- 3 Big Scoops

- Posts

- Walt Disney Is On the Move

Walt Disney Is On the Move

Disney, PayPal, and Arm

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

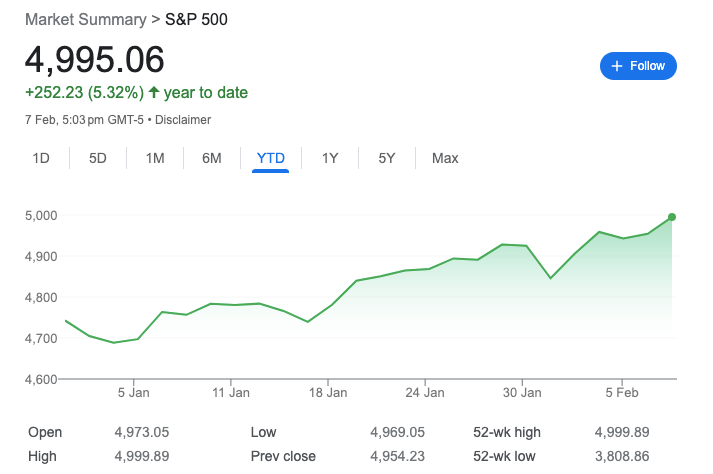

S&P 500 @ 4,995.06 (⬆️ 0.82%)

Nasdaq Composite @ 15,756.65 ( ⬆️ 0.95%)

Bitcoin @ $44,652.34 ( ⬆️ 0.51%)

Hey Scoopers,

Happy Thursday! Here’s what’s brewing this morning.

👉 Disney gains pace post Q4

👉 S&P 500 inches closer to 5,000

👉 BlackRock’s Bitcoin ETF attracts $$$

So, let’s go 🚀

Market Wrap

The S&P 500 index rose 0.82% to touch another all-time high on Wednesday, edging close to the 5,000 mark. The broad-based index breached the 4,000 level in April 2021 and is up 25% in the last 34 months.

Better-than-expected earnings and upbeat guidance have been driving the equity market higher in recent weeks. Further, strong consumer spending and a resilient economy amid elevated interest rates are also acting as tailwinds.

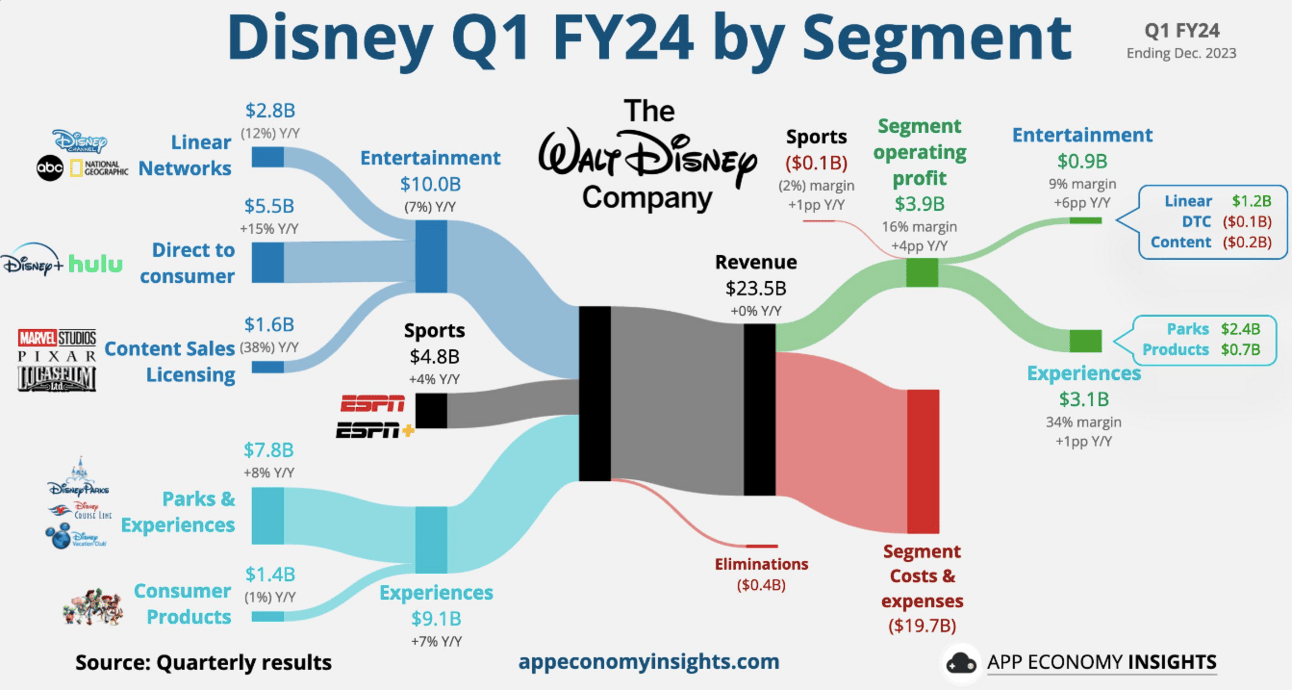

Walt Disney Trumps Wall Street

Shares of Walt Disney are trading roughly 7% higher in pre-market following its fiscal Q1 of 2024 (ending in September) results. In the December quarter, the House of Mouse reported:

👉 Revenue of $23.55 billion vs. estimates of $23.64 billion

👉 Earnings of $1.22 per share vs. estimates of $0.99 per share

While Disney’s revenue growth has stagnated, the company has focused on lowering its cost base and is on track to cut expenses by $7.5 billion in fiscal 2024.

Due to its cost savings efforts, the company emphasized its 2024 earnings should widen by 20% to $4.60 per share.

Moreover, Disney disclosed plans to acquire a $1.5 billion stake in Epic Games and launch its flagship ESPN streaming service in fall 2025.

Disney’s losses for its streaming business narrowed to $216 million from $1.05 billion in the year-ago period. While core subscribers for Disney+ shrank by 1.3 million in Q1 due to price hikes, the company experienced higher revenue per user.

Disney has underperformed the broader markets by a wide margin after it touched all-time highs in 2021. Currently, Disney trades 50% below record highs and is valued at $181 billion by market cap.

Trending Tickers

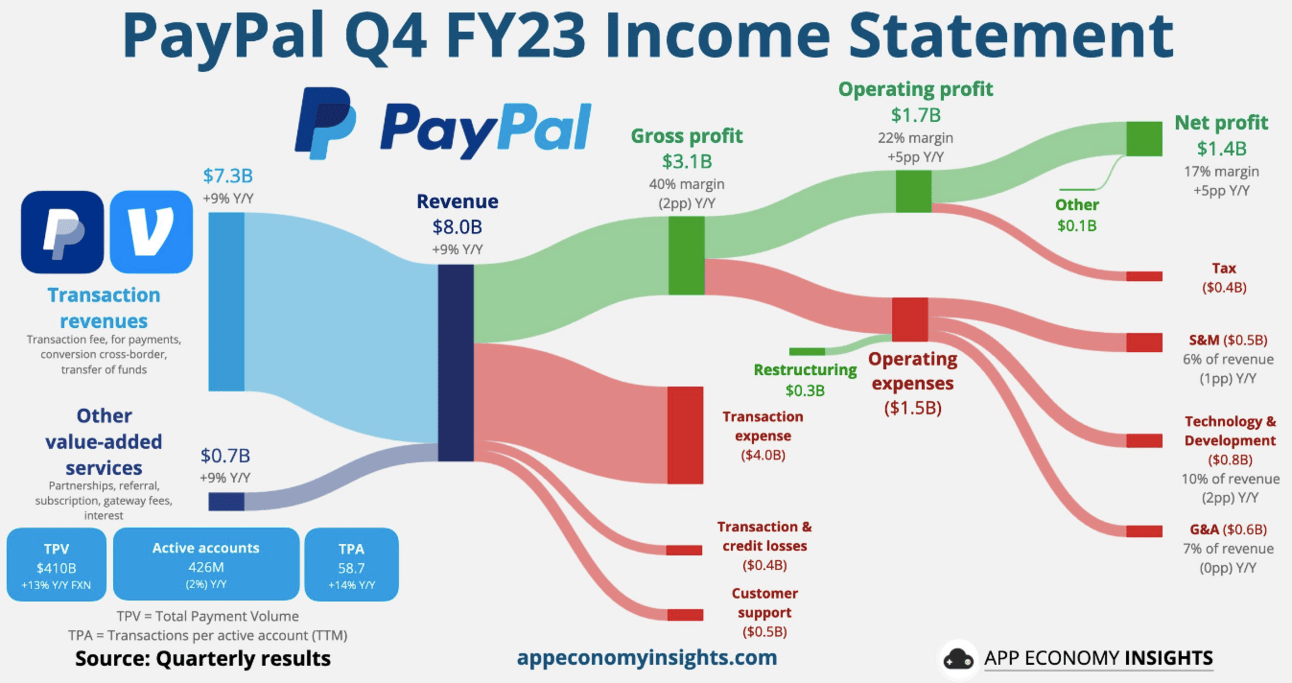

PayPal - Shares of the payments platform are down over 8% after the company provided guidance for Q1 and 2024, which were below estimates. In 2024, it forecast earnings of $5.10 per share, below estimates of $5.48 per share.

Arm - A semiconductor company, Arm is seeing its share rise by 22% in pre-market as it expects earnings between $0.28 and $0.32 per share in Q1, higher than estimates of $0.21 per share.

Big Tech - Shares of Big Tech companies such as Microsoft, Nvidia, and Meta all rose by 2%, delivering stellar gains since the start of 2023.

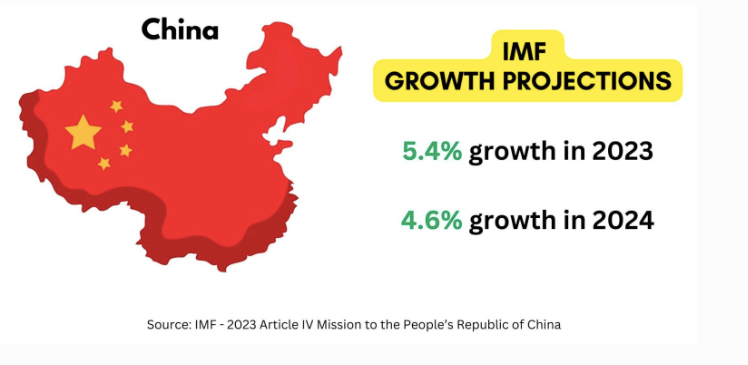

China Remains Under Pressure

China’s producer prices fell for the 16th month in January, while consumer prices saw the biggest drop in 14 years, underscoring the depth of the country's challenge in reflating its economy.

China’s producer price index fell 2.5% year over year in January, better than estimates of a decline of 2.6% and lower than the 2.7% decline in December. Comparatively, the consumer price index fell by 0.8% in January, higher than estimates of 0.5%. Food prices were down 5.9% year over year in Jan. 2024.

In comparison, the core CPI (consumer price index), which excludes energy and food prices, grew 0.4% last month. These numbers emphasize the fears attached to China, which is on the edge of deflation.

China is the world’s second-largest economy and is wrestling with a real estate crisis, slowing consumer spending, and a sluggish economic recovery.

BlackRock Bitcoin ETF Attracts $3.2 Billion

BlackRock’s spot Bitcoin ETF (exchange-traded fund) was launched less than three weeks ago. It has already attracted $3.2 billion in total fund inflows in this period.

Fidelity’s Wise Origin Bitcoin Fund is another crypto ETF in the top-10 list for the year with inflows of $2.7 billion.

The other funds that have topped these numbers are index-based funds, which track the S&P 500. Here are the two top ETFs in terms of fund inflows this year.

👉 iShares Core S&P 500 ETF - $13 billion

👉 Vanguard 500 Index Fund ETF- $11.1 billion

The two ETFs have $826 billion in assets under management.

Headlines You Can’t Miss!

Maersk stock slumps due to Red Sea disruption

Nikkei index at fresh 34-year highs

SoftBank’s Vision Fund logs $4 billion gain

Crypto firm Bakkt may go bankrupt.

Crypto ransomware payments exceed $1 billion in 2023

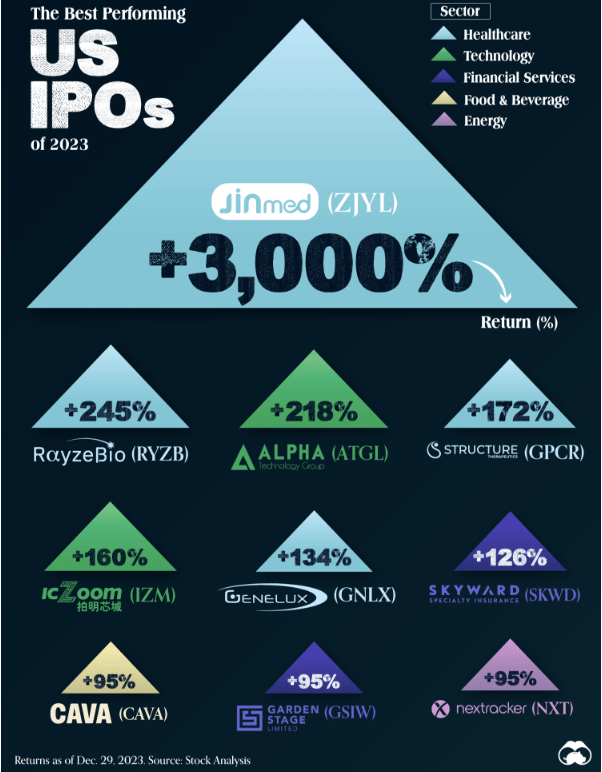

Chart of The Day

Source: Visual Capitalist

Last year, 154 companies went public in the U.S., compared to 181 in 2022 and 1,035 in 2021. But which IPO made the most money?

Well, IPO gains (for the top 10) were driven by companies part of the healthcare sector, followed by financial services, technology, and energy.

In the first position is Jin Medical, a Cayman Islands holding company that owns Chinese manufacturers of wheelchairs.

Jin Medical stock surged 3,000% in 2023 despite its delisting from the Nasdaq as it failed to meet a listing rule that required the company to have at least 300 public holders.

Other top-performing IPOs last year included healthcare companies such as RayzeBio and Structure Therapeutics, which operate in the biotech space.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.