- 3 Big Scoops

- Posts

- 🗞 Eli Lilly Tanks 6.6%

🗞 Eli Lilly Tanks 6.6%

while Boeing continues to trail Airbus

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

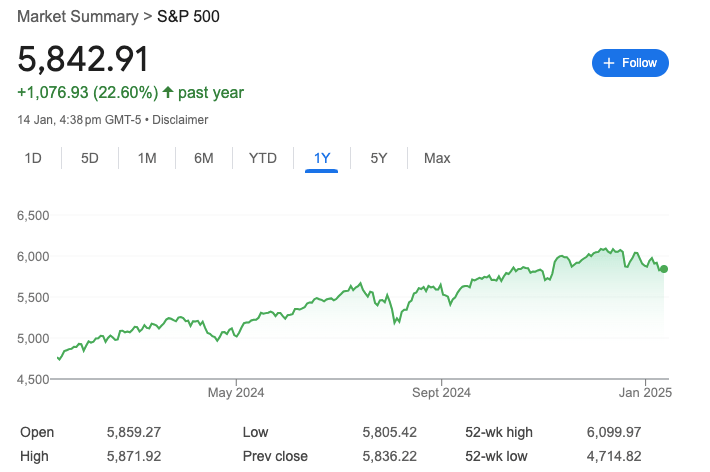

S&P 500 @ 5,842.91 ( ⬆️ 0.11%)

Nasdaq Composite @ 19,044.39 ( ⬇️ 0.23%)

Bitcoin @ $97,119.83 ( ⬆️ 0.86%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 Eli Lilly moves lower

👉 Boeing is losing the battle to Airbus

👉 Nike stock at 5-year lows

So, let’s go 🚀

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Market Wrap

Hey, Scoopers!

Let's break down Tuesday’s market moves and what they mean for your portfolio.

The Big Picture 🎯

The Dow marched upward as investors celebrated tame inflation numbers

Big Tech stumbled, with Nvidia (-1.1%) and Meta (-2.3%) taking hits

Banking stocks had a field day, with regional bank ETFs jumping 3%

Inflation's Cooling Down

Remember when inflation was the market's biggest headache? Well, yesterday brought some sweet relief.

The Producer Price Index (PPI) – think of it as wholesale inflation before it hits your wallet – came in at just 0.2% for December. That's half of what economists expected!

Even better? When you strip out volatile food and energy prices (that's what we call "Core PPI"), prices didn't budge at all. Zero. Nada.

Why This Matters For Your Money 💰

Here’s why cooling inflation is like music to investors' ears 👇

It suggests the Fed's aggressive rate hikes are working

Lower inflation could mean the Fed might start cutting rates sooner

It could be excellent news for your stock portfolio, as lower rates boost stock values

What's Next? 👀

The Consumer Price Index (CPI) report is the next big test today. If the CPI is below estimates, stocks could rally. Alternatively, a hotter-than-expected number might spook the market.

Banking on Earnings 🏦

Hold onto your hats – earnings season kicks off today with the big banks:

JPMorgan Chase

Citigroup

Goldman Sachs

Wells Fargo

These reports will give us our first peek at how corporate America finished 2024.

Trending Stocks 🔥

Lululemon - Shares of the athleisure company slipped 2.5% despite increasing its holiday outlook for earnings and revenue. It forecast fiscal Q4 earnings at $5.83 per share with revenue of $3.57 billion, compared to estimates of $5.66 per share and $3.47 billion, respectively.

KB Home - Shares in the home building firm added over 4% after it reported revenue of $2 billion with adjusted earnings of $2.52 per share, compared to estimates of $1.99 billion and $2.45 per share, respectively.

IAC Inc - The Daily Beast parent company added more than 2% following news that it planned to spin off home improvement marketplace Angi.

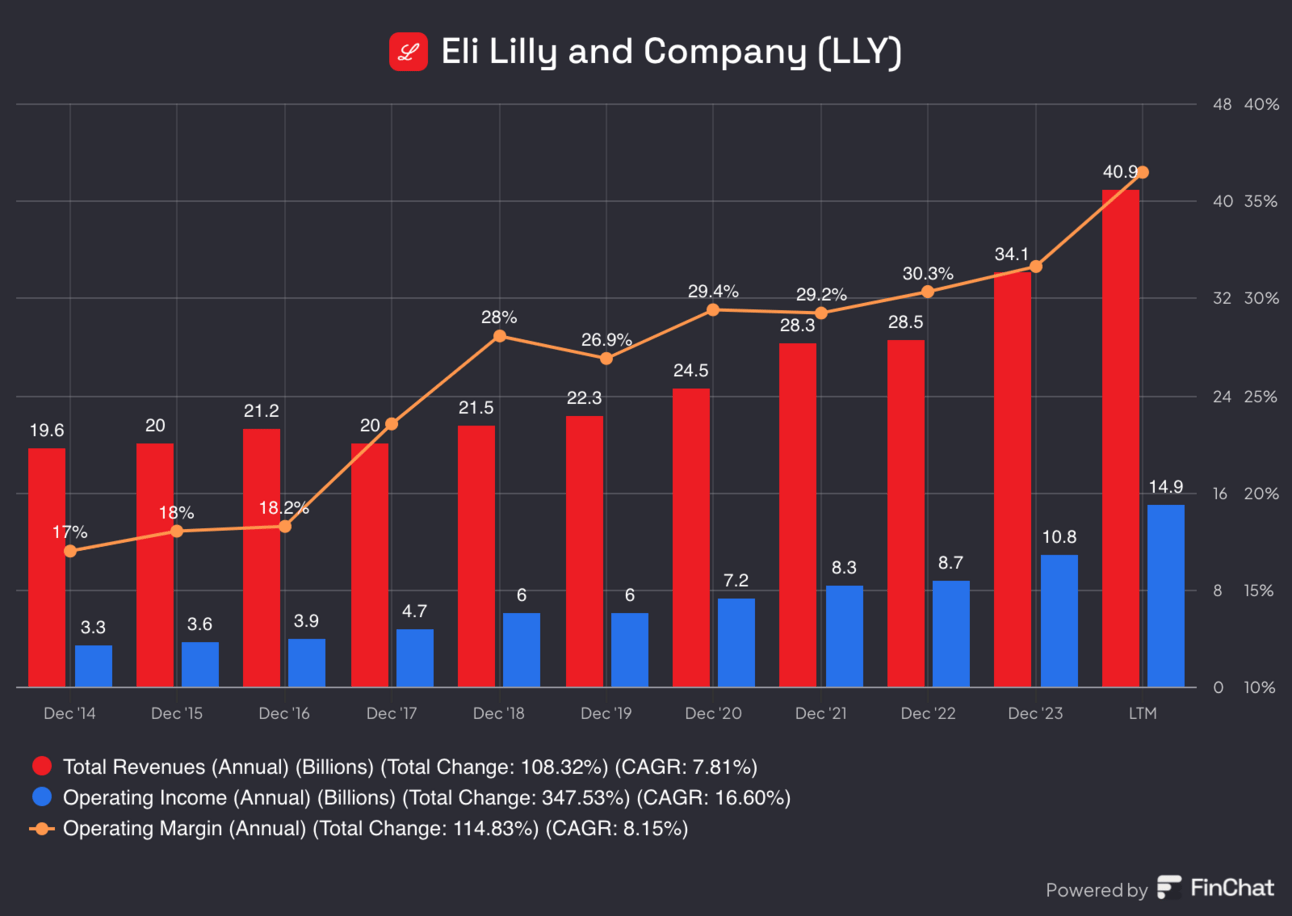

Eli Lilly Disappoints Wall Street

Eli Lilly's stock dropped over 6% after it lowered its revenue guidance despite expecting solid growth.

The Numbers That Matter 📊

2024 revenue forecast: $45 billion (down from $45.4-46 billion)

Expected YoY growth: Still impressive at 32%

2025 sales target: $58-61 billion

Q4 sales expectations: $13.5 billion (below Wall Street's $13.94 billion forecast)

The Bigger Picture 🎯

The situation illustrates a crucial investing lesson: Sometimes, great companies see share prices drop not because they're doing poorly but because expectations got too high.

Eli Lilly is still:

Dominating the weight loss drug market

Ramping up production significantly

Developing new, more convenient treatments

Growing faster than most large companies

What to Watch Next 👀

Mark your calendars for February 6th when Eli Lilly reports Q4 results. Keep an eye on:

Manufacturing capacity updates

Progress on their obesity pill development

Competition with Novo Nordisk

Any changes in demand patterns

Bottom Line 🎬

Tuesday’s drop might present an opportunity for long-term investors who believe in the obesity treatment market's potential.

Remember Warren Buffett's wisdom: "Be fearful when others are greedy, and greedy when others are fearful."

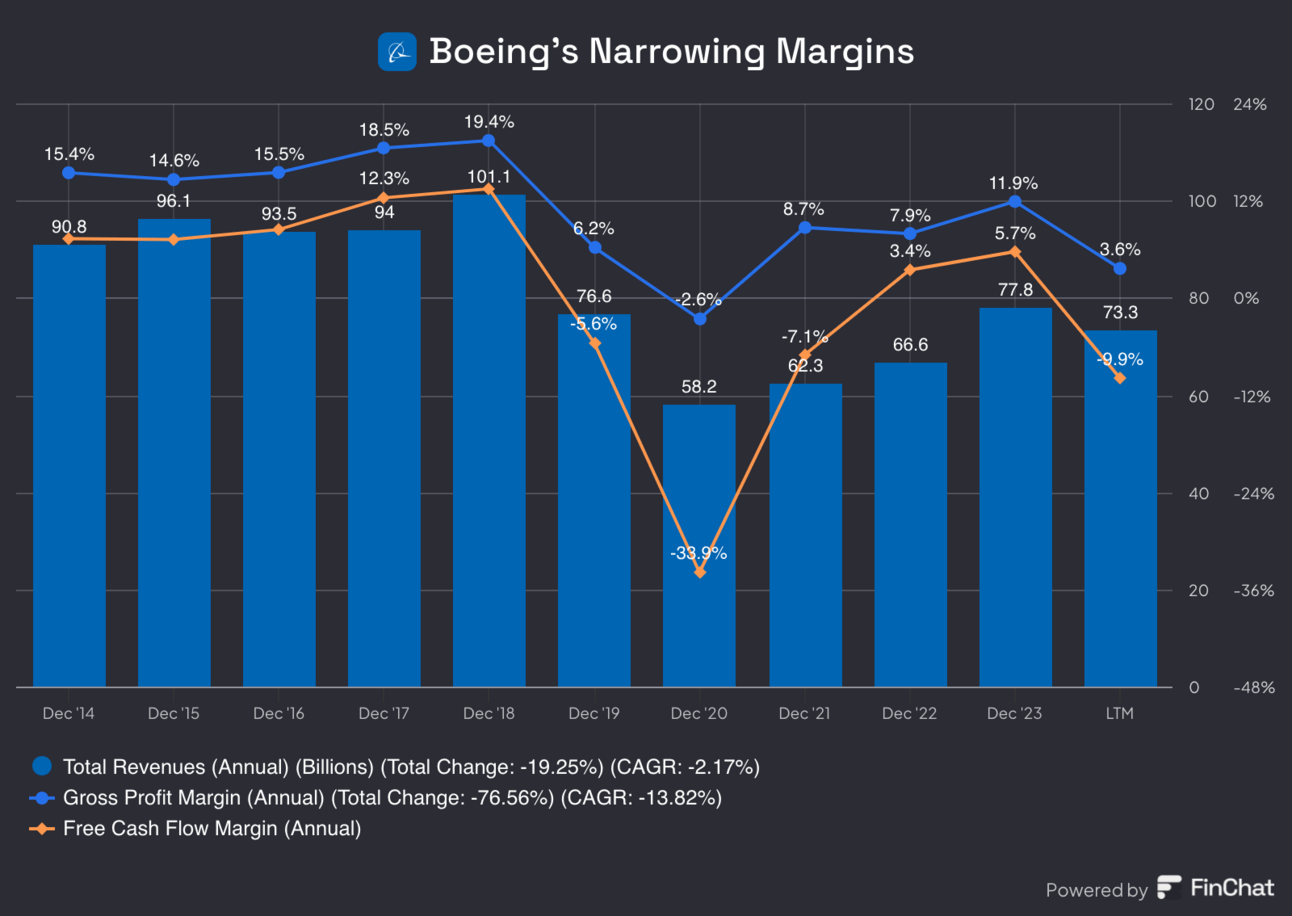

Boeing Continues to Struggle 🛩

Today, we're diving into Boeing's latest delivery numbers and what they mean to investors. Buckle up – there's a lot to unpack here.

The Numbers at a Glance ✈️

Boeing's 2024 Scorecard:

Total deliveries: 348 planes (⬇️ about 33% from 2023)

December deliveries: 30 planes

Gross orders: 569 planes

Net orders: 377 planes

Compare this to Airbus:

Total deliveries: 766 planes (highest since 2019)

Gross orders: 878 planes

Net orders: 826 planes

Why These Numbers Matter 💡

Think of airplane deliveries like closing a house sale – that's when manufacturers get paid. In Boeing's case, 2024's numbers tell us three important stories:

Production Challenges

A machinist strike halted production for 8 weeks

Recent door panel incident added to safety concerns

Supply chain issues continue to limit output

Market Position

The gap with Airbus is widening

But demand remains strong (look at those order numbers!)

Aircraft shortage is driving up lease rates to record levels

Business Health

December showed signs of recovery, with 142 new orders

Lost some orders from defunct carriers (like Jet Airways)

Still maintaining a robust order backlog

The Silver Lining ✨

Despite the challenges, there are some bright spots:

Pegasus Airlines ordered 100 737 Max planes

Flydubai signed up for 30 787s

Lease rates are hitting record highs (good for asset values)

What to Watch Next 👀

Circle January 28th on your calendar when Boeing reports 2024 earnings. Key things to monitor:

Production ramp-up plans

Profitability roadmap

Management's strategy for catching up to Airbus

The Bottom Line 🎯

Boeing is facing headwinds, but industry fundamentals remain strong.

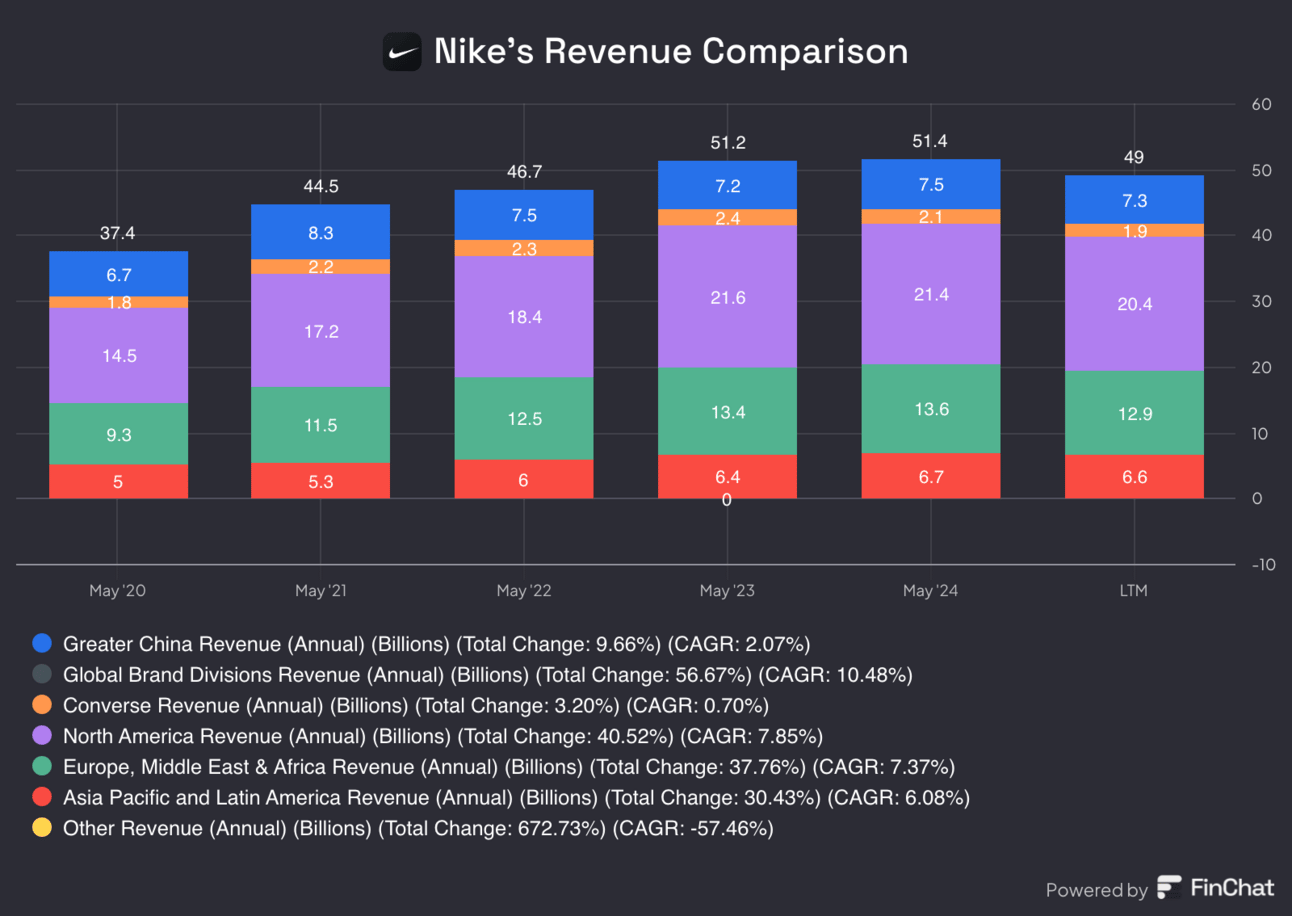

Nike Stock at 5-Year Low

Let's break down Nike's strategy shift as shares of the sneaker maker trade at five-year lows.

The Quick Sprint:

Nike stock down 27% in 2024

Fiscal Q2 revenue: $12.35B (beat expectations, but down 8% YoY)

EPS: 78 cents vs 63 cents expected

New CEO Elliott Hill (a Nike veteran who started as an intern) just dropped some truth bombs about where the swoosh went wrong:

Too Many Discounts

Half of all digital sales are promotional

Hurting brand value and profits

Partners feeling the squeeze

Lost Their Way

Over-relied on lifestyle shoes

Forgot their sports DNA

Competitors gained ground

The Fix?

Rebuilding wholesale partnerships

Getting back to performance focus

Less obsession with online sales

Clearing out old inventory (expect some pain)

Bottom Line: Think of this as Nike's reset button. The short term might be rough (expect lower margins and sales), but Hill is trying to get Nike back to what made it great: innovation and athletics.

Why It Matters: Sometimes, great companies need to step back to leap forward. For patient investors, it could be like watching the setup for Nike's next big run.

Headlines You Can't Miss!

UK inflation slows to 2.5% in December

Nvidia-backed AI video platform valued at $2.1 billion

SEC sues Elon Musk for failure to disclose Twitter ownership

Meta announces 5% cuts targeting low performers

Solana and XRP ETFs could attract trillions in 2025

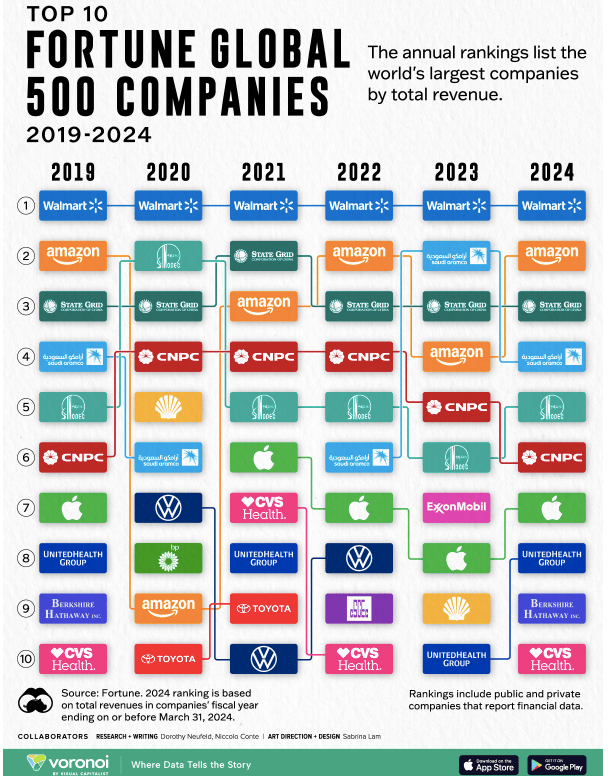

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.