’s share of your portfolio, you’re probably thinking around 60% in stocks. And with $10,000 in hand, you can afford to get a little more detailed in your approach, spreading your investments more evenly around the globe.

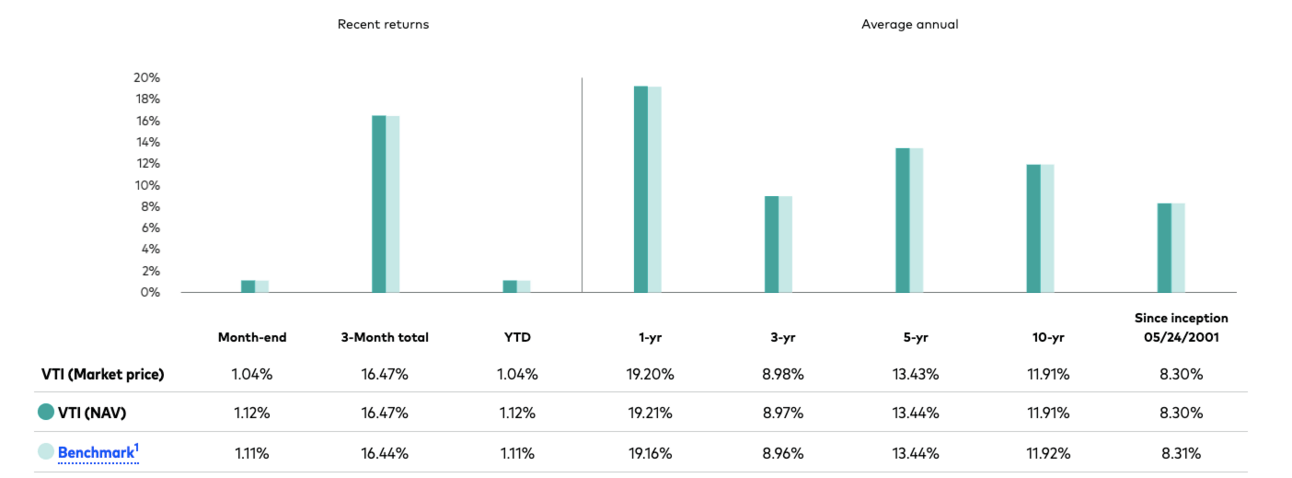

Vanguard Total Stock Market ETF Returns

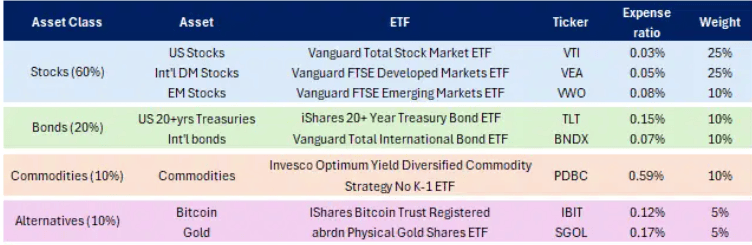

You might consider going for the Vanguard Total Stock Market ETF (VTI; 0.03%) for some US exposure (unlike the more popular Vanguard S&P 500 ETF, it has modest exposure to small and mid-cap stocks), the Vanguard FTSE Developed Markets ETF (VEA; 0.05%) for shares of companies from across developed countries, and the Vanguard FTSE Emerging Markets ETF (VWO; 0.08%) for that emerging market zing.

To put yourself in the sweet spot of diversification while not overcommitting to any region, you could put:

25% in US stocks,

25% in developed countries, and

10% in emerging markets

To offset the stock-heavy tilt and protect yourself in the event of some potentially rougher economic scenarios, you may want to snap up some government bonds.

Devoting, say, 20% of your portfolio to these traditionally safer assets could help you keep the ship a bit steadier. Half of that could go to the iShares 20+ Year Treasury Bond ETF (TLT; 0.15%): its longer-dated bonds would give you more bang for your buck.

The rest could go into the Vanguard Total International Bond ETF (BNDX, 0.07%), which invests in high-quality government and corporate bonds from other countries.

That leaves you with another 20% to invest. Both stocks and bonds struggle in high inflation scenarios, so you probably want to protect your portfolio a bit for that.

Carving out a 10% slice to put into commodities via the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC; 0.59%) is a smart option here. This clever ETF selects commodities based on their “roll yield” to enhance long-term returns and lower costs.

And then, there are the market’s wildcards – bitcoin and gold. You could decide to commit 5% of your portfolio to each, with the goal of hedging against the unpredictable effects that come from changes in central bank and government spending policies.

It might be a controversial choice, but if you ask me, there aren’t many other assets that would do well if paper currencies start losing their value. You can use the iShares Bitcoin Trust Registered (IBIT; 0.12%) for bitcoin (although I always opt to hold bitcoin via my own wallet) and the Physical Gold Shares ETF (SGOL; 0.17%) for gold.

For those who want a completely hands-off approach, the iShares Core Growth Allocation ETF (AOR; 0.15%), which invests 65% of the fund in stocks and 35% in bonds, or the iShares Core Aggressive Allocation ETF (AOA; 0.15%), which holds 80% in stocks and 20% in bonds, are easy, almost all-in-one funds.

They’re not as robust as the DIY version – and they don’t have any commodities or crypto – but for a straightforward, low-effort investment, they’re not a terrible option.

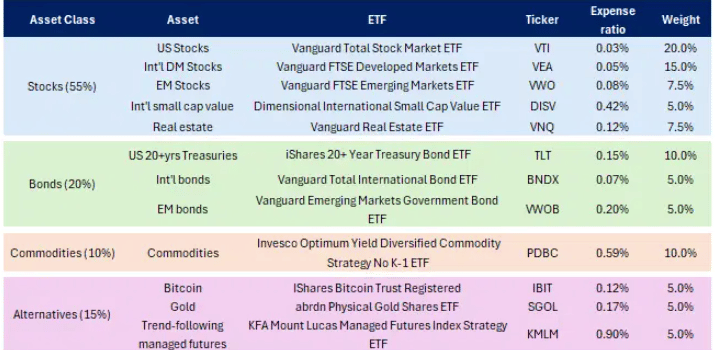

The $100,000 Portfolio

The bulk of your portfolio will look a lot like the $10,000 portfolio. But you’ve now got the money to make more calculated bets and add extra layers of diversification.

For instance, you could consider adding stocks trading at attractive valuations, like global, small-cap value stocks, such as the ones captured in the Dimensional International Small Cap Value ETF (DISV; 0.42%). A 5% allocation is a decent starting point.

You could also invest in real estate via a cheap, diversified option like the Vanguard Real Estate ETF (VNQ; 0.12%). That’s another 7.5%.

You may also want to consider devoting 5% to an emerging markets bond ETF like the Vanguard Emerging Markets Government Bond ETF (VWOB; 0.2%).

To add resilience, you could consider adding a trend-following strategy that can go both “long” (profiting from up markets) and “short” (profiting from down markets) across different assets.

This strategy tends to work particularly well when more conventional strategies falter, so it makes a great portfolio diversifier. Putting 5% into the KFA Mount Lucas Managed Futures Index Strategy ETF (KMLM; 0.9%) is a solid strategy here.

What should you do next?

A key thing to understand here is that there’s no universal, “perfect” portfolio. You may want to change up some of the assets I’ve included or tweak their weightings.

That’s fine. You can use the portfolio examples above as a sturdy jumping-off point and adjust it based on your beliefs, goals, and constraints.

It’s important to note, however, that those portfolios aren’t “all-weather” solutions – meaning, they’re unlikely to perform well in the most challenging macroeconomic environments.

They’re designed for that longer-term investor who has an appetite for risk, after all. But they’re arguably a much more robust option than a portfolio that’s invested exclusively in stocks – and US stocks, in particular.

In short, they’re a well-considered middle ground – a reasonable path that balances potential risks and rewards.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.