- 3 Big Scoops

- Posts

- 🗞 Chaos Grips Wall Street

🗞 Chaos Grips Wall Street

as S&P 500 moves close to correction levels

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,572.07 ( ⬇️ 0.76%)

Nasdaq Composite @ 17,436.10 ( ⬇️ 0.18%)

Bitcoin @ $86,151.92 ( ⬇️ 2.02%)

Hey Scoopers,

Happy Wednesday! Here’s what we’re covering today:

👉 The trade war takes off

👉 TSMC may partner with AMD and Broadcom

👉 Can Tesla rebound in 2025?

So, let’s go 🚀

Market Wrap

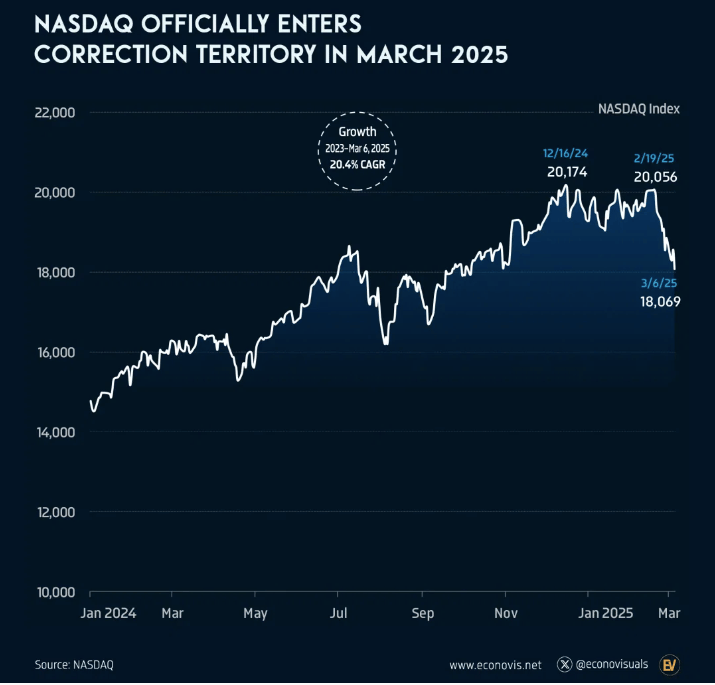

The S&P 500 fell lower on Tuesday, nearly entering correction territory as it briefly fell 10% below its record high during a volatile trading session.

Markets whipsawed as traders reacted to President Trump's rapidly changing tariff announcements.

Initially, Trump declared on Truth Social that Canadian steel and aluminum duties would double to 50%.

However, later in the day, Ontario Premier Doug Ford temporarily suspended his 25% electricity export surcharge after discussions with Commerce Secretary Howard Lutnick and Trump advisor Peter Navarro clarified that the 25% duty (not 50%) would take effect.

This chaotic trade policy environment has:

Triggered a market downturn with Monday seeing the Nasdaq's worst day since September 2022

Prompted Citigroup to downgrade U.S. stocks to neutral from overweight

Led Delta Air Lines to slash its earnings outlook due to weakening demand, dragging down other travel stocks

Despite market concerns, Trump remained steadfast, stating: "Markets are going to go up and they're going to go down but, you know what, we have to rebuild our country."

Investors now await Wednesday's Consumer Price Index report, which economists project will show 0.3% monthly growth and 2.9% annual inflation.

The Smart Home disruptor with 200% growth…

No, it’s not Ring or Nest—meet RYSE, the company redefining smart shade automation, and you can invest before its next major growth phase.

With $10M+ in revenue and distribution in 127 Best Buy locations, RYSE is rapidly emerging as a top acquisition target in the booming smart home industry, projected to grow 23% annually.

Its patented retrofit technology allows users to automate their window shades in minutes, controlled via smartphone or voice. With 200% year-over-year growth, demand is skyrocketing.

Now, RYSE’s public offering is live at just $1.90/share.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Trending Stocks 🔥

Groupon - Shares are up 19% in pre-market after the e-commerce marketplace forecasts full-year revenue between $493 million and $500 million, above consensus estimates of $491.5 million.

Heritage Insurance Holdings - The property and casualty insurance company is up 6% in pre-market after reporting net income of $0.66 per share in Q4, down from $1.15 per share last year.

Casey’s General Stores - The convenience store operator advanced 3% after it reported earnings of $2.33 per share on revenue of $3.90 billion in fiscal Q3 vs. estimates of $1.96 per share and $3.73 billion, respectively.

TSMC Might Partner With Chip Giants

Taiwan Semiconductor Manufacturing Company (TSMC) has reportedly approached prominent U.S. chip designers, including Nvidia, AMD, Broadcom, and Qualcomm, about taking stakes in a joint venture to operate Intel's struggling foundry division.

Under the proposal, TSMC would manage operations but hold less than 50% ownership of the venture.

The discussions, still in early stages, were initiated after the Trump administration requested TSMC's assistance in revitalizing the troubled U.S. chipmaker.

Key aspects of the potential deal:

Any agreement would require White House approval, as the administration doesn't want Intel or its foundry division to become wholly foreign-owned

TSMC is seeking multiple chip designers as partners who would also become customers of Intel's advanced manufacturing

Intel’s foundry division's property and equipment had a book value of $108 billion as of December 31, 2024

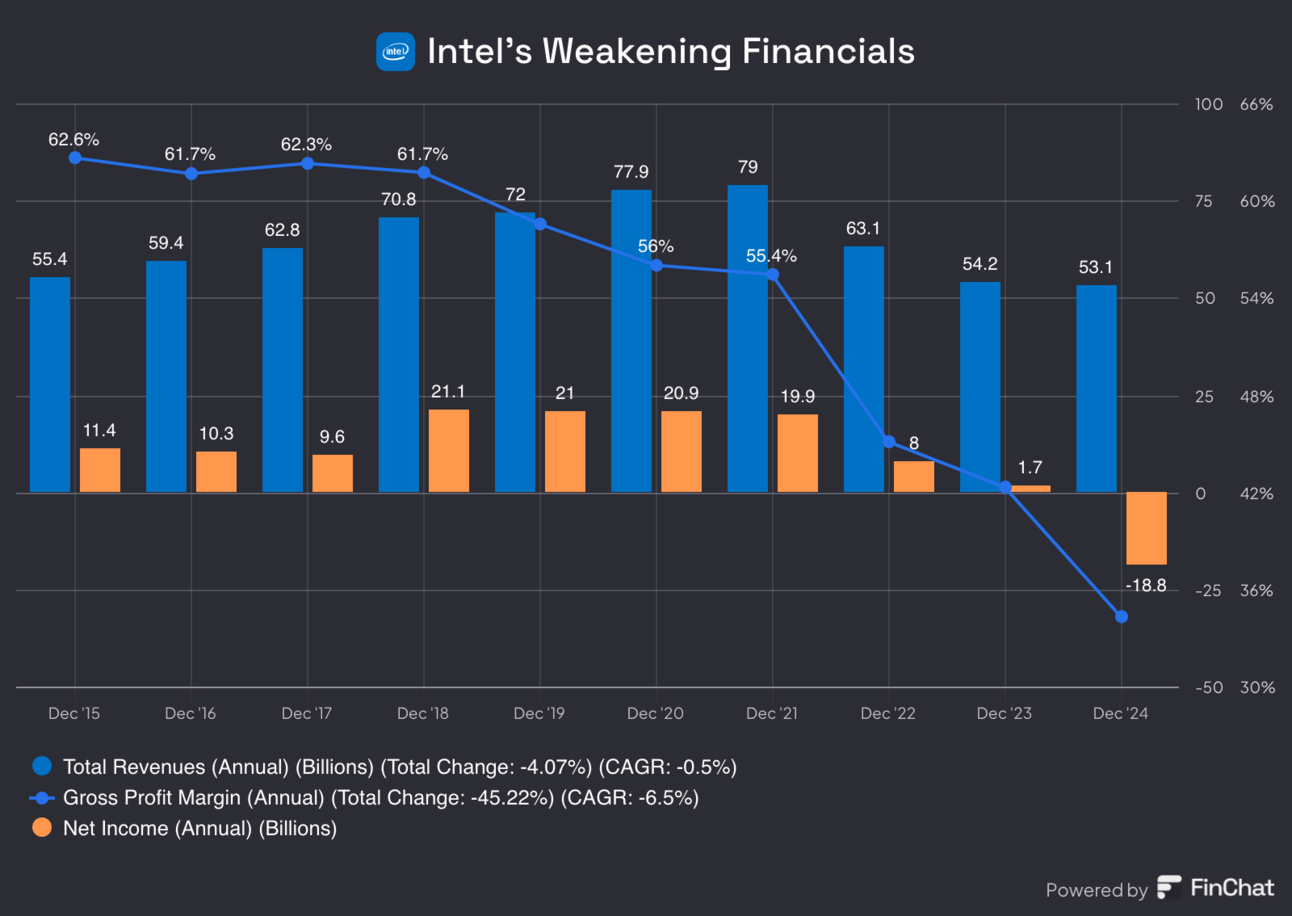

This development comes as Intel faces significant challenges, having reported its first net loss ($18.8 billion) since 1986 and seeing its share value drop by more than half in the past year.

President Trump is reportedly eager to boost American advanced manufacturing by reviving Intel's fortunes.

While Intel's board members have reportedly supported negotiations with TSMC, some executives oppose the deal.

Technical challenges remain substantial, as the companies currently use vastly different manufacturing processes and tool setups.

TSMC's proposal was made before its March 3 announcement of a planned $100 billion investment to build five additional chip facilities in the United States.

Tesla’s Crossroads Under Donald Trump

Elon Musk's close relationship with President Donald Trump has created a complex outlook for Tesla, with analysts divided on whether this alliance will ultimately benefit or harm the EV manufacturer.

Bullish analysts like Wedbush's Dan Ives view Musk's White House access as advantageous, particularly for Tesla's autonomous driving ambitions.

"Having Trump in office massively changes the regulatory environment for autonomous vehicles," Ives noted, suggesting a more favorable federal roadmap could emerge from Musk's political bet.

However, bearish investors point to several concerning developments:

The Trump administration's executive order targeting "unfair subsidies" favoring EVs threatens Tesla's $7,500 federal tax credit advantage

Tesla earned $2.7 billion in 2024 from regulatory credits that could be endangered

European Tesla sales have plummeted, with Germany seeing a 60% drop in early 2025

The administration has paused the disbursement of EV-charging infrastructure funds

Gerber Kawasaki CEO Ross Gerber, who has reduced his firm's Tesla holdings by nearly half, attributes declining sales partly to consumer backlash against Musk.

"Most people around the world hate Elon. And the way they're taking it out is on Tesla," he claimed.

Some analysts maintain Tesla's scale advantages could help it weather policy changes that might devastate less efficient EV competitors.

As Stifel's Stephen Gengaro noted, "Tesla is the only one making money. They can afford to incentivize sales and cut costs."

Ray Dalio Is Worried About U.S. Debt

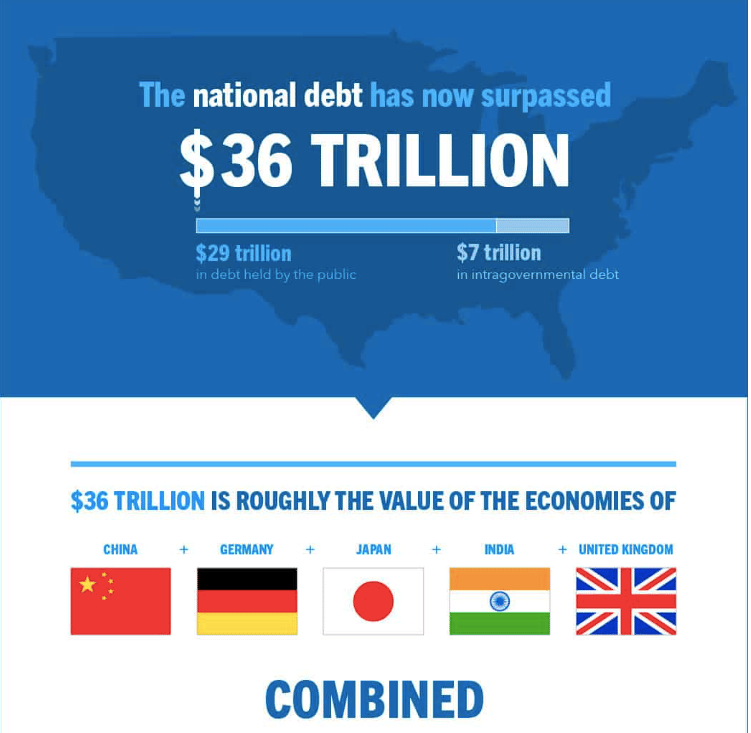

Bridgewater founder Ray Dalio delivered a stark warning about America's mounting debt crisis, describing it as a "very severe supply-demand problem" that could disrupt the global economy.

With U.S. national debt exceeding $36.2 trillion, Dalio emphasized the challenge is imminent: "[The U.S. has] to sell a quantity of debt that the world is not going to want to buy."

He stressed that the deficit needs to shrink dramatically from 7.2% of GDP to about 3%, a reduction he characterized as "a big deal."

Dalio outlined several potential consequences of this debt crisis:

Possible debt restructuring

The U.S. applying pressure on other countries to purchase its debt

Cutting off payments to certain creditor nations

The billionaire hedge fund manager drew historical parallels to 1930s Germany, noting a pattern of debt writedowns, tariff increases, and nationalistic policies.

"Be nationalistic, be protectionistic, be militaristic. That is the way these things operate," he explained.

Regarding recent trade tensions, Dalio warned that "tariffs are going to cause fighting between countries," though not necessarily military confrontation.

He cautioned that conflicts involving the U.S., Canada, Mexico, and China "will have consequences."

These comments come amid market volatility triggered by President Trump's tariff policies against major trading partners, adding to broader economic concerns about America's fiscal trajectory.

Headlines You Can't Miss!

Europe retaliates against Trump’s tariffs

The U.S. and Canada exchange tariff blows

Ukraine agrees to U.S.-led ceasefire plan

Salesforce to invest $1 billion in Singapore in AI push

Coinbase stock trades 44% below 52-week highs

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.