- 3 Big Scoops

- Posts

- 🗞 Broadcom Stuns Wall Street

🗞 Broadcom Stuns Wall Street

as Nasdaq enters correction territory

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

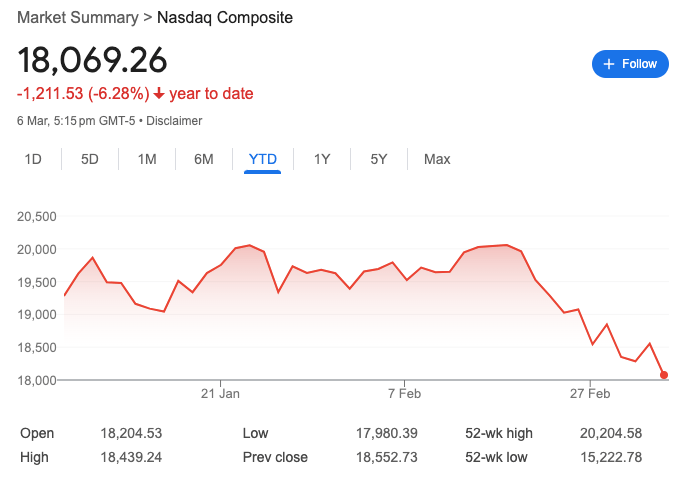

S&P 500 @ 5,738.52 ( ⬇️ 1.78%)

Nasdaq Composite @ 18,069.26 ( ⬇️ 2.61%)

Bitcoin @ $88,953.66 ( ⬇️ 2.13%)

Hey Scoopers,

Happy Friday! Here’s what we’re covering today:

👉 Broadcom beats Wall Street estimates

👉 All eyes on today’s jobs report

👉 Bitcoin pulls back

So, let’s go 🚀

Market Wrap

The U.S. stock market tumbled sharply on Thursday as Wall Street grappled with uncertainty surrounding President Donald Trump's controversial tariff policies.

Despite recent concessions from the White House, investor confidence remained shaken.

Major indices recorded significant losses:

Dow Jones Industrial Average fell 427.51 points (0.99%) to 42,579.08

S&P 500 dropped 1.78% to 5,738.52

Nasdaq Composite plunged 2.61% to 18,069.26, officially entering correction territory

The market decline follows the implementation of U.S. tariffs on Canadian, Mexican, and Chinese imports, with each nation responding with retaliatory measures.

Although the White House announced a one-month tariff extension for certain goods compliant with the USMCA agreement, the news failed to calm markets as it had in the previous session.

Treasury Secretary Scott Bessent further unsettled investors with his strong defense of the administration's "America-first trade policy" during an Economic Club of New York event, where he described Canadian Prime Minister Justin Trudeau as a "numbskull."

"You're just having confusion," explained Keith Lerner, chief market strategist at Truist. "That confusion is permeating into the day-to-day swings of the market."

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

Trending Stocks 🔥

Super Micro Computer - The server maker is moving higher in pre-market after submitting its audited financials for fiscal 2024 and statements for the last two quarters.

Jack in the Box - The fast-food chain is up 10% in pre-market after reporting adjusted earnings of $1.92 per share, above estimates of $1.69 per share.

Workday - Shares of the human resource software company are up 7% after it reported revenue of $2.21 billion and adjusted earnings per share of $1.92, compared with estimates of $2.18 billion and $1.78 per share, respectively.

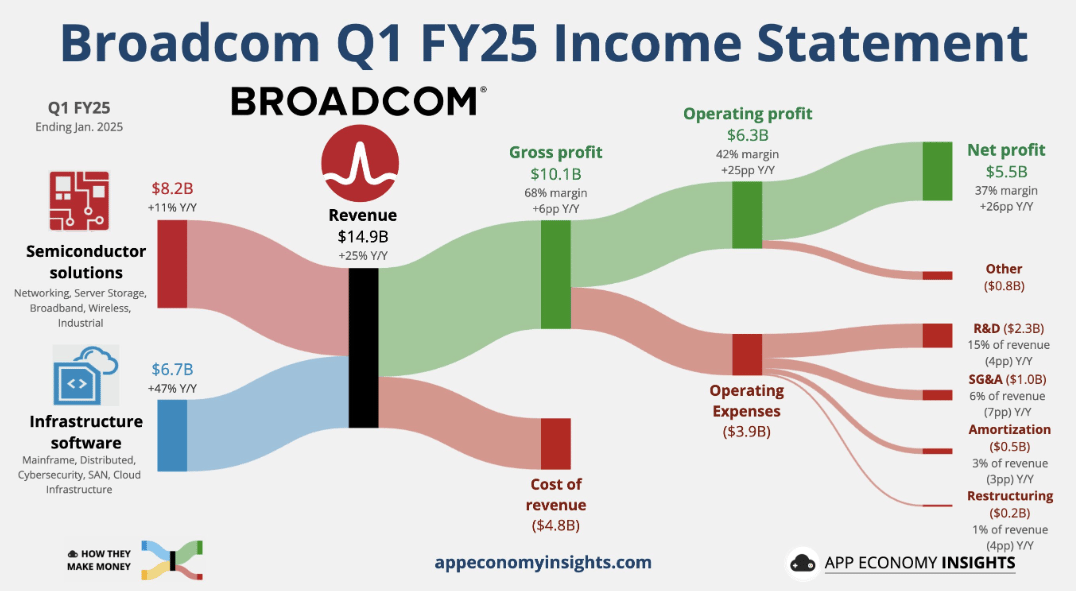

Broadcom Stock Surges Over 12%

Broadcom's shares have gained more than 12% in pre-market after the chipmaker reported first-quarter earnings that exceeded analysts' forecasts while providing optimistic guidance for the current quarter.

Broadcom reported:

Adjusted earnings per share of $1.60, beating the expected $1.49

Revenue of $14.92 billion, surpassing the anticipated $14.61 billion

Broadcom forecasts approximately $14.9 billion in second-quarter revenue, exceeding Wall Street's projection of $14.76 billion.

First-quarter revenue rose 25% year-over-year, while net income increased to $5.5 billion ($1.14 per share) from $1.33 billion (28 cents per share) in the same period last year.

Broadcom’s artificial intelligence business continues to fuel its growth, generating $4.1 billion in AI revenue during Q1—a 77% increase year-over-year.

CEO Hock Tan expects "continued strength in AI semiconductor revenue," projecting $4.4 billion in Q2.

Despite the positive earnings report, Broadcom's stock had been down about 23% so far in 2025 before this after-hours surge, as investors rotated out of tech stocks amid concerns about President Trump's tariff policies.

Tan also revealed that in addition to the three large cloud customers for whom Broadcom is developing custom AI chips, the company has "deeply engaged" with two additional hyperscalers and is working with four other potential customers.

However, he emphasized they don't develop custom chips "for startups."

Is the Labor Market Under Pressure?

The labor market is sending conflicting signals, heightening anxiety for investors already concerned about tariffs' impact on inflation and economic growth.

Workers face a paradox: employers are either cutting workers at the highest rate in years or maintaining current staffing levels.

Recent surveys reveal increasing worker uncertainty and reluctance to seek new opportunities, while job hunters report greater difficulty finding positions—despite solid traditional metrics showing strong nonfarm payroll growth and low unemployment.

"Fundamentally speaking, things are still relatively sound in the United States. That doesn't mean there are no cracks," explains Tom Porcelli, chief U.S. economist at PGIM Fixed Income, cautioning against relying solely on the "lagging" payrolls report.

Economists expect Friday's February nonfarm payrolls report to show growth of 170,000 jobs with steady 4% unemployment.

However, several indicators suggest challenges ahead:

Challenger, Gray & Christmas reported February layoff announcements reached their highest level since July 2020

Over 62,000 cuts were attributed to Elon Musk's Department of Government Efficiency (DOGE)

Consumer confidence unexpectedly dropped, with respondents anticipating fewer available jobs

Economists warn DOGE cuts could potentially reduce the workforce by 500,000+ when considering contractor impacts

As Allison Shrivastava of Indeed Hiring Lab notes, "Don't ever discount sentiment" in economic forecasting, as worker confidence directly affects hiring practices and economic health.

Trump Fails to Impress Crypto Street

Cryptocurrencies fell Thursday night after President Donald Trump signed an executive order establishing a strategic bitcoin reserve and a separate "digital asset stockpile."

Bitcoin dropped 3% to $87,586.86, briefly touching $84,688.13 following the announcement.

Other cryptocurrencies that had rallied earlier in the week on Trump's promises also retreated:

Ether declined 2% to $2,184.08

XRP and Solana's SOL fell 1% and 3% respectively

Cardano's ADA tumbled 13%

White House crypto and AI czar David Sacks clarified that the Bitcoin reserve will include Bitcoin owned by the U.S. government from prior law enforcement seizures, "not costing taxpayers a dime."

The government currently owns over 198,000 bitcoins worth approximately $17 billion.

The digital asset stockpile will consist of "digital assets other than Bitcoin that are forfeited in criminal or civil proceedings," with no immediate plans to acquire additional assets beyond those obtained through forfeiture.

"It is good news, but not what the market wanted in the short term," explained Steven Lubka of Swan Bitcoin. "People were hoping for near-term buy pressure."

The announcement came days before the first White House Crypto Summit amid broader market turbulence caused by tariff concerns.

JPMorgan recently cautioned that crypto might not see significant upward movement in the near term due to economic uncertainty and weakening demand.

Analysts warned that Bitcoin remains at risk of a pullback toward $70,000 unless it can sustainably hold above $90,000.

Headlines You Can't Miss!

China’s exports miss forecasts as U.S. tariffs hit

Japan’s 30-year bond yield hits highest level since 2008

Indian consumption stocks await a tax-cut bump

HPE to cut 2,500 jobs as stock slumps on weak outlook

SEC drops case against Coinbase

Chart of The Day

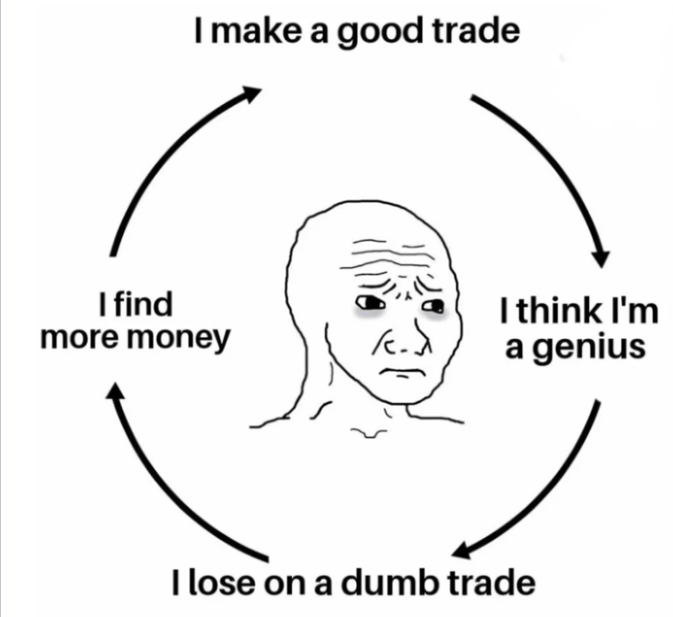

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.