- 3 Big Scoops

- Posts

- 🗞 Google Delivers in Q3

🗞 Google Delivers in Q3

Alphabet, AMD, and PayPal

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

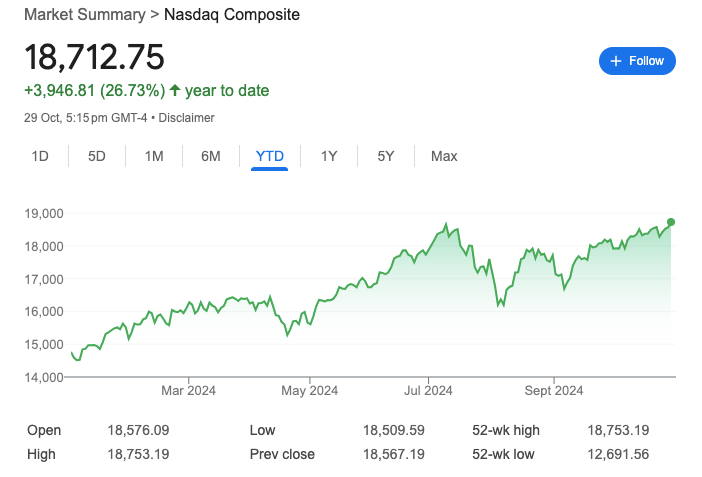

S&P 500 @ 5,832.92 ( ⬆️ 0.16%)

Nasdaq Composite @ 18,712.75 ( ⬆️ 0.78%)

Bitcoin @ $72,430.21 ( ⬆️ 1.22%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 Google beats estimates in Q3

👉 AMD disappoints Wall Street

👉 PayPal stock tanks

So, let’s go 🚀

Market Wrap

The Nasdaq Composite index rose to a fresh record on Tuesday as investors readied for key corporate earnings releases, including reports from notable tech names.

The major indices are trading at elevated multiples, which means investors expect earnings growth for Big Tech to accelerate and support high valuations.

The current week will be the busiest one this earnings season, with over 150 S&P 500 companies reporting quarterly results.

Traders continue to watch Treasury yields, as the benchmark 10-year Treasury yield rose to its highest level since July.

Investors should expect near-term choppiness with five trading days left before the U.S. presidential election.

Trending Stocks 🔥

Crocs - The footwear maker shed 19% despite posting better-than-expected results. In Q3, it reported revenue of $1.06 billion with earnings of $3.60 per share, compared to estimates of $1.05 billion and $3.10 per share, respectively.

Ford Motors - Shares of the automaker fell 8% after it guided to the low end of its previously announced full-year earnings guidance. It expects an EBIT of $10 billion as it wrestles with softening demand, rising inventory, and its ability to achieve cost cuts.

JetBlue Airways - The airline tumbled 18% after forecasting a larger-than-expected decline in sales for 2024. It also expects Q4 revenue to decline between 3% and 7%, while analysts forecast a drop of 1.4%.

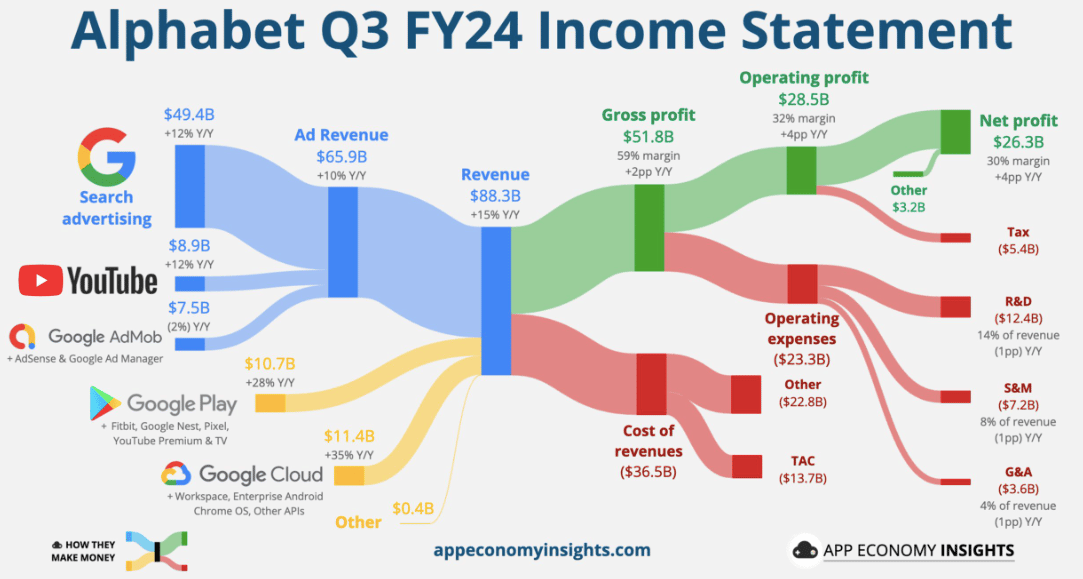

Google Beats Estimates

Google parent Alphabet reported Q3 earnings that beat consensus estimates, driving the stock higher by almost 6% in pre-market. In the September quarter, Alphabet reported:

👉 Revenue of $88.27 billion vs. estimates of $86.30 billion

👉 Earnings per share of $2.12 vs. estimates of $1.85

Here are some other key numbers for the tech giant:

YouTube ad sales of $8.92 billion vs. estimates of $8.89 billion

Google Cloud revenue of $11.35 billion, vs. estimates of $10.88 billion

Traffic acquisition costs of $13.72 billion vs. estimates of $13.53 billion

Alphabet’s revenue rose by 15%, primarily driven by cloud sales, which increased by 35% year over year. The company attributed its strong cloud results to AI offerings, which include subscriptions for enterprise customers.

Google’s search business generated $49.4 billion in sales, up 12.3% year over year, and remains the most significant contributor to revenue growth. Its ad sales stood at $65.85 billion, up from $59.65 billion last year, which shows that the ad business continues to grow.

Its Other Bets segment, which includes Alphabet’s life sciences unit Verily and self-driving car unit Waymo, reported revenue of $388 million in Q3, up from $297 million last year.

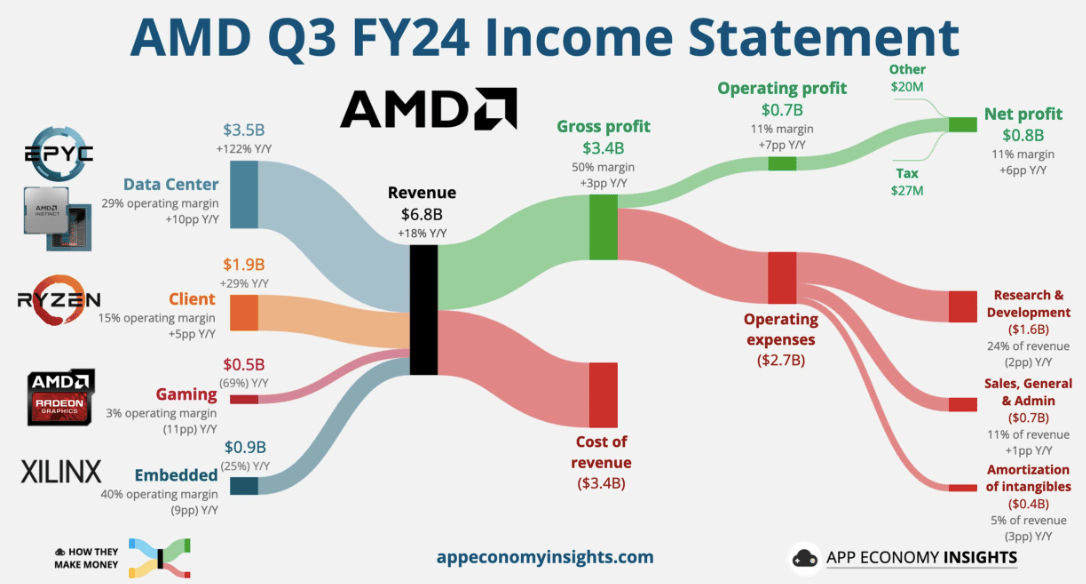

AMD Stock Tanks 7.6%

Semiconductor giant Advanced Micro Devices (AMD) is down over 7% in pre-market following its Q3 results, where it reported:

👉 Revenue of $6.82 billion vs. estimates of $6.71 billion

👉 Earnings per share of $0.92 vs. estimates of $0.92

AMD said its data center business doubled sales for the second consecutive quarter. However, the company still reported Q4 sales that aligned with consensus estimates.

AMD stock is up 20% in 2024, trailing rivals such as Nvidia and Broadcom, which have delivered greater returns this year due to strong demand for AI chips.

AMD is the second largest vendor of graphics processing units, or GPUs used to train and deploy generative AI models. Earlier this month, AMD released a new AI chip and projected the AI GPU market to be worth $500 billion by 2028.

The company expects AI chip sales to total $5 billion in 2024, up from its previous forecast of $4.5 billion. In Q3, its data center sales, which includes revenue from AI chips, rose 122% to $3.5 billion.

AMD also produces central processing chips for laptops and servers. Its client segment, which includes PC sales, rose by 23% in Q3 to $1.9 billion, while sales for the gaming category slumped by 68%.

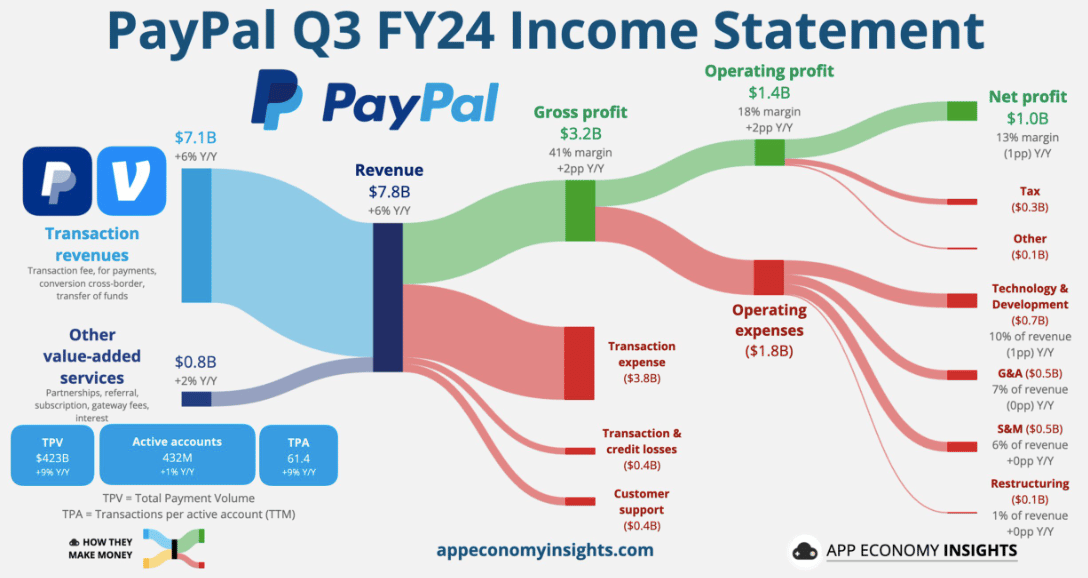

PayPal Provides a Soft Guidance

PayPal stock is down in pre-market after it provided softer guidance than analysts were anticipating for Q4. In Q3 of 2024, PayPal reported:

👉 Revenue of $7.85 billion vs. estimates of $7.89 billion

👉 Earnings per share of $1.20 vs. estimates of $1.07

In the current quarter, PayPal expects low single-digit growth, while analysts estimated the top line to grow by 5.4% to $8.46 billion. PayPal forecast EPS between $1.07 and $1.11, versus consensus estimates of $1.10.

In Q3, revenue increased 6% year over year from $7.42 billion last year. In recent quarters, PayPal has been wrestling with slowing growth due to rising competition and a declining take rate.

Savvy Investors Know Where to Get Their News—Do You?

Here’s the truth: there is no magic formula when it comes to building wealth.

Much of the mainstream financial media is designed to drive traffic, not good decision-making. Whether it’s disingenuous headlines or relentless scare tactics used to generate clicks, modern business news was not built to serve individual investors.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable insights that go beyond the headlines.

And the best part? It’s completely free. Join 1M+ readers and subscribe today.

Headlines You Can't Miss!

Volkswagen profit plunges 42% in Q3

UBS smashes Q3 earnings estimates

China’s property market might stabilize in 2025

China’s Xiaomi delivers 20,000 EVs in October

Spot Bitcoin ETFs attract $870 million

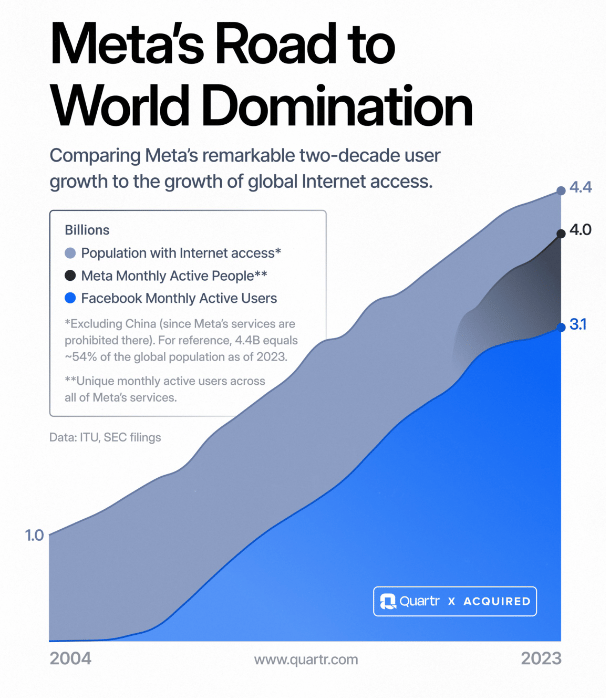

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.