- 3 Big Scoops

- Posts

- Eli Lilly Jumps, Dell Disappoints

Eli Lilly Jumps, Dell Disappoints

while Wall Street cheers Trump tariffs

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

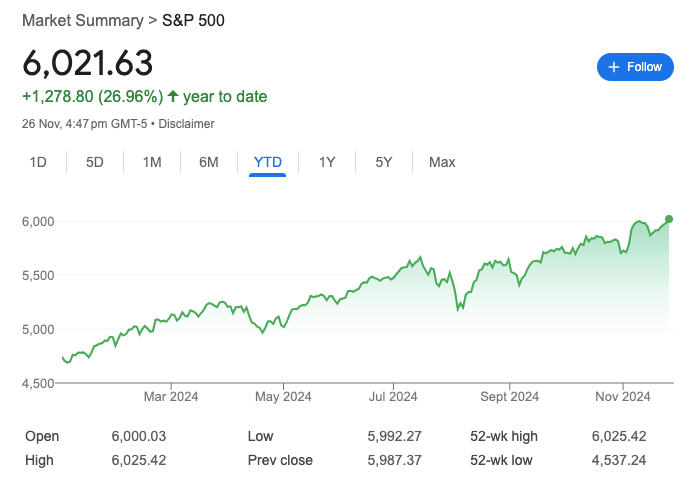

S&P 500 @ 6,021.63 ( ⬆️ 0.57%)

Nasdaq Composite @ 19,175.58 ( ⬆️ 0.63%)

Bitcoin @ $93,408.14 ( ⬇️ 2.6%)

Hey Scoopers,

Happy Wednesday! Are you ready for an exciting newsletter today?

👉 Eli Lilly jumps on Biden’s proposal

👉 Dell tanks as guidance disappoints

👉 Black Friday spending estimates

So, let’s go 🚀

Market Wrap

Stocks rose on Tuesday, with the S&P 500 and the Dow Jones Industrial Average jumping to fresh highs as investors shook off the threat of new tariffs from President-elect Donald Trump.

While the S&P 500 index gained pace, several individual names struggled as investors analyzed the potential effects of the policies Trump discussed.

Shares of auto giants such as Ford and General Motors tumbled by 2.6% and 9%, respectively, while alcohol company Constellation Brands fell over 3%.

Earlier this week, Trump called for a 25% tariff on products from Mexico and Canada and an additional 10% levy on Chinese goods.

Trump had already claimed he would impose a tariff of up to 20% on all imports and an additional duty of at least 60% on Chinese products.

The economic outlook for 2025 will depend on tariffs and tax cuts. The U.S. economy is robust and forecast to grow at 2% in 2025. However, tariffs remain an overhang on the economic forecast, and their impact may outweigh any changes to tax policies.

Trending Stocks 🔥

HP - Shares are down 7.5% in pre-market after the personal computing giant forecast fiscal Q1 earnings between $0.70 and $0.76 per share, below estimates of $0.85 per share.

Workday - The stock slid 10% after the human resources software company projected subscription revenue and operating margin to come in lower than expected for Q4. It forecasted subscription sales of $2.025 billion with an operating margin of 25%, compared to estimates of $2.05 billion and 25.5%, respectively.

Abercrombie & Fitch - Shares slipped 4% even though the apparel company beat earnings and issued a strong holiday guidance.

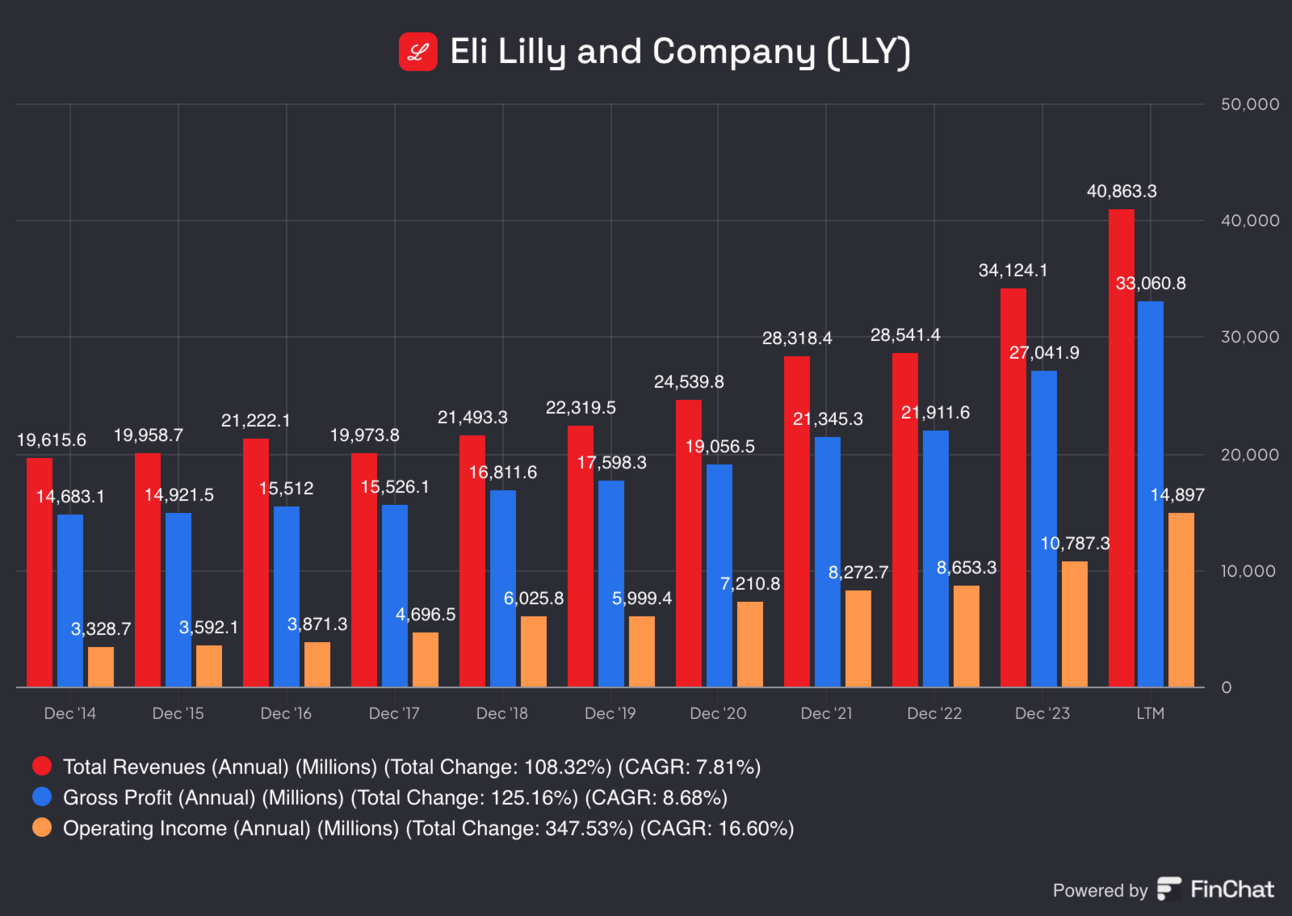

Eli Lilly Jumps Over 4.5%

Shares of Novo Nordisk and Eli Lilly rose on Tuesday, fueled by comments from the Biden administration urging Medicare and Medicaid coverage for anti-obesity drugs such as Wegovy and Zepbound.

Federal health insurance programs are currently banned from covering weight loss drugs, which is why drugmakers have been working to detail other benefits these medications can have on comorbidities such as heart disease and sleep apnea.

Lobbyists have also been pushing for a legislative change to make coverage possible, but Biden’s proposal aims to bypass this.

Morgan Stanley analyst Terence Flynn said several unknowns remain, so the full effect on the stocks is unclear. However, expanding drug coverage to people insured by these programs could be a windfall for these companies.

Wells Fargo analyst Mohit Bansal said Biden’s proposal suggests 3.4 million Medicare enrollees and 4 million Medicaid enrollees would gain coverage.

However, that estimate appears far lower than the Congressional Budget Office projection of 23 million Medicare enrollees with obesity, which leads him to believe patients would need to have another condition to get access to the drugs.

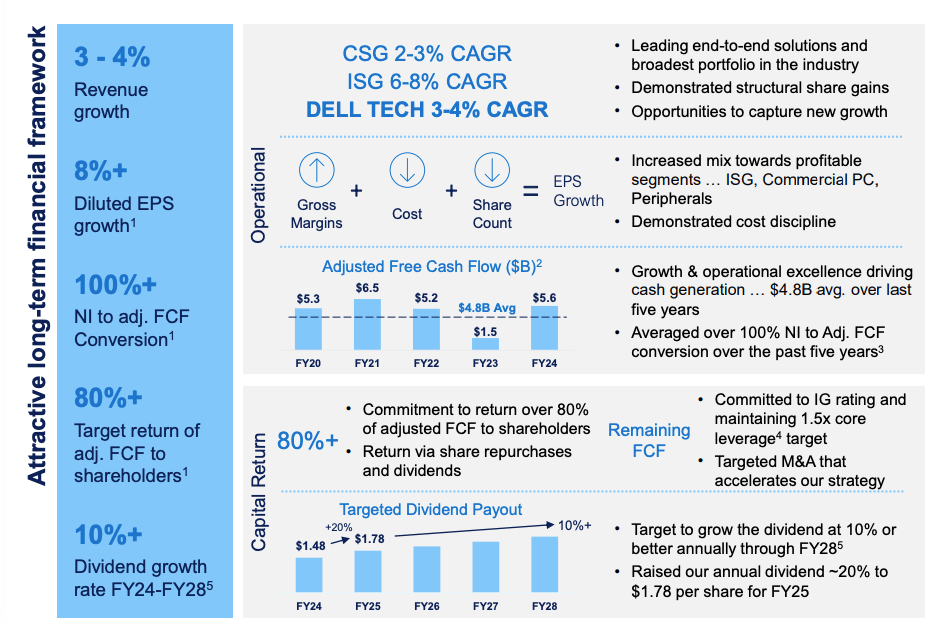

Dell Disappoints Wall Street

Dell Technologies forecast fiscal Q4 (ending in January) revenue and earnings below Wall Street estimates, despite the company's bullish commentary on AI sales, dragging the stock lower by 11% in pre-market.

In fiscal Q3 of fiscal 2025, it reported:

👉 Revenue of $24.4 billion vs. estimates of $24.67 billion

👉 Earnings per share of $2.15 vs. estimates of $2.06

Sales rose by 10% year over year in the quarter ended October. The company forecasts Q4 sales to be between $24 billion and $25 billion, lower than estimates of $25.57 billion.

Its earnings forecast of $2.50 per share was also below estimates of $2.65 per share.

Dell stock has surged over 80% in 2024 as investors realize it is among the largest companies selling tools and systems for AI developers.

Basically, Dell is a vendor for computer clusters that develop and deploy AI, especially computers based around Nvidia chips.

Dell ended Q3 with a pipeline of $4.5 billion in future orders, showcasing the demand for its AI systems.

The company’s server sales, part of the Infrastructure Solutions Group, rose by 34% year over year to $11.4 billion.

Dell’s servers and networking vertical, which includes AI systems, increased sales by 58% to $7.4 billion. In Q3, it shipped $2.9 billion in AI servers and emphasized that customers booked $3.6 billion of future AI server orders.

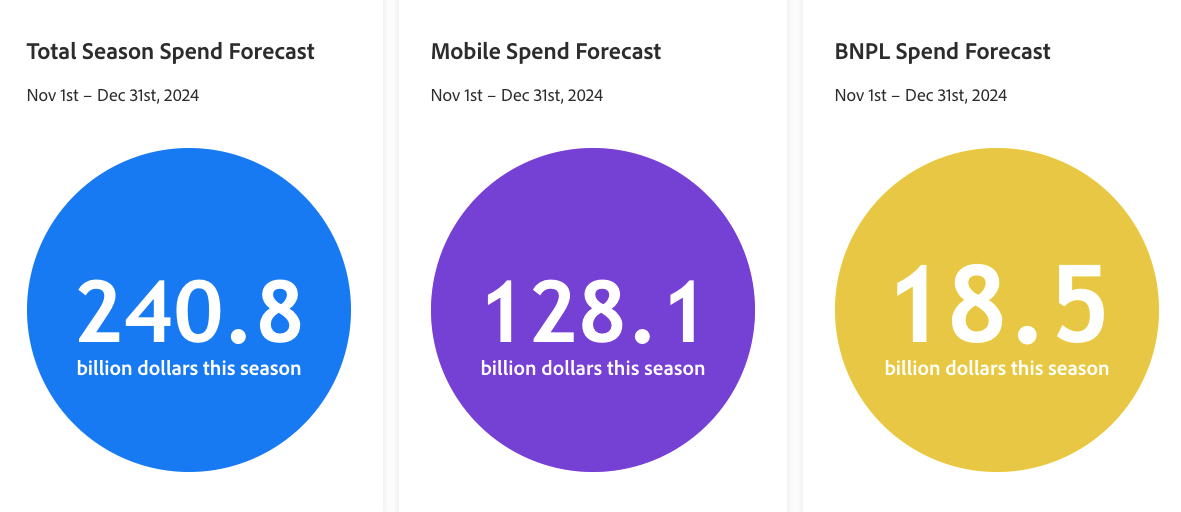

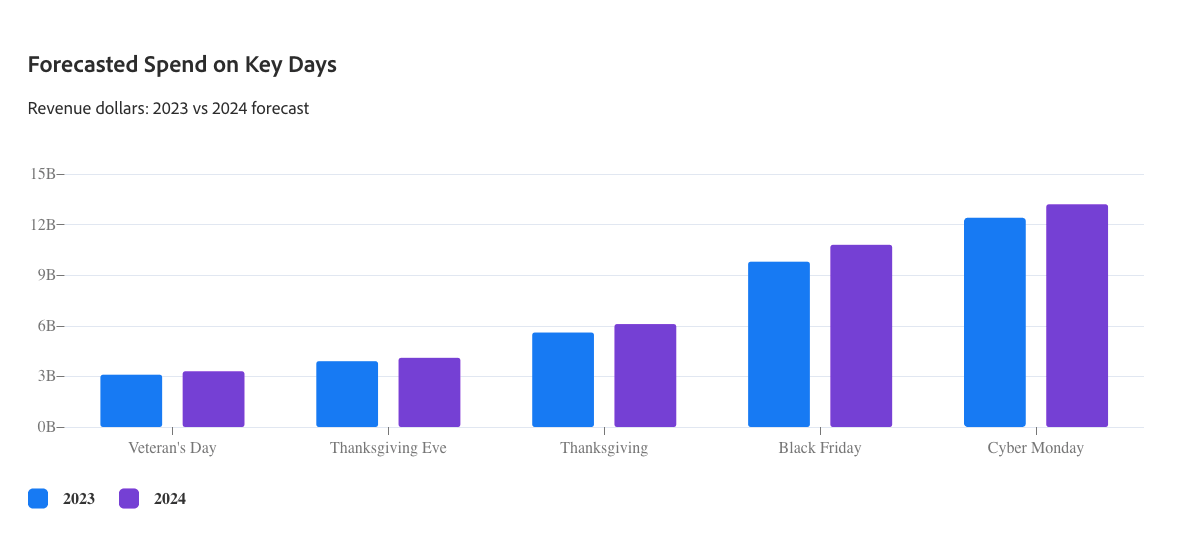

U.S. Holiday Spending Might Touch $296.5B

The holiday shopping season officially kicks off on Black Friday. According to a report from Adobe, holiday shoppers in the U.S. are projected to spend $296.5 billion online, accounting for 30.1% of total holiday sales, an increase of 3% year over year.

Here are some key numbers for holiday spending in 2024:

92% of Americans plan to shop this holiday season.

17% expected to increase spending, while 30% anticipate cutting back compared to 2023.

57% of consumers plan to purchase gifts digitally.

Buy Now Pay Later services are gaining traction, with $18.5 billion expected in spending.

45% of shoppers began their holiday purchases last month, reflecting a shift towards earlier buying habits.

This smart home company grew 200% month-over-month…

No, it’s not Ring or Nest—it’s RYSE, a leader in smart shade automation, and you can invest for just $1.75 per share.

RYSE’s innovative SmartShades have already transformed how people control their window coverings, bringing automation to homes without the need for expensive replacements. With 10 fully granted patents and a game-changing Amazon court judgment protecting their tech, RYSE is building a moat in a market projected to grow 23% annually.

This year alone, RYSE has seen revenue grow by 200% month-over-month and expanded into 127 Best Buy locations, with international markets on the horizon. Plus, with partnerships with major retailers like Home Depot and Lowe’s already in the works, they’re just getting started.

Now is your chance to invest in the company disrupting home automation—before they hit their next phase of explosive growth. But don’t wait; this opportunity won’t last long.

Headlines You Can't Miss!

Sanofi to open $555 million vaccine facility in Singapore

Reddit targets international users for ad growth

OpenAI gets $1.5 billion offer from SoftBank

China’s industrial profits fall by 10% in October

Long-term Bitcoin holders sold 728,000 BTC last month

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.