- 3 Big Scoops

- Posts

- 🗞 Elon Musk Unveils Grok 3

🗞 Elon Musk Unveils Grok 3

PLUS: Will Intel split in 2025?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

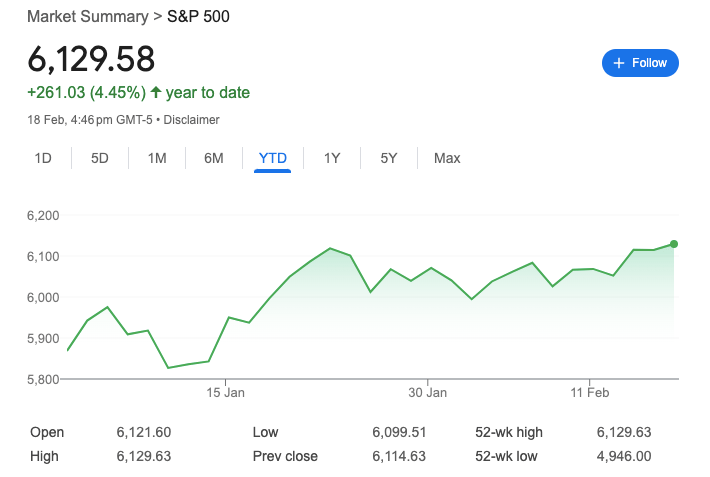

S&P 500 @ 6,129.58 ( ⬆️ 0.24%)

Nasdaq Composite @ 20,041.26 ( ⬆️ 0.072%)

Bitcoin @ $95,803.74 ( ⬆️ 0.22%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 Grok 3 enters the AI race

👉 Nike inks a big-ticket partnership

👉 Will Intel split?

So, let’s go 🚀

Market Wrap

The S&P 500 clinched a new record close Tuesday as markets showed resilience amid ongoing trade and inflation uncertainties.

Energy stocks led the advance, climbing 1.9%, with Halliburton and Valero Energy among the top performers.

However, consumer discretionary and communication services sectors pulled back, with Meta Platforms dropping 2.7% and ending its 20-day winning streak.

The gains follow a strong week, where major averages advanced after President Trump's reciprocal tariff plan relieved investor concerns about severe trade measures.

"The market's resiliency has been impressive as investors refuse to 'back down' despite rising negative sentiment," said Craig Johnson at Piper Sandler, though he expects choppy conditions ahead.

Investors continue monitoring inflation data for signals about potential Federal Reserve rate cuts.

Wall Street loads up on surprising $2.1tn asset class

Bank of America. UBS. JP Morgan. They’re all building (or have already built) massive investments in one $2.1tn asset class—and it’s not what you think. It’s not private equity or real estate, but fine art. Why?

In partnership with Masterworks, data from Citi shows it’s a potent diversifier with low correlation, and certain segments have even outpaced traditional investments. Take blue-chip contemporary art, which has outpaced the S&P 500 by 64% (1995-2023).

Masterworks knows the power of art investing, with their platform giving 900k+ users the opportunity to invest in this asset class as part of their overall portfolio strategy. In fact, from their 23 exits so far, Masterworks investors have realized representative annualized net returns like +17.6%, +17.8%, and +21.5%* (among assets held for longer than one year).

With so many users, Masterworks offerings can sell out quickly.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Trending Stocks 🔥

Howard Hughes - Shares are down 5% in pre-market after Bill Ackman upped his takeover offer for the real estate company, vowing to turn it into a “modern-day” Berkshire Hathaway.

Bumble - The online dating platform plunged over 10% after it forecast EBITDA at $61.5 million with sales of $246 million in Q1 of 2025, compared to estimates of $68.8 million and $256.9 million, respectively.

Cadence Design - The electronic system designing company saw shares decline by about 5%. While its Q4 earnings and revenue surpassed estimates, full-year guidance missed the mark.

xAI Launches Grok 3

On Tuesday, Elon Musk's xAI unveiled Grok 3, claiming its latest AI model surpasses competitors OpenAI and DeepSeek in math, science, and coding tests.

During a live-streamed demo on X, Musk showcased the model he dubbed "scary smart," announcing it would be available to premium X subscribers and through a separate subscription service.

The company also revealed plans for "Deep Search," a next-generation search engine.

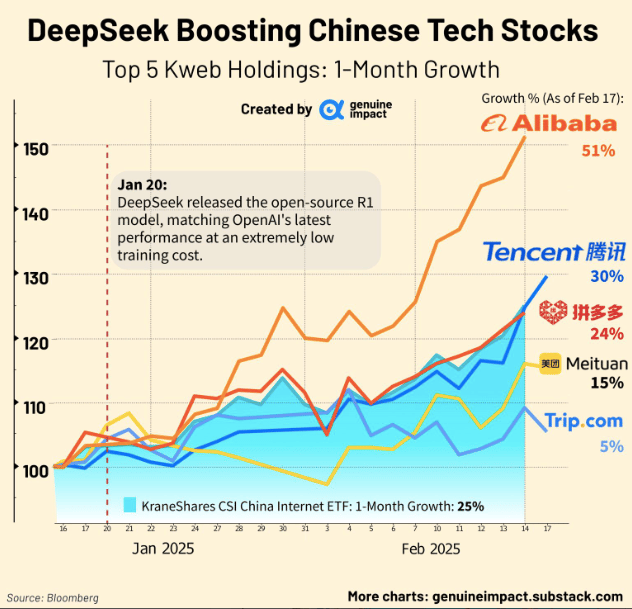

The launch comes amid heightened competition in the AI sector, following Chinese startup DeepSeek's recent breakthrough with a cost-efficient model that matches OpenAI's performance.

xAI disclosed it doubled its GPU cluster to train Grok 3, utilizing 200,000 advanced Nvidia processors.

The announcement follows ongoing tensions between Musk and OpenAI, including his recent failed $97.4 billion buyout attempt of the company he co-founded.

While early testing on Chatbot Arena shows promising results for Grok 3, Musk acknowledged the model's beta status, promising rapid daily improvements and future voice assistance capabilities.

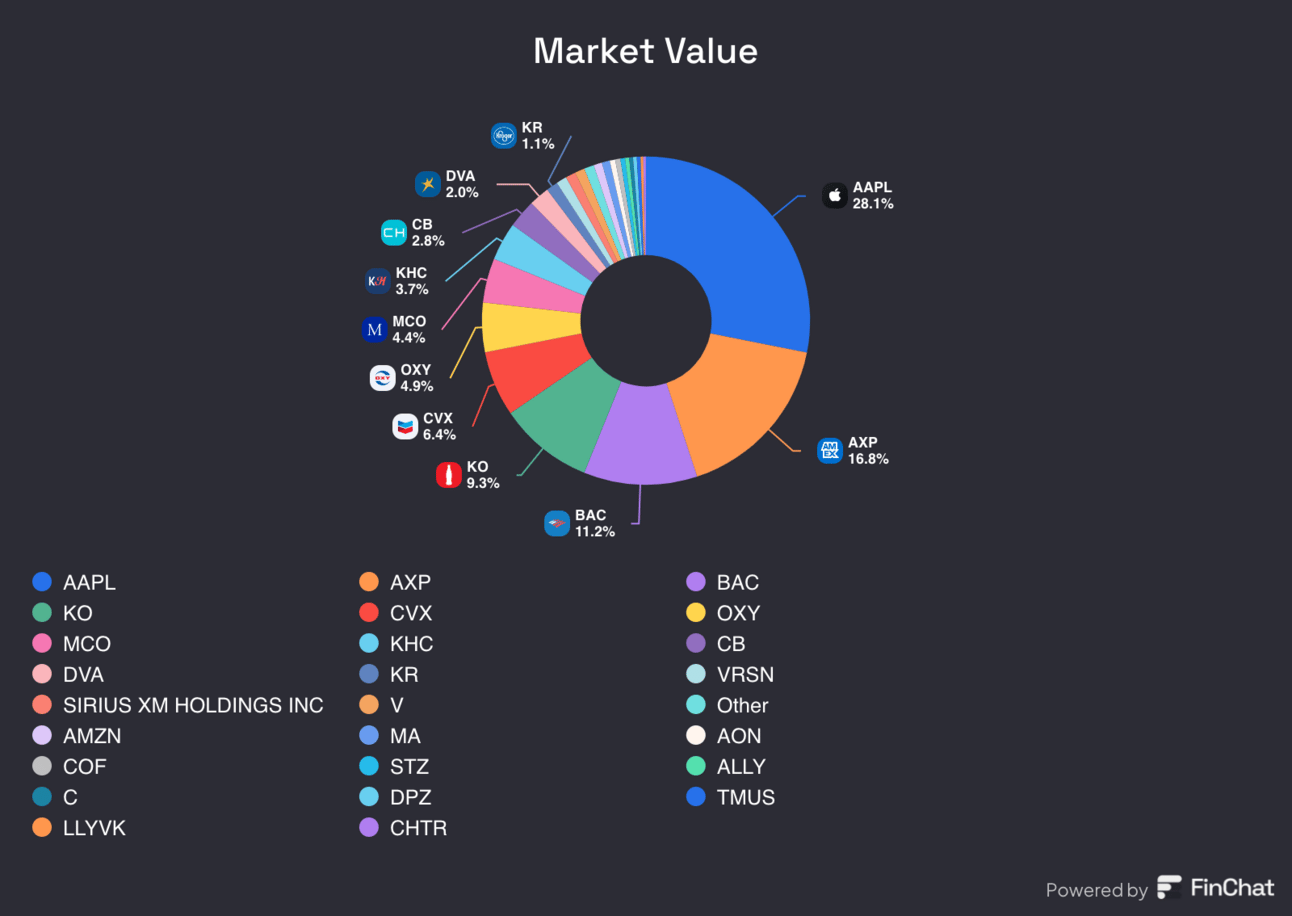

Berkshire Makes Bold Move into Constellation Brands

Berkshire Hathaway revealed a new stake in Constellation Brands worth $1.24 billion while maintaining its massive Apple position in Q4 of 2024.

The Warren Buffett-led conglomerate purchased 5.6 million shares of the Modelo beer maker, sending the stock up more than 6%.

The investment giant also increased several existing positions, nearly doubling its Domino's Pizza stake and adding 8.9 million shares to its Occidental Petroleum holdings.

However, Berkshire continued its retreat from the banking sector, selling 117 million Bank of America shares and reducing positions in Citigroup and Capital One. The company also wholly exited its recently established position in Ulta Beauty.

This filing shows Berkshire putting some of its massive $320 billion cash pile to work, reflecting a shift toward consumer staples and energy while reducing exposure to financial services.

Despite earlier reductions throughout the year, Apple remains Berkshire's largest holding, worth over $75 billion and accounting for 28% of its portfolio.

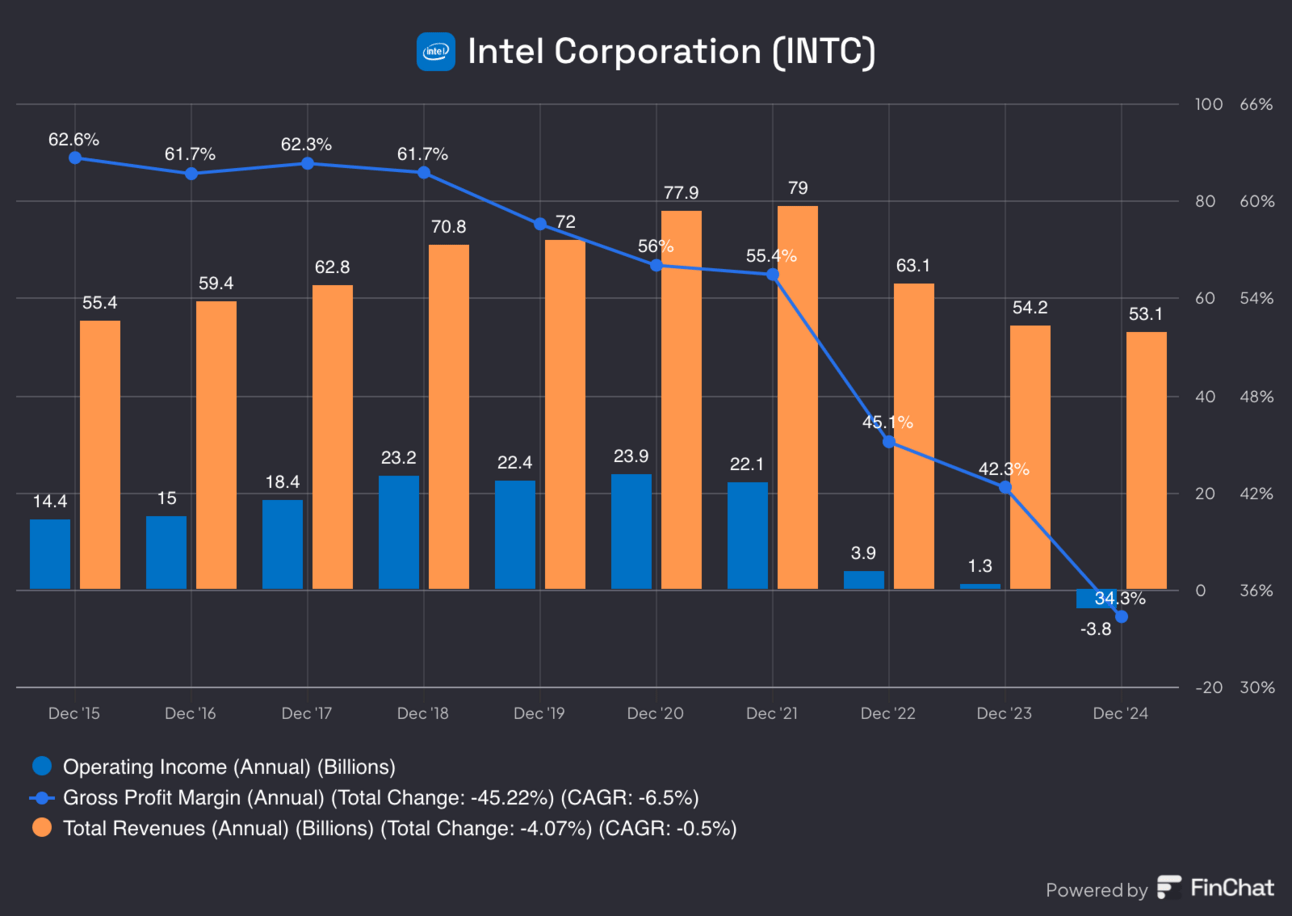

Intel Faces Potential Split as Rivals Eye Chip Business

On Tuesday, Intel shares surged 10% following reports that rivals Broadcom and TSMC are exploring potential deals to split the chipmaker's operations.

Broadcom is considering Intel's chip design and marketing division, while TSMC has shown interest in the manufacturing operations.

The news comes as Intel struggles to compete in the booming AI chip market. Its stock is down over 40% year over year despite a 30% gain in 2025.

The Trump administration has been involved in discussions about separating Intel's manufacturing business.

However, White House sources indicate President Trump may oppose non-U.S. companies operating the foundry.

Any potential deal would face regulatory scrutiny regarding TSMC's involvement, given that both companies received funding under the Chips and Science Act in addition to concerns over foreign control of U.S. semiconductor assets.

The talks follow Intel's recent restructuring efforts, which included a 15% workforce reduction and $10 billion in capital expenditure cuts announced last August.

Nike Partners with Skims

On Tuesday, Nike and Kim Kardashian's Skims announced a groundbreaking partnership to launch NikeSKIMS, a new activewear line to expand Nike's reach in the competitive women's athletic apparel market.

The collaboration comes as Nike, which has only 40% female customers and 28% of revenue from apparel, seeks to challenge dominant players like Lululemon and Alo Yoga.

The initial collection will launch this spring, and global expansion is planned for 2026.

The partnership aligns with Nike's renewed focus on female consumers under CEO Elliott Hill, highlighted by its recent "So Win" Super Bowl campaign featuring stars like Caitlin Clark.

The move could help Nike address criticism about the lack of innovation in its product line.

For Skims, valued at $4 billion, the deal provides access to Nike's manufacturing capabilities and could strengthen its position for a potential IPO.

The partnership offers an opportunity to succeed where other intimate brands, like Victoria's Secret, have struggled to enter the activewear market.

The collaboration comes amid broader market challenges, including inflation concerns and reduced consumer spending on discretionary items.

Headlines You Can't Miss!

U.K. inflation leaps to 3% in January

Singapore unlikely to be impacted by tariffs

China’s M&A activity to ramp up amid tariff war

U.S. homebuilders are worried over Trump tariffs

FTX to repay $1.2 billion to creditors

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.