- 3 Big Scoops

- Posts

- 🗞 CrowdStrike Stock: A Deep Dive

🗞 CrowdStrike Stock: A Deep Dive

Metrics, profits, and more!

Bulls, Bitcoin, & Beyond

Hey Scoopers,

In today’s special edition, we deep-dive into one of our portfolio stocks- CrowdStrike. So, let’s go!

CrowdStrike- An Overview

CrowdStrike is among the largest cyber security companies in the world. Founded in 2011, it provides cloud-delivered protection for endpoints, cloud workloads, identity, and data.

Its portfolio of solutions includes threat intelligence, managed security services, IT operations management, log management, and more.

CrowdStrike sells its services on a subscription model that helps it generate a steady stream of recurring revenue across market cycles.

Company name: CrowdStrike

Ticker: CRWD

Stock Price: $363.68

Market cap: $89.14 billion

Average daily volume: 3.94 million

Now, let’s look at our multi-step approach to analyzing the company.

CrowdStrike’s Business Model

CrowdStrike operates on a software-as-a-service (SaaS) business model, delivering cloud-native cybersecurity solutions. Its flagship product is the CrowdStrike Falcon platform, which integrates multiple security capabilities.

The key components of the company’s business model include:

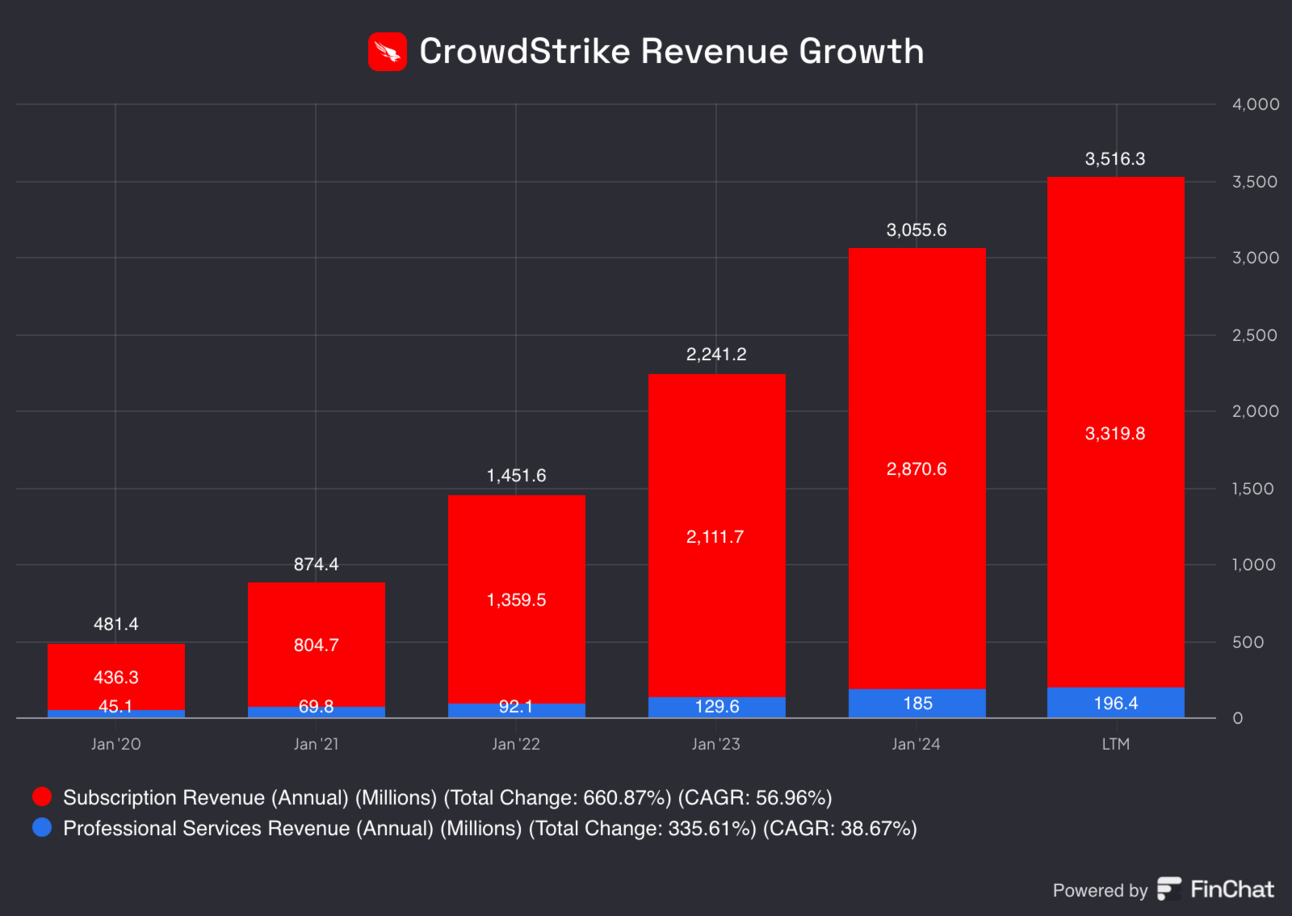

Subscription revenue: Most of CrowdStrike’s income is earned through subscriptions to its Falcon platform. In the last 12 months, its subscription sales grew to $3.3 billion, up from $2.87 billion in fiscal 2024. Total sales rose to $3.5 billion from $3 billion in this period.

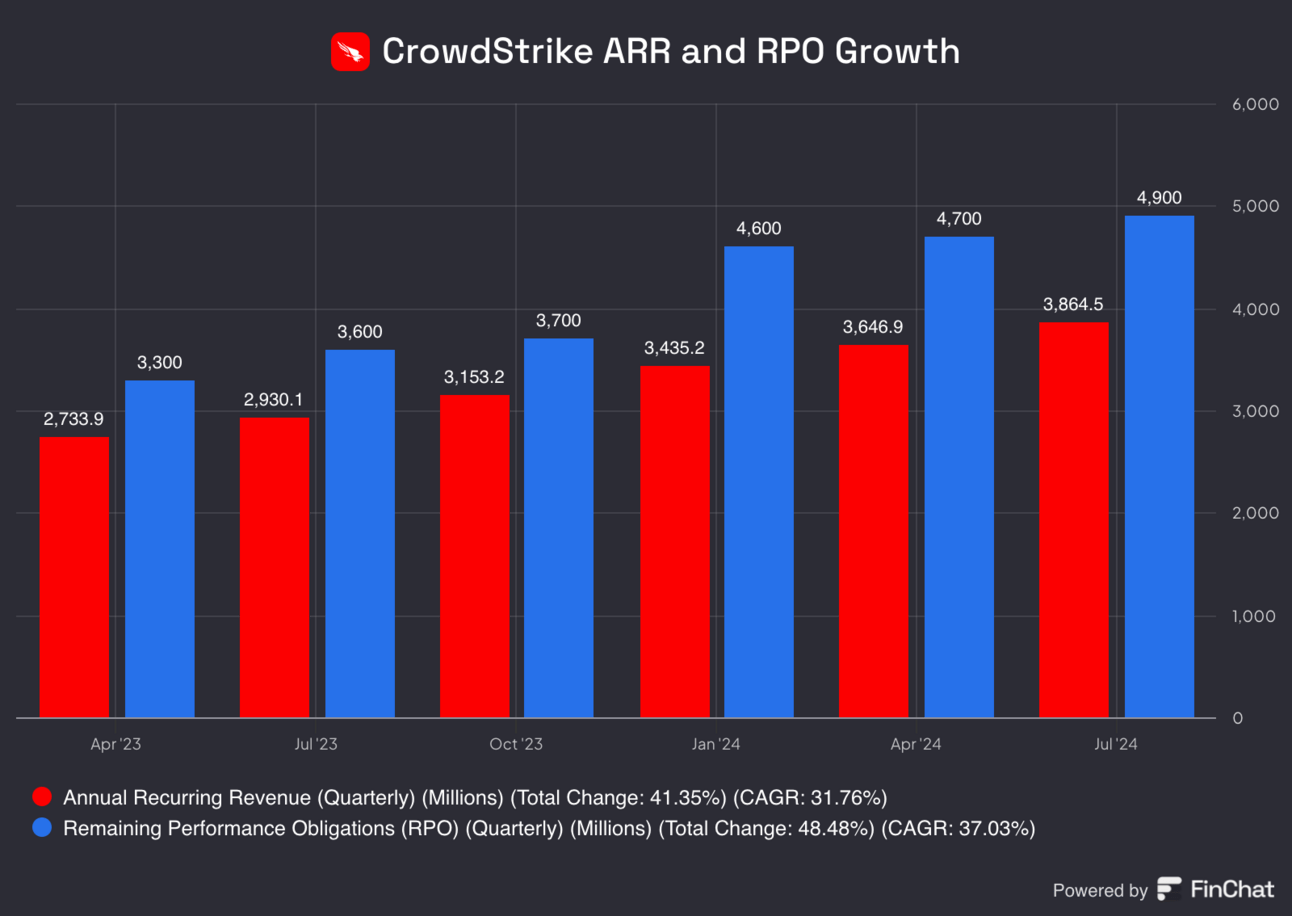

Land-and-Expand Strategy: CrowdStrike allows customers to start with minimal services and gradually expand platform usage. This strategy encourages customers to adopt additional modules as they recognize platform benefits, resulting in higher annual recurring revenue and customer retention rates.

Now, the company’s value proposition is built on key benefits such as:

Scalability and Rapid Deployment: Its cloud-based services enable easy scalability and implementation.

AI capabilities: CrowdStrike leverages artificial intelligence and machine learning capabilities to enhance threat detection and response.

A Sustainable Competitive Advantage?

CrowdStrike is armed with sustainable competitive advantages based on its:

Cloud-native architecture

Advanced technology and innovation

Strong brand recognition

Robust partner ecosystem

Economies of scale and network effects

High switching costs

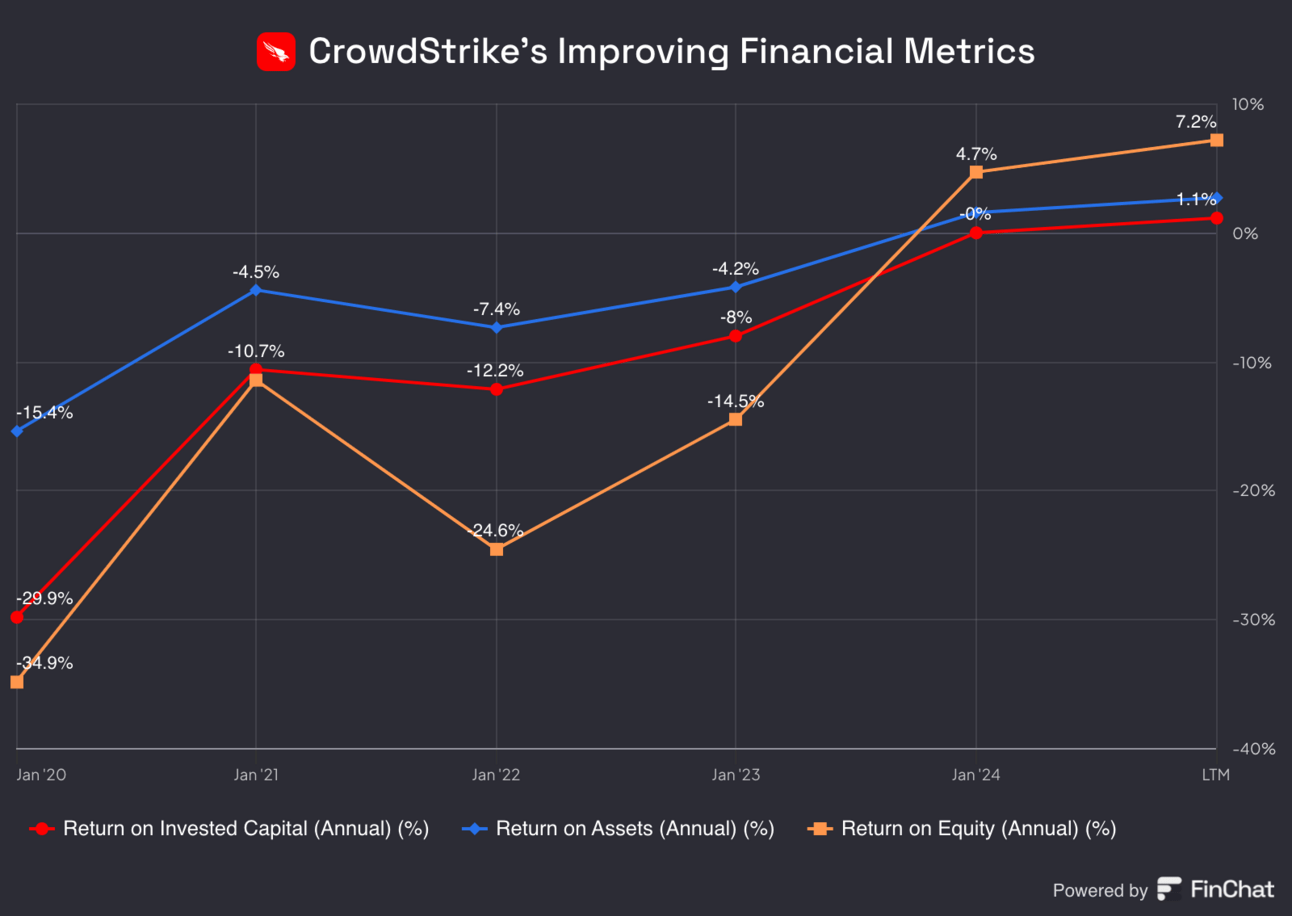

Generally, a company with high gross margins and ROIC (return on invested capital) has a sustainable competitive advantage. It would help if you shortlisted companies with gross margins of over 40% and a ROIC of over 15%.

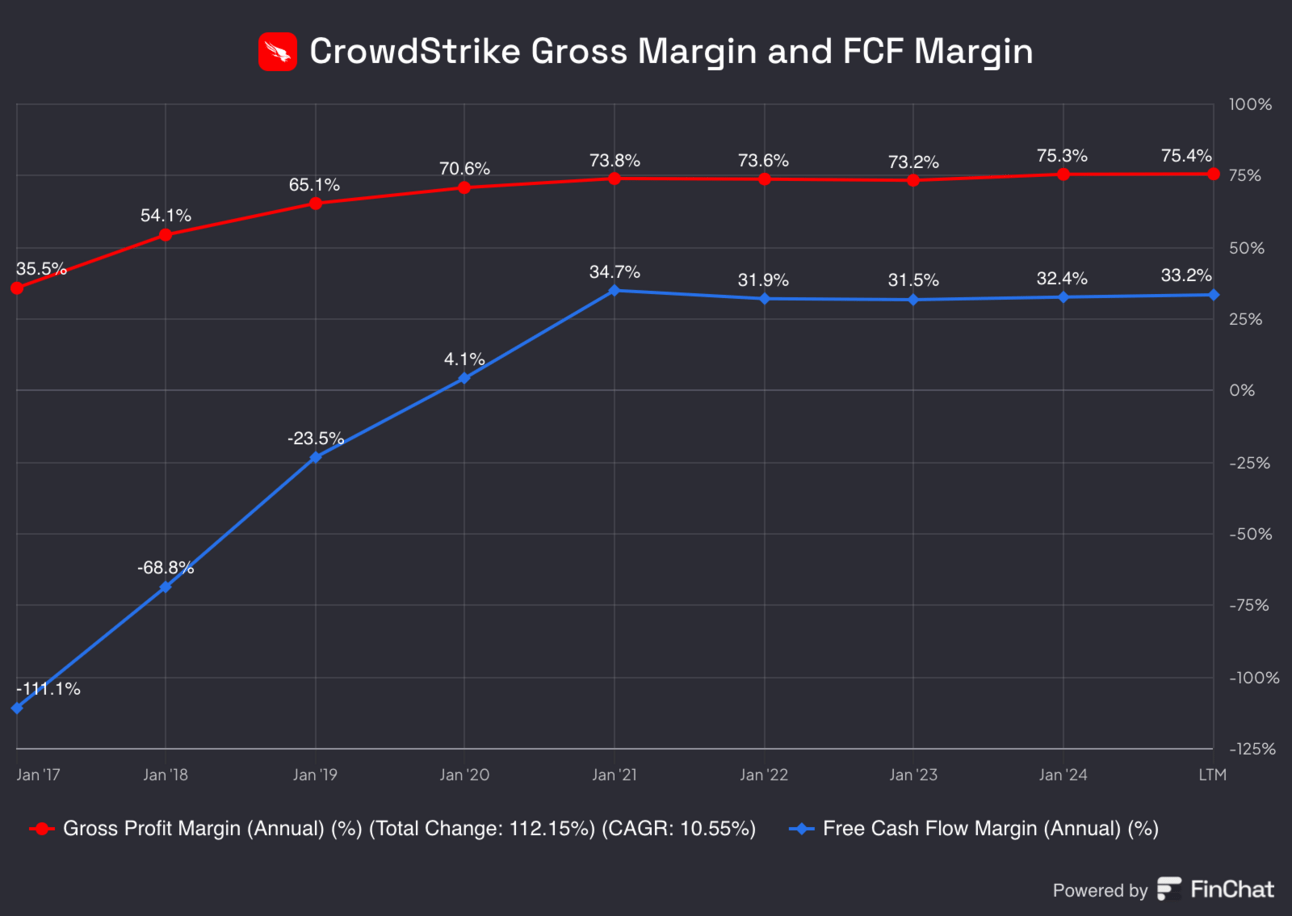

CrowdStrike’s gross margins in the last 12 months totaled 75.4%, up from 75.3% in fiscal 2024 to 65% in fiscal 2019.

Meanwhile, it has just started to report consistent profits with an ROIC of 1.1% in the last 12 months.

An Expanding Addressable Market

CrowdStrike is part of an expanding addressable market. It forecasts its TAM to more than double to $250 billion in CY 2029, up from $116 billion in CY 2025.

Analysts forecast CrowdStrike to report revenue of $4.78 billion in fiscal 2026. If the company maintains its market share, it could end fiscal 2030 with revenue of $10.30 billion.

Balance Sheet Metrics

Let’s take a look at CrowdStrike’s balance sheet with the help of a few ratios:

EBITDA/Interest Expense: 7.2x

Long-Term Debt/FCF: 0.64x

Goodwill/Assets: 10%

CrowdStrike’s balance sheet is quite healthy. The company generates enough free cash flow to pay off its long-term debt, allowing it to invest in inorganic growth or acquisitions.

A good capital allocator?

Capital allocation is the most essential task of management. So, look for companies that put shareholders' money to work at an attractive rate of return.

CrowdStrike:

Return On Assets: 2.7%

Return On Equity: 7.2%

Return On Invested Capital: 1.1%

These numbers don’t look attractive, as we want the ROIC to be at least 15%. Notably, CrowdStrike continues to reinvest heavily in growth and customer acquisition, resulting in lower profit margins.

However, like other asset-light companies, CrowdStrike should benefit from a high operating leverage and improve each of these metrics in the future.

How profitable is the company?

It is essential to identify companies that are improving their profit margins, earnings, and cash flow.

Here’s what things look like for CrowdStrike:

Gross Margin: 75.4%

Operating Margin: 1.5%

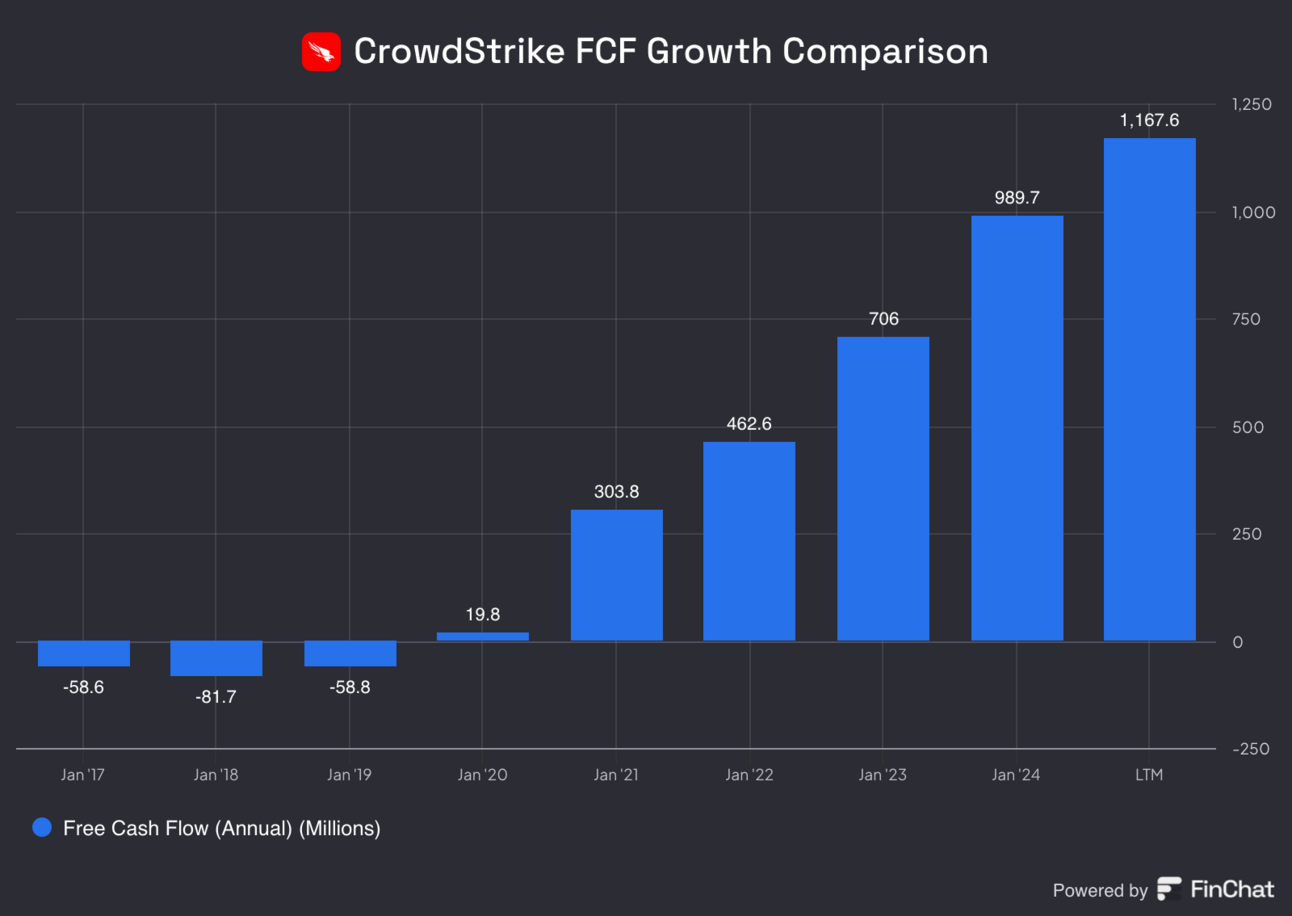

FCF Margin: 33.2%

CrowdStrike’s operating margin is relatively low, but its FCF margin is solid. This indicates that a significant portion of its expenses are non-cash.

The free cash flow is often considered a more reliable measure of a company’s financial health than net income or operating income. FCF is based on actual cash transactions and is quite tricky to manipulate.

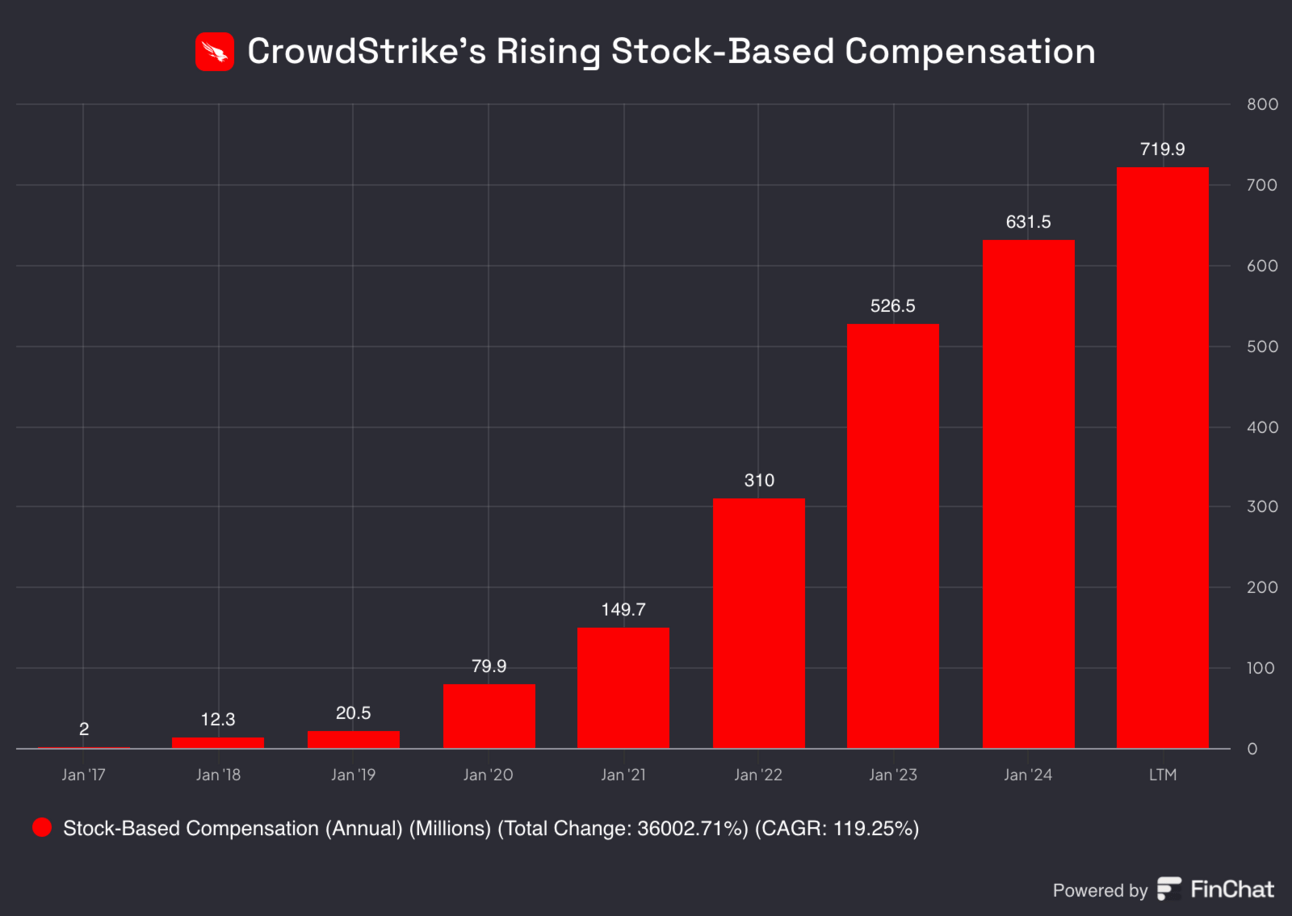

A Look at Stock-Based Compensation

Stock-based compensation is a cost for shareholders and should be treated accordingly.

Preferably, we want SBCs as a % of Net Income to be lower than 5%.

CrowdStrike:

SBCs as a % of Net Income: 20.5%

Avg. SBC as a % of Net Income past 5 years: 20.6%

As you can see, CrowdStrike relies heavily on SBC to reward its employees, but this number should normalize over time.

Strong Growth Metrics

Companies that grow steadily should help long-term investors generate market-beating returns.

CrowdStrike:

Revenue Growth past 5 years (CAGR): 58.54%

FCF Growth past 5 years (CAGR): 120%

Exp. Revenue Growth next 2 years (CAGR): 25%

Exp. EBITDA Growth next 2 years (CAGR): 23.4%

Long-Term Growth Estimate EPS (CAGR): 34.5%

This outlook looks attractive.

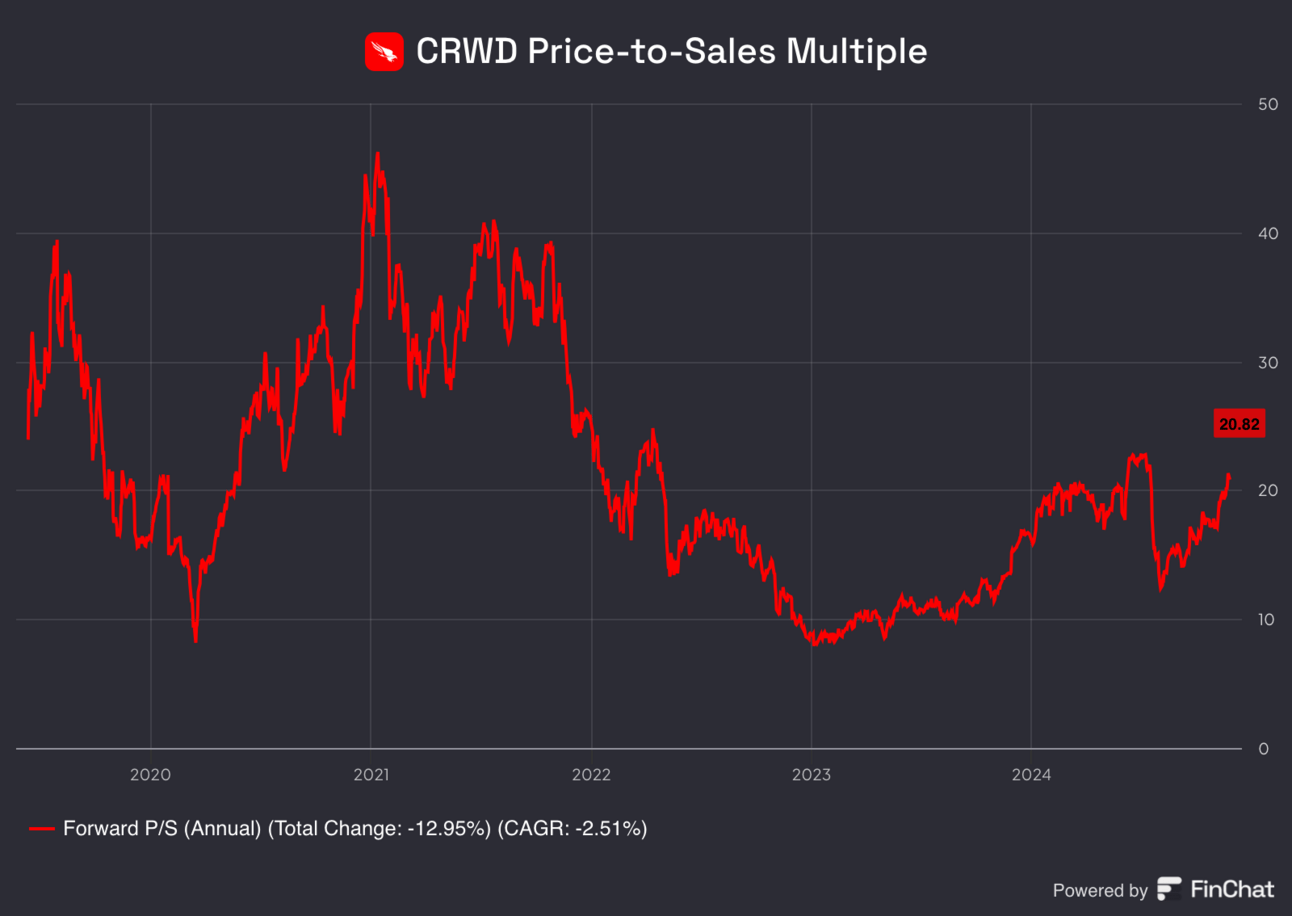

A Look at Valuation

The first thing we do is compare the current forward PE with its historical average over the past 5 and 10 years. However, as CrowdStrike is a growth stock, it’s better to value the stock based on the price-to-sales multiple.

Today, CRWD trades at a forward P/S of 25.4x, compared to a historical average of 28.8x over the past five years. CRWD stock remains expensive even though it trades at a lower multiple.

CrowdStrike is forecast to end FY 2027 with an FCF of $1.75 billion, up from $706 million in FY23. It trades at a lofty forward price to FCF multiple of 50x.

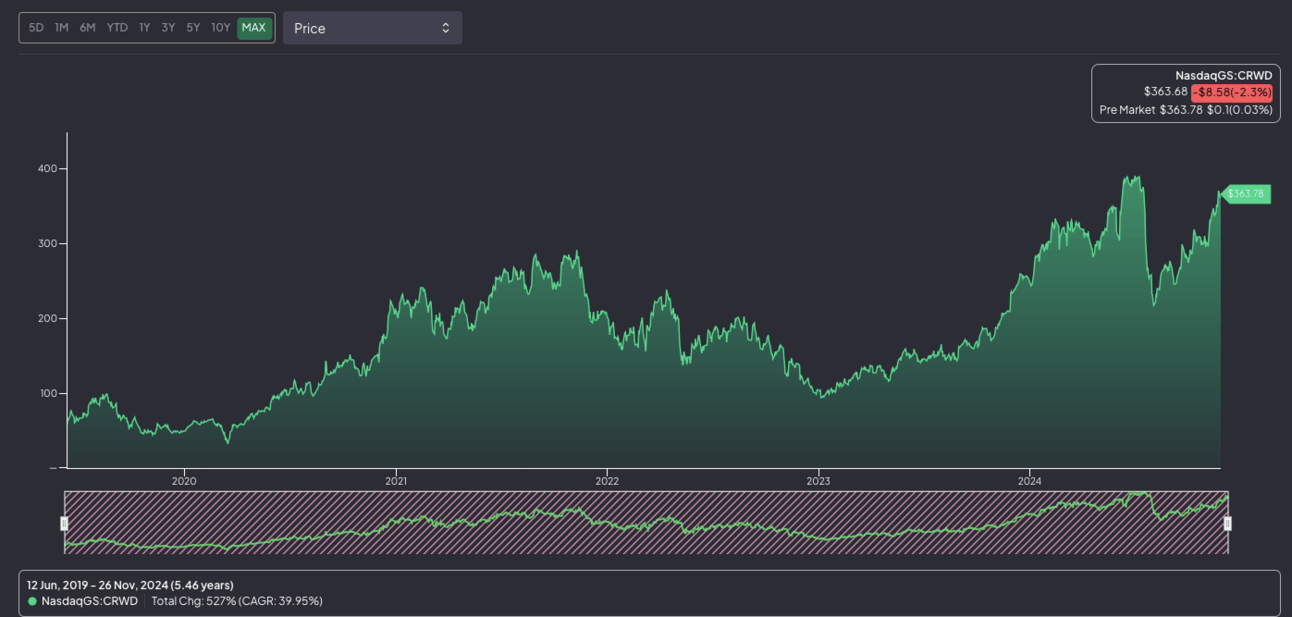

Past Performance

You would want to invest in companies that have showcased an ability to deliver inflation-beating returns in the past. CrowdStrike went public in June 2019 and has since delivered solid gains to investors.

CRWD Stock Performance

Source: Finchat

Here’s what the performance of CrowdStrike looks like:

YTD: +47%

5-year CAGR: +45.5%

CAGR since IPO (June 2019): +39.93%

The Final Verdict

The bull case for investing in CRWD stock:

An expanding TAM

Expanding and improving profit margins

Healthy FCF margin

Strong revenue and earnings growth estimates

The bear case for investing in CRWD stock:

Trades at a lofty multiple

An economic slowdown could lead to sluggish growth

Rising competition from peers such as Palo Alto Networks

CrowdStrike is a quality growth stock that allows it to trade at a premium valuation in November 2024.

If the company can gain market share and grow faster than its peers, CRWD stock should continue to deliver outsized gains to shareholders in the upcoming decade.

You can passively gain exposure in CRWD stock by investing in exchange-traded funds that track indices such as the S&P 500 and the Nasdaq Composite.

Free Daily Trade Alerts: Expert Insights at Your Fingertips

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.