- 3 Big Scoops

- Posts

- Foxconn Powers Tech Rally

Foxconn Powers Tech Rally

PLUS: Disney inks a streaming deal

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

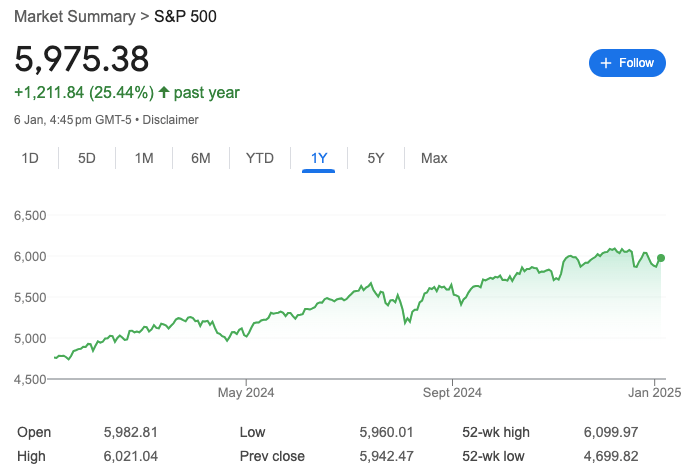

S&P 500 @ 5,975.38 ( ⬆️ 0.55%)

Nasdaq Composite @ 19,864.98 ( ⬆️ 1.24%)

Bitcoin @ $101,707.80 ( ⬆️ 2.88%)

Hey Scoopers,

Happy Tuesday. Here’s what we’re covering today.

👉 Foxconn stuns Wall Street

👉 FuboTV partners with Disney

👉 Bitcoin’s supply squeeze

So, let’s go 🚀

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Market Wrap

Hey, Scoopers!

The S&P 500 and Nasdaq started the week on a high note, with chipmakers stealing the show.

Here's what's driving markets

Semiconductor stocks are having a moment after Foxconn's stellar earnings (more on this later).

Nvidia (+3.4%) hit fresh highs, while Micron Technology surged over 10%. The entire chip sector, measured by the VanEck Semiconductor ETF, popped 3%.

Key developments to watch

Trump's reported shift toward targeted tariffs (instead of broad ones) gave automakers like GM (+3%) a boost

Treasury yields climbed above 4.6% ahead of crucial economic data

Markets will be closed on Thursday to honor former President Carter

📅 What's Next

All eyes are on Friday's jobs report, one of the last major data points before the Fed's next meeting. Before that, we'll get JOLTS data on Tuesday and ADP employment numbers on Wednesday.

The Smart Money Take

While tech's momentum is impressive, CFRA's chief strategist warns of "heightened volatility" ahead. With rich valuations and potential shifts in interest rate expectations, focusing on quality companies with strong earnings growth becomes even more critical.

Trending Stocks 🔥

American Airlines - Shares gained over 3% after TD Cowen upgraded the airline to a buy from a hold rating and lifted its price to a Wall Street high, implying a 47% upside from Friday’s close.

Paycor - Shares of the payroll services provider Paycor surged 23.3% after Bloomberg reported the company is in advanced talks to be acquired by Paychex.

Plug Power - The developer of hydrogen fuel cell systems gained 20% after adding 13% on Friday after U.S. regulators released final rules for billions in tax credits for companies involved in making hydrogen.

AI Boom Drives Foxconn to Record-Breaking Quarter

Here's a story that perfectly captures today's tech landscape: Foxconn, the company that assembles your iPhone, just posted its highest quarterly revenue ever – but not because of smartphones.

The Numbers That Matter

Q4 Revenue: $64.72 billion (up 15.2% year-over-year)

December Revenue: Up a whopping 42.3% from last year

Stock Performance: Surged 76% in 2024 (vs. Taiwan market's 28.5%)

The Real Story Behind the Numbers

While Foxconn is known for assembling Apple's iPhones, the AI revolution is supercharging its growth.

The company is seeing explosive demand for AI servers, particularly from clients like Nvidia. Meanwhile, their iPhone business is "roughly flattish" (their words, not mine).

Looking Ahead: Foxconn expects Q1 of 2025 to follow seasonal patterns (tech's typical post-holiday slowdown), but it projects significant growth compared to last year. Full earnings details will be released on March 14.

The Smart Money Take

This earnings report tells us where tech is headed: While consumer electronics remain essential, the real growth engine is AI infrastructure.

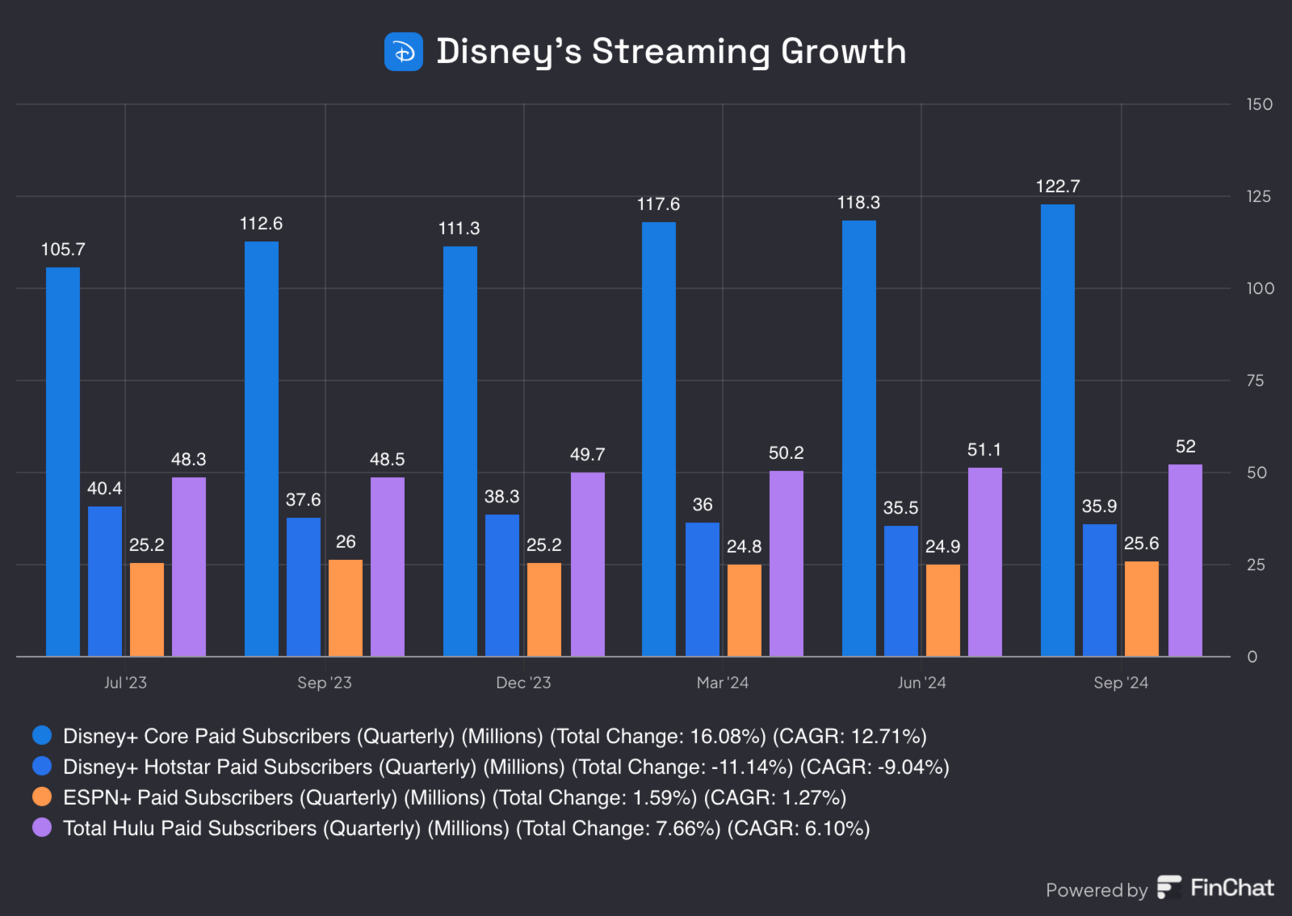

Disney Merges Hulu with Fubo

Disney is merging Hulu+ Live TV with Fubo in a deal that will reshape the streaming TV landscape. After being rivals, they're joining forces, with Disney taking a 70% stake in the combined company.

By the Numbers:

Combined subscriber base: 6.2 million

Fubo stock: +250% (from $1.44 to about $5)

Deal timeline: 12-18 months

Cash injection: $220 million from Disney, Fox & Warner Bros. Discovery

Additional funding: $145 million Disney loan to Fubo in 2026

Why This Matters👇

Streaming Strategy: Disney isn't just combining services—it's building a sports streaming powerhouse. Fubo's sports focus and Disney's entertainment muscle make it a formidable player in the streaming space.

Market Dynamics: The deal settles Fubo's lawsuit over Venu (the planned sports streaming service from Disney, Fox, and Warner Bros. Discovery), clearing the path for multiple sports streaming options.

Financial Impact: Fubo expects to become cash flow positive immediately after the deal closes – a crucial milestone for streaming businesses that often burn cash.

The Smart Money Take:

The move shows Disney's commitment to dominating both traditional and streaming TV. For investors, it signals that consolidation in the streaming space is accelerating, with sports content becoming an increasingly valuable battleground.

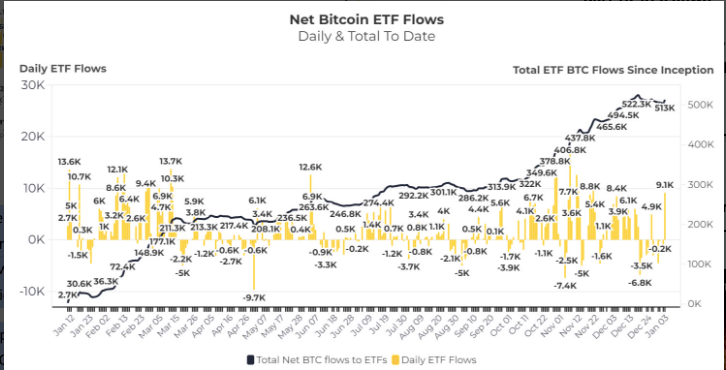

Bitcoin ETF Demand Remains Strong

Here's a story that perfectly captures why Bitcoin hit $108,135 in December: U.S. Bitcoin ETFs are buying BTC faster than miners can create it.

Breaking Down the Numbers

ETF Buying: 51,500 BTC in December

New Bitcoin Mined: 13,850 BTC

The Gap: ETFs bought 272% more than what was produced

Current Bitcoin Price: $101,707

The Big Picture

Imagine this: Bitcoin "prints" new coins every month through mining (like a company issuing new shares).

But right now, just one type of buyer – U.S. ETFs – demands nearly triple what miners can produce. And that's before counting retail investors, overseas funds, or institutional buyers.

Major Miners' December Production

MARA Holdings: 9,457 BTC

Riot: 516 BTC (up 4%)

CleanSpark: 668 BTC

Core Scientific: 291 BTC

Bitfarms: 211 BTC

The Money Move

January is looking even hotter, with ETFs buying nearly $1 billion worth of Bitcoin on Monday alone. This supply-demand imbalance is precisely what Bitcoin bulls have been waiting for—institutional demand meeting limited supply.

The Smart Money Take

This dynamic illustrates why understanding supply and demand is crucial for investors. When demand significantly outstrips supply, and that supply is fixed (like Bitcoin's), price is the only variable that can adjust to reach equilibrium.

Headlines You Can't Miss!

Volvo reports record sales in 2024

Eurozone inflation rises to 2.4% in December

Nvidia releases gaming chips for PCs

Samsung banks on AI growth in 2025

FTX EU acquired by Backpack Exchange

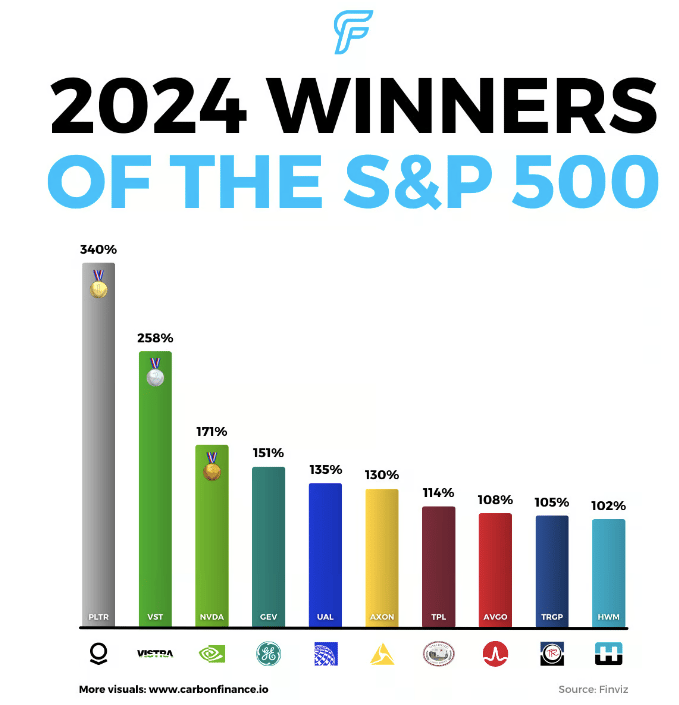

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.